This Week in Crypto, Full Written Summary: W4 December 2025

A Fresh New, Bullish Start For the New Year?

Executive Summary

- Retail sentiment has exploded into the new year, with Bitcoin optimism hitting a multi-month high and memecoins like $PEPE surging over 41%, signaling a return of speculative interest.

- Beneath the surface, large 'whale' investors are quietly accumulating, with wallets holding 10-10,000 BTC adding over 55,000 Bitcoin in just two weeks—a strong underlying bullish signal.

- Despite the hype, on-chain data reveals some weakness: the average long-term Bitcoin holder is still down 11.5% (MVRV), indicating that underlying market health has not yet recovered from the recent downturn.

Introduction

Kicking off the new year, Brian and Maksim returned for their first livestream of 2026 to analyze the crypto markets. In this session, they uncovered a surprising 41% rally from a popular memecoin, a massive spike in bullish sentiment for Bitcoin, and a very encouraging pattern of accumulation from large whale wallets.

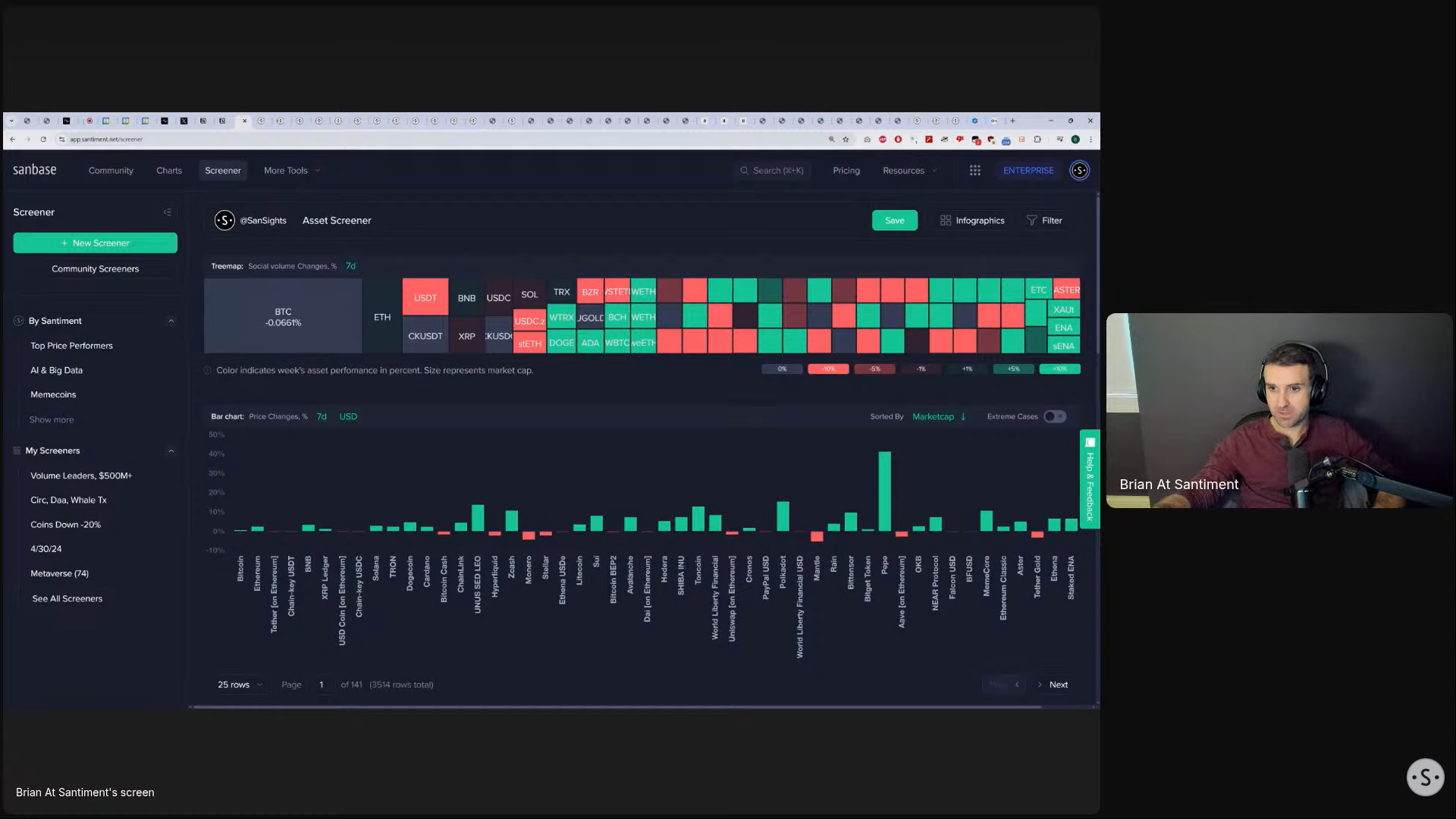

Social Volume Analysis: Which Mid-Cap Altcoins Are Gaining Retail's Attention?

