Narrative: Metals and Real-World Assets

Over the past six months, the market has shown a noticeable rotation of capital into metals and real-world assets. Increasingly, cryptocurrencies appear less attractive to a broad range of investors, while the narrative surrounding crypto assets is gradually losing its ability to capture sustained attention.

The focus is steadily shifting toward tangible assets such as metals. Market participants are showing less interest in assets that exist purely in the digital space and more interest in those that can be physically held, preserved, and used as a form of capital protection. This shift may reflect growing preparation for a more defensive or crisis-oriented phase of the market amid ongoing economic uncertainty. At the same time, it could also signal a broader turning point — one that is shaping an entirely new investment narrative.

The market is entering a phase where capital preservation becomes more important than maximising upside potential. In such an environment, growth-driven narratives give way to defensive ones. From this perspective, metals stand apart: they do not rely on storytelling, marketing, or community support. Their value exists independently of narrative cycles.

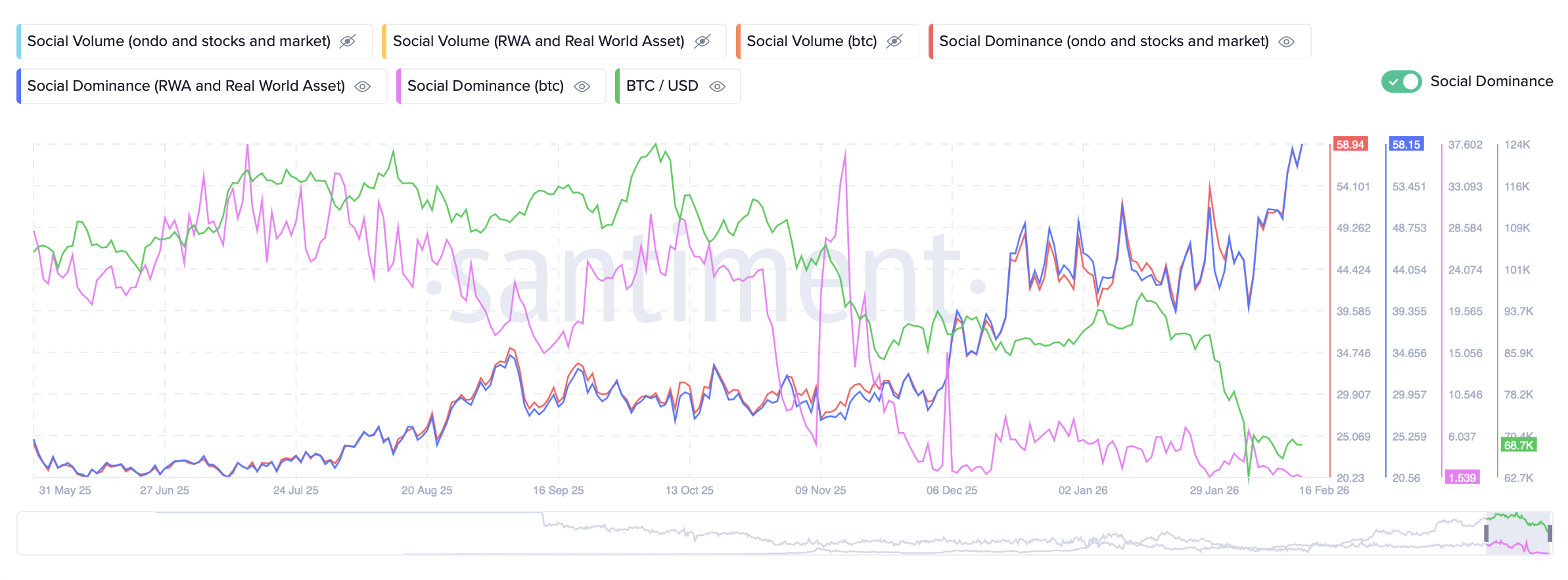

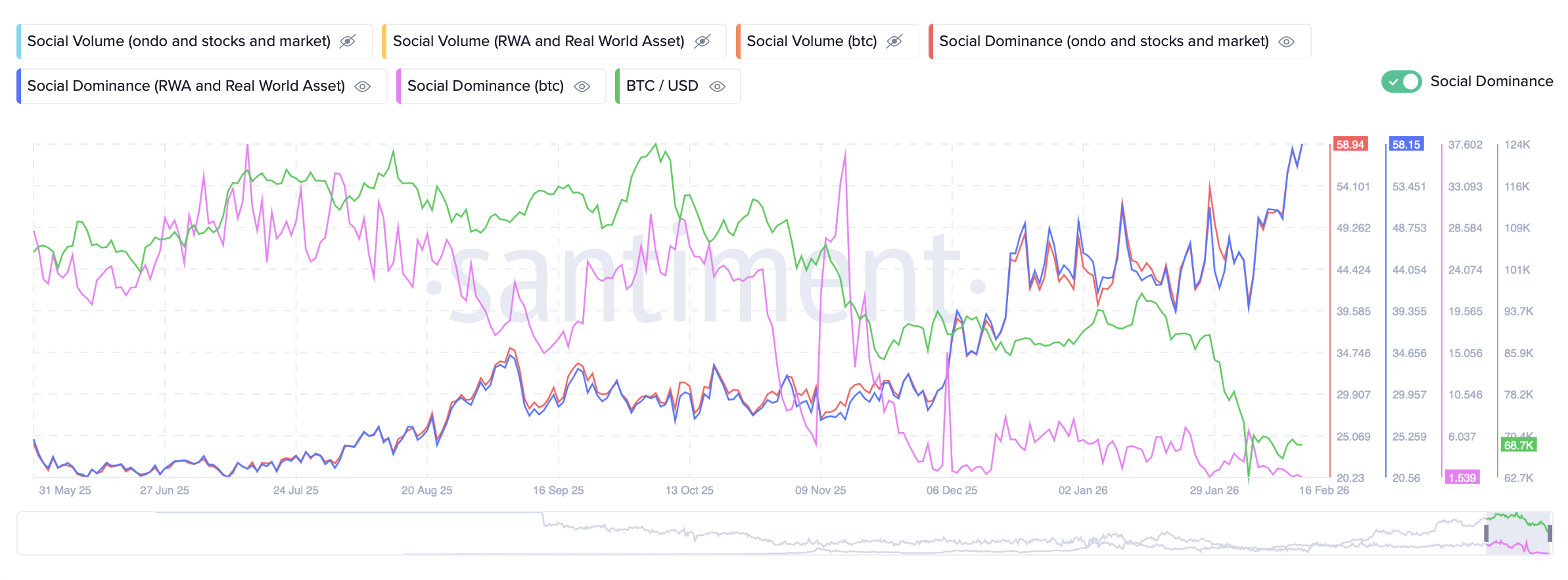

The chart below compares Social Dominance across Bitcoin, the stock market, and the RWA (real-world assets) category within crypto assets. The data shows a clear increase in social attention toward more “real” or tangible assets, while Bitcoin’s social presence declines over the same period.

