Deep Dive: Hyperliquid's Hyper Volatility

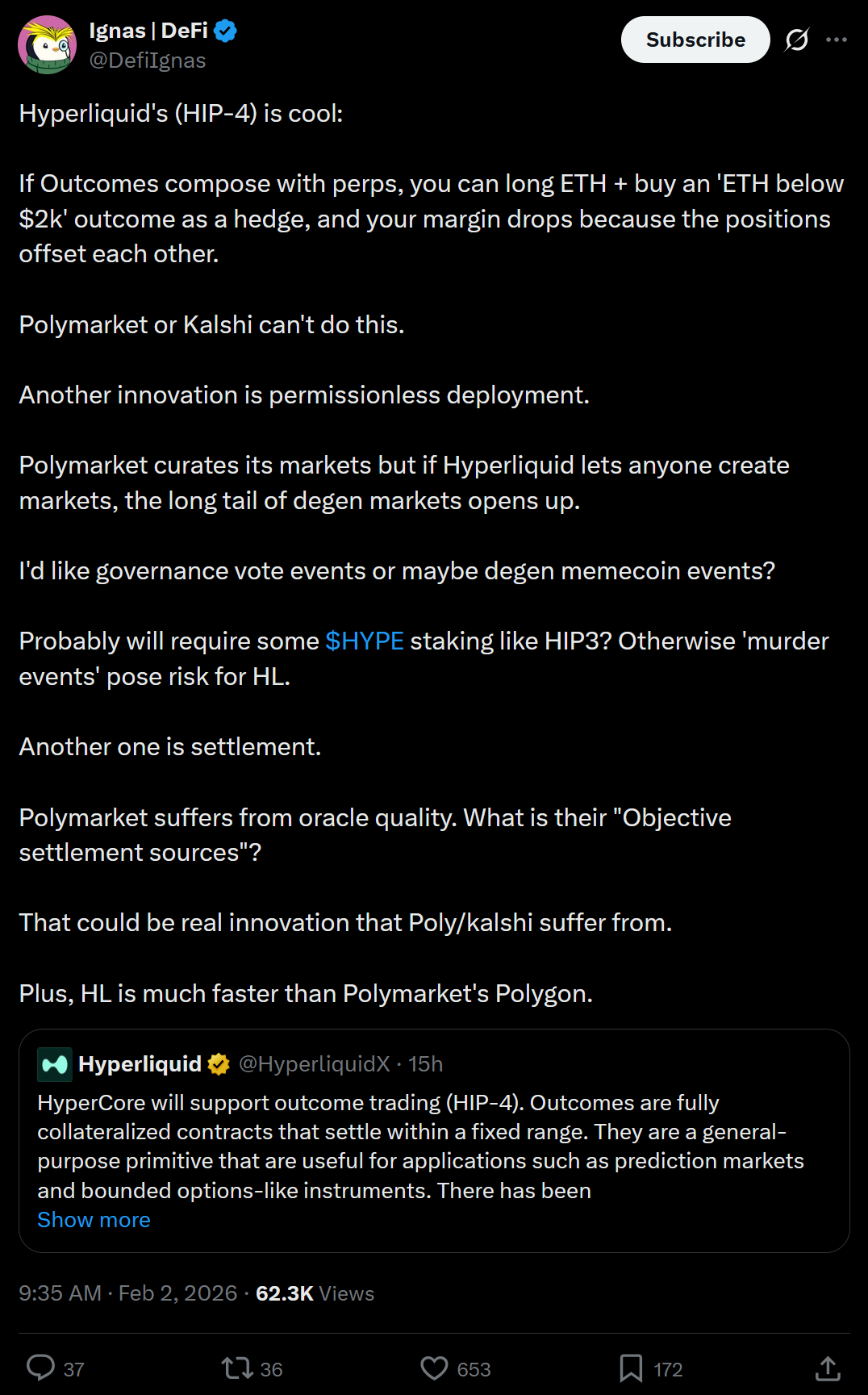

The crowd appears to be hyped over Hyperliquid rolling out HIP-4, a major protocol upgrade that introduces what the team calls “outcome trading.” This new feature lets traders use fully collateralized contracts that settle within a fixed price range and don’t use leverage or margin calls. That’s different from traditional perpetual futures, where leverage and liquidations are common. Instead, outcome contracts cap both gains and losses by design, making them safer and better suited to prediction markets and options-like strategies in DeFi.

