Deep Dive: Aave Drama Showing Up In Its Metrics

Aave became the focus of intense debate inside the crypto community, not because of a security failure, but because of a conflict between its DAO and Aave Labs, the development company tied to founder Stani Kulechov. The dispute raised serious questions about governance, revenue ownership, and who ultimately benefits from Aave’s success. What began as a governance disagreement soon turned into a market moving event that affected sentiment, price action, and investor behavior.

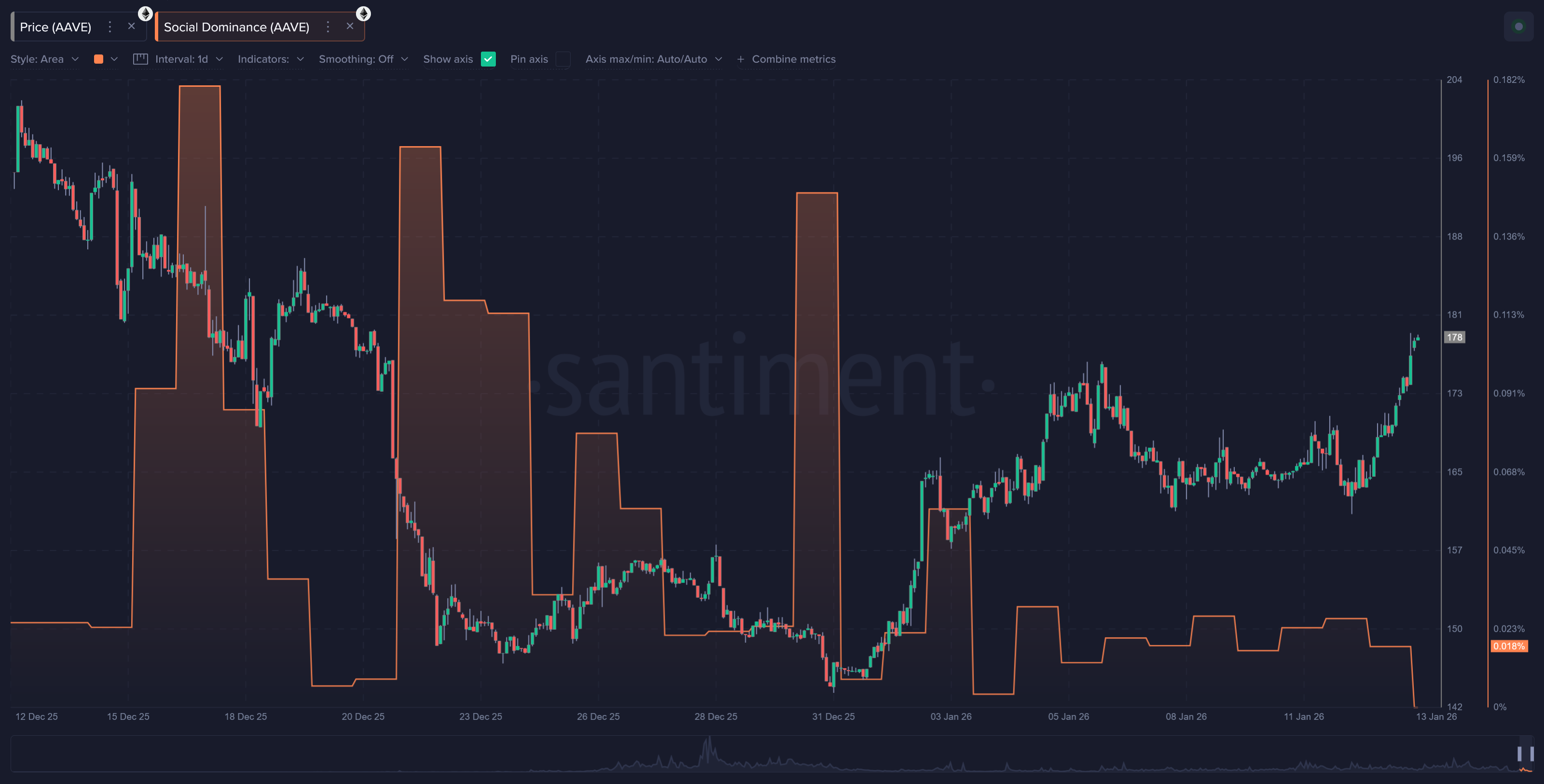

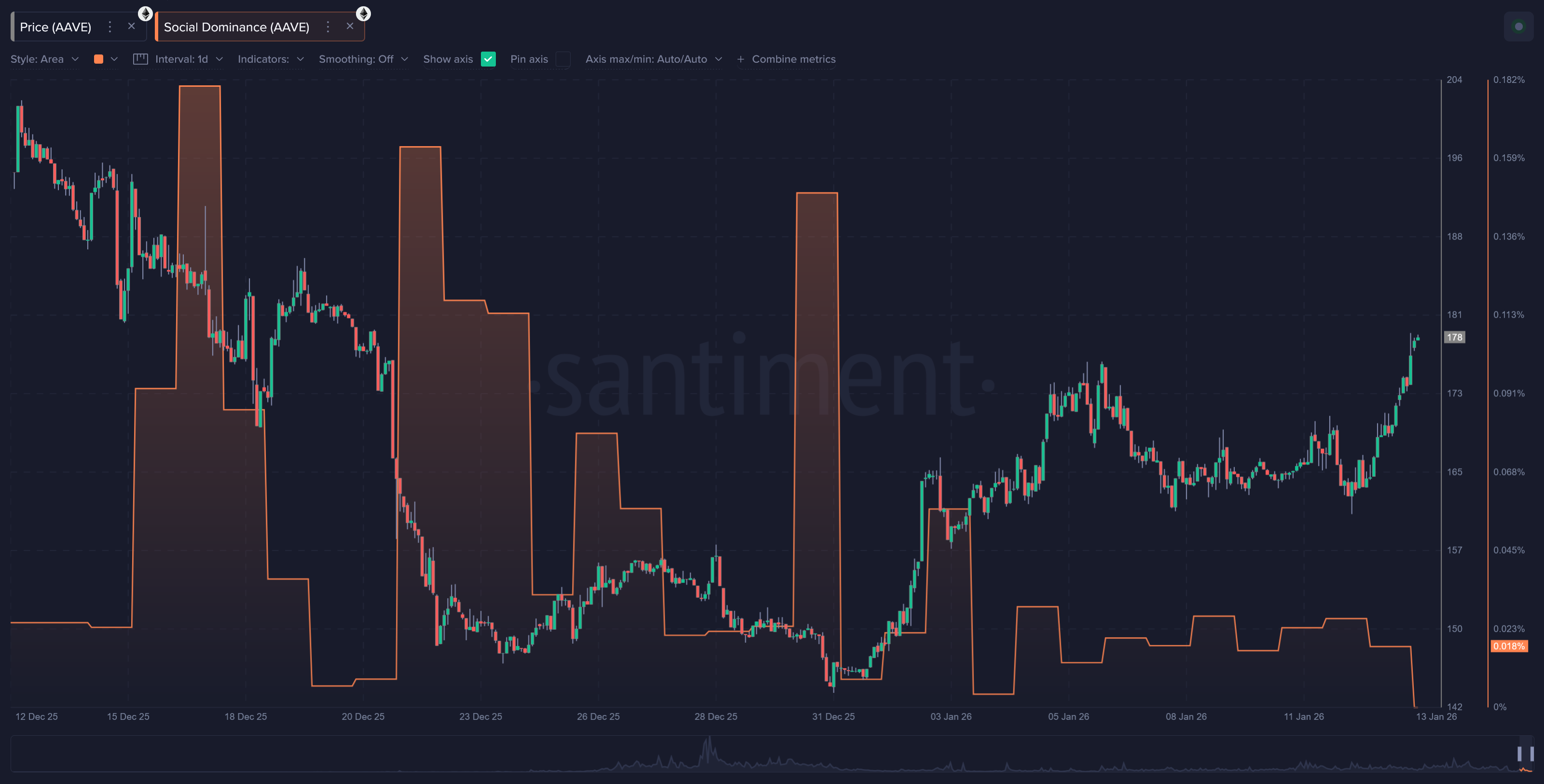

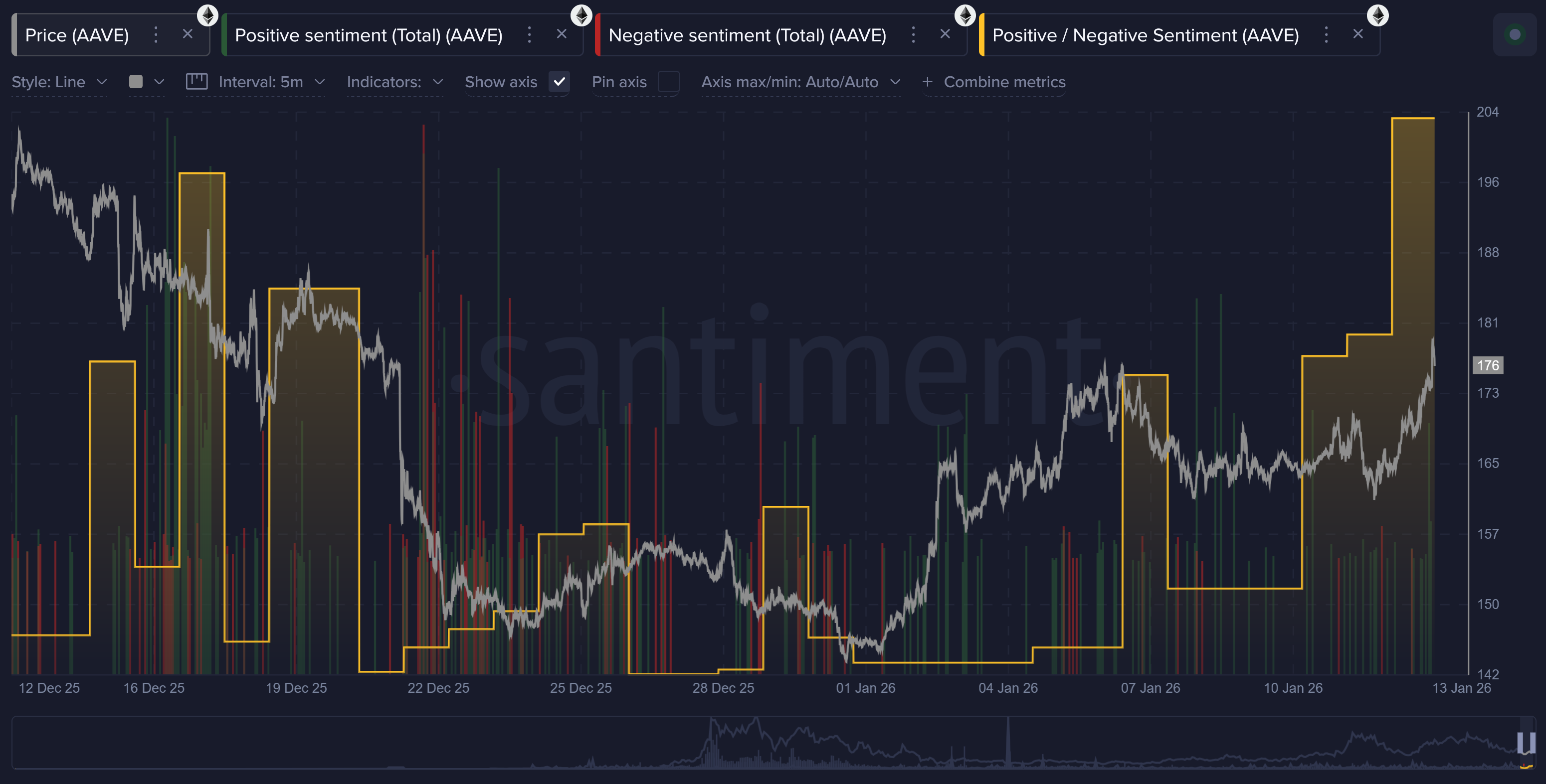

December 16th was when social discussion about AAVE initially spiked amid growing visibility of the governance dispute that was beginning to hit mainstream crypto circles. Around mid-December, the narrative in markets included:

- Reports of Aave’s token price falling sharply while fundamentals such as deposits and revenue were strong, attracting commentary that the price was disconnected due to the DAO vs Labs drama.

- Users were pointing out that deposits were up year-over-year while price was down, and attributing at least part of that disconnect to governance tension. This kind of commentary drove debate and reposts on social platforms.

