Deep Dive: Government Shut Down No More?

Things have been looking quite bleak for cryptocurrency markets recently. But as Bitcoin fell to $72.8K Tuesday, a somewhat encouraging turnaround happened. Why? Well, it turns out that even though Bitcoin may "exist" and be "perceived" to operate outside of traditional finance, its price is still heavily influenced by U.S. politics and interest rate expectations.

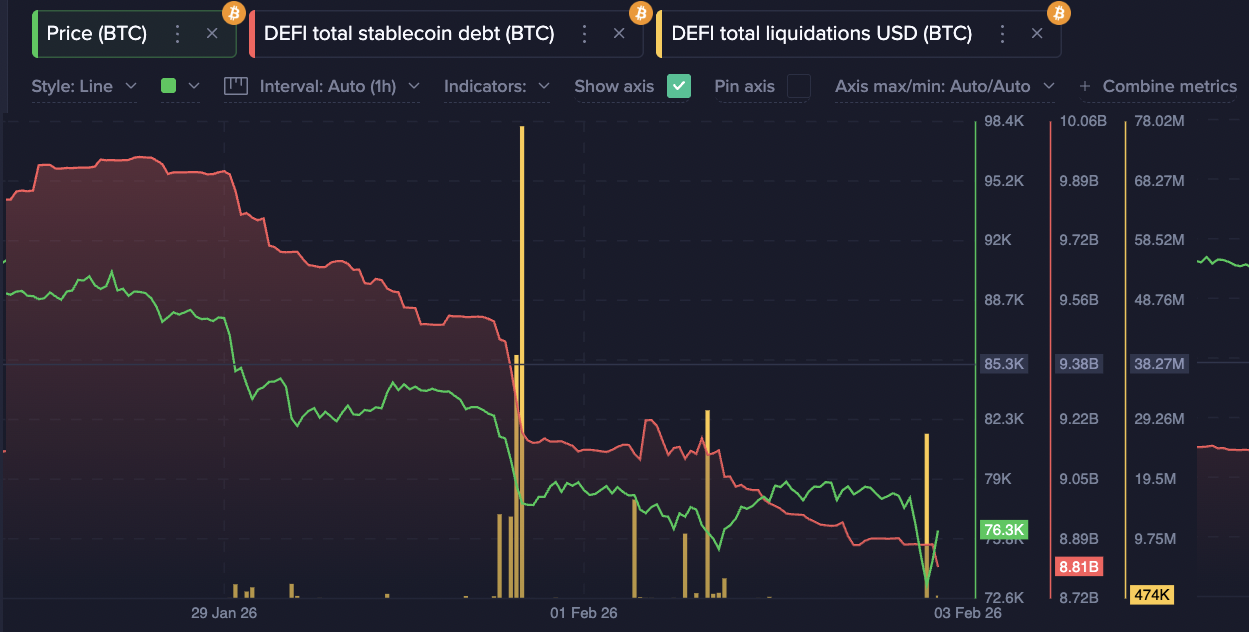

Uncertainty was really at a high when the U.S. House was in session over an important bill that could have very well shut down the government for the time being. When crypto's top market cap (BTC) dipped to its low, we saw $30M in total DEFI liquidations. As is typically the case, we began to see a short-term bounce.

