Deep Dive: A History of Bitcoin and Crypto... a Reminder of Why We're All Still Here!

Bitcoin officially began on January 3, 2009, when the mysteriously-named Satoshi Nakamoto mined the Genesis Block (Block 0). Nakamoto is considered the inventor of Bitcoin, but his origins are clouded in mystery. As for where the name itself came from, there is no truly confirmed explanation. However, several reasonable interpretations are often discussed:

- Japanese-style name: “Satoshi Nakamoto” looks like a traditional Japanese name, which may have been chosen to add mystery or misdirection. Despite this, Satoshi’s writings were in fluent English, and their online activity matched Western time zones more closely than Japan’s.

- Possible symbolic meaning: Some have speculated that the name could be symbolic. In Japanese, “Satoshi” can loosely relate to meanings like wisdom or clear thinking, while “Nakamoto” can mean central origin or middle base. These interpretations are debated and not official, but they fit Bitcoin’s theme of thoughtful design and decentralized origins.

- Intentional anonymity: Using an alias protected Satoshi from legal, political, and personal risk. Creating a money system outside traditional banking could attract serious attention, so anonymity helped keep the focus on the technology rather than the creator.

At the time of Bitcoin's origin, the coin had no real market value and was believed to have mainly started as an experiment to see if digital money could exist without banks. One of the most famous early moments came in 2010, when programmer Laszlo Hanyecz paid 10,000 Bitcoin for two pizzas, marking the first known real-world Bitcoin purchase. What a long way we have come. Back then, this was seen as nothing more than a fun milestone because Bitcoin was worth so little. Now, of course, that same pizza purchaser is looked at as a classic cautionary tale as to why one shouldn't sell their coins "too early".