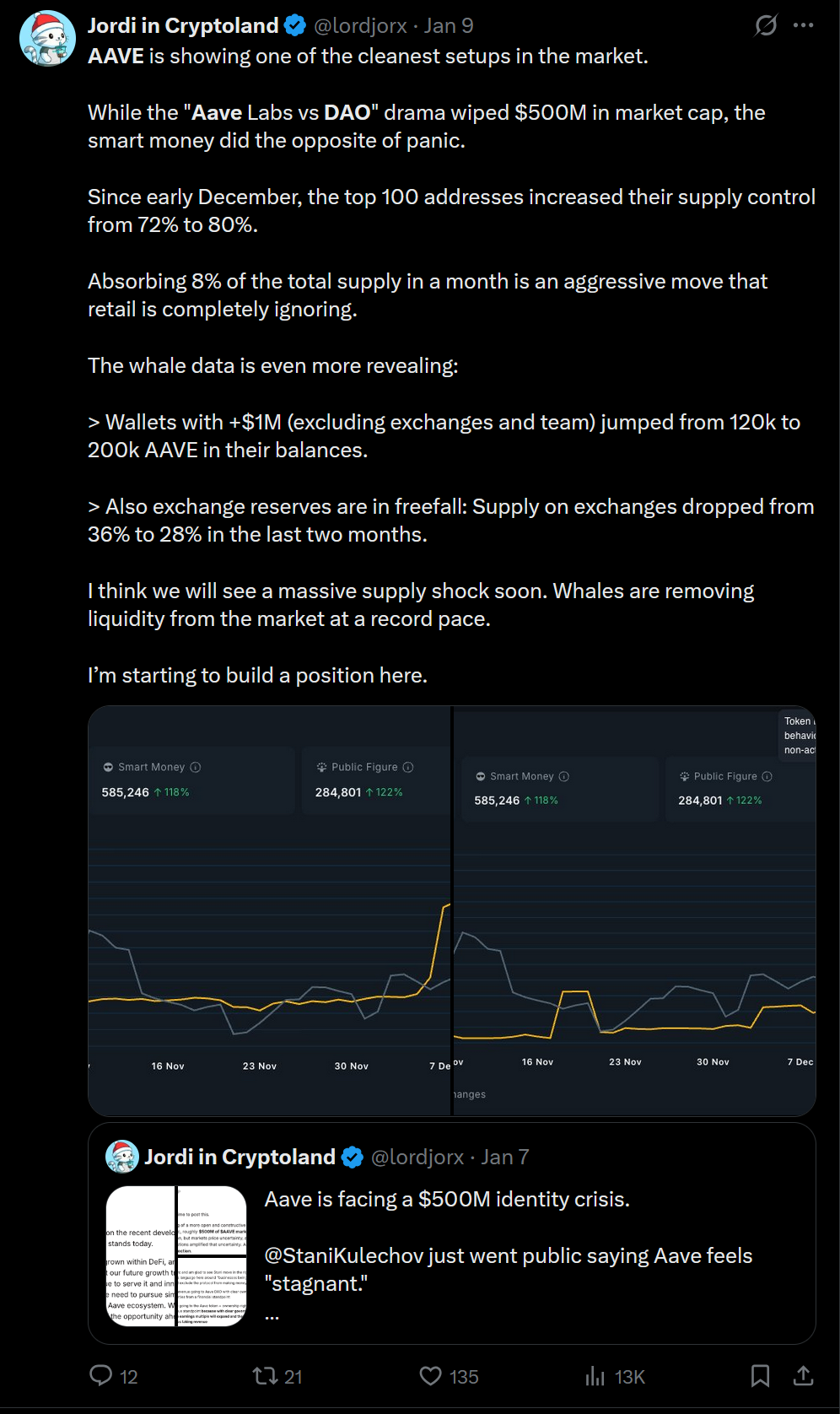

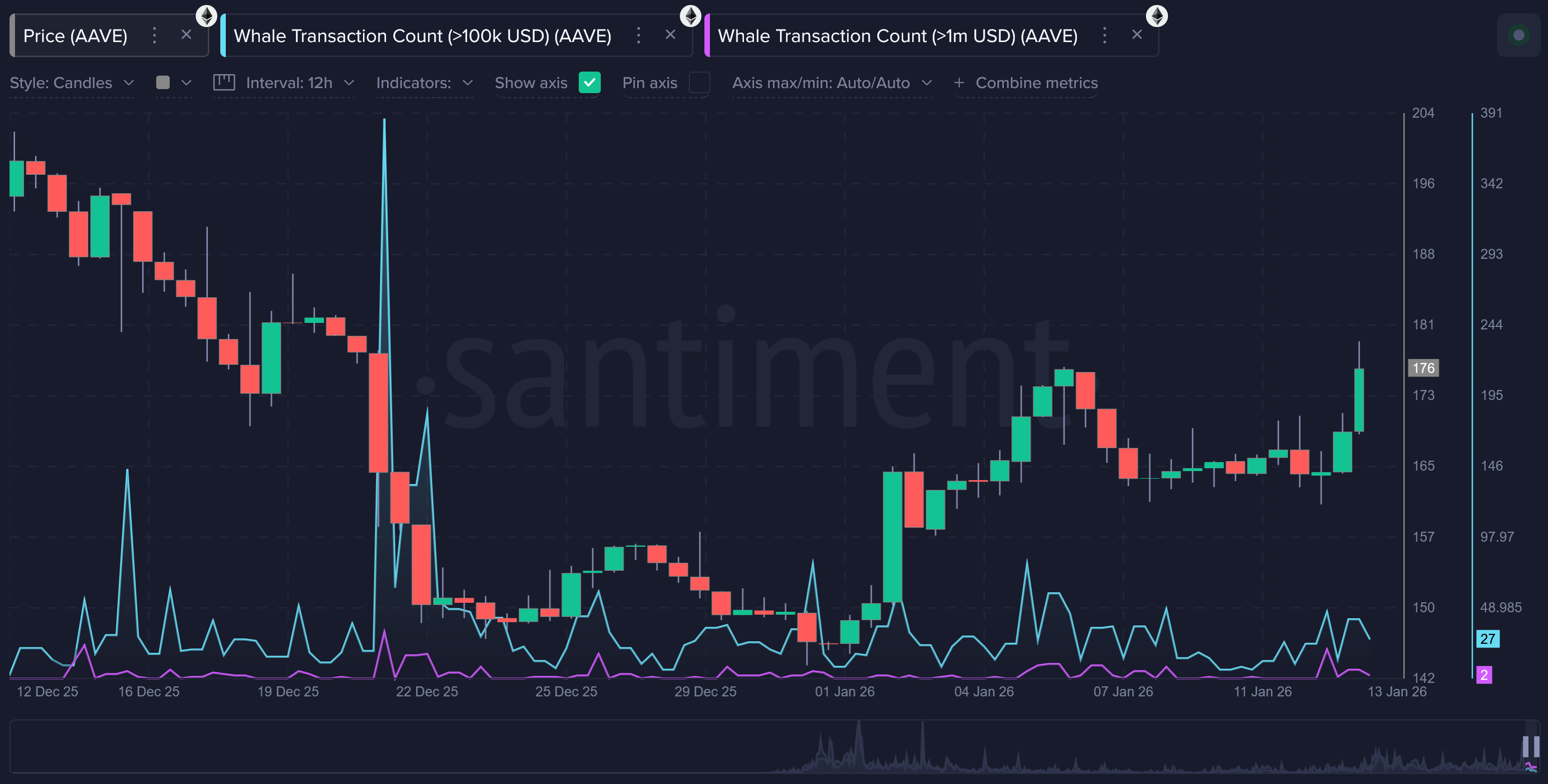

Around December 22, attention grew on chain data and whale activity, especially as:

- Large AAVE holders began accumulating tokens even as price dipped instead of selling.

- Analysts pointed out that whale balances were rising, exchange supply was falling, and that this could foreshadow a supply tightening event if accumulation continued.

