This Week in Crypto, Full Written Summary: W2 September

Bitcoin Above $115K, But Is a Fed Rate Cut the Real Story? This Week in Crypto Summary September 12th

Executive Summary

For those short on time, here are the key takeaways from this week's crypto market analysis:

- Market Rallies, But Volume is Low: Bitcoin reclaimed $115K and altcoins like Dogecoin (+23%) and Mantle (+40%) surged. However, overall trading volume is down 8.3%, suggesting some caution.

- All Eyes on the Fed: A major Fed rate cut is expected next week. This event is the single biggest factor influencing market direction right now.

- Whales Are Buying, Retail Is Selling: Large Bitcoin holders have accumulated over 237,000 BTC in the last six months, while smaller wallets have been selling—a historically bullish divergence.

- On-Chain Warning Signs: Despite rising prices, Bitcoin's network activity (active addresses, transaction volume) is declining, creating a bearish divergence that could limit the rally's potential.

Introduction

In this week's market update, Brian provides a solo analysis of the market, offering a focused look at the forces shaping prices. The market is showing solid gains, but the real story may be brewing outside of crypto. From a near-certain Fed rate cut to the surprising behavior of Bitcoin whales, this summary captures the essential data and narratives you need to know.

Market Movers: Bitcoin Hits $115K, Altcoins Like DOGE & Mantle Surge

The crypto market had a strong week. Bitcoin is back above $115,000, and Ethereum has reclaimed the $4,500 level. These leaders are up 4% and 6% respectively over the past week. The real excitement were altcoins. Dogecoin jumped over 23% amid speculation that a DOGE ETF is imminent. Mantle, a platform token, stood out with a nearly 40% gain in just seven days. This positive momentum pushed the total crypto market capitalization past a staggering $5 trillion.

- Key Data: The total crypto market cap has surpassed $5.01 trillion, though overall trading volume declined by 8.3% week-over-week.

- Actionable Tip: Watch for periods where altcoins significantly outperform Bitcoin. This can signal a shift in market risk appetite.

The 99% Bet: Why Experts Expect a Major Fed Rate Cut Next Week

The biggest story impacting all markets is the Federal Reserve's upcoming decision on interest rates. According to Brian, most experts believe a rate cut is highly likely next week. Some sources are reporting odds as high as 99% for a cut. Why does this matter for crypto? Rate cuts are designed to stimulate the economy. Historically, this has led to positive performance in assets like stocks and crypto, as more capital flows into the markets.

- Key Data: Market expectations for a Fed rate cut next week are as high as 99%, with some influencers pointing to a potential 350-375 BPS cut.

- Actionable Tip: Mark your calendar for the Fed's announcement on September 17th. High-impact economic news often leads to significant market volatility.

Bitcoin vs. S&P 500: Is Crypto About to Play Catch-Up?

Looking at the bigger picture, crypto has performed well but may have more room to run. Over the past six months, Bitcoin is up about 40%. In the same period, the S&P 500 gained 18% and gold rose roughly 25%. Brian pointed out an interesting correlation where Bitcoin often plays catch-up to the S&P 500. Given the S&P 500's recent strength, this pattern suggests Bitcoin could be poised for another move upward (chart).

- Key Data: Over the past six months, Bitcoin (+40%) has more than doubled the performance of the S&P 500 (+18%).

- Actionable Tip: Compare Bitcoin's price chart against the S&P 500. A divergence where the S&P 500 leads could offer clues about Bitcoin's next potential move.

