Sentiment's Wild After a Topsy Turvy End to the Week

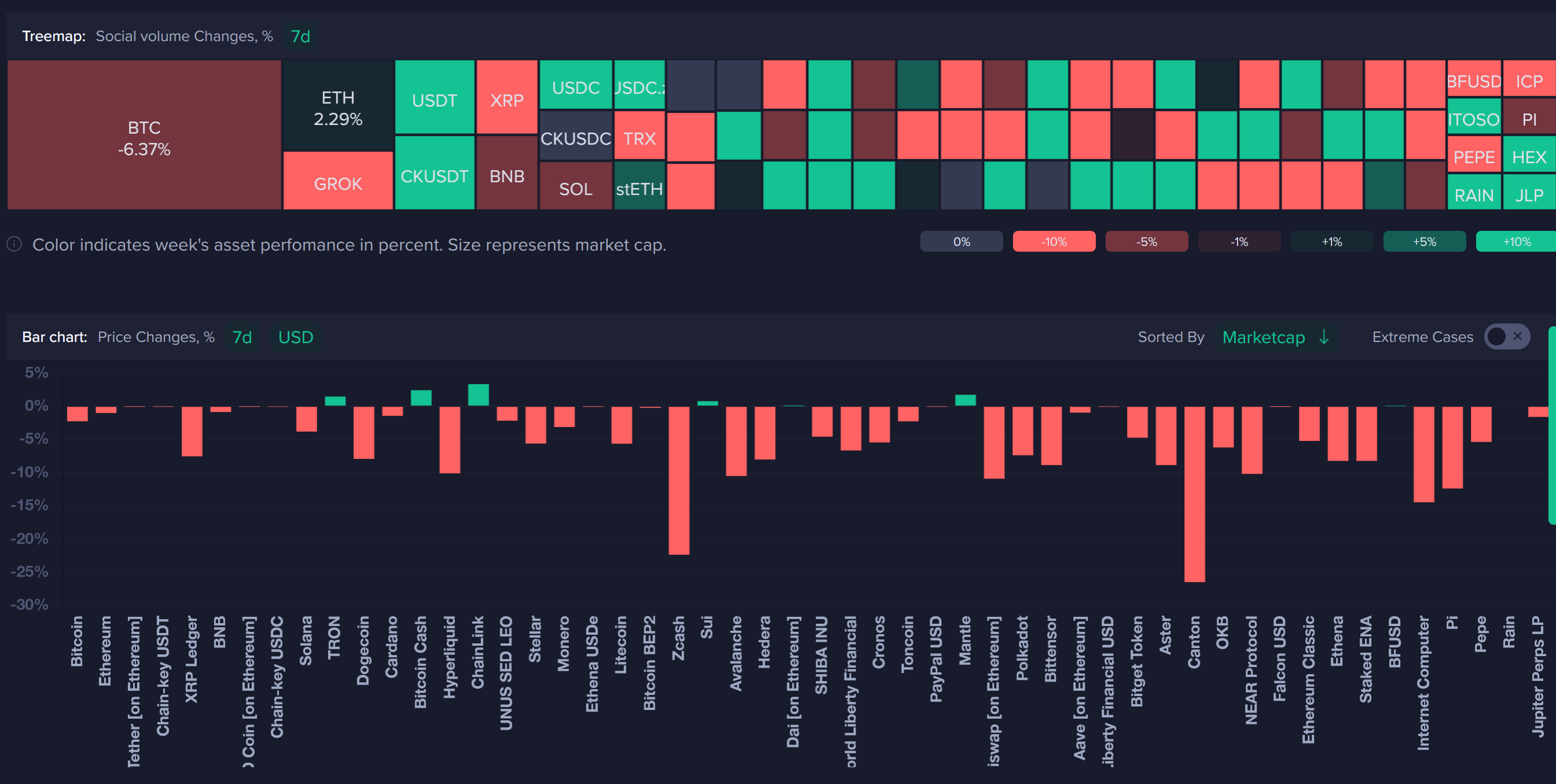

In a week that had several side stories and Bitcoin jumping back up to a high of $94K, crypto heads to the weekend with disappointment and crypto's top cap back at $89K. The vast majority of coins are in the red, with coins like Zcash (-22%) and Canton (-26%) being the biggest notable losers.

