Gearing Up for US Election Volatility! (This week in crypto summary October 25th)

Introduction

In this week's crypto market analysis, Brian examines the upcoming US election's influence on crypto markets while tracking Bitcoin's mild downturn alongside Solana's remarkable 133% surge. The analysis highlights record whale accumulation of 16.2 million coins in 10+ BTC wallets and Microsoft's upcoming vote on a potential 1% Bitcoin investment proposal. With just 10 days until the US election, Brian provides crucial insights into whale behavior, institutional interest, and shifting dynamics between major coins that could shape market direction.

Market Overview

The past week has seen significant ups and downs, with changes in both on-chain and social metrics. Meme coins experienced a surge, while Solana emerged as an outlier. In contrast, Bitcoin and Ethereum experienced only slight declines. As the US election approaches, market volatility is likely to increase, with the crypto community showing a slight preference for Trump due to his pro-crypto stance. This political context adds complexity to market predictions.

Social Trends Tool: Analyzing Candidate Mentions & Market Correlation

Brian highlighted the influence of social sentiment on market movements, noting that spikes in mentions of political candidates often coincide with market rallies. Trump, in particular, tends to dominate social media discussions, which could impact crypto prices as the election nears. The Santiment social trends tool reveals that Trump's mentions frequently surpass those of his opponent, Kamala Harris, suggesting a correlation between his media presence and market activity.

Whale & Shark Accumulation Patterns

A key focus of the live stream was the behavior of whales and sharks in the crypto market. Brian pointed out that wallets holding 10 or more BTC have reached an all-time high, indicating strong accumulation. However, miners are moving in the opposite direction, which could signal potential market shifts. Despite this divergence, the overall whale activity suggests a bullish outlook for Bitcoin, with the potential to breach the 70k mark if current trends continue.

BTC MVRV Analysis: Current Risk Levels

Market sentiment remains neutral, which Brian suggests is not necessarily a bad thing. Historically, neutral sentiment has often preceded market rises, driven by whale accumulation and other factors. The MVRV (Market Value to Realized Value) ratio indicates that traders are slightly above average in terms of returns, suggesting a moderate level of risk for new investments. This metric serves as a valuable tool for identifying potential buy-low, sell-high opportunities.

Trending Words Analysis & Market Dynamics

The live stream also touched on trending topics within the crypto community. Microsoft made headlines with a proposal to invest 1% of its portfolio in Bitcoin, sparking significant interest. Meanwhile, Solana's performance continues to draw comparisons to Ethereum, with users favoring its lower transaction fees and faster processing times. The meme coin season has also seen a flurry of activity, with new coins emerging on the Solana blockchain.

Meme Coin Market: GOAT & Trading Group Dynamics

The meme coin market remains a hotbed of speculative activity, with GOAT emerging as a standout performer. Brian highlighted the role of trading groups in driving meme coin prices, noting that these groups often have significant influence over market dynamics. While meme coins can offer substantial returns, they also carry heightened risks due to their speculative nature. Investors should approach this market with caution, recognizing the potential for rapid price swings driven by trading group dynamics.

Bull Market Sentiment: Signs of Market Disbelief

Despite recent price increases, mentions of a "bull market" have declined, indicating a sense of disbelief among traders. This skepticism could be beneficial for the market, as it suggests a lack of excessive optimism or FOMO (fear of missing out). Historically, periods of disbelief have often preceded further price gains, as they reflect a more cautious and potentially undervalued market sentiment.