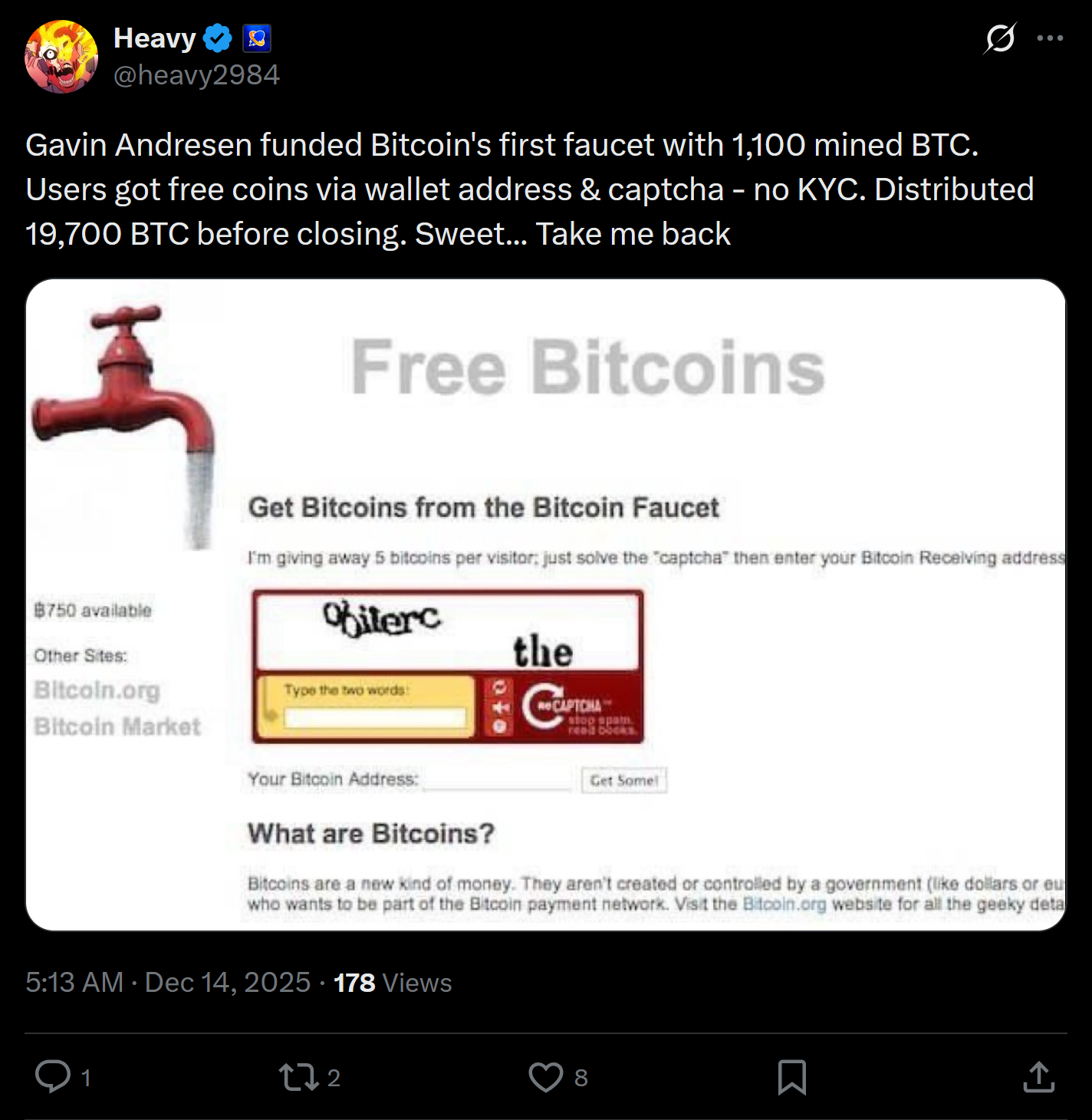

Around the same time, early users could also get free Bitcoin from “faucet” websites like The Bitcoin Faucet, created by developer Gavin Andresen, and later sites like FreeBitco.in, which handed out small amounts just for participating. The website, just this week, coincidentally announced it will be shutting down, which truly marks the end of an era. These early moments helped show that Bitcoin could be used, shared, and valued, even if no one yet imagined what it would eventually become.

The appeal for Bitcoin 15 years ago was mostly “this is new and interesting”, and it appealed to mainly hobbyists. It wasn’t normal to think of it as an investment. It was more like a hobby, a puzzle, and a way to prove that digital money could work without a bank running the system. A lot of the excitement came from the fact that you could get small amounts of Bitcoin in playful ways. People traded it on tiny forums, and tipped each other online with hundreds or thousands of BTC at a time. Mining on home computers was also part of the fun. The fascination was less about “getting rich” and more about being early to something that felt like the internet in its startup era.

Then, around 2011 to 2015, Bitcoin started to pick up a stronger political and social identity (along with its prices). After the 2008 financial crisis, many people didn’t trust banks and big financial institutions. Crypto became appealing as “money that no company or government can control.” For some, it wasn’t just technology anymore, it was a statement: a way to opt out of traditional systems that felt unfair, slow, or corrupt. There was an increasing anti-bank and anti-central control message showing up in very visible ways. Supporters often pointed to Bitcoin’s fixed supply of 21 million coins as proof that it could not be inflated by governments the way national currencies can. Online forums like Bitcointalk were filled with discussions about escaping bank bailouts, money printing, and hidden fees.

In 2011, Bitcoin began to be used by activists and donors after traditional payment companies blocked certain organizations, reinforcing the idea that no single authority could shut it down. The rise of early crypto slogans like “Don’t trust, verify” and “Be your own bank” captured this mindset, while open-source developers around the world contributed to the code without permission from any corporation. Together, these examples helped turn crypto into a symbol of decentralization and resistance to centralized financial power, not just a new kind of digital payment system.

