Bitcoin's Mild Retrace Deserves a Deep Dive

Bitcoin has frustrated traders with a -8.81% price fall since its all-time high of $123.8K back on August 13th. Six weeks later, we are finally beginning to see a crowd reaction to the drop.

One of the first things we like to look for is a sign of retailers showing enthusiasm toward buying the dip. Sometimes, all it takes is a rapid downswing (as opposed to a more gradual one). And unlike the slow slide of the past few weeks, Monday (today) began with a fairly large slide that resulted in BTC falling to a 13-day low of $112.2K. As a result, we are suddenly seeing the highest level of "buy the dip" mentions in 25 days.

You may initially think this is a sign of a quick rebound looming. But if you've followed Santiment's insights and various content over the years, you'll know that we have seen plenty of evidence pointing to this kind of signal indicating we have NOT yet reached the bottom. Prices typically move the opposite direction of the crowd's expectations. So if retail traders believe that $112.2K is finally the time to buy, then a little more pain needs to be felt. Once the crowd stops feeling optimistic, and they begin to sell their bags at a loss, this is typically the time to strike with your dip buys.

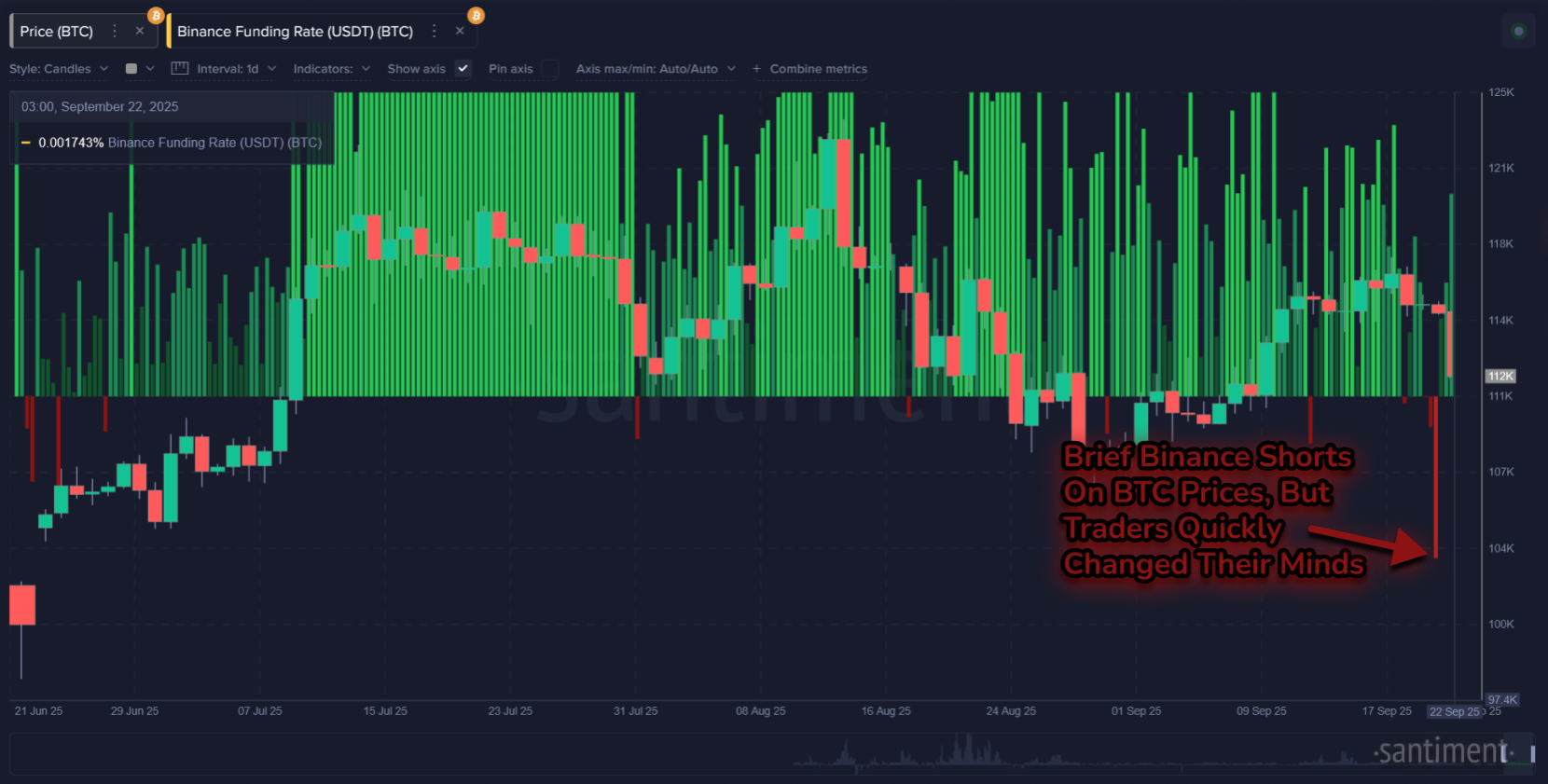

Interestingly, just before Bitcoin's latest large red price candle, we saw Binance's highest level of shorts (vs. longs) in over three months. However, after the drop all the way down to $112.2K, traders quickly switched back to being mildly long. Ideally, for a notable price bounce to occur, we need to see a sustained period of shorts outpacing longs. In other words, more traders (and more money) on exchanges betting that the price of Bitcoin will go down, as opposed to betting that Bitcoin's price will go up. Short liquidations are one of the primary ingredients to justify a price rebound, so seeing more sustained efforts from traders to bet against Bitcoin's price will be crucial.

