Rates Trimmed, Idols Raised

As expected, the Federal Reserve delivered the widely expected 25 bps rate cut Wednesday, lowering the target range to 4.00%–4.25% and restarting the American easing cycle after a long pause. Chair Jerome Powell described the move as a “risk-management” step and stressed there wasn’t broad backing for a bigger 50 bps reduction.

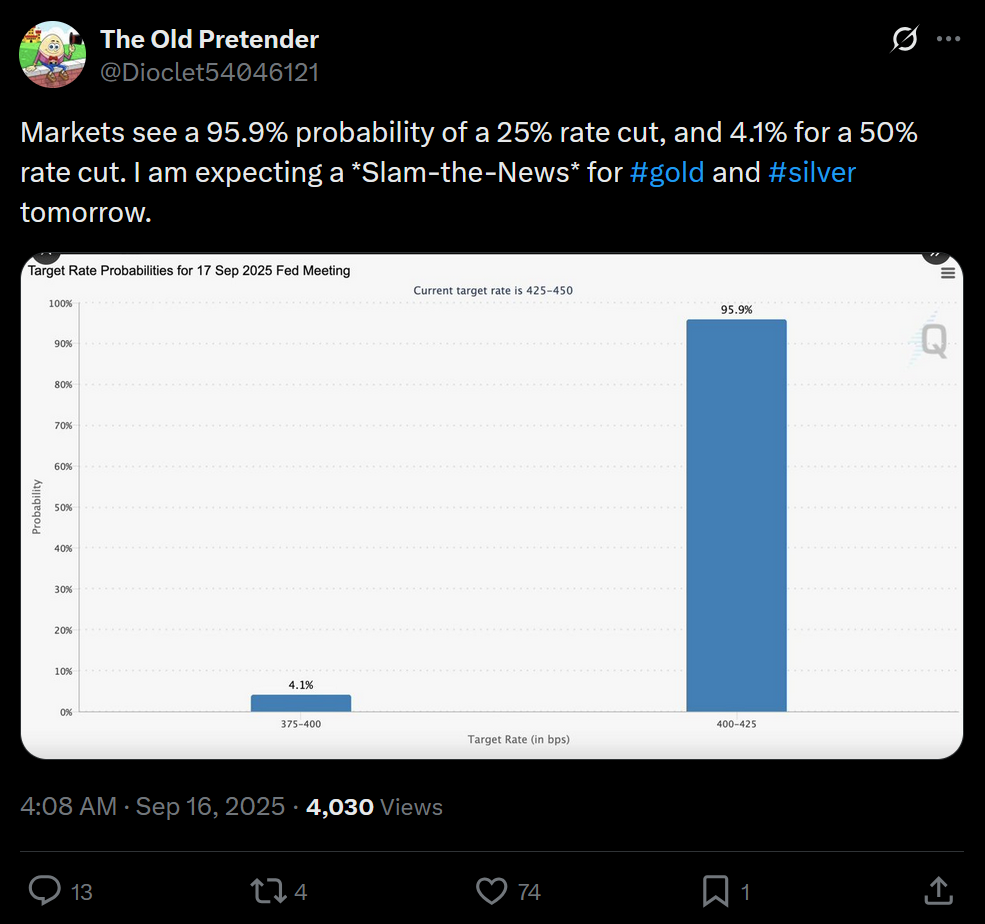

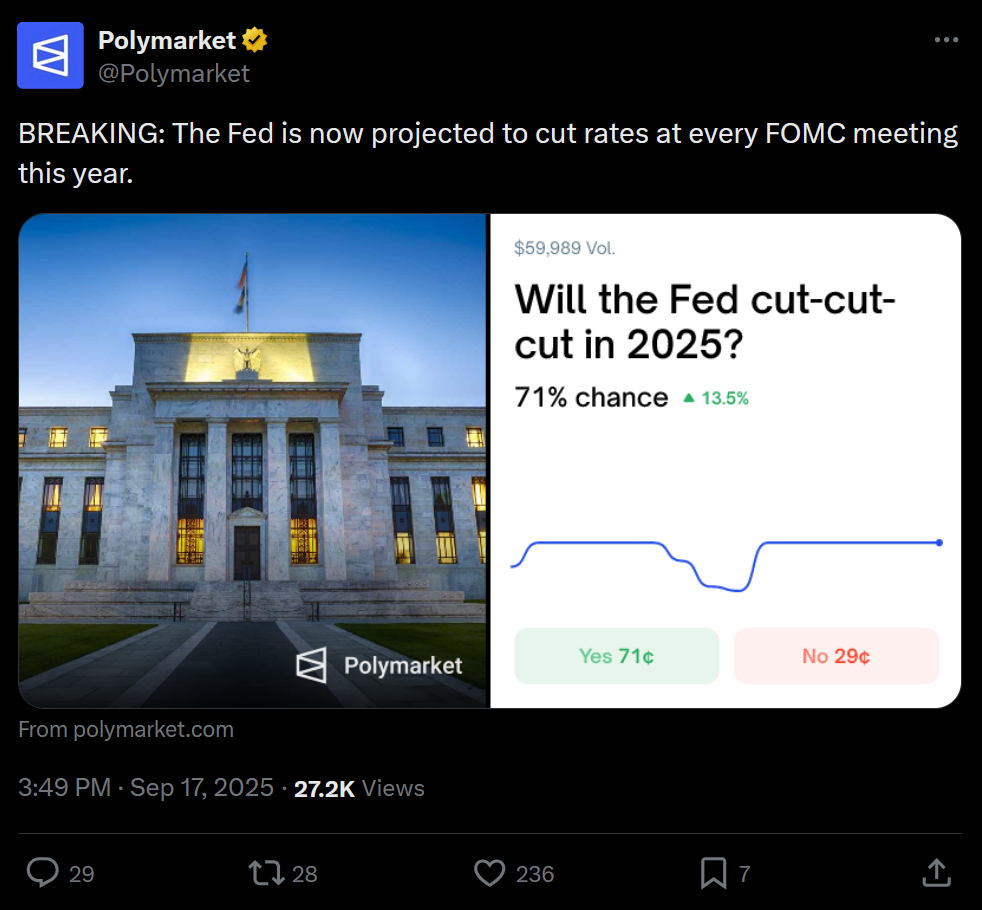

Here at Santiment, prior to the decision being made, we had discussed how a non-rate cut would lead to a fairly chaotic pullback... while a rate cut larger than 25bps would lead to a big breakout. The odds on Polymarket were overwhelming toward what turned out to be the correct result:

Neither "surprise scenario" happened, and we were met with the result that was widely predicted. Since a 25bps cut was such a solidified assumption among the crowd, markets did not see a huge reaction.