The stream began with a look at social volume, a metric that tracks how much a cryptocurrency is being discussed online. While top assets like Bitcoin and Ethereum saw little change in discussion, several mid-cap altcoins showed a significant jump in retail interest. Dogecoin discussion was up 57% from the previous week and Cardano saw a 19% increase. Brian noted this suggests retail traders may be looking for an altcoin rally after a quiet end to 2025.

- Key Data: Dogecoin social volume increased by 57% and Cardano's by 19% compared to the previous week.

- Actionable Tip: Use social volume screeners to spot which altcoins are capturing retail attention, as this can be a precursor to increased volatility.

Bitcoin vs. $90k: What to Expect from Retail Traders

At the time of the stream, Bitcoin was approaching a key level of $90,000. Brian explained that such milestones often attract a rush of retail interest. This can lead to a short-term push above the level before larger limit-sell orders are triggered. The behavior around this price point is a critical test of market strength and retail sentiment as the new year gets underway.

- Key Data: Bitcoin was trading just under the $90,000 psychological price level.

- Actionable Tip: Pay attention to how the market reacts at significant round-number price levels, as they often trigger predictable retail behavior and institutional sell-offs.

PEPE's 41% Rally: An Isolated Pump or the Start of a Memecoin Frenzy?

The biggest story in terms of price performance was $PEPE, which surged an incredible 41% over the past week. Brian pointed out that this was an isolated pump. Most other cryptocurrencies were trading sideways or posting modest gains. This makes PEPE's rally particularly noteworthy, as it indicates high volatility and speculative interest focused on a single memecoin rather than a broad market upswing.

- Key Data: Pepe's price increased by 41% in the past week, significantly outperforming the broader market.

- Actionable Tip: When a single asset rallies hard while the market is flat, it's a sign of isolated speculation. Track its social volume to gauge if the hype is sustainable or fading.

Sentiment Check: Why Holiday Optimism Could Be a Contrarian Red Flag

General market sentiment is very optimistic as 2026 begins(charts). Trending topics highlight expectations for institutional adoption and new all-time highs. Brian cautioned that while this could be post-holiday excitement, extreme positive sentiment can be a contrarian indicator. If prices climb and retail traders begin to show signs of FOMO (Fear Of Missing Out), it could signal that a short term market top is near.

- Key Data: Trending topics on social platforms show high optimism and expectations for new all-time highs.

- Actionable Tip: Use sentiment analysis tools to measure crowd emotion. Extreme optimism across the board can often signal a good time for caution, not for chasing pumps.

Fact-Checking the "January Rally": A Look Back at Recent Volatility

A popular narrative suggests January is historically a green month for crypto. Brian fact-checked this, confirming that the last three Januarys did indeed close with positive gains. However, he vividly recalled the extreme volatility within those months. For example, the market saw a huge "sell the news" event after the 2025 presidential inauguration. This serves as a reminder that a positive monthly close does not guarantee a smooth or predictable ride for traders.

- Key Data: January has closed with a net positive gain for the last three consecutive years.

- Actionable Tip: Look beyond simple monthly returns. Analyzing intra-month volatility and reactions to major news events for a more realistic picture of potential market behavior and trigger points for trading decisions.

A Classic Mistake: How "Buy the Rumor, Sell the News" Burned Traders in the Past

Using historical examples, Brian explained the classic market pattern of "buy the rumor, sell the news." He referenced events like the 2022 Ethereum Merge and the 2025 inauguration. In both cases, prices were already "baked in" before the event occurred. Traders who bought in after the news was official were often left with losses as early investors took profits. It is a timeless lesson on how markets price in future events.

- Key Data: Past major events like the 2022 Ethereum Merge saw price drops immediately after the event occurred.

- Actionable Tip: Be aware of the "buy the rumor, sell the news" phenomenon. Often, the market prices in an anticipated event long before it happens.