The outcome contracts in HIP-4 are built to support contracts that behave more like prediction market bets or bounded-risk options. Traders put up the full amount of collateral up front, and the contracts settle based on objective reference prices in a known range. This structure is appealing to users who want exposure to specific outcomes or event-based bets without the risks associated with leveraged positions.

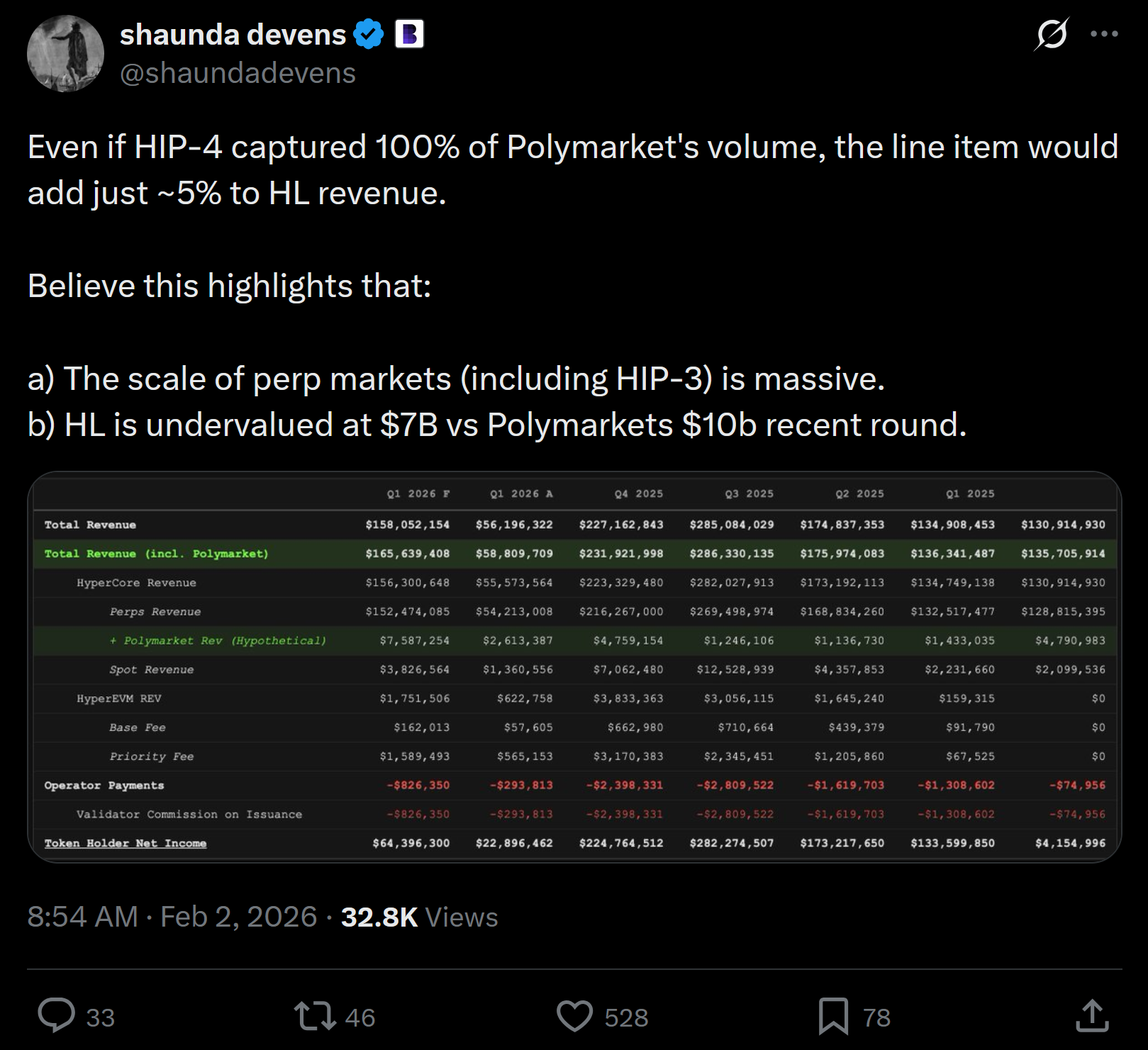

Discussion around HIP-4 has also included comparisons to existing prediction platforms like Polymarket. One widely shared analysis from a market commentator estimated that even if Hyperliquid captured 100% of Polymarket’s current volume, the added revenue would represent only about 5% of Hyperliquid’s total business. The point of the comparison wasn’t to downplay HIP-4, but to highlight the scale of Hyperliquid’s existing perpetual markets. In other words, prediction markets are being viewed as a strategic extension of an already large trading engine, rather than the primary revenue driver for the time being.

