Deep Dive: Chainlink Bridges Wall Street and DeFi With Real-Time Stock Pricing

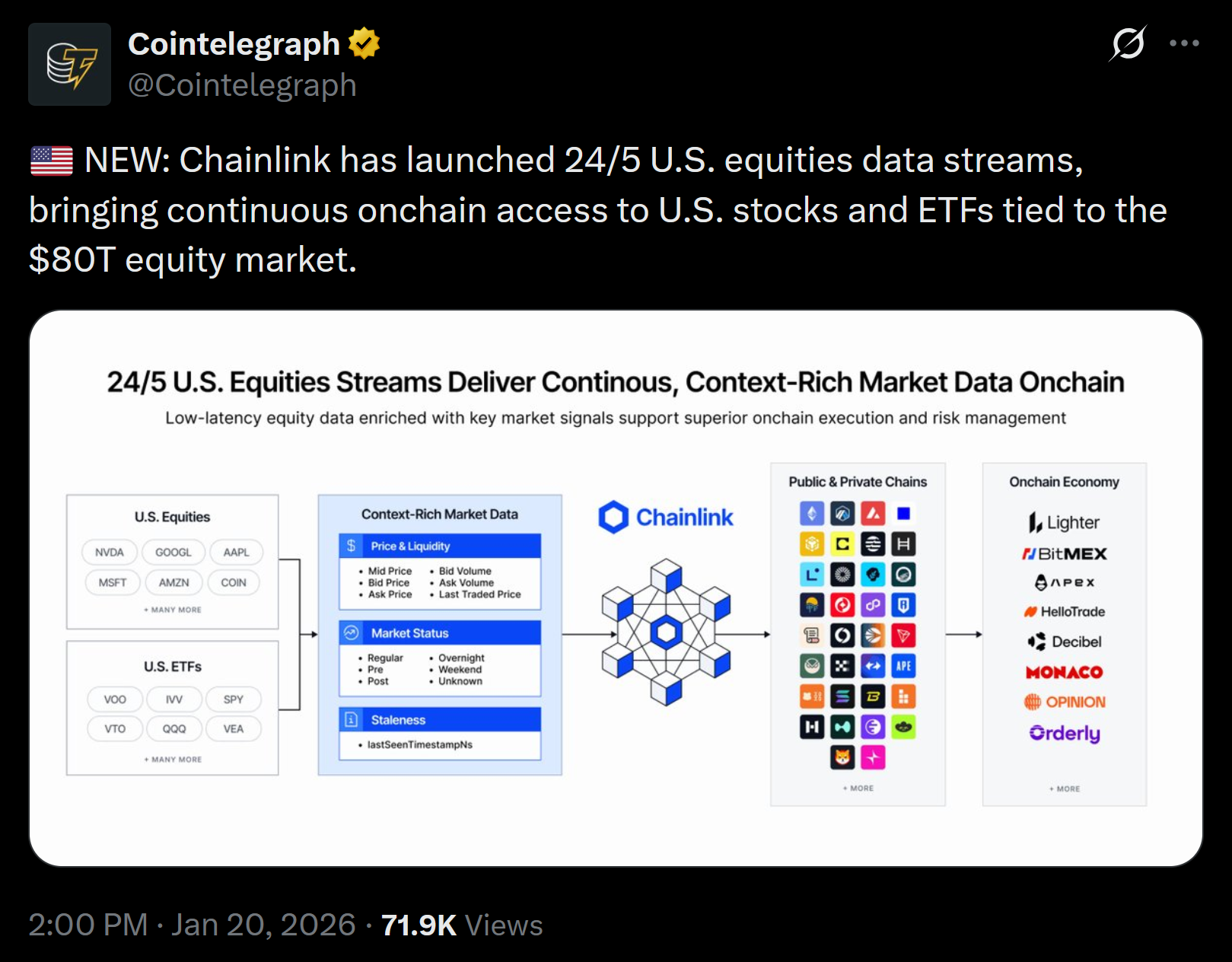

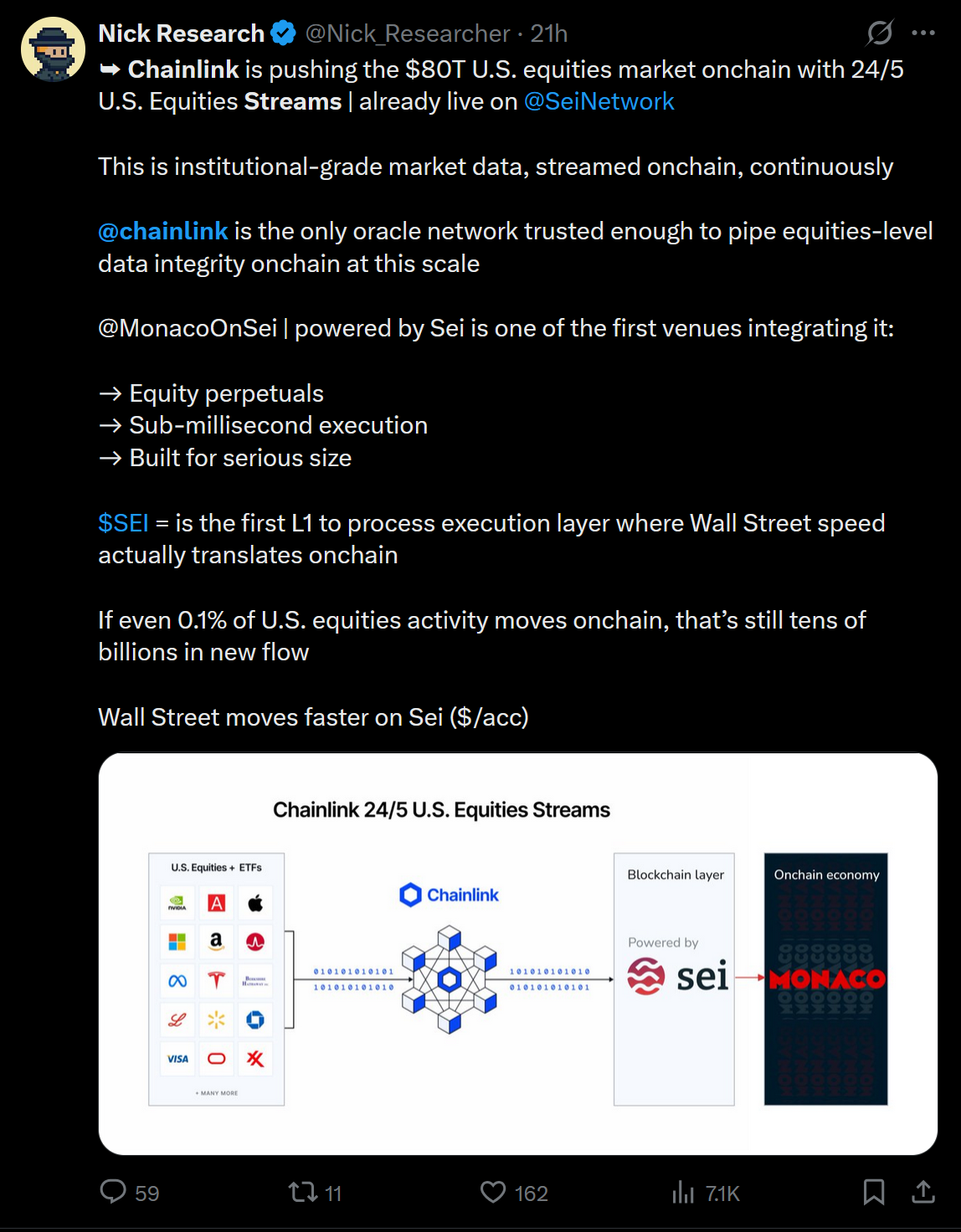

Chainlink is taking a major step toward blending traditional finance with crypto by launching new 24/5 data streams that bring U.S. stock and ETF prices on-chain. This system allows decentralized finance (DeFi) platforms to access real-time pricing data for equities while markets are open, covering roughly $80 trillion worth of assets. Until now, most on-chain financial products relied on delayed or limited price feeds when referencing traditional markets. Chainlink’s update aims to remove that gap.

These new data streams allow tokenized versions of stocks and ETF's to behave more like their real-world counterparts. DeFi platforms can now settle trades, manage collateral, and trigger smart contracts using up-to-date equity prices instead of outdated snapshots. This is important for applications like on-chain lending, derivatives, and structured products that depend on accurate price movements to function safely.

In simple terms, these new data streams help blockchains “know” the real prices of stocks while markets are open. Instead of guessing or using old information, apps on the blockchain can see the same prices that people see when trading stocks during the day. This makes on-chain stock products safer and more reliable, similar to how weather apps need live forecasts instead of yesterday’s temperatures.