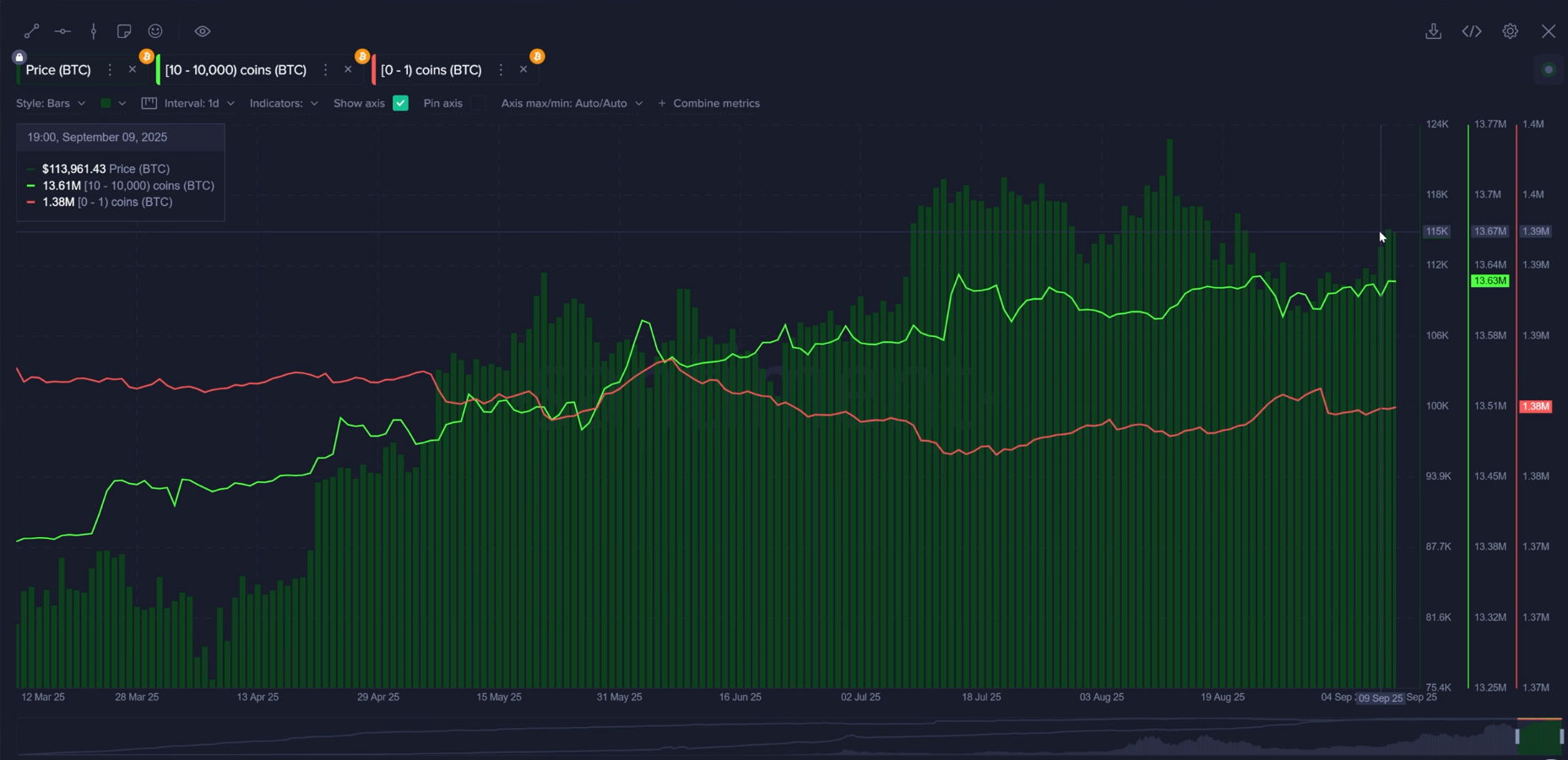

Follow the Smart Money: Whales Accumulate 237K+ BTC as Retail Sells

On-chain data reveals a fascinating trend in who is buying and selling. Large Bitcoin holders, often called "sharks" and "whales" (wallets with 10 to 10,000 BTC), have added more than 237,000 BTC to their holdings over the past six months. Meanwhile, smaller retail holders (wallets with less than one BTC) have been moving in the opposite direction. This divergence is often seen as a positive sign(chart).

- Key Data: Wallets holding 10 to 10,000 BTC are up 1.8% in their holdings over six months, while wallets with under 1 BTC are down 0.2%.

- Actionable Tip: Use on-chain tools to track the supply distribution between large and small wallets. When whales accumulate as retail sells, it can signal strong conviction from experienced players.