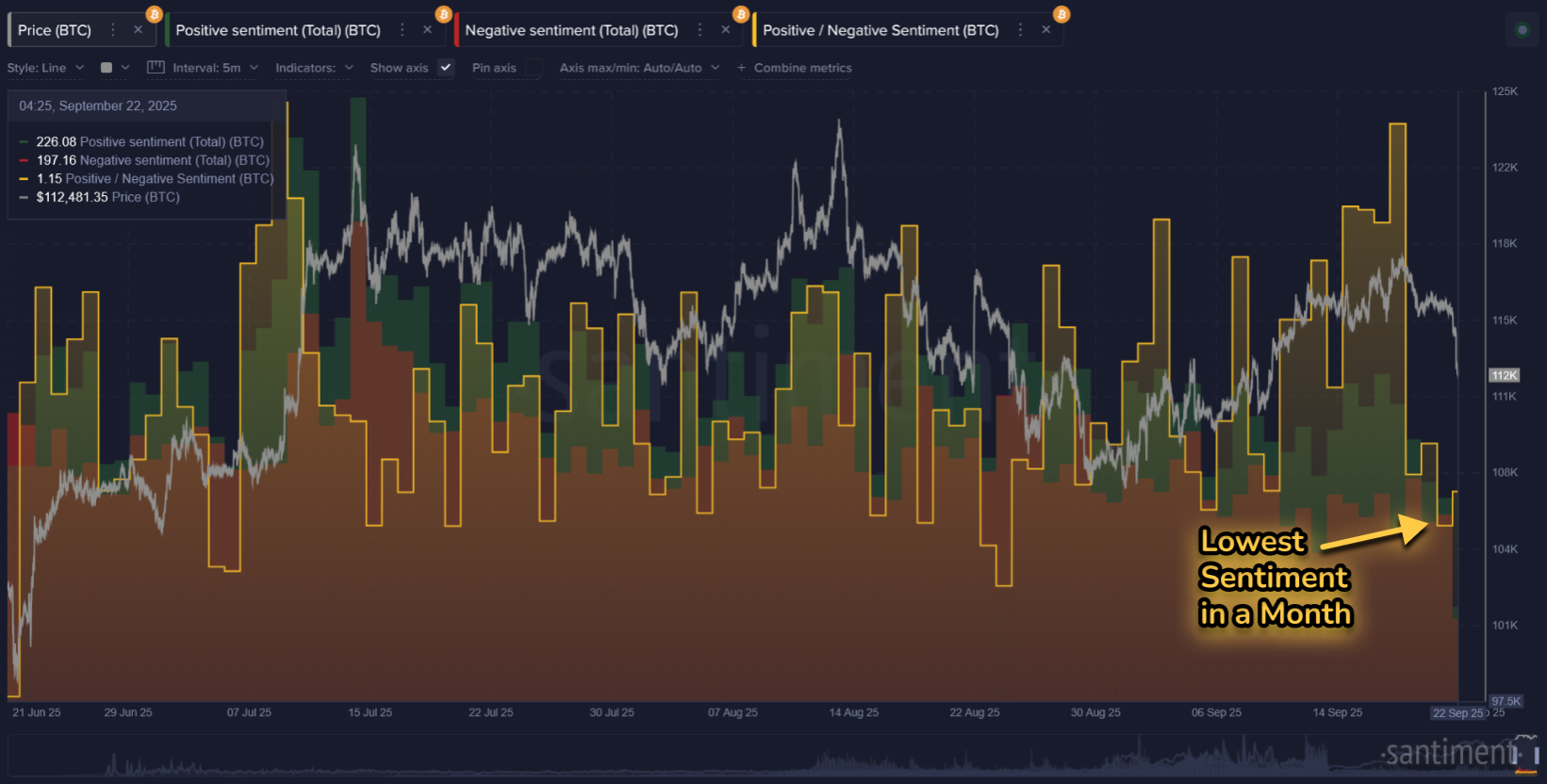

As for overall sentiment from the crowd, we have began to see a much more negative narrative forming across social media. Ever since prices began to sink below $114K, sentiment quickly turned from euphoric to fearful. This is contrary to all of the "buy the dip" hype. But the fear isn't quite low enough to signal that there is "blood in the streets". We want to see a major level of fear that coincided with the early April bottom (related to Trump tariffs) or mid-June bottom (related to Israel/Iran/US war fears). The crowd panic sold in these moments, and were kicking themselves when prices began to aggressively rebound right afterwards.

In terms of overall trading returns (MVRV), this Bitcoin price drop has done enough damage to cause average 30-day traders to dip back into the red for the first time since September 10th. Historically, this means that there is mathematical justification to buy or add on to your position, implying that there is less risk than average now that your peer traders are down money. When you buy while your trader peers are down money, you are jumping in while others are in pain. And averages tend to even out and eventually bring MVRV's back to 0... therefore a negative MVRV is typically when you want in.