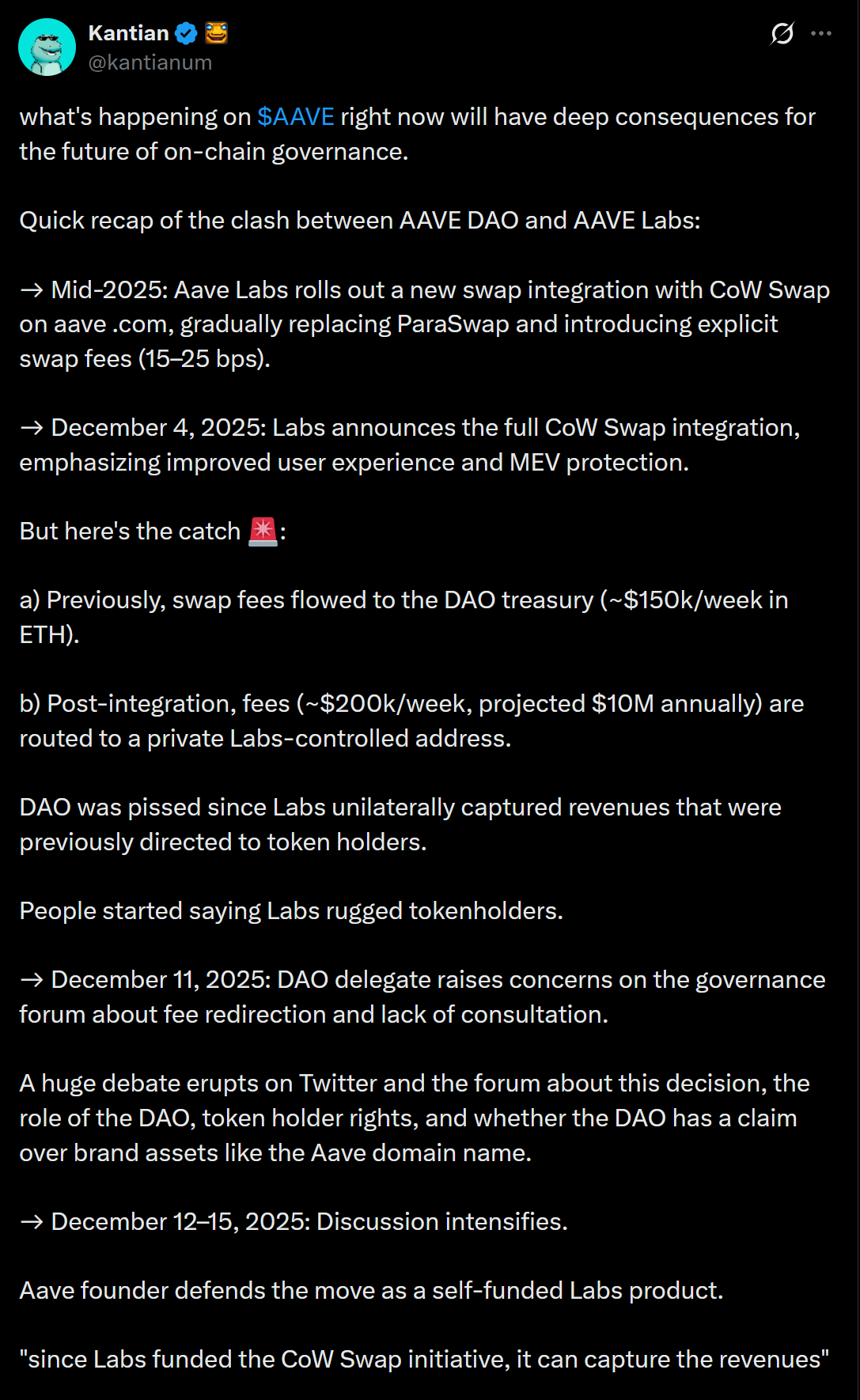

The conflict began when DAO members noticed that certain revenue streams connected to Aave’s integrations were not flowing into the DAO treasury. Fees tied to activity outside the core lending protocol appeared to benefit Aave Labs instead. Some token holders argued that this revenue depended on Aave’s brand and infrastructure and should therefore be shared with the DAO. This sparked frustration and accusations that value was being captured without clear approval.

As these concerns spread, the disagreement became highly public. Traders and analysts openly referred to the situation as a clash between Aave Labs and the DAO. During this period, AAVE’s market capitalization briefly dropped by around five hundred million dollars as uncertainty spread. However, on chain data suggested that not all participants reacted the same way.

Despite the sharp reaction in price, large holders appeared to take advantage of the volatility. The top one hundred AAVE addresses increased their supply control from roughly 72% to 80%. Wallets holding more than one million dollars worth of AAVE also increased their balances significantly, even as retail interest faded. As we can see in the chart below, wallets with 1K-100K AAVE (smart money wallets) dumped significantly sometime during the internal disputes in the first week of December. And they gradually accumulated back, particularly during the days right before Christmas when the token's price was plummeting during the heart of the dispute.