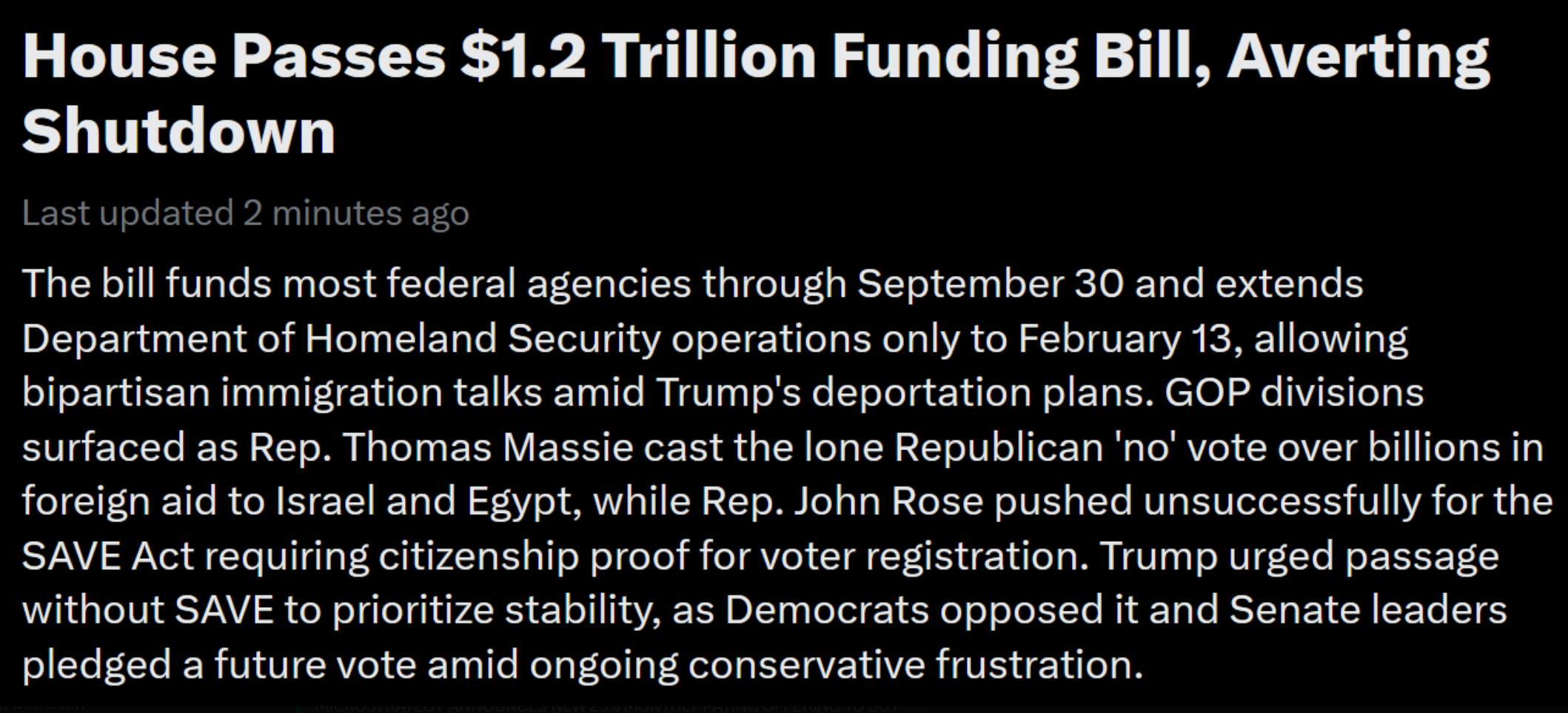

However, the question still remained on whether the House bill would pass. The reason U.S. policy carries such outsized weight is because the U.S. dollar remains the world’s primary reserve currency and the U.S. financial system sits at the center of global liquidity, meaning decisions made in Washington ripple through nearly every major market.

As we saw, particularly during the crash in 2022 (when interest rates were raised), and rebound in 2023 (when interest rates were cut), the Federal Reserve can instantly change how attractive risky assets look compared to safer investments like bonds. Politics matters too, because government decisions affect economic stability, investor confidence, and how much money flows through the financial system. When uncertainty rises in Washington D.C, traders around the world often become more cautious. That caution can spill directly into crypto markets, causing sharp moves that look disconnected from blockchain news but are tied to macro events instead.

Nevertheless, the most recent example of how U.S. policy impacts markets has just taken place, and largely went under the radar. In simple terms, Congress was deciding whether to approve spending bills to keep federal agencies operating. If lawmakers failed to pass a funding agreement, parts of the government would likely temporarily shut down. A shutdown means certain government workers stop being paid, some public services pause, and key economic reports may be delayed. Even if a shutdown is temporary, it creates uncertainty about how smoothly the economy is functioning. The funding package being debated was designed to keep most U.S. government operations running through the end of the fiscal year. Lawmakers argued over how money should be allocated and how long certain departments would be funded.

Throughout the morning (U.S. time), headlines suggested disagreement and a tight vote. During this window of uncertainty, Bitcoin, the S&P 500, and gold all experienced synchronized declines. This kind of move is often called a “risk-off” reaction, where investors pull money out of volatile assets until they feel more confident about the outcome of a political or economic event. However, after some uncertainty, the bill ended up getting passed.

Markets dislike uncertainty (such as we saw with Trump's tariff announcements throughout 2025) more than almost anything else, so the risk of a shutdown alone can move prices before anything actually happens. Crypto tends to trade like a high-risk asset during moments like this. When traders worry about instability, they often sell positions that swing widely in price, and Bitcoin is still viewed as one of the most volatile major assets. That is why Bitcoin’s drop mirrored weakness in U.S. stock markets. The correlation doesn’t mean the funding bill directly changes Bitcoin’s technology or adoption. Instead, it shows that global investors were adjusting their overall risk exposure at the same time across many markets. When fear rises, correlations between assets often tighten because traders are reacting to the same macro headlines.

Gold’s behavior added another layer to the story. Gold is usually seen as a safe-haven asset, meaning investors buy it when they want protection. However, during fast market stress, investors sometimes sell gold too in order to raise cash or re-balance portfolios. This can cause gold to briefly fall alongside stocks and crypto before stabilizing. The shared dip across Bitcoin, equities, and gold suggested that traders were focused less on individual asset narratives and more on managing short-term political risk tied to the funding debate.