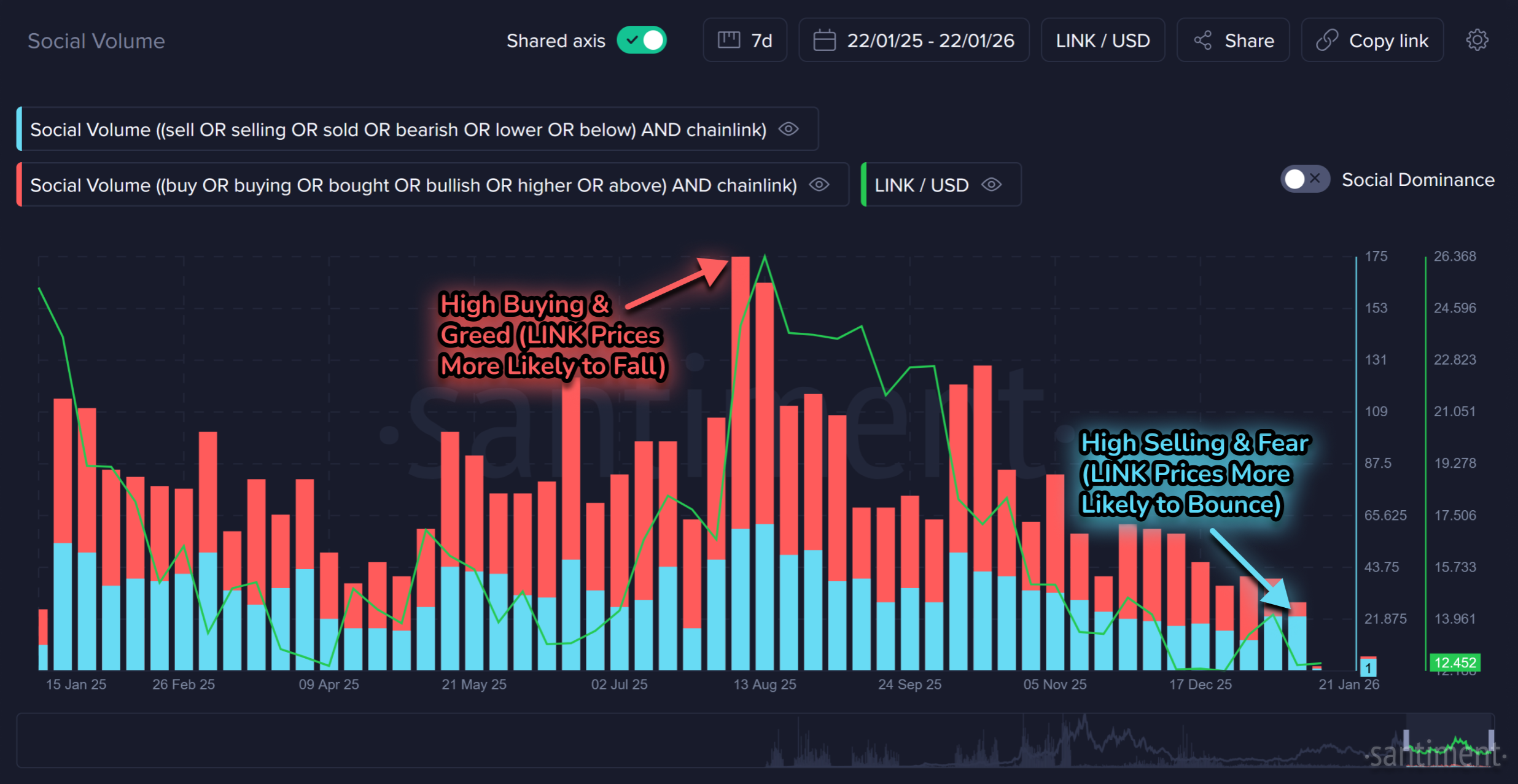

The move also highlights how tokenized assets are becoming more accepted by traditional finance players. Major institutions have been experimenting with tokenized bonds, funds, and stocks, but reliable pricing data has been a major hurdle. Chainlink’s role as a trusted data provider puts it at the center of this shift, helping bridge Wall Street systems with blockchain networks. Needless to say, this generated a considerable amount of hype. Even with LINK (and most of the rest of crypto) plummetting Tuesday, the coin saw a 5-week high in social volume.

At the same time, cryptocurrency markets have stabilized after reports that Trump stepped back from proposed tariffs on eight European countries following his claim that the framework of a Greenland deal has been made with NATO. This eased short-term market stress and allowed investors to refocus on technology and infrastructure developments.

With LINK already being prominently in the news this week due to this announcement, we can naturally begin to see some bullish momentum build now. Due to all of the price retracing, social data has indicated a higher and higher ratio of selling vs. buying mentions over the past month. And as of the day of this Chainlink announcement, the bears are closer to overtaking the bulls than they've been in well over a year.