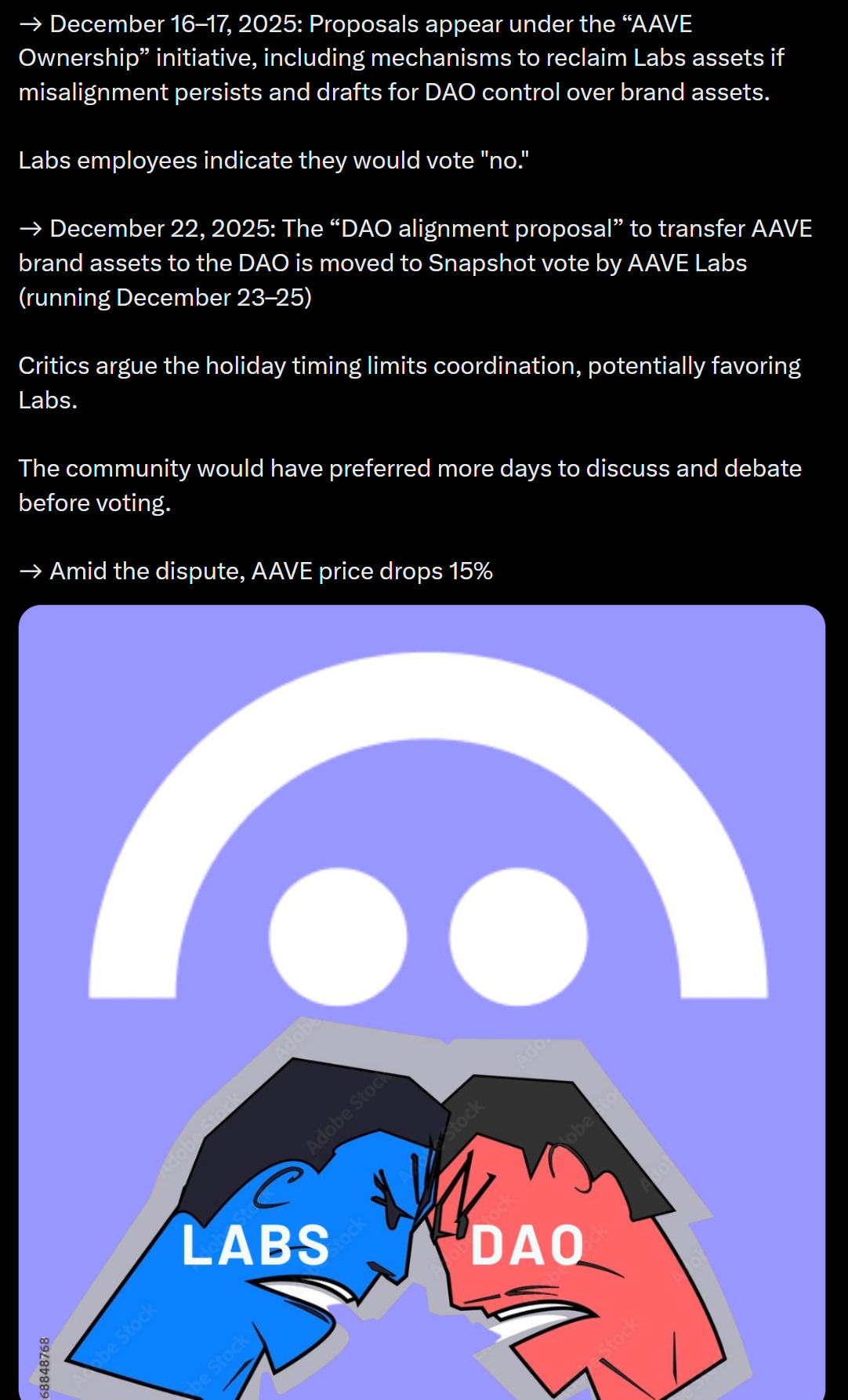

Governance tensions peaked with a vote related to Aave’s intellectual property and brand ownership. The proposal aimed to move control of key branding assets into a DAO governed structure. When the vote failed, it revealed deep divisions within the community. A large number of tokens voted against the proposal, while many others chose not to vote at all, signaling uncertainty rather than unity.

Attention then shifted toward founder Stani Kulechov, after reports surfaced that he had acquired a large amount of AAVE tokens before the dispute escalated. While there was no evidence that these tokens were used to manipulate governance outcomes, the timing raised concerns. The episode highlighted how concentrated token ownership can complicate decentralized decision making.

Market data suggested that sentiment began to shift after Aave Labs responded to the backlash. The company publicly stated that it would explore sharing revenue generated outside the core protocol with AAVE token holders. This announcement was widely seen as a meaningful step toward alignment and helped calm fears that the DAO would be permanently sidelined.

As confidence improved, sentiment data reflected a clear change in tone. Santiment showed sustained positive sentiment climbing while negative sentiment remained muted. In fact, the asset now has the highest ratio of bullish vs. bearish comments (on January 13, 2026) that its seen since before the dispute again.

Derivatives data added another layer to the story. Total open interest for AAVE rose quickly on exchanges, signaling renewed trader engagement and positioning. Unlike panic driven spikes, price action during this period appeared controlled, with higher lows forming as open interest expanded. This combination often reflects growing conviction rather than short term speculation.

There was a clear disconnect between Aave’s fundamentals and its token price. Deposits on the protocol were up roughly sixty percent year over year, while price remained well below earlier levels. Weekly revenue had already reached an all-time high in late 2025, suggesting that the underlying protocol activity remained strong despite governance noise.