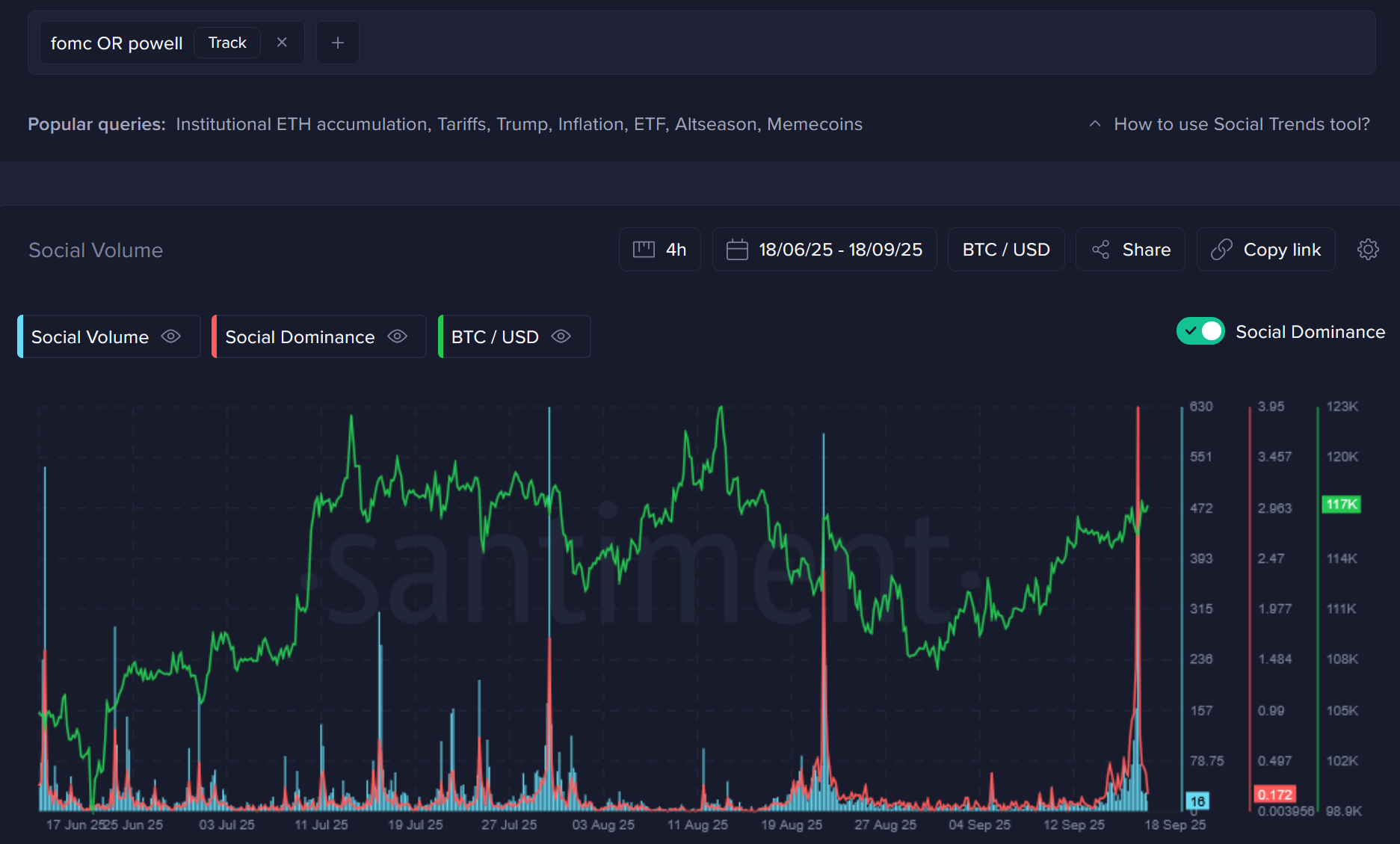

However, there was a huge social dominance spike that greatly eclipsed any other discussions about the FOMC or Powell. The last time we saw discussion rates of this size was in April, while tariffs were still the center of attention and Trump had anticipated a rate cut due to the massive market dips happening during that time.

What does this huge social spike mean? Well, traders were particularly keyed in on this one, considering it would (and turned out to) be the first cut in nearly two years. And unlike the dozen or so past FOMC meetings, this one was finally the one that was finally anticipated to result in a change. The question is... did this change actually result in any future price change? Well, we can look at a few MVRV's to see how things are looking for top caps.

