This Week in Crypto, Full Written Summary: W2 February 2026

Bitcoin Reclaims $70k: Is the Correction Finally Over?

Executive Summary

- Inflation Cools, Crypto Heats Up: A cooler-than-expected CPI report (2.4%) has repriced rate cut expectations, pushing Bitcoin back toward $70k and sparking a relief rally across the board.

- Whales Wake Up: After weeks of dormancy, key whale tiers (10-10k BTC) have accumulated over 18,000 BTC in the last four days, though retail traders aggressively buying the dip remains a concern.

- Opportunity Zones Active: Key on-chain metrics like MVRV remain deeply negative (-29% for Bitcoin), suggesting the market is still in a low-risk accumulation zone despite the recent pump.

Introduction

The latest CPI print has breathed new life into the crypto markets, sending Bitcoin testing the $70k resistance. But is this a sustainable reversal or just a temporary pump destined to fade? The Santiment team analyzed the on-chain data, from whale behavior to funding rates, to see if the data supports a continued rally.

00:00 - Bitcoin Tests $70k on CPI News

The market reacted positively to the latest inflation data, with Bitcoin jumping over 5% in 24 hours to reclaim the $68k level. While this momentum is encouraging, Friday pumps on economic news often require Monday confirmation. The bounce appears to be a regression to the mean after very strong downward pressure on price.

- Key Data: Bitcoin +5.3% in 24 hours; Price >$68,700.

- Actionable Tip: Be cautious of "Friday optimism"; wait for the weekly close to confirm the trend strength.

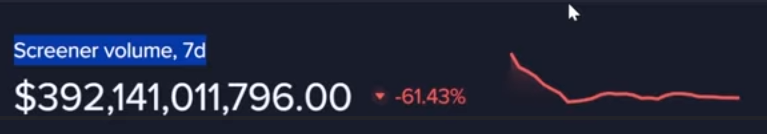

04:14 - Why Trading Volume Has Collapsed

Despite the price uptick, trading volume has evaporated, dropping significantly compared to last week (data). This indicates a state of capitulation and "analysis paralysis" among traders who have been battered by months of red candles. When the crowd sits on its hands, it often signals that the market is resetting for its next major move.

- Key Data: Trading volume down 61% week-over-week.

- Actionable Tip: Low volume often precedes high volatility—do not mistake boredom for stability.

06:19 - Inflation Data & Rate Cut Implications

Headline CPI missed expectations at 2.4%, while Core CPI hit 2.5%. This "cooling" inflation narrative has reignited hopes for a Fed rate cut in 2026. However, traders should be wary of the "buy the rumor, sell the news" dynamic. While the immediate reaction is bullish, macro reports rarely drive long-term crypto price trends on their own.

- Key Data: Headline CPI at 2.4%; Core CPI at 2.5%.

- Actionable Tip: Use macro events for short-term volatility plays, but rely on on-chain data for long-term trend analysis.

07:51 - Coinbase Outages & Exchange FUD

Coinbase experienced outages during the volatility, coinciding with a missed Q4 earnings report. In a bear market, technical glitches amplify user anger and distrust. Along with ongoing Binance scrutiny, this friction tests trader patience. However, exchange FUD is often a lagging indicator of bottoming sentiment.

- Key Data: Coinbase reports large net loss for Q4.

- Actionable Tip: Diversify your holdings across multiple exchanges or self-custody to avoid being locked out during volatility.

10:26 - Memecoin Capitulation Signals

There is a growing narrative of "nostalgia" regarding memecoins, with many traders treating the sector as if it is permanently dead. This collective acceptance of the "end of the meme era" is a classic capitulation signal. When the crowd completely writes off a sector, it is often the contrarian time to start paying attention again.

- Key Data: "Memecoin peaks" trending in social narratives.

- Actionable Tip: Watch sectors that the crowd has left for dead; max pain often marks the bottom.