For Chainlink investors, this real-time stock pricing strengthens the project’s long-term value proposition. Chainlink is not just serving crypto-native assets anymore. The platform is actually positioning itself as core infrastructure for global financial markets moving on-chain. If tokenized equities continue to grow, demand for Chainlink’s data services could rise steadily, supporting the network’s relevance and usage over time.

In the short term, LINK’s price reaction may be more muted or volatile, especially if Bitcoin continues to struggle breaking its $90K resistance level for the long run. Traders often wait to see whether new partnerships or integrations follow big announcements like this, or at least see what kind of instant KOL reactions there may be to help them decide how to feel. But the reality is that if DeFi platforms begin actively using these equity data streams and volume grows, it could create stronger near-term momentum.

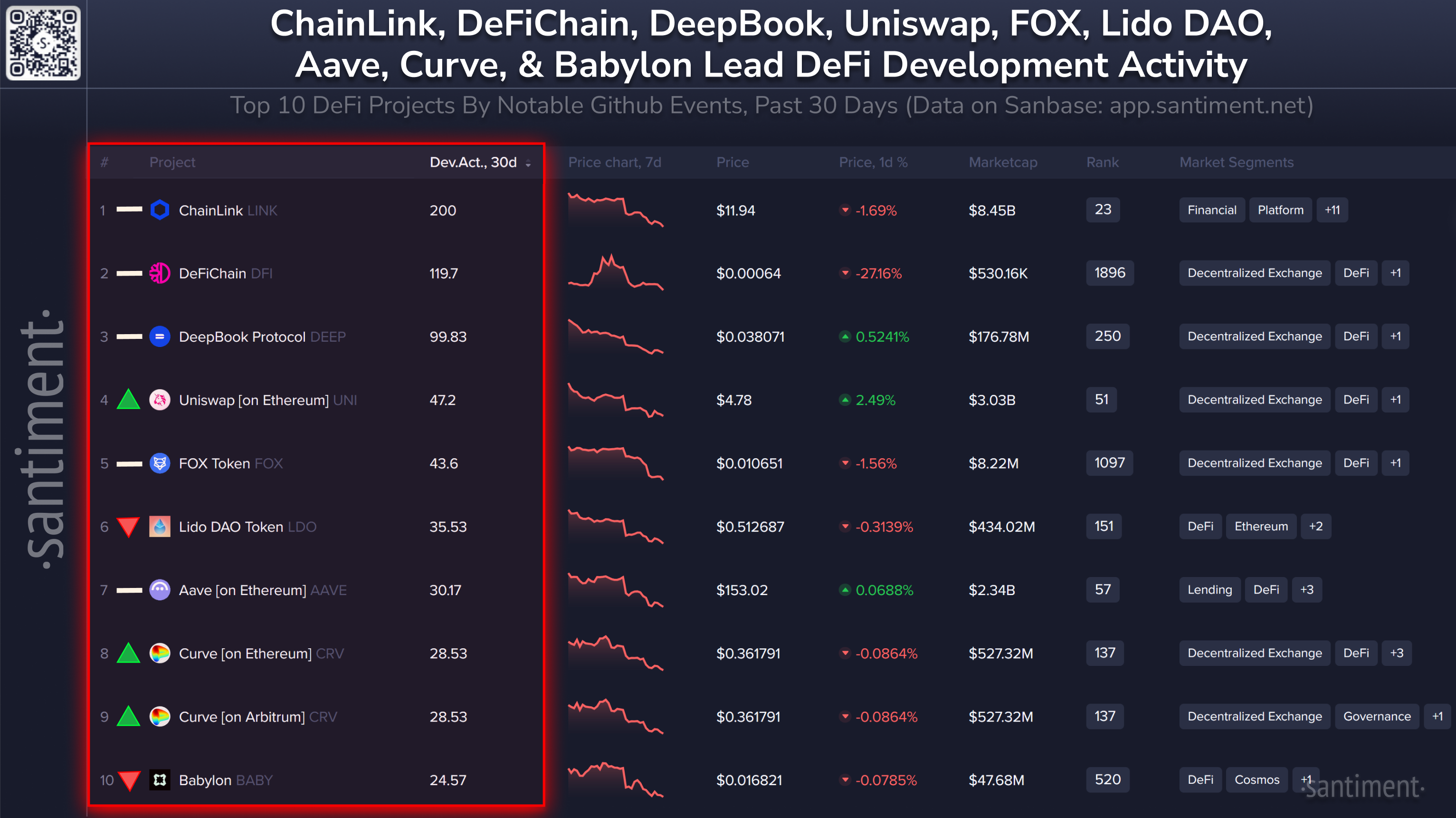

