Deep Dive: Has Solana Lost Its Soul?

The Solana crowd hype from 2025 has appeared to have all but vanished, along with its market cap (now -67% since its $249 price top on September 18, 2025). Social dominance toward SOL was well over 6% when vibes were high toward the #7 market cap asset, but now sit below 0.4% on a daily basis.

But how did we get here? Obviously all of cryptocurrency has taken a major beating since the retraces began at the beginning of Q4, 2025. But for Solana specifically, a big part of the recent frustration has come from the community's increased urgency for a validator security patch and the messy reality of getting everyone to install it fast. In January, Solana’s client maintainers urged validators to upgrade to Agave/Jito v3.0.14 after two critical vulnerabilities were disclosed, including one that could crash validator nodes and another tied to vote processing that raised concerns about consensus integrity. The fixes arrived quickly, but the bigger confidence issue was coordination: when updates are labeled urgent, markets pay attention to how smoothly a decentralized validator set can respond, because that response directly affects uptime, finality, and the safety of funds moving through DeFi.

Developers and validators began discussing rollback options, patch releases, and how to diagnose node instability. Some advised users to check validator status pages and retry transactions once congestion eased. At the same time, Zora made headlines by migrating its new “attention markets” product from Base to Solana, charging around 1 SOL per creation. The move sparked debate. Some saw it as a vote of confidence in Solana’s speed and culture, while others questioned incentives and token implications. The contrast between new apps launching and the network facing performance issues left the community split.

For many long-time holders, the emotional rollercoaster is nothing new. Solana’s identity was shaped by viral, meme-driven moments that defined entire market cycles. Traders still reminisce about Madlads minting chaos, the Pengu and Trump memecoin launches, the FTX crash fallout, Solbears and Baloonsville experiments, and Jupuary 2025 airdrop fever. They remember the USDC depeg panic, the Melania token buzz, the celebrity meme craze, and even the painful September 2021 network outage.

There were explosive NFT runs like Okay Bears, Degenerate Ape Academy, and DeGods pumping to 1000 SOL. Bonk’s 500B DeGods allocation burn and later Bonk airdrops brought fresh waves of retail energy. Magic Eden’s rise, Solanart’s early days, Metaplex Candy Machine v1 launches, and meme launchpad wars made Solana feel like the wild west of crypto. Even oddities like the Saga phone Bonk airdrop, Solana Mobile’s harsh reviews, LA Vape Cabal rumors, Mango Markets drama, LIBRA controversy, Sahil’s memecoin promotions, and the Hawk Tuah rug all became part of Solana folklore. The highs were unforgettable, but so were the scars. And over time, the character and 'fun' of Solana's ecosystem has dissipated to the massive market cap losses accrued by the community.