The Massive Risk if the Fed Blindsides the Market

While a rate cut is widely expected, what happens if it doesn't materialize? Brian warns that this would be a bad scenario for the markets. So much of the recent rebound in both stocks and crypto is based on the expectation that rates will be cut. If the Fed decides to hold rates steady, it would blindside investors and could trigger a wave of fear, uncertainty, and doubt.

- Key Data: The primary risk is that the market has "priced in" the high probability of a rate cut, making a surprise decision highly impactful.

- Actionable Tip: Consider potential outcomes for major economic events. Understanding the consensus view helps you anticipate what might happen if an unexpected result occurs.

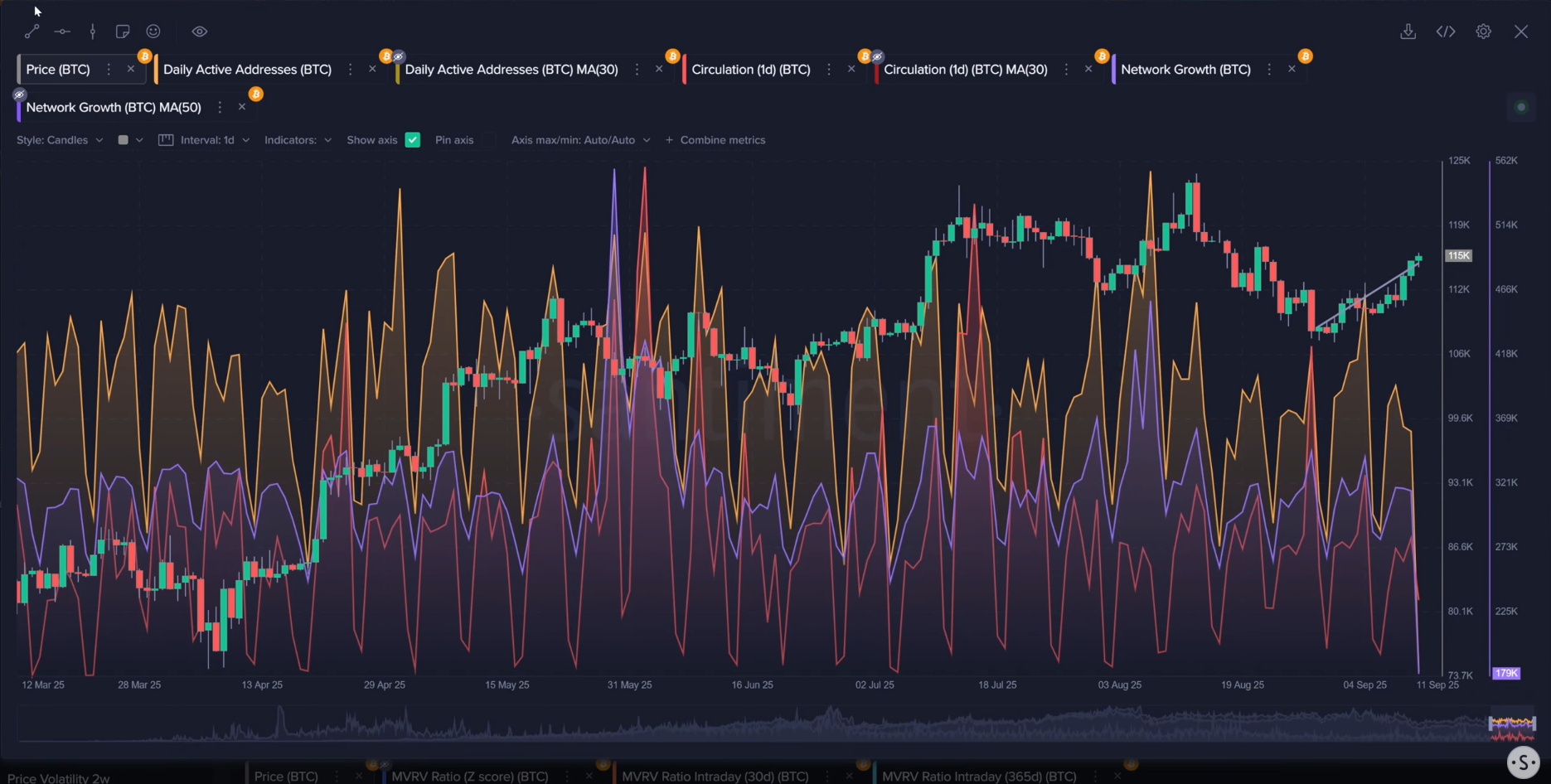

A Hidden Warning? Bitcoin's On-Chain Utility Shows Bearish Signs

While price action is positive, some of Bitcoin's underlying on-chain metrics are less encouraging. Key indicators like transaction volume, active addresses, and network growth are all showing a mild decline. Brian explains that for price growth to be sustainable, it needs to be supported by a growing network. When prices rise while utility falls, it can create a bearish divergence.

- Key Data: Bitcoin's network growth, active addresses, and transaction volume are all in a mild downtrend, contrasting with the recent price increase.

