Metrics Explained: Realized Market Capitalization Hodl Waves

Welcome to a new Santiment Metrics Explained Series, where I take metrics I find hard to understand at first glance and write a dive deep with definitions, examples, and explanations. You'll learn what the metric is, what it indicates, and what the blind spots might be.

Disclaimer: I may get some things wrong, if I do please leave a comment or message me (@Davidutro) and I will edit or republish with the corrections!

Today's metric is Realized Market Capitalization Hodl Waves.

Let's dive in.

My first question, what the hell is "realized market capitalization"?

Very simple. Instead of multiplying the supply x current price, which would be the regular market capitalization, multiply each token by the price at which it last moved on-chain, which looks something like this but way more detailed, let's use BTC and a bunch of made up numbers as an example:

Assume 21,000,000 supply

Regular Market Cap

21m x 91,000 = 1.9 Trillion

versus

Realized Market Cap

4m x 1,000 + 7m x 30,000 + 7m x 60,000 + 2m x 90,000 + 1m 100,000

4B + 210B + 420B + 180B + 100B = 914 Billion

What does this figure accomplish? What does it mean? Think of it like an alternative "market cap" that's weighted by holder behavior and historical cost basis rather than just the spot price. Most movements come from trades, but some are non-trade transfers (gifts, internal wallet moves, etc.), so there's a bit of noise. Still, it ties together the historic purchase prices of coins with their current economic weight.

The more long time holders from low prices exist, the lower the realized market cap. If there's more activity at higher prices then the realized market cap is higher and closer to the regular market cap. If there is a small or large difference in market cap and realized market cap, that should give you some hint about the aggregate positions of all holders.

Rules of thumb:

- If old coins bought low are sold, number moves up more sharply.

- If coins bought high are sold low, number moves down (can't happen during ATHs).

- Since transactions are always happening there is always a force pushing the figure towards the regular market cap. Eg., the current BTC price of 90,000 updates all of today's transacted tokens. If moved today, low priced coins or higher priced coins get placed in the 90k tier, which brings the realized market cap closer to the regular market cap.

Key questions to ask:

- how different are the two numbers and why?

- how quickly is the realized cap converging on the market cap and why?

Next question, what is a "hodl wave"?

A hodl wave is a grouped set of held tokens acquired as a certain time interval. For example, tokens acquired in the last month would be one set of hodl waves, while tokens acquired 7d - 30ds ago are yet another set of waves. You can segment the waves however you like, the essential idea is that coins/tokens with similar "age" are grouped together. Age distribution is somewhat synonymous to "hodl waves."

So if you were to sort all actively circulating coins into age buckets, like: Coins moved in the past week, Coins moved in the last 1–4 weeks, over 1 month ago, over 1 year ago, etc... HODL Waves show what percentage of circulating supply falls into each of those age groups.

If you look up Realized Market Cap HODL Waves in the Sanbase Charts you will notice that they are separated by time intervals, aka coin age (0 - 7d, 7 - 30d, 30 - 60d, etc...)

Final question, how do hodl waves and the realized market cap go together?

Instead of just showing supply percentage by age, they show the economic weight (realized value) of each age interval as a percentage of the total realized market cap.

Here's an example: realized_cap_hodl_waves_1d_to_7d is computed by dividing the realized cap of coins that are 1 to 7 days old with total realized market cap: (realized_cap_usd_7d - realized_cap_usd_1d) / realized_cap_usd