But once the House passed the funding bill and the shutdown risk faded, markets rallied almost immediately. The rebound reflected relief rather than excitement. Traders were no longer pricing in the worst-case scenario, so risk appetite returned. Bitcoin bounced alongside the S&P 500, and gold recovered part of its losses. For crypto investors, the takeaway is that macro events can temporarily dominate price action, even in a decentralized market. The question now is whether THIS event uncertainty was a large part of what was causing crypto's decline so far in February. Well, now we keep a close eye on how key stakeholders react.

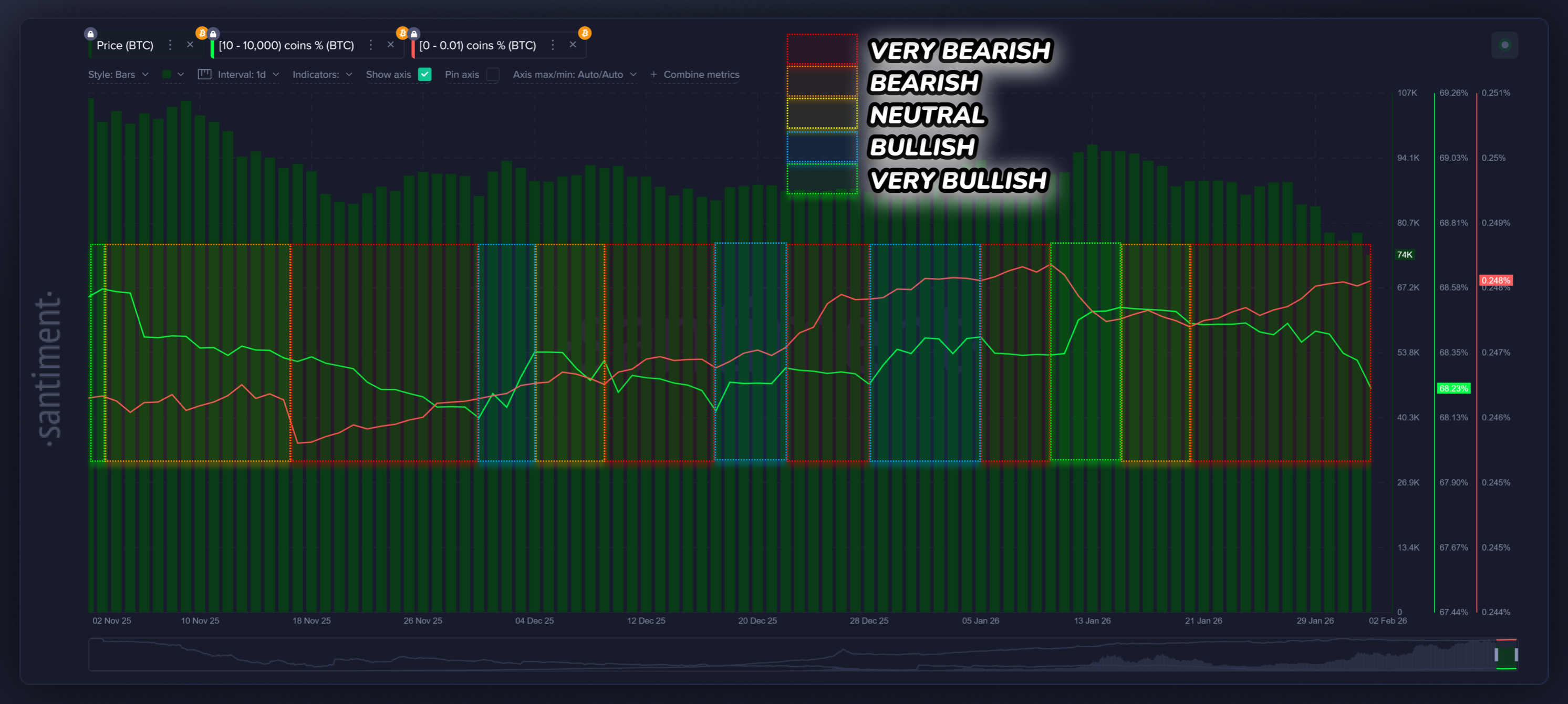

According to our data, key stakeholders (wallets with 10-10K BTC) have dumped 50,181 coins in the past 2 weeks. Simultaneously, retail has been accumulating rapidly. This is the exact OPPOSITE combination that typically leads to Bitcoin (and crypto) market caps growing. Now that a key House bill has passed, we will be monitoring and updating you on whether important metrics like this begin to turn around and point to a more bullish upcoming market performance.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.