Spikes in Dip Calls Are Nice, But Crash Calls Are Where Things Have Gotten Spicy!

📉 There is a difference between how traders perceive a crypto #dip vs. a #crash. In the former, it's usually a simple observation that prices have gone down enough to be noticed. In the latter, a full-on crash is when things get interesting.

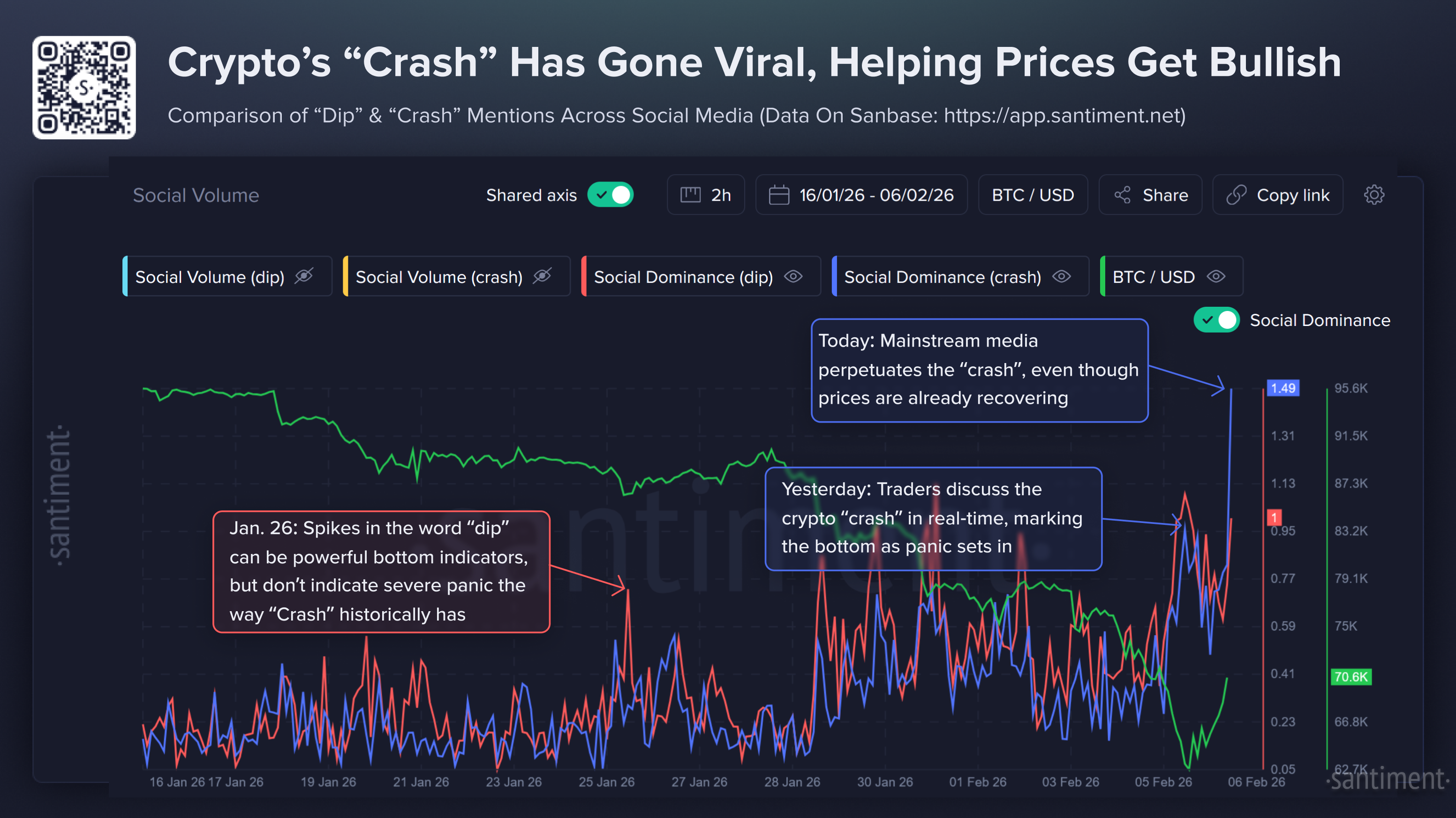

👍 There is no true rule-of-thumb for what should differentiate a dip vs. a crash. But according to our social data, when traders have decided that a crash has occurred (as they did yesterday), it's a very reliable bottom indicator.

📊 We can see in the chart below that there had been several high frequency mentions of "dip" across social media. But when Bitcoin dropped down to $60.0K yesterday, this was finally enough for traders to show legitimate panic and sell their bags at a loss. As soon as they did, prices immediately rebounded (precisely at the moment when "crash" spiked).

📰 As a bonus, the mainstream media (who are often quite late to the party) have began to make the crypto "crash" get many more eyeballs on it, even though $BTC has already recovered +13% from yesterday's bottom. This simply perpetuates more panic for the latecomers, and allows key stakeholders an easy path to buy from panicked retail.