But there were some positive signs, such as Ethereum's successful Fusaka upgrade. The upgrade went live on December 3, 2025 (at block slot 13,164,544). It focuses on improving Ethereum’s speed and scale. It also introduces PeerDAS, which lets the network check that rollup data exists without forcing every node to download it. It also raised data capacity per block and made blob fees more stable so that future scaling does not require a full hard fork.

Fusaka is seen by the retail crowd as a win because it lowers fees for layer 2 networks and makes it easier for regular users to run nodes. That leads to cheaper apps, more network activity, and stronger long term demand for ETH.

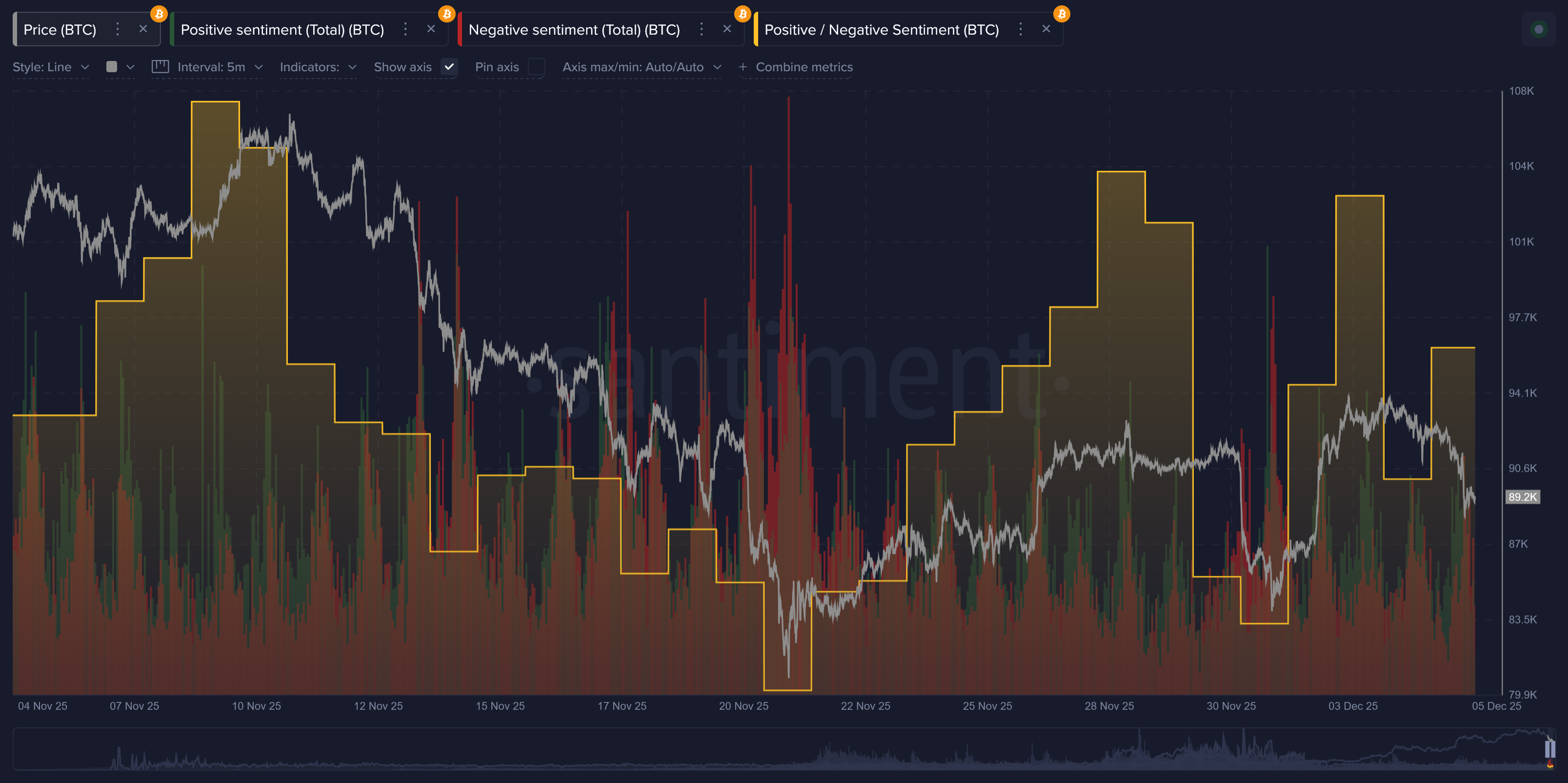

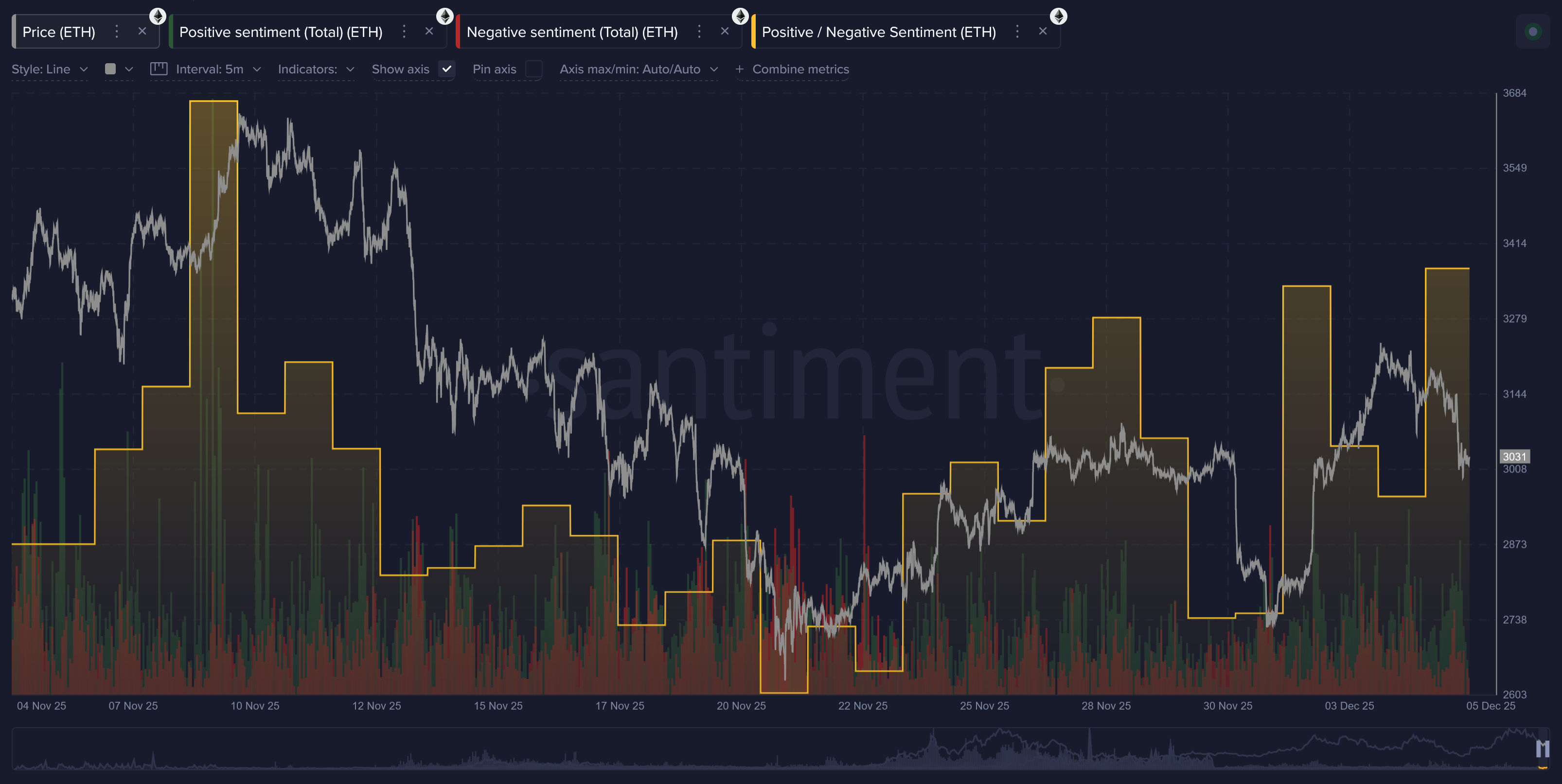

