This Week in Crypto, Full Written Summary: W1 January 2026

Can Crypto Resume Momentum From the Beginning of 2026?

Executive Summary

- The "Hype" Warning: Despite a strong start to 2026, severe divergences in meme coin metrics and a lack of retail panic selling suggest the market hasn't fully reset yet.

- Historic Data Spike: Ethereum recorded its highest network growth of the decade on Jan 7th—a signal of extreme excitement that historically precedes a short-term price cool-down.

- Bearish Short-Term Outlook: On-chain signals point to a potential deeper correction (with potential ETH targets at $2,600–$2,800) before the long-term bullish trend can resume.

Introduction

The crypto market kicked off 2026 with a bang. Prices surged across the board before cooling down later in the week. Our in-house analyst, Brian and Santiment CEO, Maksim came together to analyze whether this momentum can continue or if a deeper correction is on the horizon.

Their views offer a refreshing break from standard price predictions. Instead of guessing, they look at on-chain signals and social metrics to see what the crowd is actually doing. From a historic spike in Ethereum network growth to concerning divergences in meme coins, this session unpacked the data that matters right now.

00:00 - Market Start 2026: Winners & Losers

The first nine days of the year brought strong performance for certain assets. Brian highlighted that $XRP saw an isolated decoupling while $SUI and $TON stood out as top performers. Meme coins like $PEPE also had a strong start before calming down. The "Magnificent 8" non-stablecoins all remained in positive territory for the year as of the recording.

Key Data: Bitcoin hovered around the 90k level after touching 94k earlier in the week; Bitcoin was up 3% in the last 12 hours.

Actionable Tip: Watch for assets that "decouple" or move independently from Bitcoin as they often signal specific narrative strength.

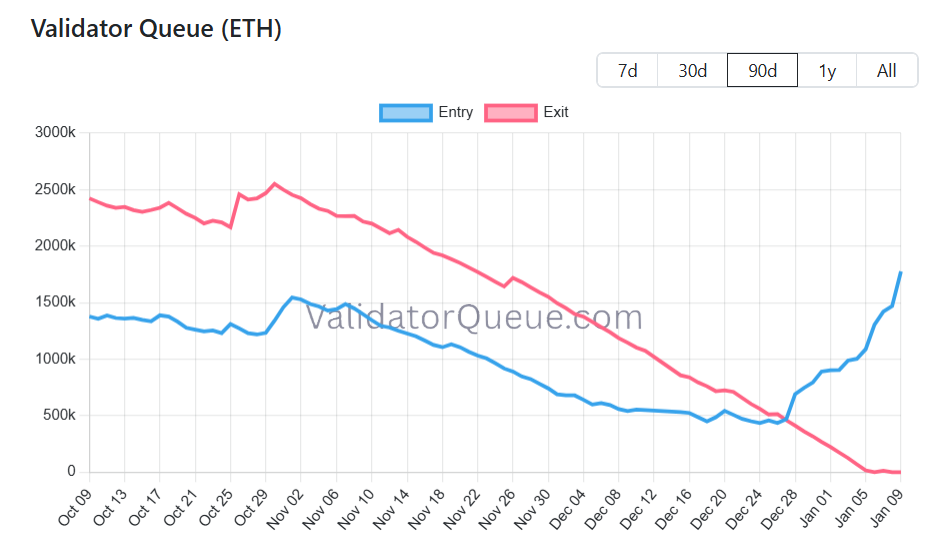

02:45 - Ethereum Staking Trends & Bitcoin Hype

Ethereum has been quieter than other assets but is seeing rising discussion rates. Brian noted that this is largely driven by staking hype. Investors appear to be locking up their coins rather than trading them. This accumulation indicates a desire to stay in the ecosystem despite the lack of immediate price action.

Key Data: Ethereum exit queue dropped to a 6-month low (32 validators); entry queue hit a 2-year high.

Actionable Tip: Monitor staking inflows during sideways markets as high staking usually indicates holders are positioning for the long term.

04:58 - The Psychology of Timing Market Tops

Maksim shared his perspective on the difficulty of timing the market perfectly. He admitted that being "wrong" about the exact moment of a top is part of the process. The key is understanding the sentiment pattern that builds around it. A bearish signal might be invalidated by new data, so mental flexibility is essential to endure the psychological stress of trading and to give yourself the best probability of making a good decision.

Actionable Tip: Do not stick rigidly to a prediction if new data contradicts it; let the market prove you right or wrong day by day.

07:37 - How to Read Extreme Sentiment Data

Weighted sentiment remains a powerful indicator for spotting tops. Maksim explained that extreme positive sentiment often precedes a price drop, though the timing can lag. The crowd celebrates loudly before the correction. They discussed how retail traders often react to headlines rather than the underlying reality of the news.

Key Data: Weighted sentiment hit "Extreme" levels for Bitcoin on Friday and Sunday prior to the price drop.