From 2013 to 2014, this trend continued as the idea of Bitcoin's "mass adoption" really began to gain traction. That idealism faced its first major reality check on February 24, 2014, when news broke that Mt. Gox, then the largest Bitcoin exchange in the world, had suddenly gone offline and was missing roughly 850,000 Bitcoin. Many users had trusted Mt. Gox like a bank, leaving their funds on the platform instead of controlling their own private keys. When withdrawals stopped and the scale of the losses became public, those funds were effectively gone, with no insurance and little legal protection. This moment forced the crypto community to confront a hard truth: while Bitcoin itself was decentralized, many of the services built around it were not. The Mt. Gox collapse did not end the anti-bank message, but it reshaped it, teaching investors that “be your own bank” also meant taking full personal responsibility for security, storage, and risk.

Crypto was always global by design, but in the early years it was hard to use. Before 2015, the tools were clunky, exchanges were unreliable, and very few people trusted the system after events like Mt. Gox. Around 2015–2016, several improvements came together at once. More exchanges launched in different countries, wallets became easier to use on rapidly evolving smartphones, and Bitcoin’s network proved it could keep running without interruption. As a result, more people began to realize that crypto already worked across borders. It was just reaching a point where the masses could finally begin to take advantage of this.

Between 2016 and 2018, the story shifted again as crypto became more mainstream and more tied to investing. There were several higher percentage rallies in previous years, but 2017, in particular, was the first one that seemed to capture the mainstream global attention, with news headlines fueling the Bitcoin and altcoin craze more than ever before. Big price rallies brought headlines, and many newcomers arrived mainly because they didn’t want to miss out. This was also the era when lots of new tokens launched and everyday people heard about “ICOs.” For many, the fascination changed from “this is a cool idea” to “this might be my chance at a big financial win.” It was rare, during this time, for serious crypto owners to not have the Blockfolio app to track their holding values from their phones at any time.

In 2018 to 2020, the mood became more serious. After big hype cycles cooled off, crypto communities started focusing more on building real products and explaining the technology in simpler terms. Security, scams, and lost funds became part of the public conversation too. Society’s view became mixed: some people saw crypto as the future, while others saw it as risky, confusing, or full of hype.

Decentralized finance (DeFi) projects began to gain real traction, showing how crypto could recreate traditional financial services without banks. Platforms like MakerDAO, which allowed users to lock up crypto and generate the stablecoin DAI, became one of the earliest and most trusted DeFi systems. Compound and Aave introduced decentralized lending and borrowing, letting users earn interest or take out loans directly from smart contracts instead of financial institutions. Uniswap, launched in 2018, changed how trading worked by allowing people to swap tokens directly from their wallets using automated liquidity pools. These projects attracted growing amounts of money and attention, proving that crypto could offer practical financial tools, not just speculative assets, and helping push the industry toward more serious development and real-world use.

From 2020 to 2021, crypto’s appeal exploded again, but with new reasons. Stimulus money, low interest rates, and people spending more time online (due to the pandemic) helped fuel trading and speculation. At the same time, new areas like decentralized finance (DeFi) and NFTs made crypto feel like more than just Bitcoin. It looked like a whole new online economy where you could borrow, lend, trade, collect digital art, and build communities. Even though scams and slightly sketchy projects were popping up during this time, traders were having fun trading digital non-fungible tokens to distract them from the concerning global conditions outside.

During 2021 to 2022, perception started to split sharply around the world. In some places, crypto was seen as an exciting new asset class and a way to grow wealth. In other places, it was seen as dangerous, especially after major crashes and high-profile failures. Regulators and politicians began paying closer attention, and public trust took hits when people realized how many platforms were not as safe or transparent as they seemed. This appeared to be the point in which institutionals began to become heavily involved and show major interest in being part of the movement that was initially started by everyday retail traders.

Large financial firms, hedge funds, and publicly traded companies began allocating money to Bitcoin and other digital assets, signaling that crypto was no longer just a retail-driven movement. Major companies added Bitcoin to their balance sheets, while traditional banks started offering crypto services, research reports, and trading desks to clients. At the same time, futures markets, custody services, and regulated investment products expanded, making it easier for institutions to enter in a way that fit existing financial rules. While this institutional interest helped legitimize crypto in the eyes of some investors, it also changed market behavior, increasing correlations with traditional assets and raising concerns that the space was becoming more influenced by the same large players it originally set out to avoid.