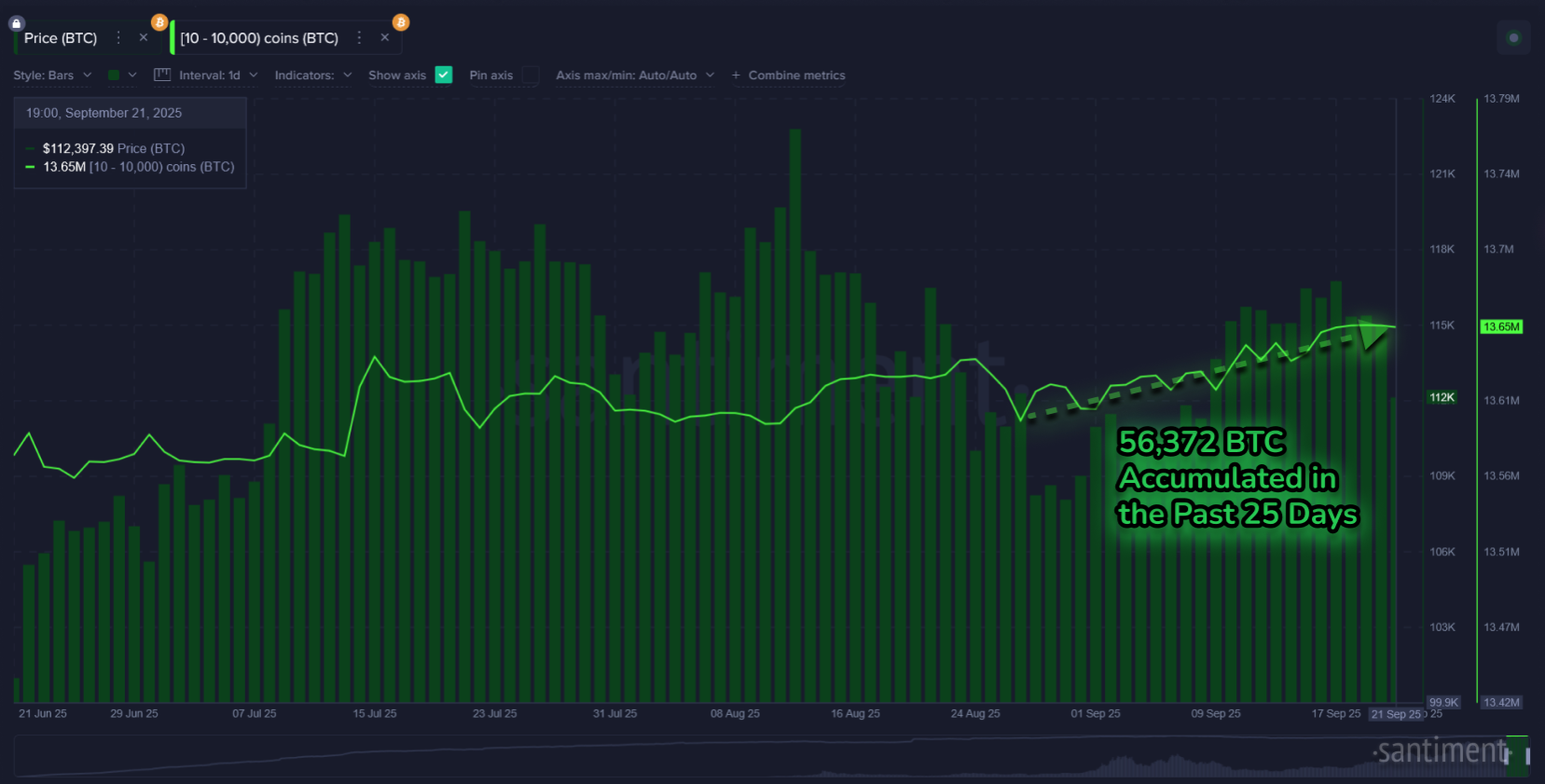

And it's certainly a great sign that Bitcoin's key stakeholders are accumulating still. Going back to August 27th, wallets with 10 to 10K BTC have collectively added 56,372 more coins. These sharks and whales don't appear to be phased by the major volatility, and it should be a sign of confidence that crypto markets have limited downside at the moment.