- Actionable Tip: Look beyond price. Assess on-chain utility metrics to gauge the underlying health of a network and the sustainability of its rally.

Is Altcoin Season Here? Bitcoin's Social Dominance Hits a Low

Another interesting social metric is Bitcoin's low social dominance. Right now, discussions about altcoins are overshadowing conversations about Bitcoin. This is partly due to the Dogecoin ETF talk and strong performances from other assets. Brian views this as a bit concerning for Bitcoin, as it suggests a lack of excitement around the market leader.

- Key Data: Bitcoin's social dominance is currently low, indicating that trader attention has shifted toward altcoins.

- Actionable Tip: Track social dominance to understand where the crowd's focus is. A sustained drop in Bitcoin's dominance often coincides with increased speculation in altcoins.

Tether's New US-Based Stablecoin (USAT) & Solana ETF Buzz

Tether, the company behind the world's largest stablecoin, announced plans for a new, regulated US-based stablecoin called USAT. This expansion is a significant development for the stablecoin issuer. Elsewhere, Solana is generating buzz with discussions about its potential role in transaction fees and even talk of a future Solana ETF.

- Key Data: Tether has announced a new regulated, dollar-backed stablecoin for the US market named USAT.

- Actionable Tip: Keep an eye on developments in the stablecoin and ETF spaces. These narratives can act as powerful catalysts for specific assets and the market as a whole.