Actionable Tip: When you see "Extreme" positive sentiment on social platforms, consider taking profits or tightening stop-losses.

09:15 - The MicroStrategy Narrative Trap

The conversation shifted to how narratives can trap retail investors. The MicroStrategy story about the MSCI keeping MSTR on its indexes created a "we win" wave on social media. However, closer research showed the news was actually a downgrade in position. This disconnect between perception and reality often marks a local top.

Key Data: Social volume spiked on the MicroStrategy headline before the price retraced. Actionable Tip: Read the full research report behind a headline before buying into the immediate social media hype.

13:47 - Bitcoin MVRV: Is It Safe to Buy?

Brian reviewed the MVRV (Market Value to Realized Value) ratios for Bitcoin(chart). The long-term metrics suggest a safer zone for accumulation compared to peak bull runs. However, the short-term view is less clear. Maksim noted he prefers to see more pain in the market before calling a definite bottom.

Key Data: Long-term 365-day MVRV sits around -10%; 30-day MVRV is near breakeven. Actionable Tip: Use negative long-term MVRV as a signal for safer dollar-cost averaging zones during market dips.

16:42 - The Massive Ethereum Network Growth Spike

The most shocking data point of the week was Ethereum's network growth. The Ethereum network saw a massive surge in new addresses. While generally bullish long-term, Maksim noted that historic spikes like this often happen right before a severe correction as they signal peak excitement.

Key Data: January 7th saw the highest number of new ETH addresses, one of the strongest spikes in history.

Actionable Tip: Be cautious when network growth spikes vertically continuously, as it often indicates a "blow-off top" event is imminent.

19:55 - Tracking Retail vs. Whale Activity

Maksim analyzed the behavior of small Bitcoin wallets versus whales. He wants to see retail holdings decrease to indicate panic selling(chart). Currently, retail balances are staying flat. This lack of capitulation suggests the correction might not be over as the market has not yet "reset."

Key Data: Holdings for wallets with 0 to 0.01 BTC remain flat; no significant spike in realized losses.

Actionable Tip: Wait for signs of retail capitulation (small wallets selling) before entering a trade to catch a market bottom.

24:08 - Sentiment Analysis: ETH & Solana

Sentiment for Ethereum has dropped significantly which Brian pointed out is actually a positive sign for price stability. Solana saw a massive "Buy the Rumor" spike due to ETF news followed by a crash. This is a recent example of the classic pattern where social volume peaks coincide with local price tops.

Key Data: Ethereum sentiment is at a 3-week low; Solana sentiment spiked heavily on Morgan Stanley news (charts).

Actionable Tip: Look for low or negative sentiment as a potential entry point, as the crowd is usually wrong when they are fearful.

26:57 - Meme Coin Divergence Signals

Meme coins led the rally early in the year but displayed some red flags. Maksim identified multiple divergences where prices rose but on-chain activity varying between trading volume, DAA, Network Growth, or transaction volumes fell. This "empty dance floor" means the price rise was unsupported by any meaningful behavior in many cases.

Key Data: Trading volume and active addresses for major meme coins dropped while prices continued to climb.

Actionable Tip: If a coin's price is rising but its active addresses are falling, treat it as a bearish divergence and strongly consider an exit.

31:40 - Solana Metrics vs. Price Action

Solana displayed different behavior than the meme coins on its chain. Its network growth and transaction volumes rose along with the price. However, Solana is still tethered to the broader market and cannot completely escape a general downturn.

Key Data: Solana network growth and transaction volume remained correlated with price (no major divergence).

Actionable Tip: Distinguish between a Layer 1 blockchain's metrics and the speculative tokens built on top of it.