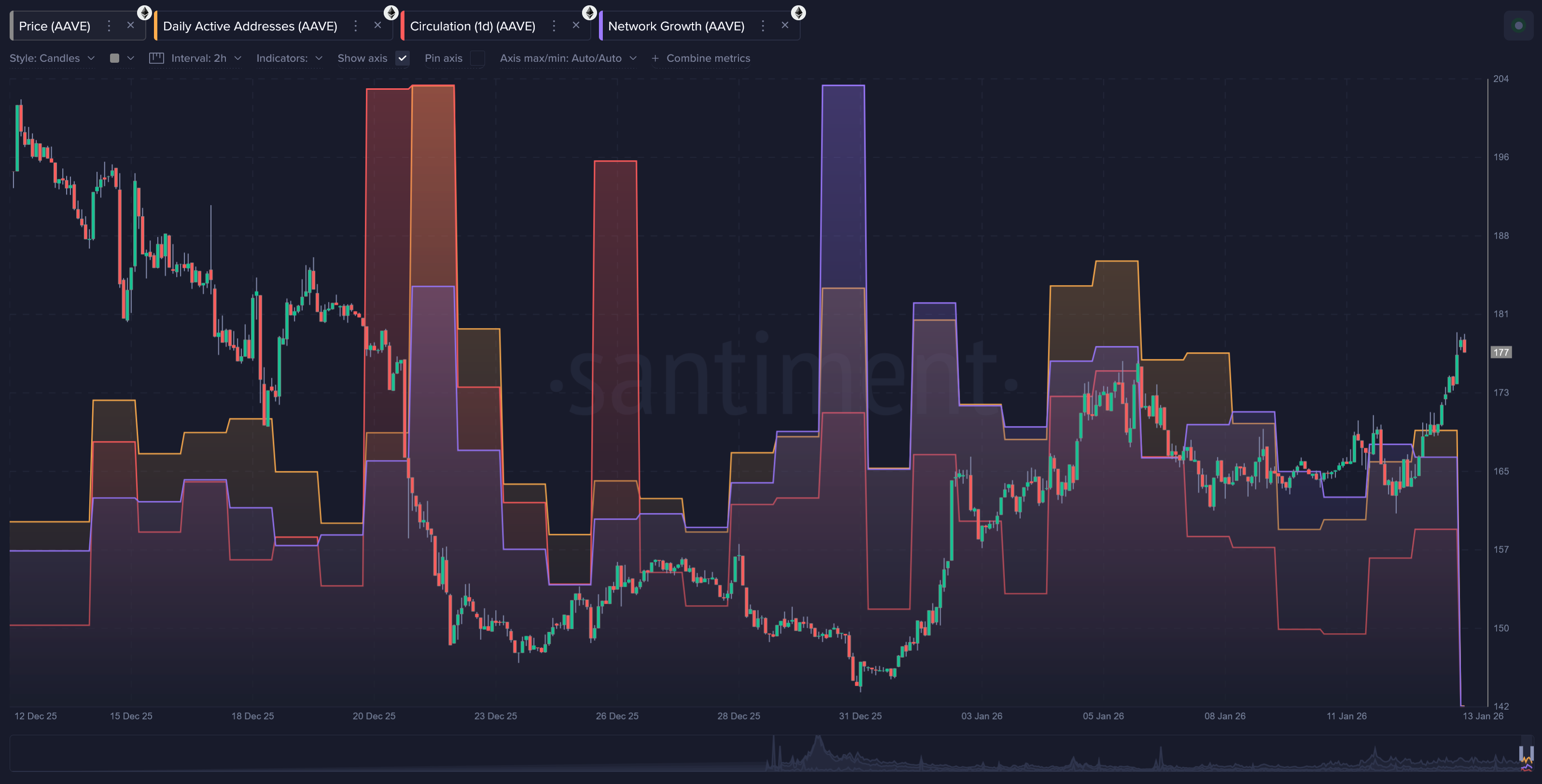

Take a look at how active addresses, circulation, and network growth for AAVE were all peaking as polarizing opinions were taking over in mid to late December. Whether it was because of the early January price bounce, or because things were just genuinely getting hashed out around this time, it appeared that the abnormal on-chain network activity calmed down and normalized around this time.

At the same time, whale transaction counts have stayed relatively low, suggesting that large holders (which we explored early) were accumulating quietly rather than trading aggressively. We aren't seeing any significant whale activity spikes similar to what was showing up on the network just at AAVE's downfall began right before Christmas. And that is probably a solid sign that resolutions and trust are close to, or have fully, returned.

In the end, the Aave situation became a real time stress test for decentralized governance. While the DAO and Aave Labs remain in active discussion, the response from long term holders suggests that many see the conflict as part of Aave’s maturation rather than a fatal flaw. How the next governance proposals unfold will likely shape not only Aave’s future, but also how other major DeFi protocols approach power, incentives, and accountability.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.