eg., (30,000 BTC x $90,000 = 2.7B) / (1.09T) = ~0.002477064

scaled as a % between 0 and 100, this would show up as 2.4%

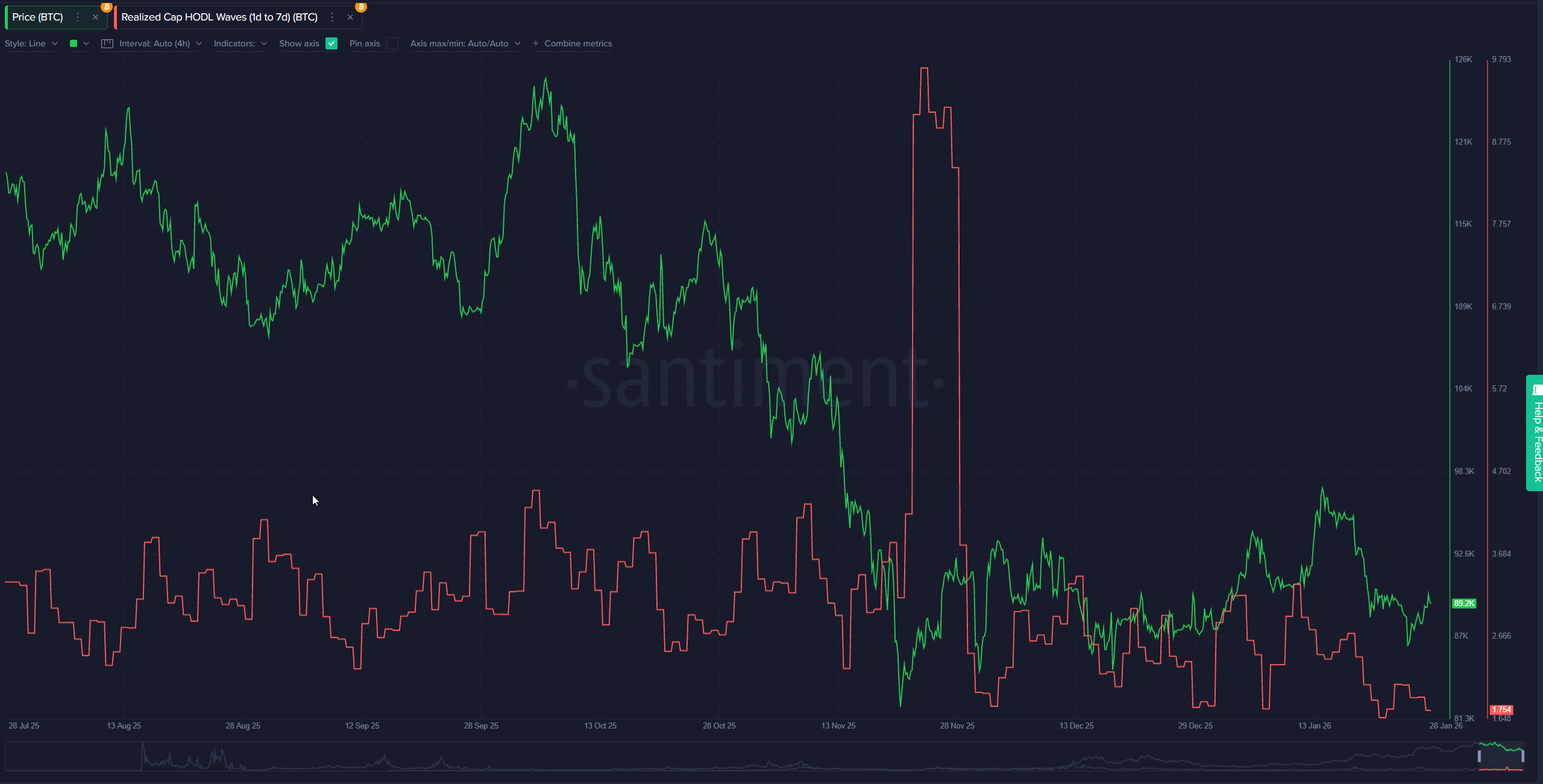

The resulting number is a ratio of that period's (value of tokens purchased) / (entire realized market cap). What does this number tell us? It tells you: "What portion of the entire realized market cap was 'purchased' (or last transacted) in the last 1–7 days?" In other words, it's a price-weighted view of short-term trading activity within that window. Spikes in a short-term band (like 1d–7d) often signal heavy recent buying or selling at current prices. You can see this in BTC's 1d–7d Realized Cap HODL Wave chart—e.g., a big upward move in late November reflected strong net accumulation by short-term participants, a hodl wave.

Bonus: how is this metric different than just simple volume?

Volume just counts total value of all the transactions in a given period. Realized Cap HODL Waves filter to show only the economic significance of trades within a specific holding period. In the example above, all the trades of BTC held outside of the specified time interval are excluded, so you can see what the 1d - 7d short term holders did.

Bonus: How do I make use of this metric?

Compare behavior: short-term traders vs. medium-term vs. long-term holders

Overlay the waves on a price chart. During a bull run, watch if short-term bands expand rapidly (indicating influx of new capital from retail traders), while long-term bands contract (as veteran holders take profits). Conversely, in bear markets, long-term bands may widen as coins "age" without moving, signaling accumulation by patient investors. For Bitcoin, historical data shows short-term bands peaking at over 50% near cycle tops (e.g., 2021 bull market), while long-term bands dominate bottoms (e.g., post-2022 crash).

Spot shifts in sentiment: Are short-term bands spiking during euphoria (possible top signal)? Are long-term bands growing during fear (accumulation)?

Set alerts for thresholds, like short-term bands (<6 months) exceeding 45%, which has historically preceded Bitcoin corrections (e.g., 2017 and 2021 peaks).

During the 2022-2023 bear market, long-term bands grew, bottoming out around the FTX collapse, which marked a prime accumulation zone. Use this to time entries/exits: Buy when long-term waves are rising amid low sentiment (fear), and consider selling when short-term waves dominate high sentiment (greed).

Track convergence/divergence between bands to gauge whether momentum is broad-based or concentrated among certain holder classes.

Analyze band ratios or differences over time. For instance, if short- and medium-term bands converge upward but long-term bands diverge downward, it might signal a concentrated pump by traders, not a fundamental shift (e.g., meme coin frenzies). In Bitcoin's 2024 cycle, early convergence across bands supported the post-halving rally, but later divergence hinted at profit-taking.

More ways

- Identify Macro Market Cycles: The waves help delineate bull/bear phases. Younger bands (>1 year) often peak at 50-70% near all-time highs, signaling distribution, while older bands bottom out at cycle lows.

- Observe Supply Distribution Dynamics: It reveals if wealth is concentrating among long-term holders (bullish for stability) or dispersing to short-term ones (bearish for volatility). Pair it with metrics like Mean Dollar Invested Age or Supply in Profit for a fuller picture.

- Risk Management and Strategy Building: Use it to backtest trading strategies—e.g., enter positions when long-term bands cross above 40% during dips. For portfolio allocation, monitor waves for your holdings to avoid overexposure to assets with heavy short-term dominance.

- Cross-Asset Comparison: Compare HODL Waves between Bitcoin, Ethereum, or altcoins to identify relative strength (e.g., ETH's waves showing more long-term commitment than a volatile meme token).

Conclusion

This metric gives deeper insight into who is driving price action and how committed different holder cohorts are. In essence, it visualizes the distribution of wealth among holders categorized by how long they've held their assets. Short-term bands (e.g., <1 week, 1-3 months) typically represent newer or speculative investors, while long-term bands (e.g., 1-2 years, >5 years) indicate committed "HODLers" or institutional players.

Leave a comment and let me know what you think!