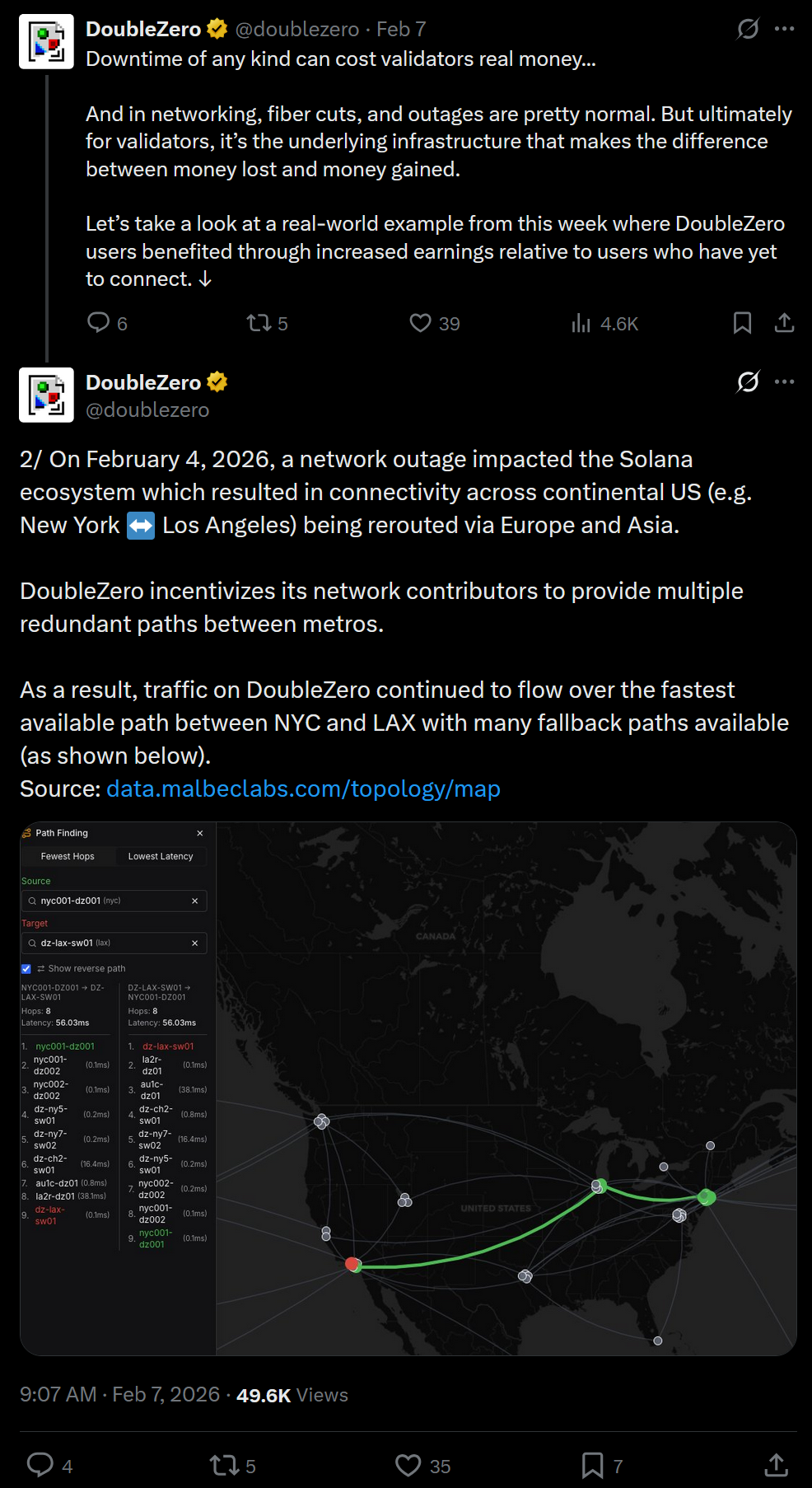

Infrastructure debates have also resurfaced surrounding Solana. After a February 4, 2026 network disruption, DoubleZero posted that connectivity across the continental US was temporarily rerouted through Europe and Asia due to infrastructure issues. In normal internet networking, fiber cuts and rerouting are not unusual. DoubleZero emphasized that its system incentivizes redundant metro-to-metro paths, claiming traffic continued to flow along the fastest available routes between New York and Los Angeles with fallback options in place. Still, for validators, infrastructure reliability is not just technical talk. It determines whether blocks are produced smoothly or rewards are missed. In a high-speed chain like Solana, milliseconds matter, and underlying hardware and routing can mean the difference between profits and losses.

Looking at the TA outlook from the crowd, the former support in the low $100's has now began acting as resistance. The Relative Strength Index has dropped into the low 30s, a level that often signals oversold conditions but also reflects weak momentum. From a bearish perspective, this opens the door for a possible retest of the $50 to $60 range if sellers stay in control.

From Santiments' own metrics perspective, it's also worth noting that exchange funding rates have recently become very negative toward Solana. Beginning during the most recent price collapse below $100, we saw a small bottom form as many aggressive shorters got liquidated. But this hasn't dissuaded many from trying again now, hoping for the price to drop even lower as February progressses.

This negative funding rate should absolutely be interpreted as at least a short-term bullish signal, as extreme shorts often act as 'rocket fuel' to allow an asset to recover more quickly than it otherwise would have. As we've seen with the recent Binance drama, exchanges are always prone to liquidating futures and margin positions, forcing prices to move in the opposite direction. And this is indeed an argument that Solana, with its long-lasting negative funding rate, is much more likely to see upside than further risk of a larger crash.