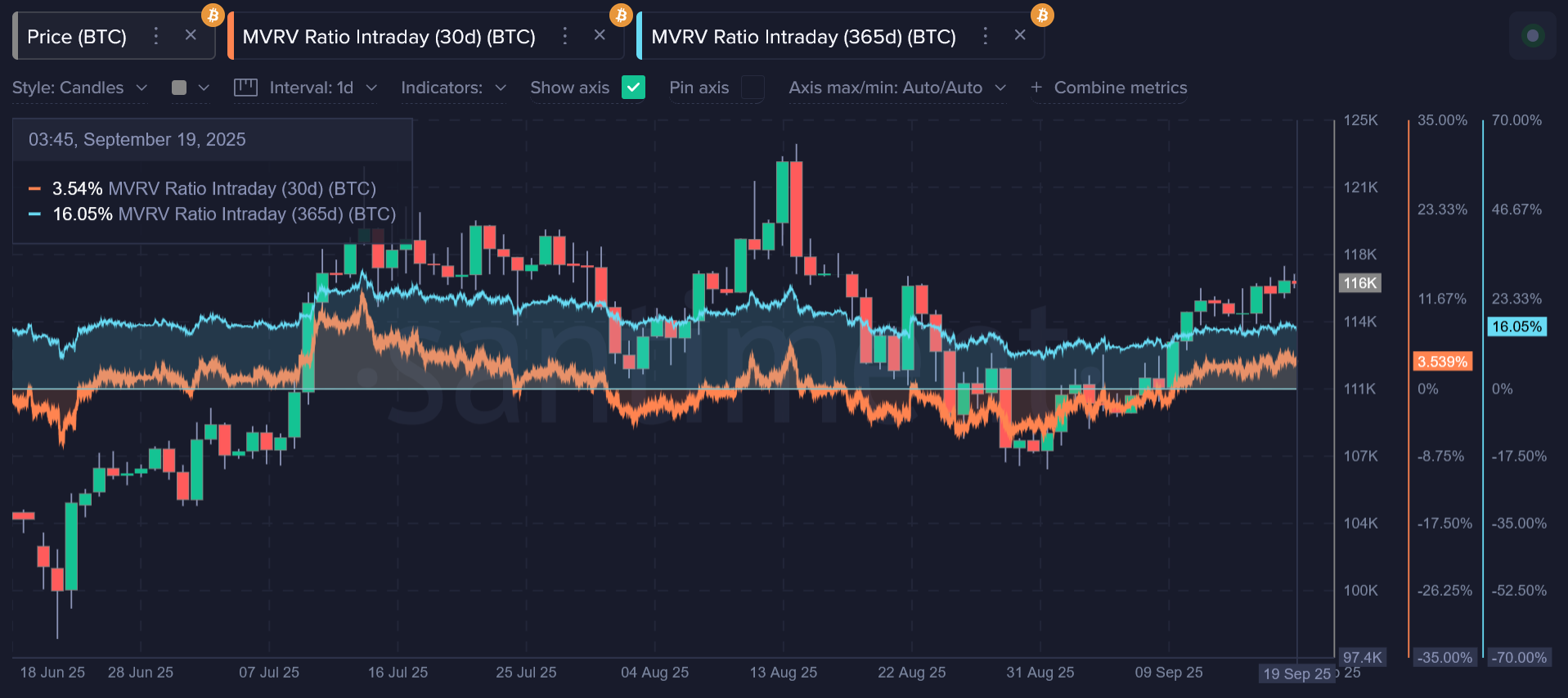

As far as Bitcoin's price action has been going, it has rebounded +8.1%. And with rate cuts made official, retail sees a straight path toward $120K+ again. But we may want to pump the brakes on a continued rally, at least right away.

Average wallets active in the past 30 days are up an average of +3.5% on their investments. While average wallets active in the past year are up an average of +16.1%. Both of these signal a mild amount of risk in buying or adding on to your position at this time.

Meanwhile, Ethereum is seeing a slightly better opportunity in jumping in for a short-term rally, with 30-day traders up just +1.0% on their investments, on average. However, due to the #2 market cap's huge mid-year rally, the 1-year MVRV is still way up there at +37.4%. This indicates that Bitcoin is mathematically a much safer bet if you plan on hodling the rest of 2025.

Even though Trump and many bullish traders did in fact get their rate cuts yesterday, it came with a bit of an asterisk. Powell’s report of the cut was paired with caution. He signaled that the Fed is easing because growth and jobs look softer, not because inflation risk has vanished. The new projections and market pricing imply only modest additional easing this year (roughly another 50 bps on median, depending on the source), and even some internal disagreement emerged, with Governor Stephen Miran reportedly favoring a larger move.

Bets are already being placed on Polymarket on how the results of the rest of the interest rate decisions will go. With two other FOMC meetings to go, the bets currently show a 71% expectation in both resulting in further cuts.

This all matters greatly for Bitcoin and crypto markets because their price fluctuations have been overwhelmingly correlated with U.S. equities in recent years. Multiple studies and market analyses show BTC’s correlation with the S&P 500 rises in “risk-on” regimes and can tighten when policy pivots change the cost of capital: when stocks catch a bid on easier financial conditions, Bitcoin often magnifies the mov up or down. In other words, what the Fed says to stocks frequently echoes in crypto, just louder.

And yes, on a related note, there was a 12-foot golden statue of former President Donald Trump holding a Bitcoin, unveiled on the National Mall near the Capitol just before the decision. Some view this as a positive signal that one of the world's most powerful nations continues to push toward a pro-crypto, mass adoption society.

This statue has been rocketing around social feeds, garnering mixed reactions as expected. Pro-crypto traders seem to view it as a slightly bullish sign for crypto, or at least "not harmful". They generally see it as a wink toward mainstreaming and political momentum for digital assets, even though many critics saw it as pure meme-marketing. Either way, it really does symbolize how cultural and political theater now intersects with macro catalysts to shape crypto’s narrative on big Fed days.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.