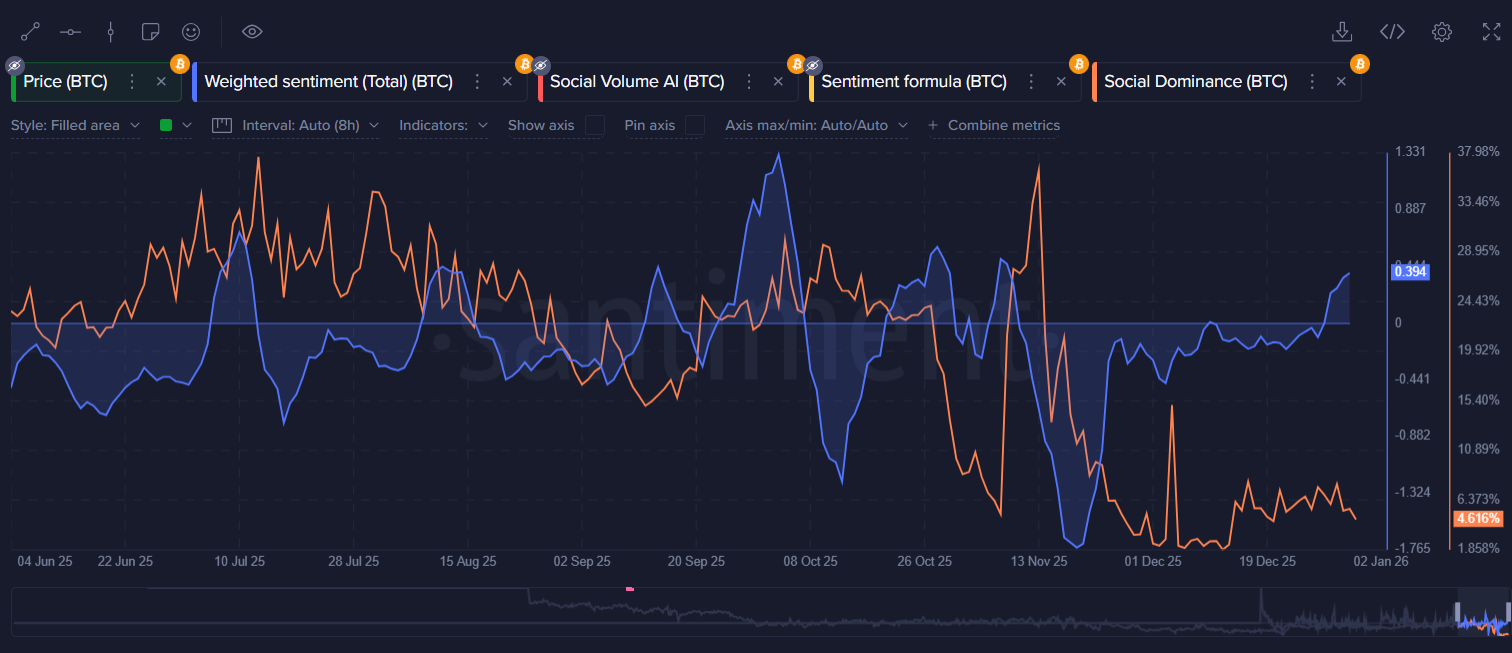

Data Anomaly: BTC Sentiment Sees Its Largest Bullish Spike in Over a Month

A key chart revealed a massive spike in positive sentiment for Bitcoin. The ratio of bullish to bearish comments reached nearly two-to-one, the highest level in over a month and one of the strongest readings in the last six months. Maksim noted that such a strong signal is significant. It could either act as a "catapult" for the market or mark a local top, requiring a closer look at other metrics for context.

- Key Data: The ratio of bullish vs. bearish comments on Bitcoin reached nearly 2-to-1, the highest in over a month.

- Actionable Tip: A sudden, extreme spike in sentiment for a single asset is a critical signal. Cross-reference it with on-chain data to determine if it's backed by fundamental activity or just social hype.

The Strongest Bullish Signal? Whales Are in a Sustained Accumulation Phase

Brian identified what he called the "best sign" of the day: sustained accumulation from large Bitcoin holders (chart). Wallets holding between 10 and 10,000 BTC have been steadily buying. Over the past two weeks alone, these key stakeholders have accumulated 55,400 BTC. This quiet buying pressure from large, influential wallets is a powerful bullish indicator that contrasts with the loud optimism from the retail crowd.

- Key Data: Wallets holding 10 to 10,000 BTC added 55,400 BTC to their holdings in the prior two weeks.

- Actionable Tip: Track the behavior of large wallet cohorts (whales). Sustained accumulation by these key stakeholders can be a strong underlying signal of market strength, even if prices are flat.

Maksim's Take: Is the Market Still Asleep After the Holidays?