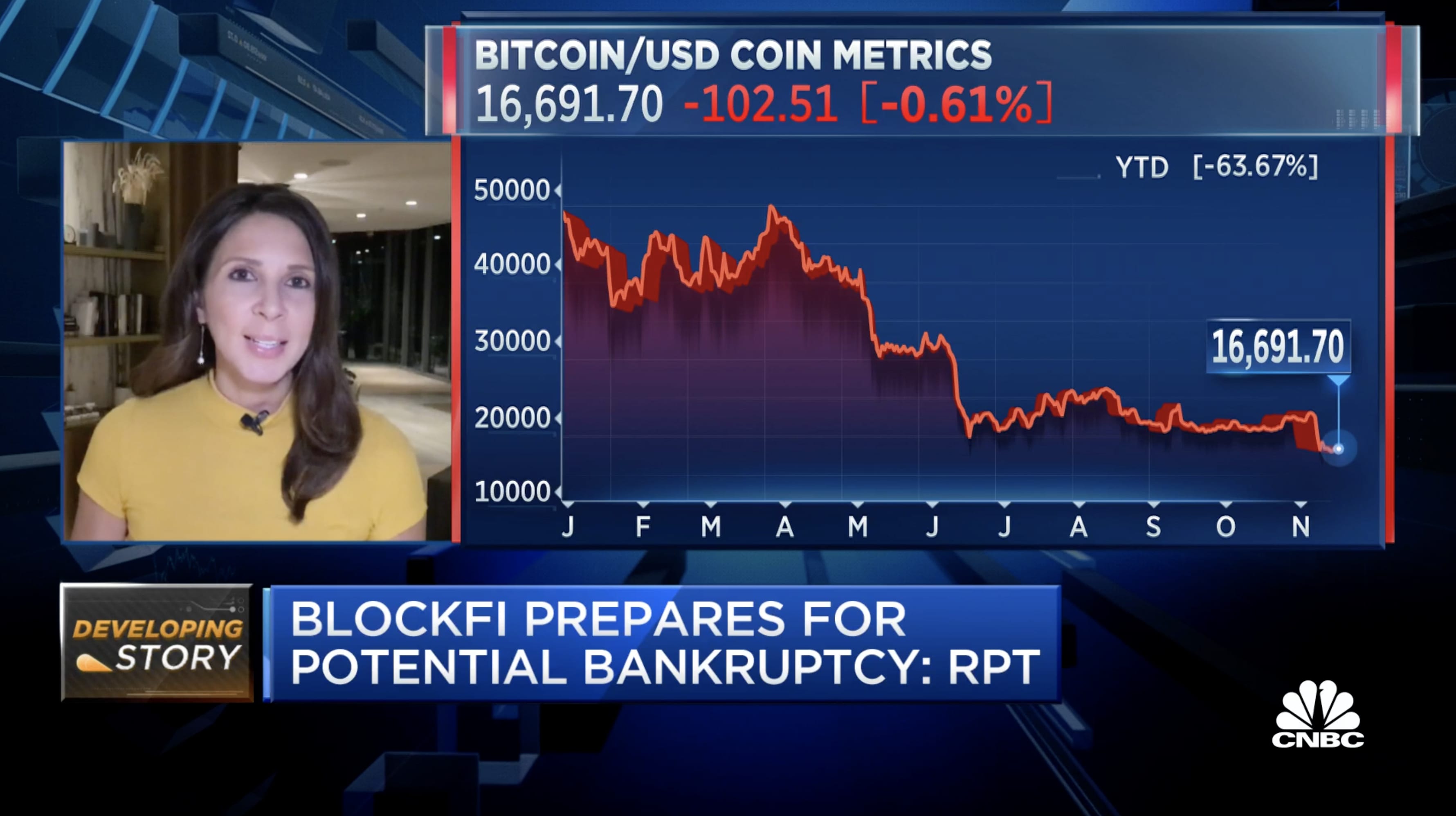

In 2022 to 2023, the fascination evolved into something more cautious and “grown up.” Instead of only chasing hype, more people began asking basic questions like: Who is holding my funds? Is this platform regulated? What problem does this coin actually solve? Crypto didn’t disappear, but the public narrative became more about survival, risk management, and separating strong projects from weak ones.