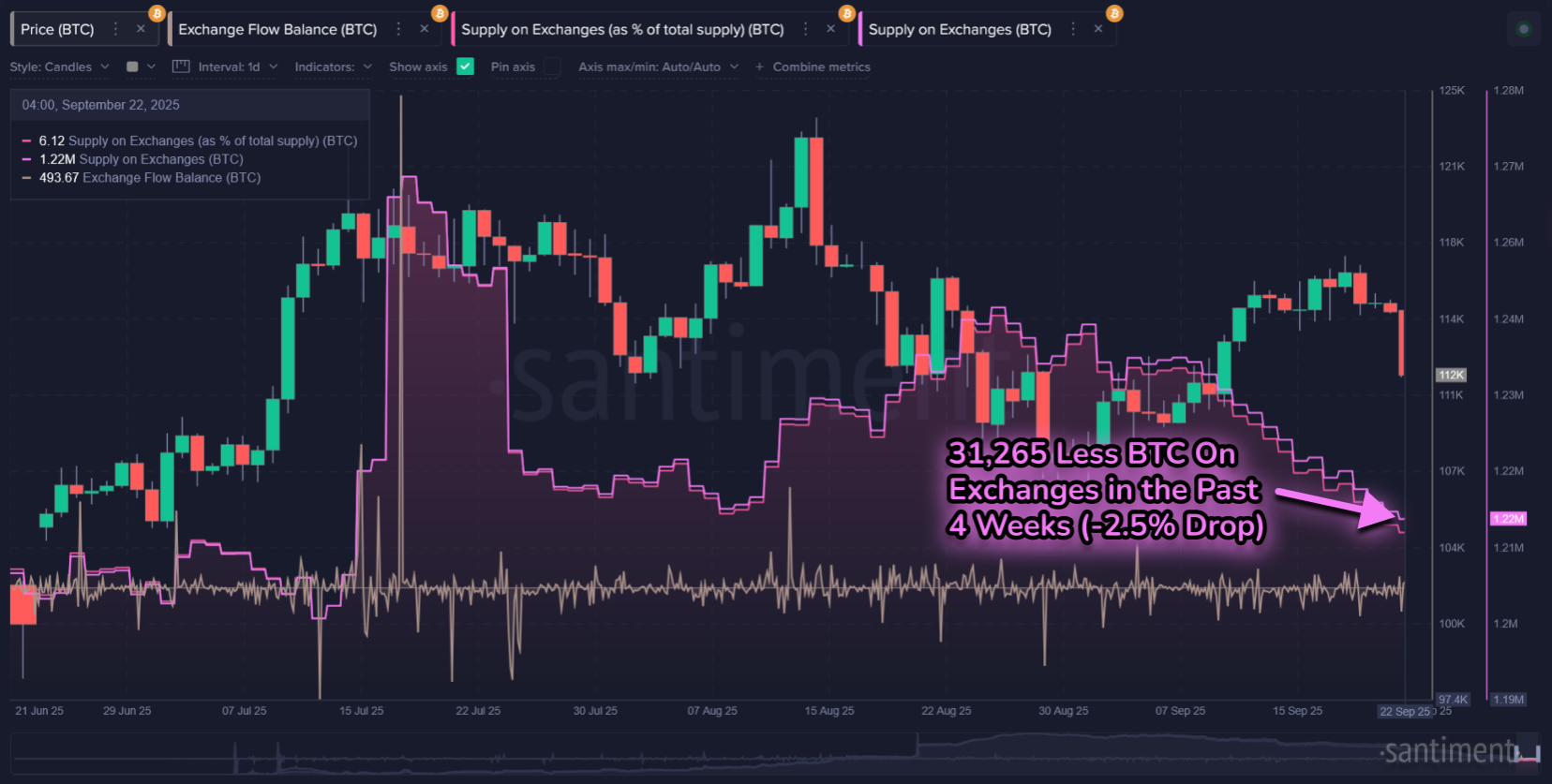

Another sign that should give you confidence is the fact that the supply of Bitcoin on exchanges has continued to drop, dating back to four weeks ago. There are 31,265 less BTC on exchanges now, during this relatively short period of time. This means less coins are available to sell off on exchanges, which again implies limited further downside pressure.

Bitcoin’s recent pullback is testing the patience of traders, yet several signals suggest the market is quietly preparing for a much larger next move. A -8.1% pullback from the all-time high six weeks ago really is not a significant move, relative to some of the carnage we've seen in crypto's 17-year history. It usually takes a much larger downswing (typically -15% to -20% at minimum) to really start to cause traders to pivot into a full fledged state of panic.

We may not necessarily need complete carnage in order to reverse course, but the metrics indicate that there is still a decent amount of optimism across social media. Retail enthusiasm to “buy the dip” remains a caution flag, as prices tend to fall further when the crowd turns too optimistic too quickly. At the same time, Bitcoin's short-term traders have finally fallen into negative range, which is a good sign. And steady whale accumulation alongside a continued decline in exchange supply point to growing strength beneath the surface of crypto's top network.

If you are ready to buy the dip, there is enough evidence to indicate that you can be profitable at these levels. But doing it in a dollar cost average format (such as five limit buys at $112K, $108K, $104K, $100K, and $96K) could allow you to still get exposure to these lower prices while de-risking and benefiting no matter which way the markets swing from here. You can benefit from more BTC accumulation if prices keep falling, and a small slice of successful profiting if you buy a small amount right before we see a big bounce.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.