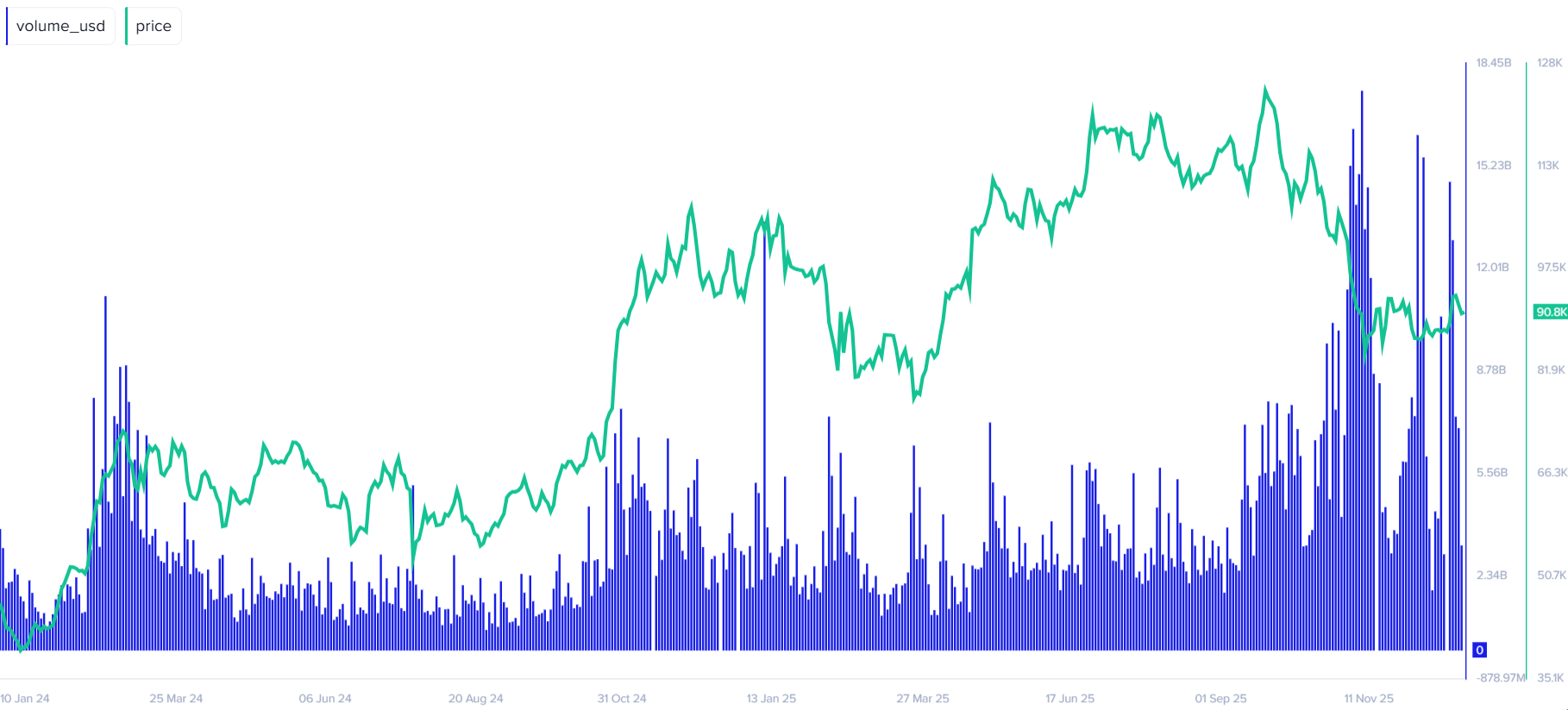

35:26 - ETF Inflows: Bitcoin, ETH, & Solana

The hosts reviewed ETF flow data. Historically, massive inflow spikes mark tops while negative spikes (outflows) mark bottoms. Solana saw a huge volume spike related to the ETF filing news. Brian interprets these spikes as fear and greed indicators.

Key Data: Solana ETF volume hit ~$384 million on the Morgan Stanley announcement. Actionable Tip: Use massive ETF inflow spikes as a contrarian signal that the local top might be near.

38:26 - Using "Higher vs Lower" to Spot Tops

Brian showcased a social metric that tracks how often people predict prices will go "higher" versus "lower." For XRP and Bitcoin, massive spikes in "higher" predictions coincided perfectly with the local top. The best buying opportunities appear when the crowd is screaming for "lower" prices.

Key Data: "Higher" mentions for XRP spiked exactly at the local price peak.

Actionable Tip: Search for keywords like "higher" or "moon" to gauge if the crowd is becoming irrationally greedy.

43:08 - Zcash Crash & Developer Drama

Zcash ($ZEC) suffered a significant drop following news that the development team had left due to a governance dispute. Brian showed that development activity on GitHub had flatlined. This serves as a cautionary tale that price action often reacts to the fundamental reality of a project.

Key Data: Zcash dropped 14% in a week; GitHub development activity fell to near zero. Actionable Tip: Always check a project's GitHub activity to ensure developers are still building before investing in a "cheap" coin.

47:30 - Final Outlook: Bullish or Bearish?

Maksim and Brian agreed that they both share a cautious short term outlook. The year started with too much hype particularly in meme coins. Maksim is leaning bearish in the short term and is looking for a potential drop in Ethereum to the 2,600-2,800 level to flush out leverage.

Actionable Tip: remain patient and protect capital until on-chain metrics confirm that the "hype" has fully cooled off.

Conclusion

Price reacts to data, not empty hunches. The historic spike in Ethereum's network growth and the divergences in meme coins provided early warnings of the current cool-down. While the long-term structure looks fine, the short-term requires patience. Investors should watch for retail capitulation and realized losses to signal a true bottom. Until then, caution is the best strategy.

Spotting, analyzing, and understanding the markets is easier with the right tools and a strong like-minded community. Sign up for app.santiment.net and join our discord for more frequent and timely analysis of the crypto markets. For more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.