This shift was driven by a series of painful but important events that forced investors to slow down and reassess risk. In 2022, the collapse of major players like Terra/LUNA, Celsius, Voyager, and FTX wiped out billions of dollars in value and affected millions of users worldwide. Many people learned, sometimes for the first time, that centralized crypto platforms could fail in ways similar to banks, but without the same protections.

These failures led to greater interest in self-custody, hardware wallets, and on-chain transparency tools that allowed users to verify reserves and activity themselves. As a result, attention shifted toward projects with long operating histories, open-source code, and clearer use cases, reinforcing the idea that long-term survival in crypto depends less on hype and more on trust, transparency, and responsible design.

From 2023 through the end of 2025, crypto has become even more connected to traditional finance. More investors have started treating it like a long-term asset category, similar to stocks or commodities, rather than a fringe experiment. One major reason is growing political involvement, especially from Donald Trump, whose public shift from criticizing Bitcoin to openly supporting crypto initiatives drew massive attention. Trump-backed NFT launches, public statements supporting U.S.-based crypto innovation, and discussions around making America a “crypto leader” brought digital assets directly into mainstream political debate. While this support energized parts of the crypto community, it also unintentionally tied crypto prices more closely to political news cycles, much like stocks respond to elections, policy promises, and leadership changes.

As crypto became more politically visible, its price movements began to line up more closely with traditional markets like the S&P 500. Investors started reacting to the same headlines across both markets, especially during major geopolitical events. For example, the Russia–Ukraine war continued to influence global energy prices, inflation fears, and risk appetite, which affected both equities and crypto at the same time. Similarly, rising tensions in the Middle East, including conflicts involving Israel and surrounding regions, caused sudden “risk-off” behavior, where investors pulled money from both stocks and crypto simultaneously. These events reinforced the idea that crypto was no longer isolated from the global financial system, but instead moving in sync with broader economic uncertainty.

Another key factor linking crypto and traditional markets has been the strong focus the crypto community places on the Federal Reserve’s interest rate decisions. Just like stock investors, crypto traders closely watch Fed meetings, rate cuts, and inflation signals, often reacting within minutes. Lower interest rates are generally seen as positive for crypto, since cheaper borrowing and increased liquidity encourage risk-taking. Higher rates, on the other hand, tend to pressure prices as money flows back into safer assets like bonds. By 2025, it became clear that crypto was responding to the same macroeconomic forces as the S&P 500, showing how far it had moved from its original role as an independent alternative into a fully connected part of the global financial system.

Globally, crypto’s meaning has also changed depending on where you live. In wealthier countries, it’s often viewed as an investment, a trading market, or a tech trend. In countries dealing with inflation, strict capital controls, or unstable banking systems, it can be viewed as a practical tool for saving value or moving money. But there are still plenty of messages around that still follow the message being purported since the early 2010's:

Looking back, Bitcoin and crypto did not follow a straight path from experiment to investment. Instead, they evolved through curiosity, rebellion, growth, failure, rebuilding, and finally integration with the global financial system. What began as a small idea shared on forums has survived crashes, hacks, hype cycles, and political attention, while constantly forcing people to rethink money, trust, and control. Today’s crypto market looks very different from the faucet days and pizza purchases, but the original ideas of openness, choice, and independence still exist beneath the surface.

As crypto continues to mature, its future will likely be shaped less by quick excitement and more by how well it balances innovation with responsibility, freedom with structure, and idealism with real-world use. The fascination has grown up, but it hasn’t become boring, because crypto still sits right at the intersection of money, power, technology, and human emotion. The combination of all of these aspects continues to pull people in... the new adopters are just a little more frequent when there's a massive bull market going on. And that will always be the case!

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.