Link to the chart: https://app.santiment.net/s/rjmyRtxp

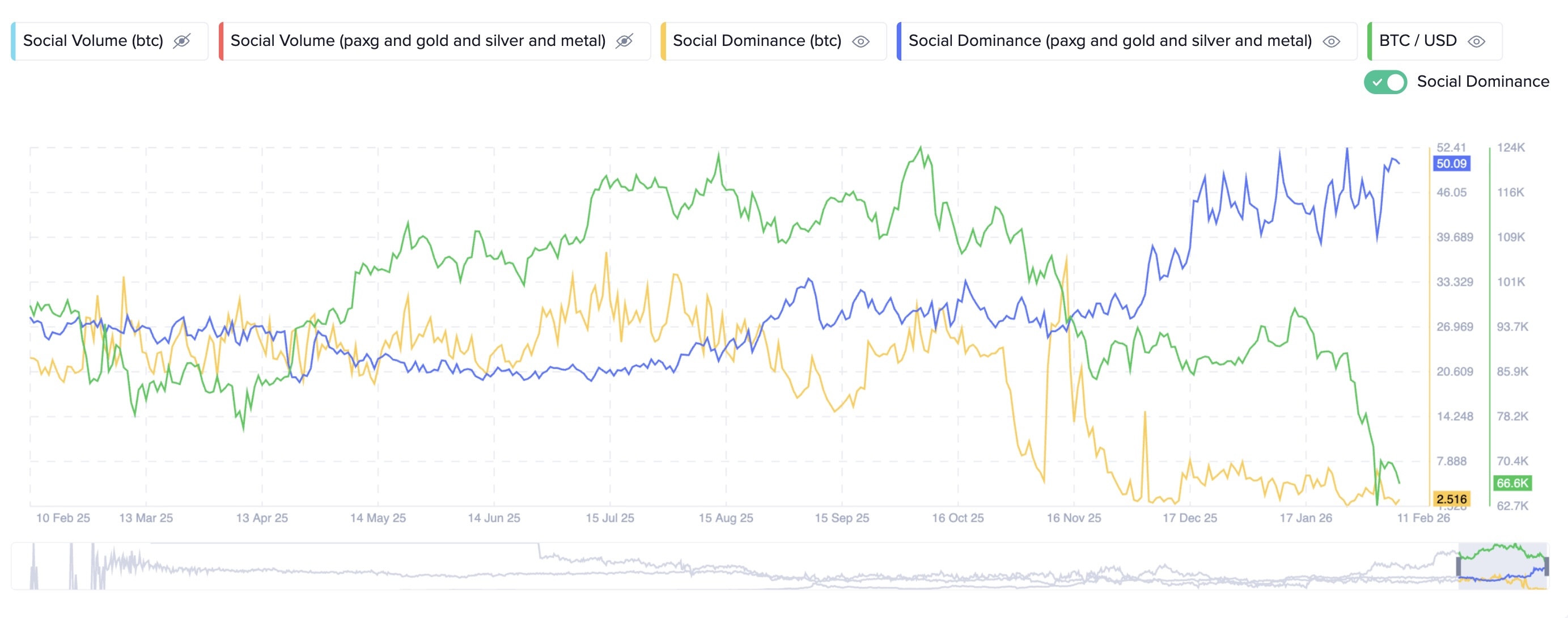

A direct comparison of Social Dominance between metals and Bitcoin further highlights this divergence. Bitcoin shows a pronounced downward trend in social activity, whereas metals demonstrate strong and sustained growth in attention.

Link to the chart: https://app.santiment.net/s/aObBzJuU

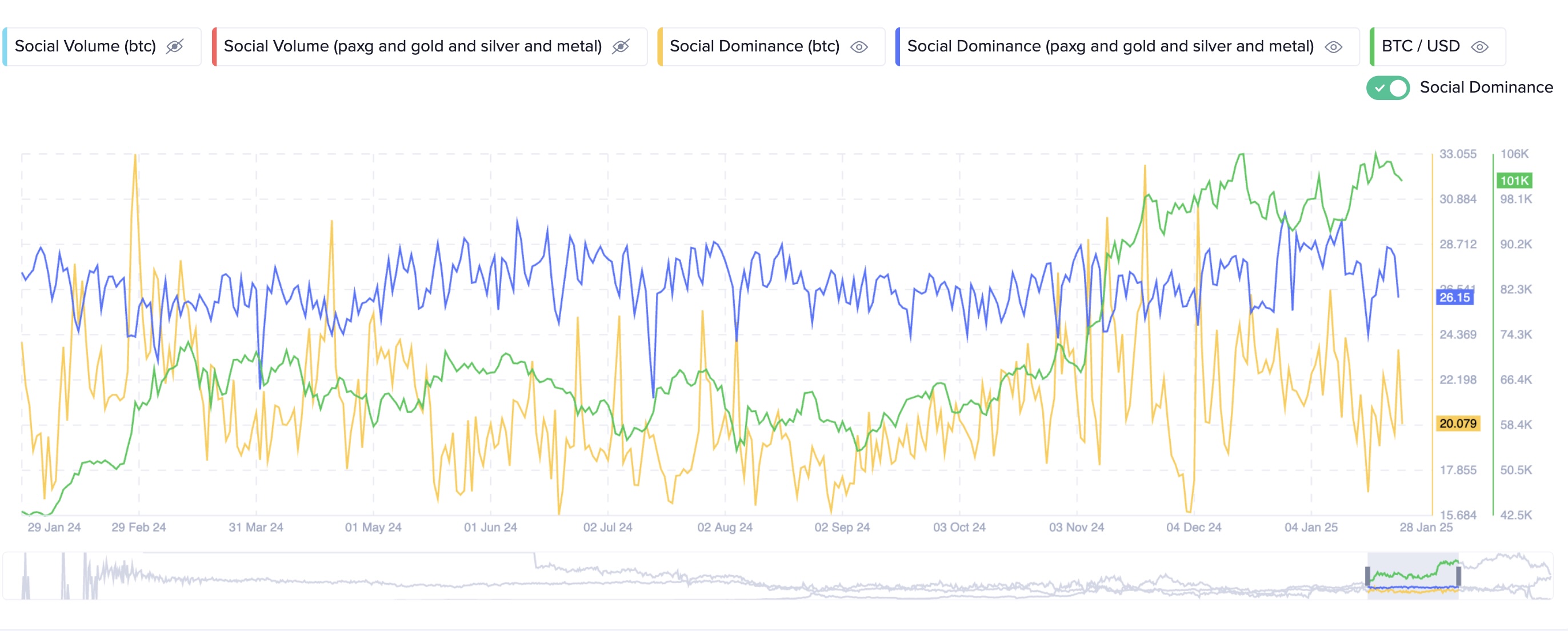

For context, a comparison with 2024 data shows that Bitcoin previously maintained social dominance levels comparable to those of metals. This contrast underscores how materially the current narrative differs from earlier market phases.

Link to the chart: https://app.santiment.net/s/MNLktlhe

It is reasonable to assume that this shift represents only the early stages of a developing narrative, leaving room for further continuation. At the same time, the current signals suggest that a larger structural change may be underway. Rather than chasing short-term opportunities, the primary challenge for investors may now lie in positioning and preparing for these evolving market dynamics.