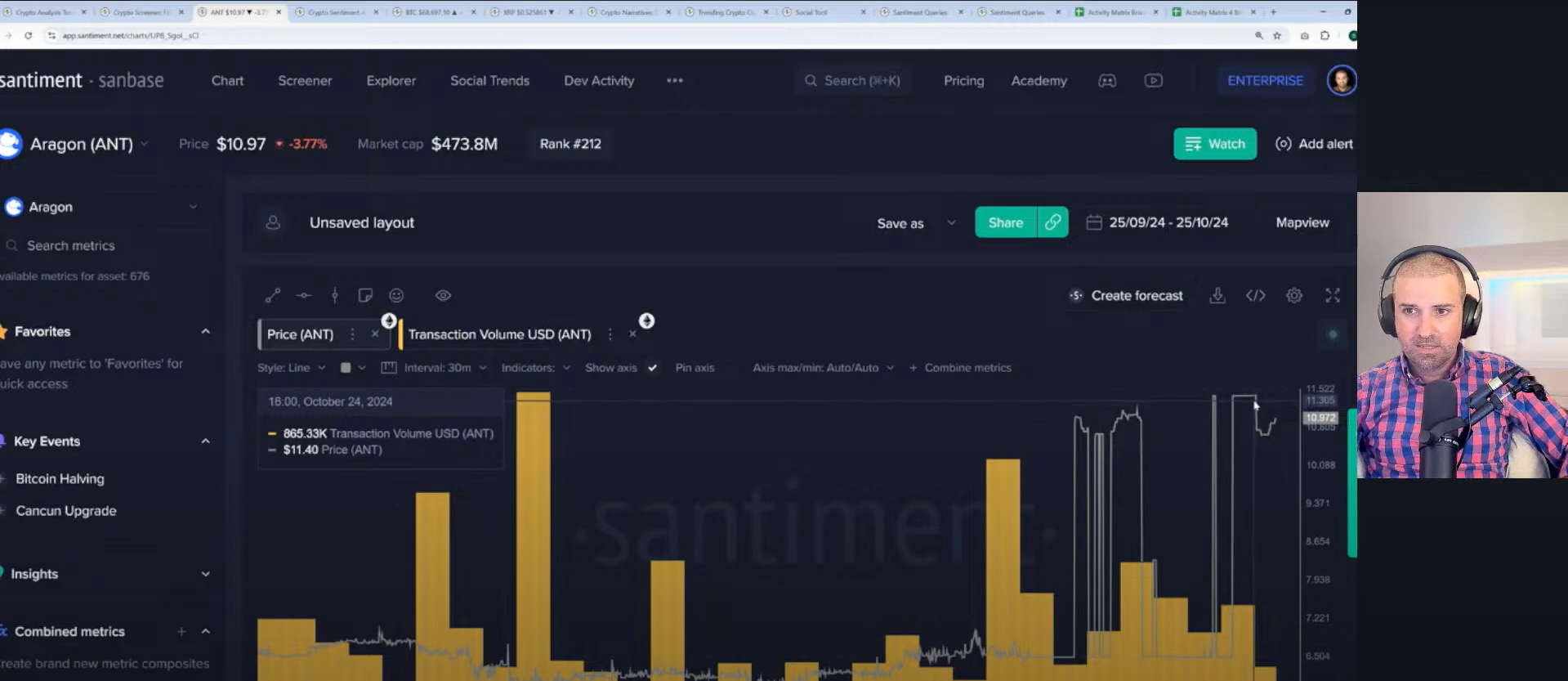

Network Activity Matrix: ANT Analysis

Brian explored the Network Activity Matrix to identify altcoins with significant network activity. Aragon (ANT) emerged as a standout, showing a massive spike in activity and price fluctuations. This spike indicates a surge in transactions and interactions within the Aragon ecosystem. Over the past month, ANT has experienced significant price volatility. High activity suggests that there may be increased interest in Aragon, possibly driven by recent updates or community initiatives. Additionally, whale transactions have shown notable spikes, indicating that larger investors are actively engaging with ANT. This level of activity often precedes major price movements, making ANT a focal point for traders looking to leverage short-term market dynamics.

Conclusion

With the US election around the corner and market sentiment changing, having solid data is more important than ever. Brian's insights show how crucial it is to keep an eye on whale movements, social media chatter, and on-chain data to make smart investment choices. Santiment's tools give investors a leg up, helping them stay on top of market trends and seize opportunities. We encourage you to check out these resources, keep up with Santiment's updates, and stay alert.