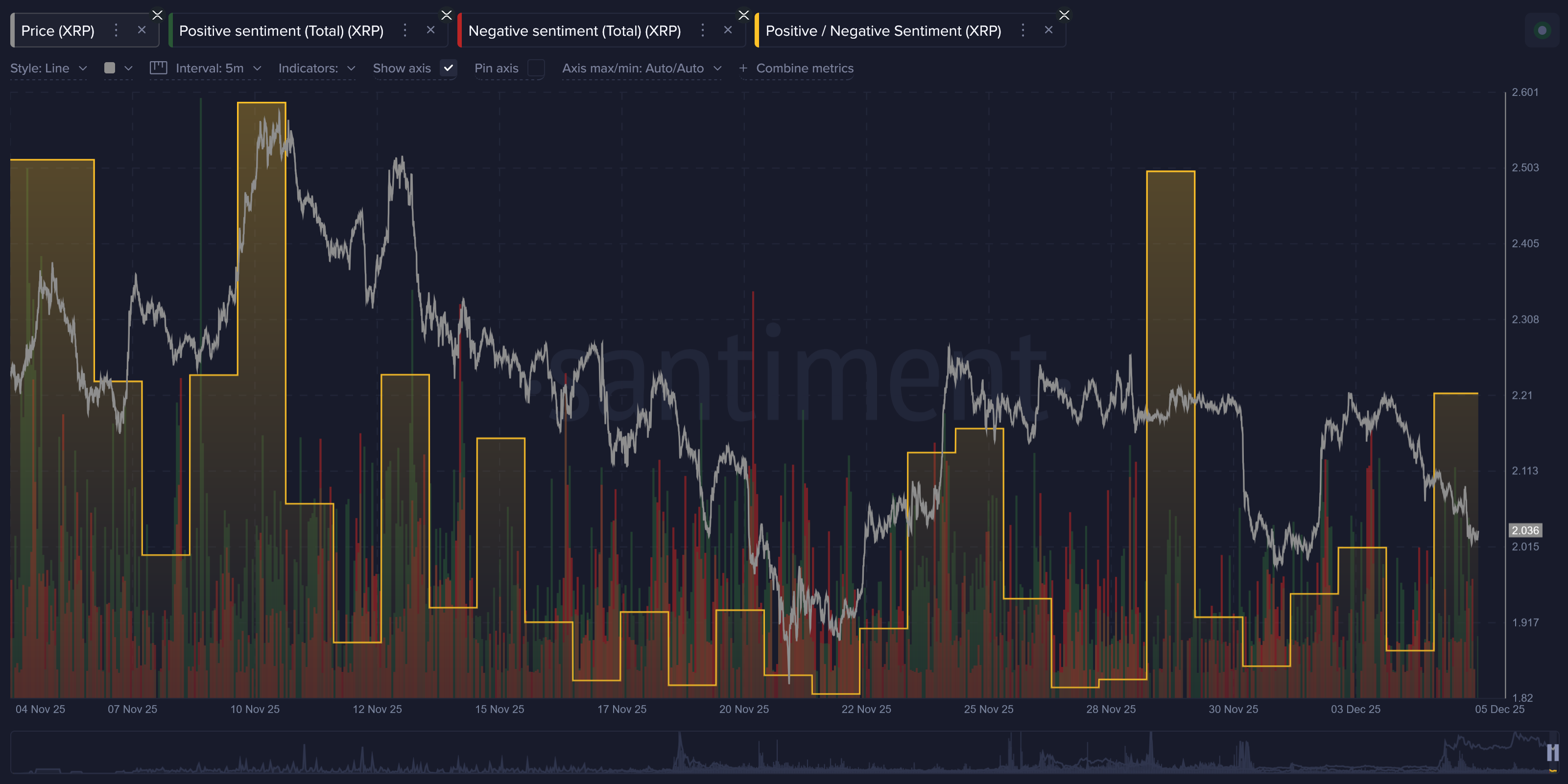

As for how sentiment has shifted for each asset, while keeping in mind that greed (high gold bars) is a bad sign for the price and fear (low gold bars) is a good sign, here is a breakdown of the top six non-stablecoins:

Bitcoin

Bitcoin dropped to the mid-$80K range to start December, but made a strong rebound to get as high as $94K. Retail has been patiently waiting for the $97K resistance level as a sell point, but as is usually the case, the crowd's hopes for a price level were never quite reached, and they're going to have to wait a bit longer now that we've seen the #1 market cap fall back to $89K.