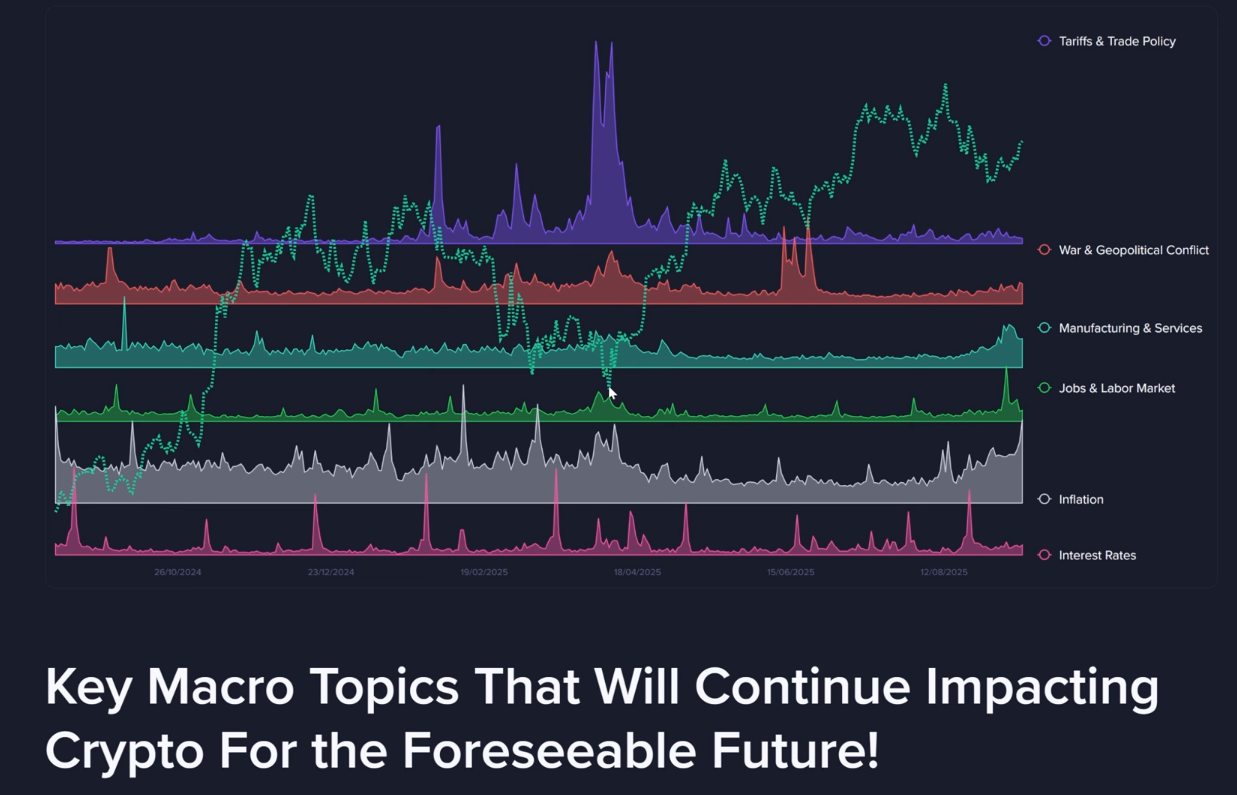

Decoding the Market: How War & Inflation Pinpoint Bitcoin's Tops & Bottoms

Brian shared a powerful chart from a recent article showing how social volume for major economic topics like tariffs, war, and inflation correlates with Bitcoin's price. Major price bottoms and tops have often coincided with huge spikes in these discussions. For example, a massive spike in talk about tariffs and geopolitical conflict occurred right at Bitcoin's price bottom in April.

- Key Data: A major spike in social volume for "tariffs" and "war" directly coincided with Bitcoin's price bottom around April 7th.

- Actionable Tip: Use social trend tools to monitor macroeconomic keywords. A sudden, massive spike can signal that the market has reached a point of peak fear or euphoria.