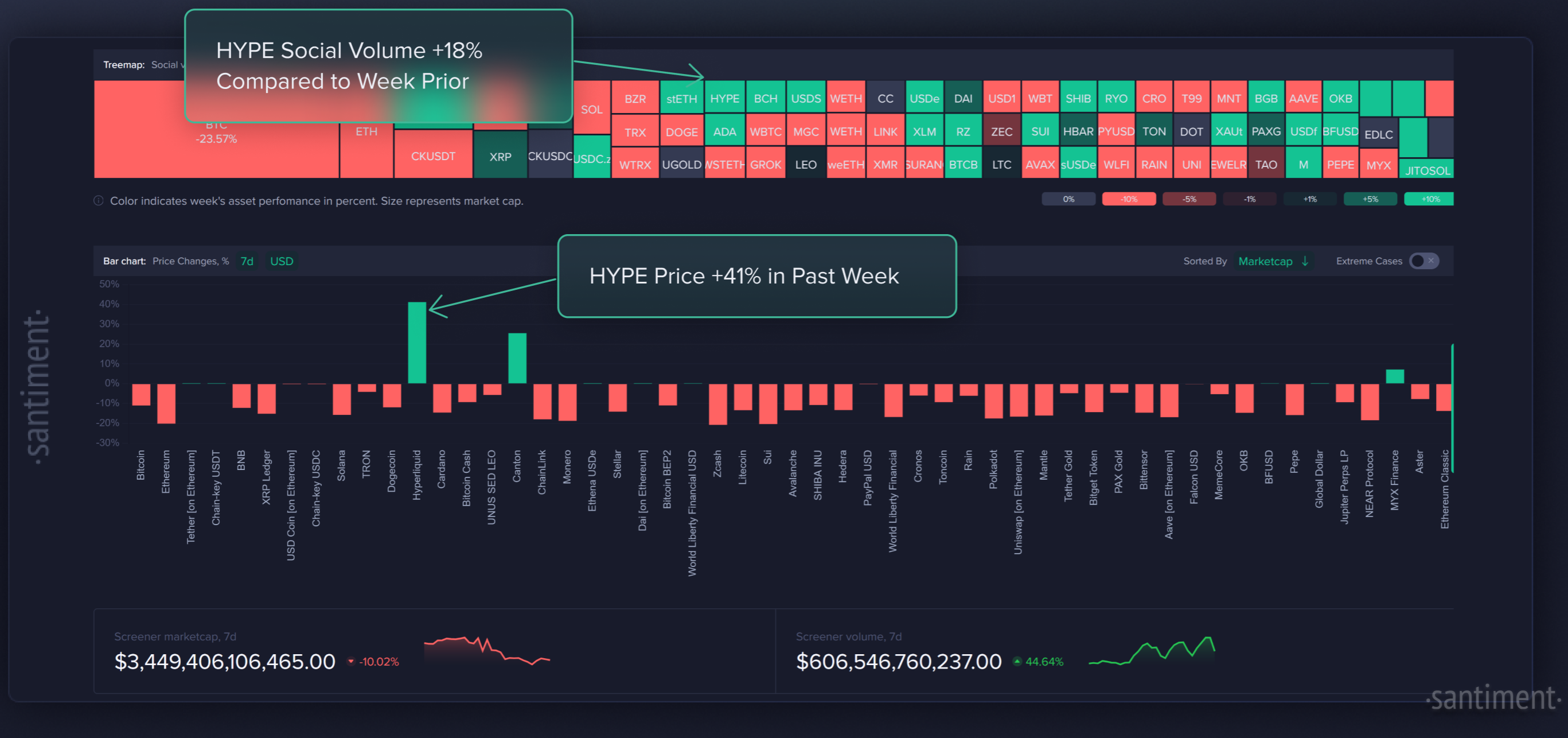

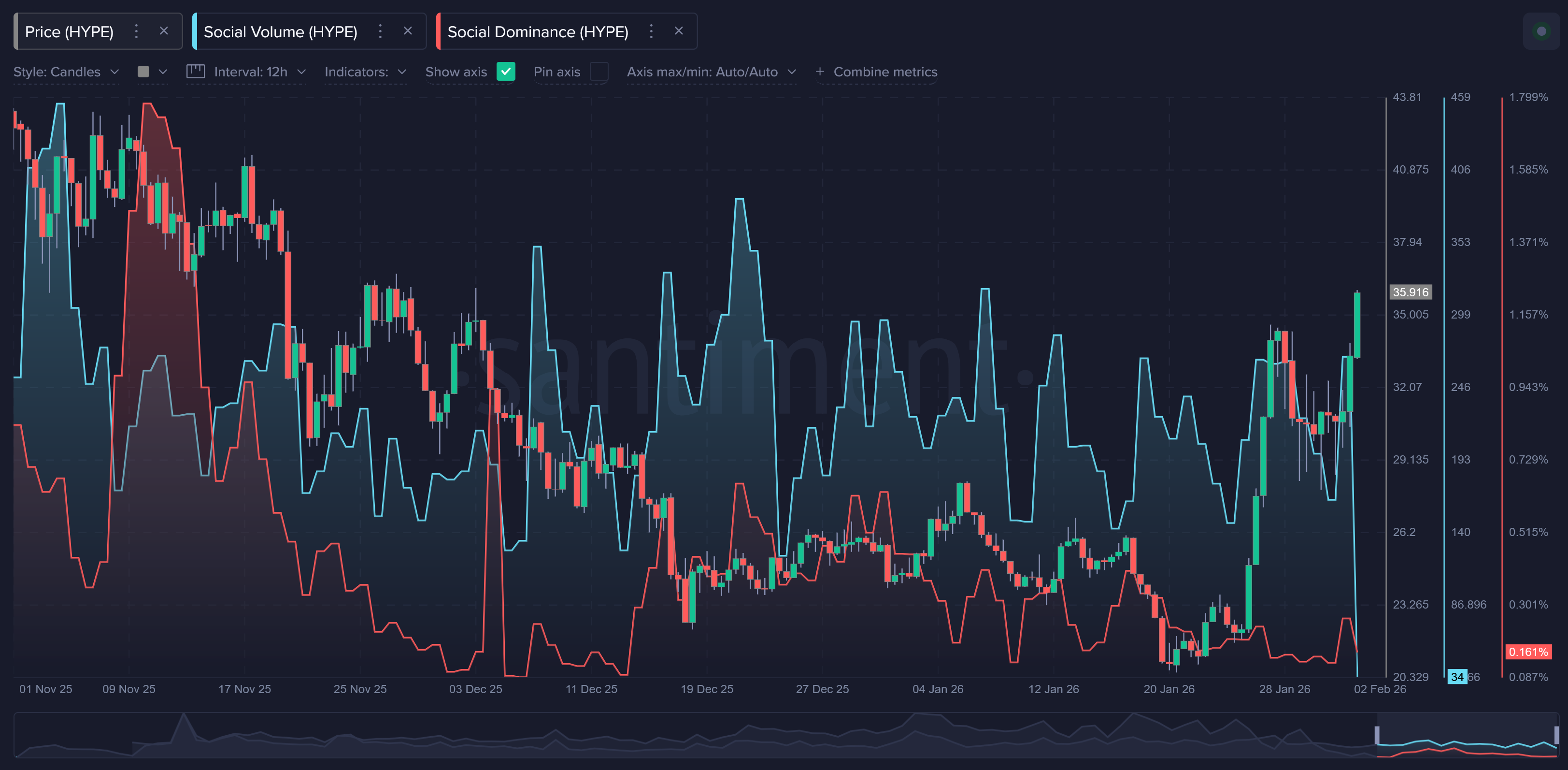

The crypto community has reacted strongly to the Hyperliquid news. Traders and speculators have bid up the native token $HYPE sharply after the announcement. In the last 24 hours alone, the price of HYPE jumped roughly +16%, reflecting traders’ positive sentiment about HIP-4’s potential to expand product offerings. Over the past two weeks, since hitting a local bottom on January 19, 2026, HYPE has climbed about +71%, outpacing altcoins that have overwhelming spent the last week in the red. We're also seeing discussion rates on the asset rising by +18% compared to last week.

Interestingly, social dominance doesn't point to the crowd giving HYPE nearly as much recognition as you may expect with its outlier bullish price performance, as well as the HIP-4 news. It could be because traders have had enough of chasing profits from singular pumps in a bear cycle, for the time being. And it also simply be because the news of these developments haven't quite hit the mainstream crypto circles just yet.