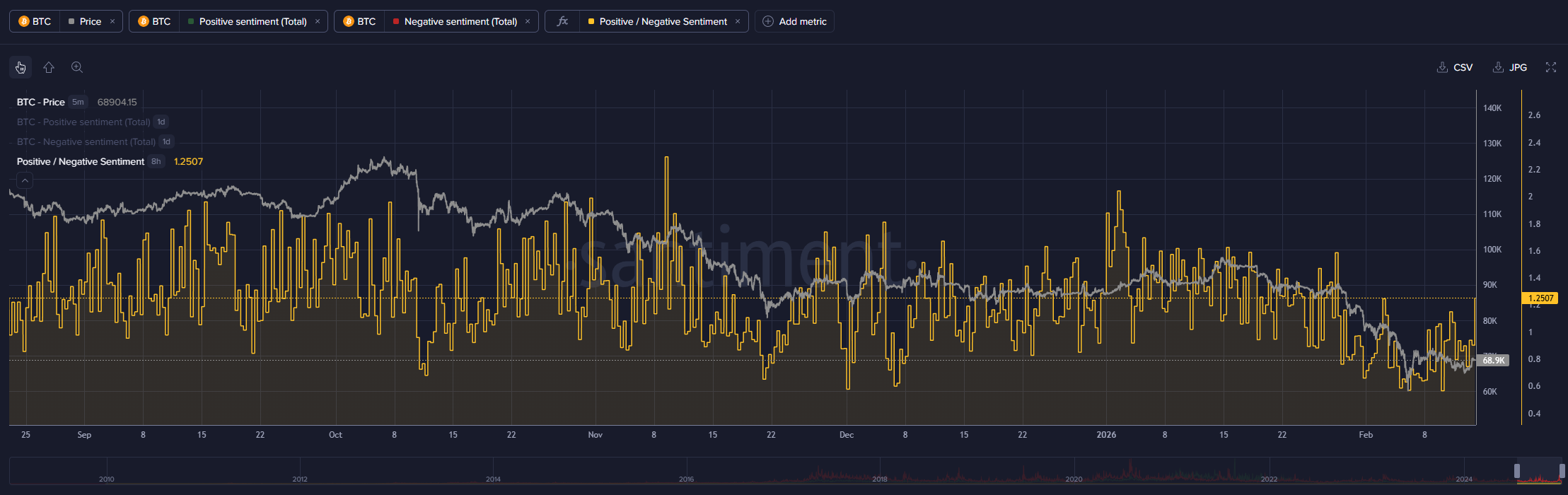

12:22 - Social Metrics & Bearish Sentiment

Sentiment remains fearful. The ratio of bullish to bearish comments is sitting below 1, meaning there are more negative comments than positive ones. Historically, markets move against the crowd's expectations. This lingering disbelief, even during a price pump, is a healthy sign for a potential sustained recovery (data).

- Key Data: Bullish/Bearish Comment Ratio was at ~0.89.

- Actionable Tip: Look for long entries when the crowd is fearful (ratio < 1) rather than euphoric.

15:26 - Whales vs. Retail: Who Is Buying?

We are seeing a mixed signal in wallet behaviors. "Smart money" whales (10-10k BTC) have added roughly 18,000 BTC recently. However, small retail wallets are also aggressively buying. Ideally, a market bottom sees whales buying while retail sells in fear. The current dynamic suggests we aren't at a "perfect" bottom yet.

- Key Data: Whales (10-10k BTC) added 18,290 BTC in the last 4 days (data).

- Actionable Tip: Wait for the "red line" (retail holdings) to decline while whales accumulate for a high-confidence buy signal.

18:02 - Bitcoin Network Health & MVRV

Bitcoin's 365-day MVRV (Market Value to Realized Value) sits at -29%, placing it in a historic low-risk zone. This means the average long-term holder is down significantly on their investment. When both short-term and long-term MVRVs are this negative, it increases the probability of a relief rally to bring these metrics closer to zero.

- Key Data: 365-day MVRV at -29%; 30-day MVRV at -10.9%.

- Actionable Tip: Negative MVRV ratios historically present the best risk/reward entry points for accumulation.

21:00 - Funding Rates & Short Squeeze Potential

Funding rates on exchanges have dipped into negative territory or remained neutral (data). This indicates that traders are betting on the rally failing. If prices continue to rise, these short positions will be forced to cover, potentially fueling a "short squeeze" that propels Bitcoin higher.

- Key Data: Aggregated funding rates flipping between neutral and negative.

- Actionable Tip: Bet against the majority leverage; if funding is negative, expect price upside via liquidations.