Despite the recent swings, Bitcoin still continues to set the tone for other coins. When it rises, most altcoins tend to follow, and when it falls, they usually feel the impact. For now, the mood around Bitcoin remains cautious but hopeful, with investors looking for a clear breakout.

Crowd Sentiment: Neutral

Ethereum

ETH did enjoy a mini surge after the Fusaka upgrade, but the price boost was pretty short-lived. Even during slower periods, Ethereum remains one of the highest-used networks for apps, NFTs, and decentralized finance, and this has to be remembered for long-term investing strategies.

What stands out about Ethereum is how much it is used every day, not just how much it is traded. Its upgrades and strong developer base make it a top choice for builders. That steady growth in activity helps support long-term interest, even when the price moves up and down. For now, traders are still showing a slight bullish bias after the upgrade a couple days ago.

Crowd Sentiment: Semi-Bullish

XRP

XRP has continued to struggle to keep up, now shedding -32% of its market cap in the past 2 months lone. However, large investors and funds have continued adding XRP, which suggests that long-term interest has not disappeared. Even with slower price action, that type of support can help keep the asset from dropping too sharply.

If XRP sees more clarity in regulation and market conditions, it could find a stronger footing again. For now, the community seems patient, watching for signs of better momentum and wider financial use. It did just see the crowd swing extremely bearish on the asset, but it's come back to middle ground for now.