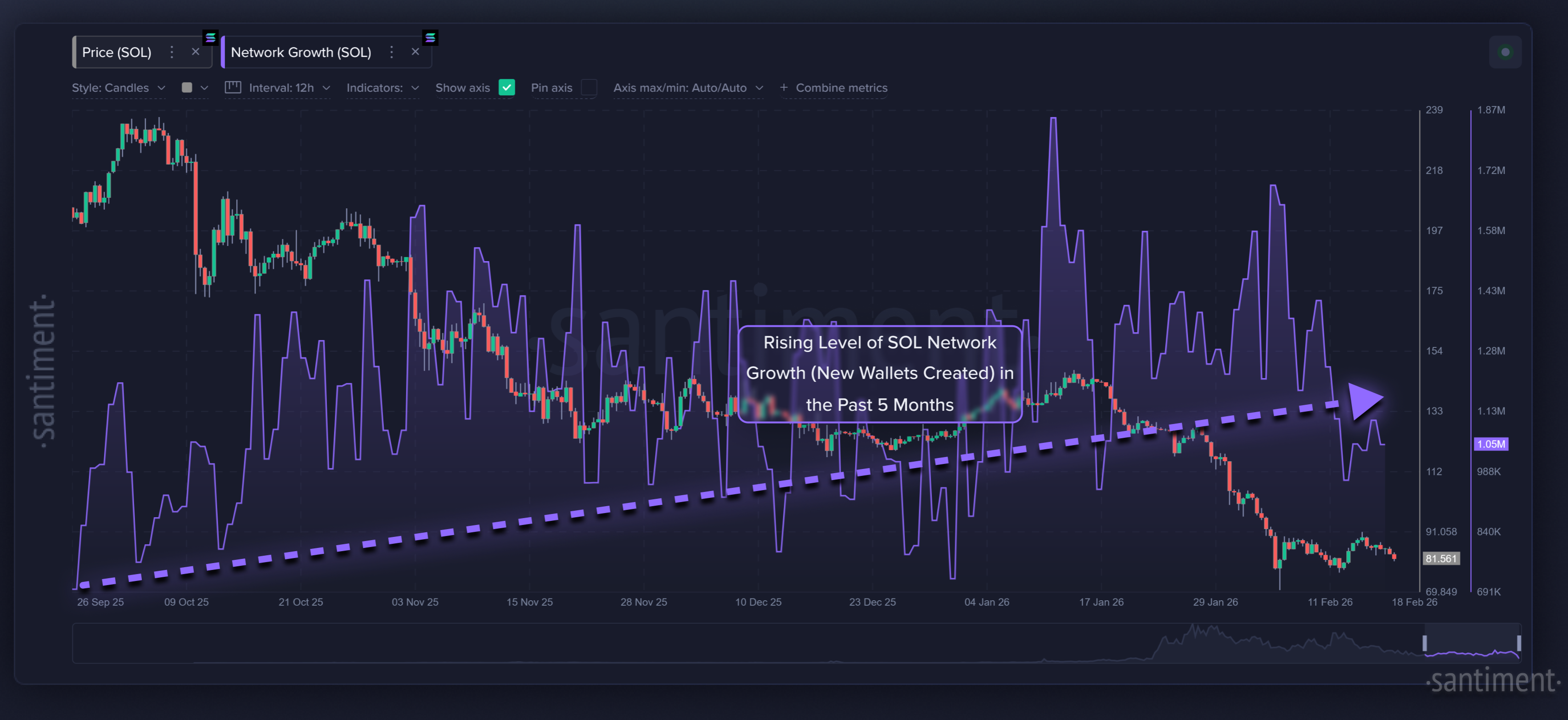

More good signs on the horizon that suggest Solana's market value can recover once Bitcoin and altcoins begin to finally reverse course. The amount of daily network growth (new wallets created) has actually been rising despite prices plummeting.

This is a sign that the network is still quite alive and well, with utility proving the network's use cases are there, and still appealing to traders and investors even during suppressed price conditions.

So, has Solana truly lost its soul? Or has it simply lost its momentum? The recent validator patch urgency, infrastructure debates, bearish technical setup, and negative funding rates all point to a network under pressure. Yet at the same time, new projects are still launching, funding rates are crowded to the short side, and daily network growth continues to climb even as prices struggle. That combination tells a more nuanced story. Solana’s “soul” was never just about price. It was about speed, experimentation, risk-taking, and a culture that thrived on chaos and innovation. Markets move in cycles, hype fades, and sentiment collapses before fundamentals do. If coordination improves, infrastructure continues to harden, and builders keep shipping while retail pessimism peaks, Solana’s identity may not be gone at all. It may simply be in the quiet phase before its next defining chapter.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.