Joining the stream, Maksim offered his initial perspective on the new year. He observed that social media engagement was still very low, suggesting many traders have not yet returned from the holidays. "It looks like people are still celebrating," he remarked. He believes a clearer picture of the market's true state will not emerge until Monday when people are back to their regular schedules.

- Key Data: Social media engagement and reactions to market-related posts were unusually low for the start of the year.

- Actionable Tip: Be mindful of market conditions during holiday periods. Low volume and engagement can lead to exaggerated price moves and may not reflect the market's true sentiment.

Will Crypto Play Catch-Up to the Stock Market's New Year Rally?

Brian highlighted a recent divergence between crypto and traditional markets. Toward the end of 2025, the S&P 500 rallied while crypto remained flat(chart). With the stock market starting 2026 on a strong note, he raised the possibility that crypto may be due for a catch-up period. This potential re-correlation is something to watch in the coming weeks.

- Key Data: The S&P 500 showed a strong start to the year, while crypto's price action remained flat, breaking a recent correlation.

- Actionable Tip: Monitor the correlation between Bitcoin and major stock indices like the S&P 500. A strengthening correlation can indicate that crypto is being influenced by broader macroeconomic trends.

A Warning from the Silver Market: Is a Major Top Forming?

Maksim drew an interesting parallel between crypto and the precious metals market. He mentioned seeing long-term charts of silver where massive price spikes have historically marked the end of a major rally. "Every time it has this kind of spikes, that was the end," he explained. He posed the question of whether a similar pattern could be unfolding, which could have broader implications for risk assets like Bitcoin.

- Key Data: Historical silver charts show that massive, parabolic price spikes have often preceded long-term market tops.

- Actionable Tip: Look for historical parallels in other asset classes. Patterns in markets like precious metals can sometimes offer clues about potential long-term cycles in crypto. Create for yourself a deeper understanding of a given market by also doing other analysis types, such as the macro analysis, to see how the current scenario might be different from the past.

On-Chain Deep Dive: MVRV Shows BTC Purchased This Year is Still Down

A look at the Market Value to Realized Value (MVRV) ratio provided a reality check. The 365-day MVRV for Bitcoin sits at -11.5%, meaning that the average Bitcoin purchase anytime in the last year is still down on their investment. This underlying financial losses exist despite the recent market optimism and shows that a true recovery has not yet been felt by long-term holders.

- Key Data: The 365-day MVRV for Bitcoin is at -11.5%, indicating long-term holders are, on average, at a loss.

- Actionable Tip: Use the MVRV ratio to gauge the profitability of different holder cohorts. When long-term holders are significantly in loss (deep negative MVRV), it can signal market bottoms.

Maksim's Theory: Are Traders Front-Running an Anticipated Michael Saylor Purchase?

Looking ahead to the weekend, Maksim proposed a compelling theory. He suggested that the current price action could be traders attempting to "front-run" an anticipated Bitcoin purchase by Michael Saylor's MicroStrategy. The market often expects Saylor to make large buys, and speculators may be positioning themselves for such an announcement.

- Key Data: The discussion points to a speculative narrative—anticipation of a large corporate buy—driving short-term price action.

- Actionable Tip: Be aware of dominant market narratives. Understanding what story the crowd is trading on can help explain short-term price movements that aren't supported by on-chain data.

Final Prediction: Weekend Push Higher Before a Monday Stall

Based on the high sentiment and his front-running theory, Maksim outlined a possible short-term prediction. He believes players may try to push prices higher through the weekend, capitalizing on retail excitement and anticipation. However, he would expect a reversal to begin on Monday as more professional traders return to the market. "Probably Sunday latest Monday I would expect going down," he concluded.

- Key Data: The prediction is for a price increase over the weekend, followed by a potential downturn on Monday.

- Actionable Tip: Observe how market dynamics change between weekends and weekdays, especially surrounding major holidays. Weekends often have lower liquidity and are more retail-driven, which can lead to patterns that reverse when institutional volume returns on Monday.

Conclusion

The first analysis of 2026 reveals a tricky state of the market. While retail traders are showing renewed optimism and are fueling memecoin rallies, the low overall volume indicates this might be a short term image. The most powerful signal is the sustained accumulation by Bitcoin whales, which suggests confidence from major players. This years’ acquired BTC is still down and sentiment is reaching levels that often precede price declines. To see all the charts and hear the full analysis from Brian and Maksim, you can watch the complete livestream recording.

Spotting, analyzing, and understanding these conflicting signals is easier with the right tools and a strong like-minded community. Sign up for app.santiment.net and join our discord for more frequent and timely analysis of the crypto markets.

For more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.