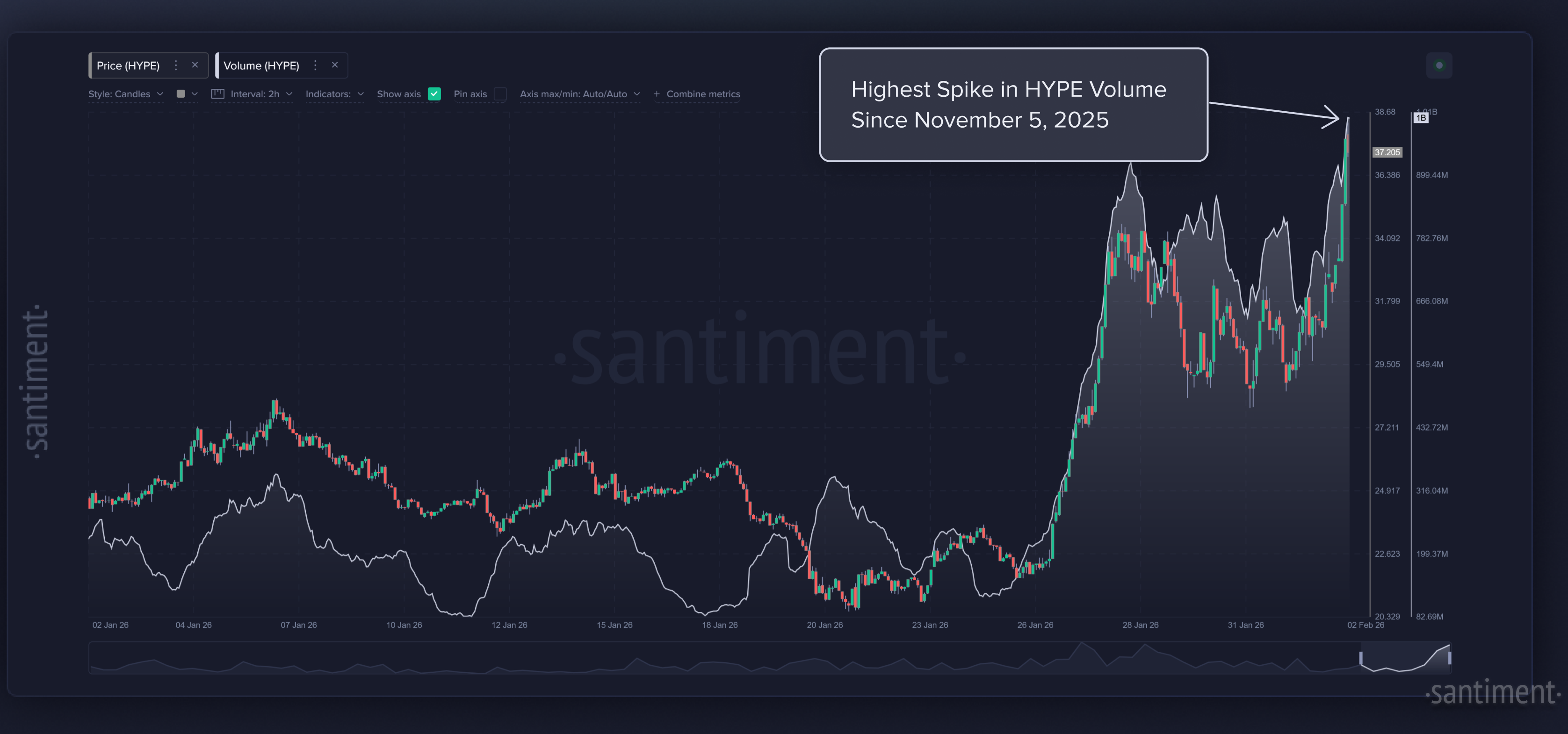

Regardless, much of this price action indicates that community expectations around new derivatives and prediction markets could attract fresh volume. Even though discussion rates may not be matching the expectations right now, trading volume has had a very correlated with price, and HYPE is seeing its highest levels in three months.

There are plenty of traders tracking HYPE’s performance as an indicator of Hyperliquid’s product adoption, especially since outcome markets open paths toward new types of trading activity that may bring in both crypto-native users and those interested in event-based bets. And even if the #10 market cap in crypto isn't all over your news feed yet, its recent momentum signals that early adopters may already be betting on Hyperliquid becoming a major hub for next-generation derivatives. The community is already theorizing unique ways it can be used.

While technical upgrades alone don’t guarantee success, the combination of expanded derivatives tools and a clear positive price reaction suggests that many in the community view HIP-4 as a meaningful step forward. Whether this translates to sustainable usage and deeper liquidity over time will depend on how soon outcome markets go live on mainnet and how actively traders use them for hedging, speculation, or structured strategies.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.