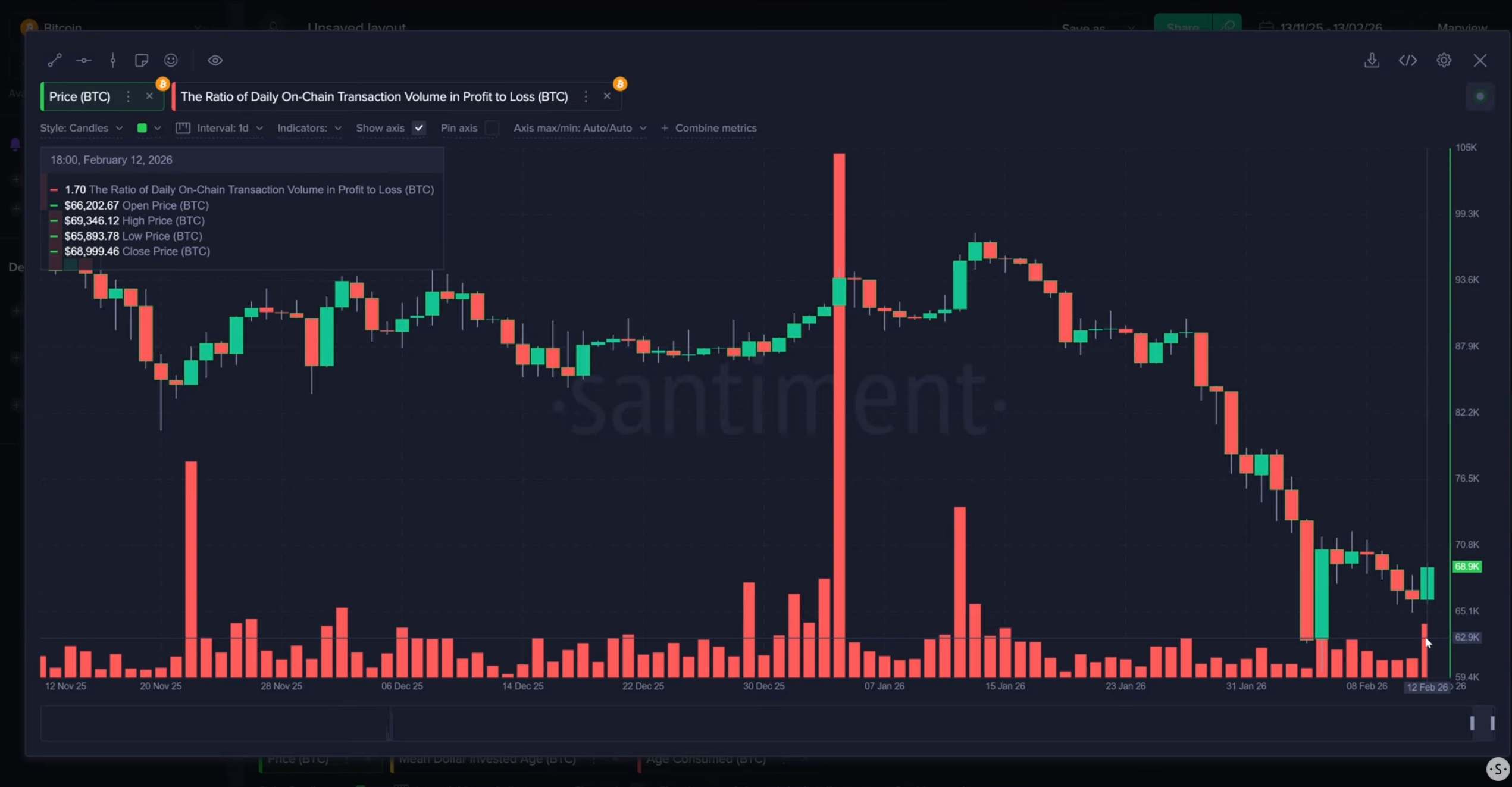

23:24 - Profit Taking vs. Realized Losses

For the first time in a month, we are seeing a spike in the ratio of profitable transactions. While profit-taking can temporarily stall a rally, sustained realized profits are necessary for a healthy bull market. Currently, the market has been dominated by realized losses, so this shift is worth monitoring.

- Key Data: Highest ratio of profit-to-loss transactions in 30 days (data).

- Actionable Tip: Watch for consistent profit-taking to confirm that confidence is returning to the market.

25:19 - Bitcoin Supply on Exchanges

Unlike the volume drop, the supply of Bitcoin on exchanges has crept up slightly over the last month. While not at alarming levels compared to a year ago, increasing exchange supply generally implies a higher potential for sell-side pressure.

- Key Data: Slight increase in BTC supply on exchanges over 30 days (data).

- Actionable Tip: Monitor exchange inflows closely; large spikes often precede price corrections.

27:10 - Ethereum Staking & Holder Milestones

Ethereum continues to see a divergence between price action and network growth. The number of ETH holders has surpassed 178 million, and staking deposits are rising. Investors seem to be moving funds into staking contracts to hedge against price drops, creating a supply shock that could be bullish long-term.

- Key Data: Ethereum holders surpass 178 million (data).

- Actionable Tip: Distinguish between selling pressure and staking lockups when analyzing ETH outflows.

30:35 - XRP Network Growth & Shorting

XRP has been heavily shorted, more so than BTC or ETH. However, its MVRV is even deeper in the opportunity zone at -38.5%. While network activity is lagging, the extreme bearish positioning from traders could set up a violent reversal if a catalyst arrives.

- Key Data: XRP 365-day MVRV at -38.5%.

- Actionable Tip: Deeply negative MVRV combined with high short interest often creates a high-probability reversal setup.

Conclusion

The data presents a something of a case for a relief rally, though the conviction is still weak. With inflation cooling, whales accumulating, and MVRV ratios in deep opportunity zones, the risk/reward does favor the bulls. However, the persistence of retail buying and negative sentiment suggests we may not have seen the absolute "max pain" bottom yet. Watch for short liquidations to confirm the next leg up.

Spotting, analyzing, and understanding the markets is easier with the right tools and a strong like-minded community. Sign up for app.santiment.net and join our discord for more frequent and timely analysis of the crypto markets.

For more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.