Crowd Sentiment: Neutral

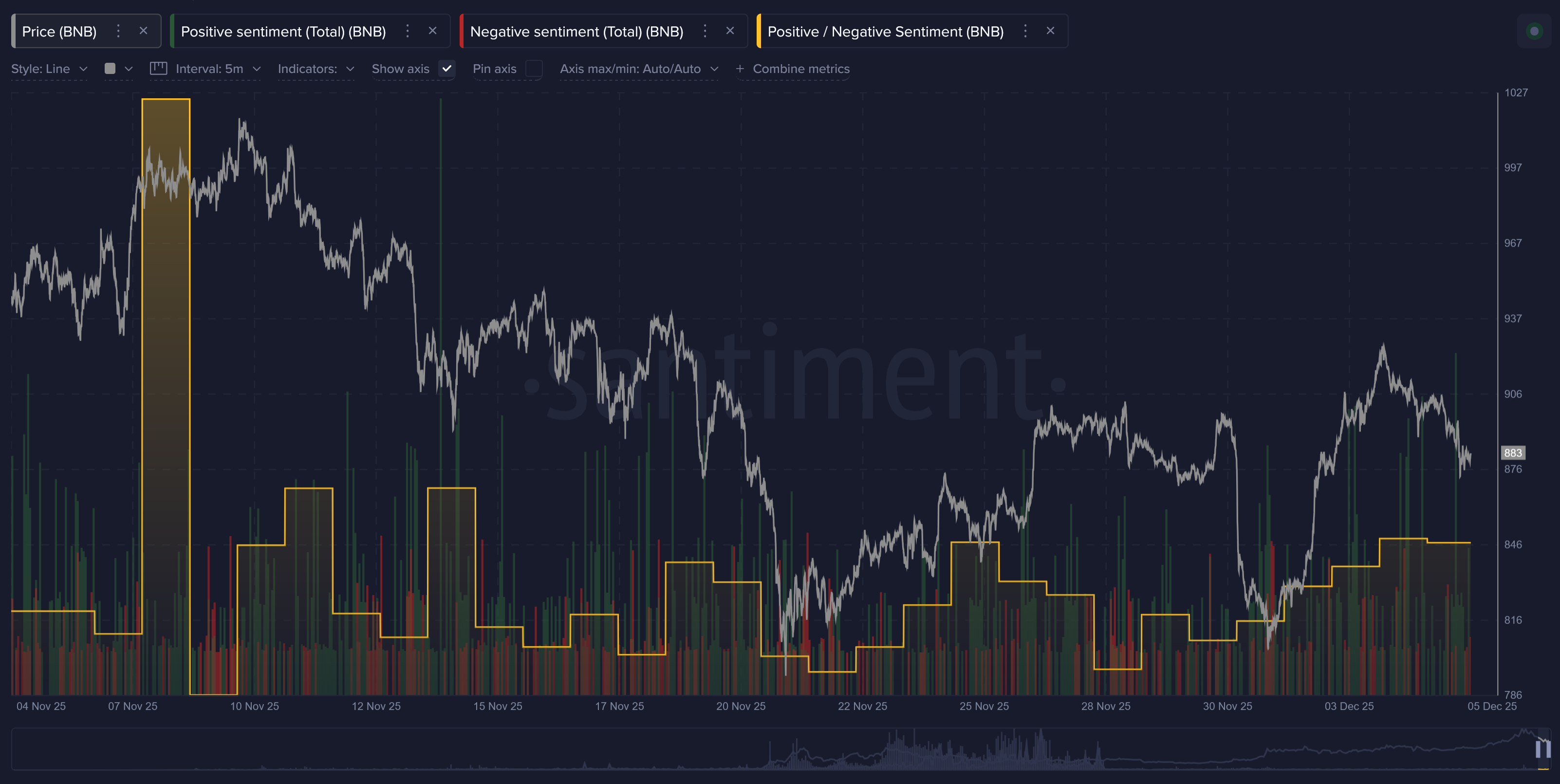

BNB

BNB moved mostly in line with the rest of the top coins, dipping during the broader market slump and then recovering when sentiment improved. Its strong ties to the Binance ecosystem keep it in regular use for trading, fees, and staking. Traders who have held BNB for a long time were rewarded with a major pump to a new all-time high of ~$1,370 just four weeks ago. But since then, it's rapidly given -35% of that pump back.

Nevertheless, because BNB is backed by one of the biggest platforms in the world, it continues to hold a high market rank even during quieter periods. As long as Binance remains active, BNB is likely to stay a major player in the crypto space. Everything appears very quiet in terms of sentiment toward the coin for now.