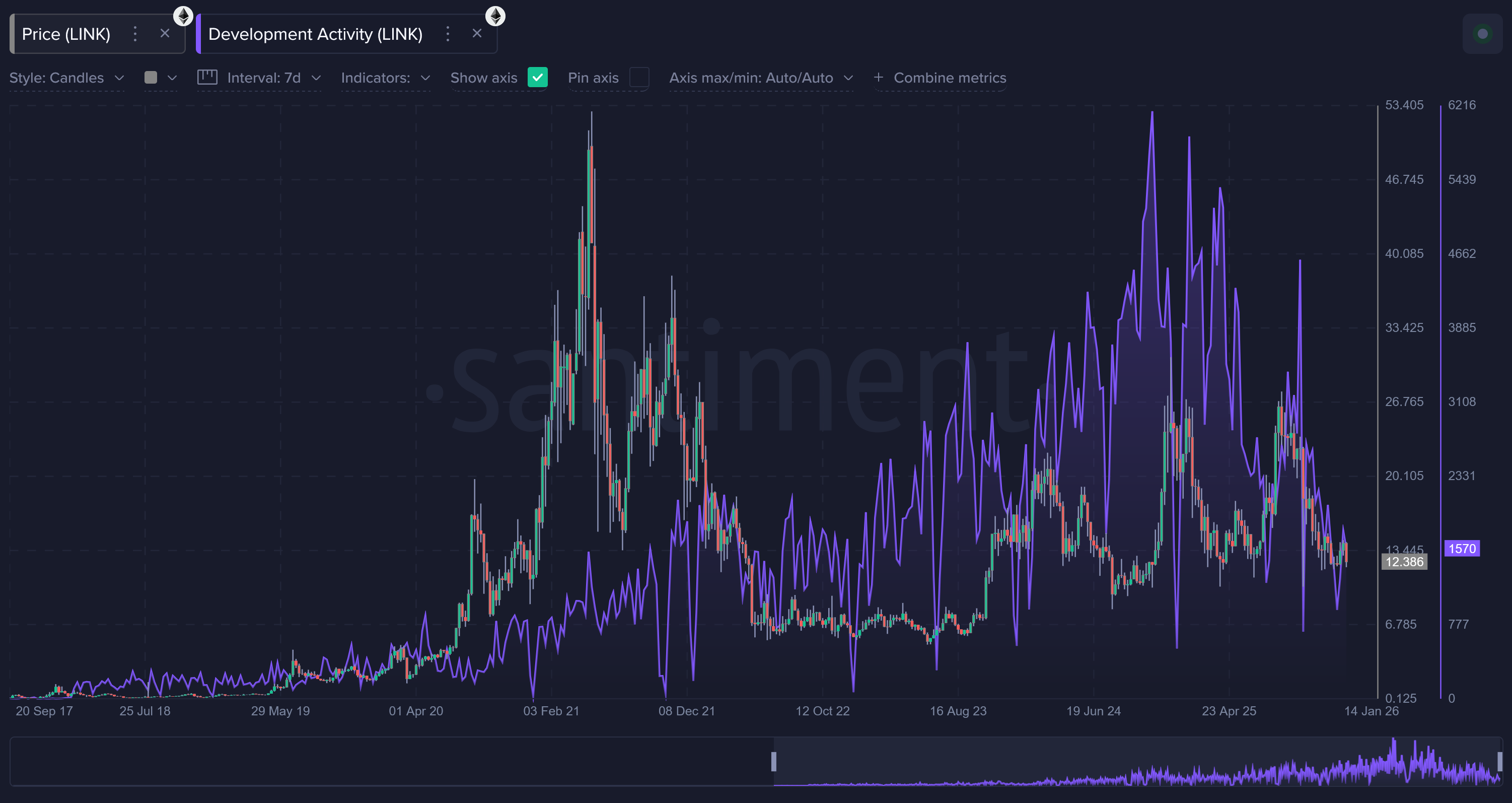

Without immediate adoption, price movement may remain range-bound despite the positive news. As of Wednesday, Chainlink is still the top developing DeFi project in crypto by a wide margin, however. So there are other reasons to be excited for the long-term.

And no, this is not a fluke. Notable github events for Chainlink have been rising at a considerable rate since the genesis of the project back in 2017:

It's hard to deny that bringing trillions of dollars’ worth of traditional assets on-chain will expand the total market Chainlink can serve by a massive margin. This could support a stronger investment narrative around LINK as a backbone of tokenized finance, rather than just a crypto oracle token tied to DeFi cycles. If tokenization becomes a lasting trend, Chainlink could benefit from more stable demand over time, while still offering upside during broader crypto market rallies.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.