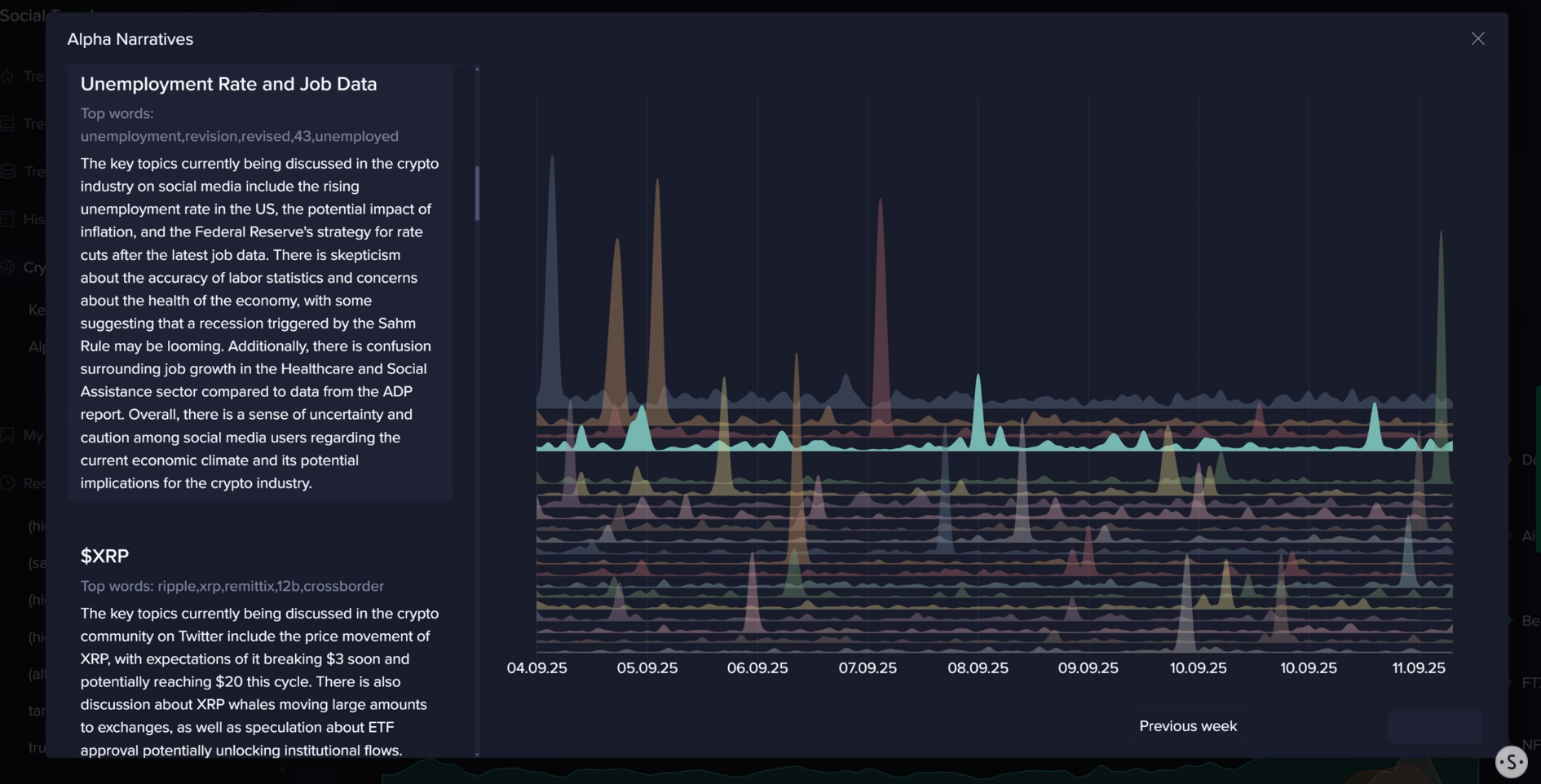

Today's #1 Narrative: Why Jobs Data Is Dominating Crypto Talk

Looking at the most current narratives, one topic stands above the rest: jobs and unemployment. With the Fed meeting just days away, discussions around the latest jobs data, rising unemployment, and the accuracy of labor statistics are spiking. This makes sense, as this data will be a key factor in the Fed's decision to cut rates.

- Key Data: The top emerging narrative in crypto discussions today is centered on "jobs" and "unemployment" data.

- Actionable Tip: Pay attention to the dominant market narratives leading into major economic events. They reveal what traders are most focused on and what could move prices.

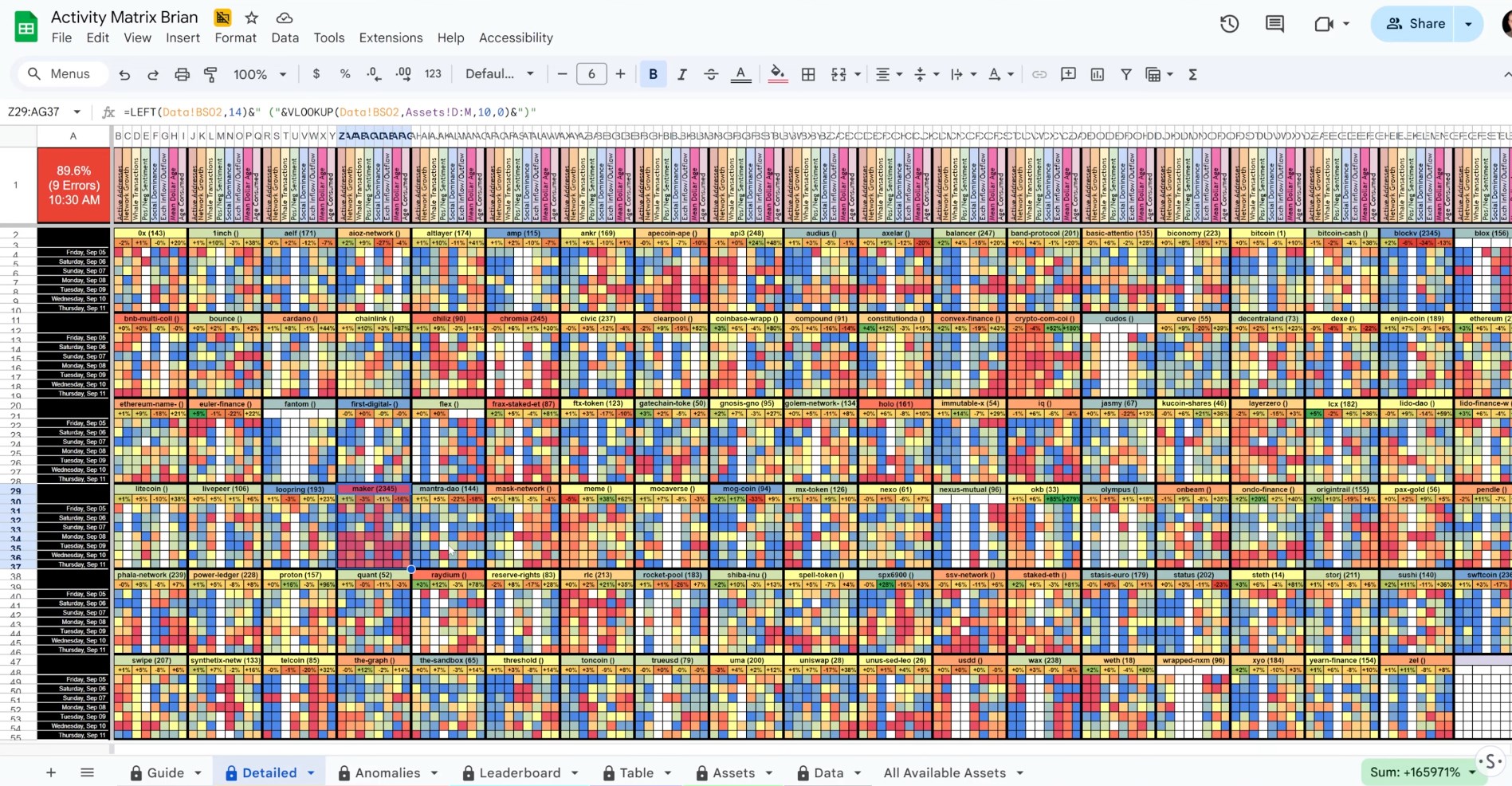

Activity Matrix: Identifying "Hot" Tokens Poised for Reversal

Santiment's Activity Matrix offers a snapshot of which crypto networks are seeing unusual levels of on-chain activity. Maker (MKR) is a prime example. The asset is down 16% over the past 90 days, yet its network activity is currently rated as extraordinarily hot. This kind of divergence—a falling price with soaring network activity—can sometimes indicate that a price trend is about to reverse.

- Key Data: Maker (MKR) is the #1 "hottest" token for on-chain activity despite its price being down 16% over the past 90 days.

- Actionable Tip: Look for assets with a strong divergence between price and on-chain activity. A declining price paired with surging network growth can be a powerful indicator of a potential turnaround.

Data Insights: Extreme Euphoria & Where Whales Are Moving

Digging deeper into the data, Holo (HOT) is currently showing the highest level of euphoria, a sign of extreme positive sentiment that can sometimes warn of a local top. On the other hand, Convex (CVX), Curve (CRV), and staked Ethereum (stETH) are seeing their biggest outflow days from exchanges in 90 days, which is generally a bullish signal as it suggests coins are moving to private wallets for holding.

- Key Data: Holo (HOT) is registering its highest euphoria score, while Convex (CVX) and Curve (CRV) are seeing their largest exchange outflows in three months.

- Actionable Tip: Use sentiment data to spot potential over-excitement in an asset. Conversely, monitor exchange flows to identify assets that are being moved into long-term storage.

Conclusion

This week, the crypto market is in a strong position, but its future direction hinges on next week's critical decision from the Federal Reserve. While prices are up, on-chain data presents a mixed picture, with whale accumulation offering a bullish case while declining utility metrics urge caution.

What are your thoughts on the potential Fed rate cut? Let us know in the comments below, and don't forget to like this post and subscribe for more weekly crypto insights.