Crowd Sentiment: Neutral

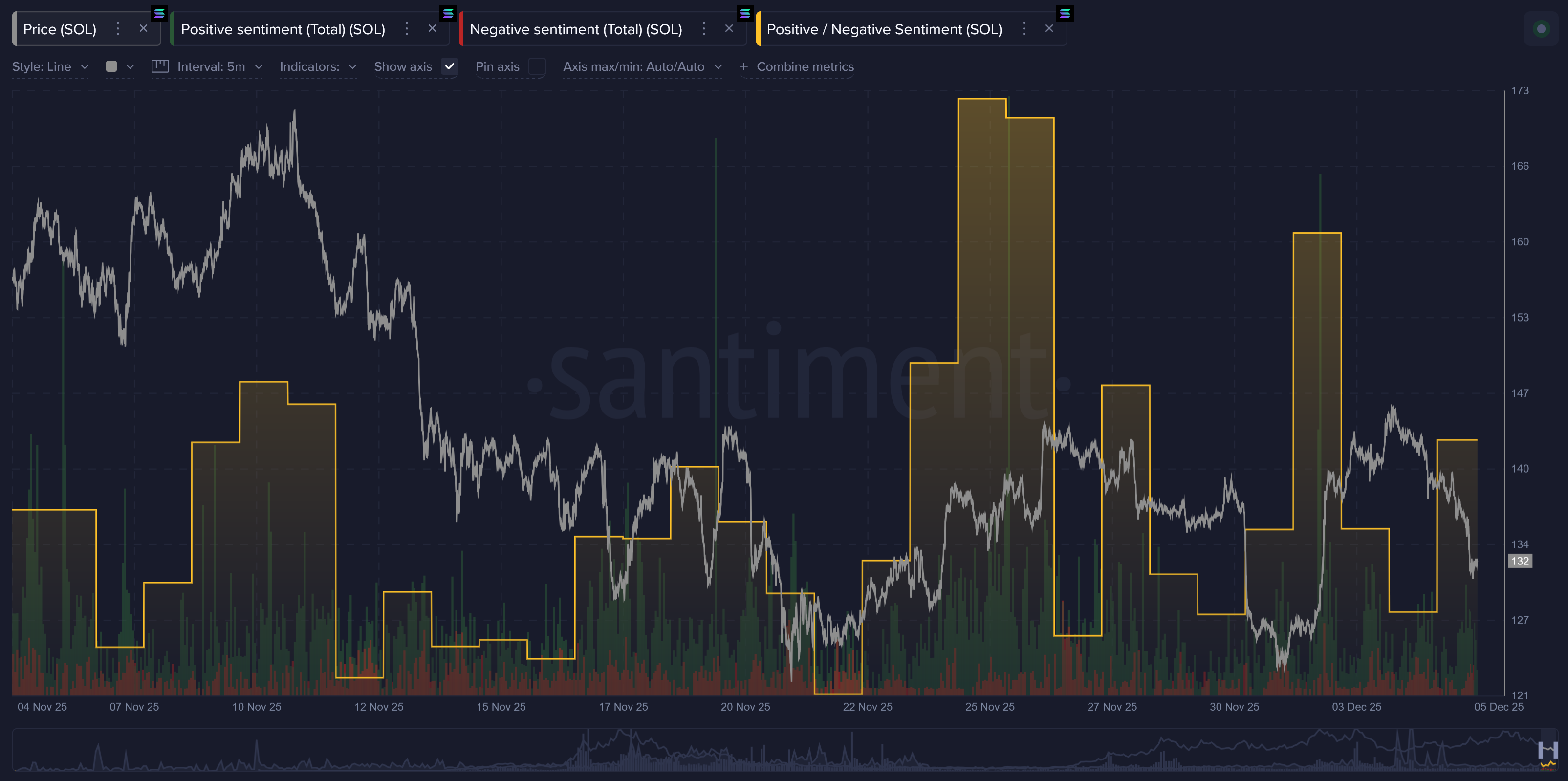

Solana

Solana has recently gained a lot of attention not just for its technology, but because new exchange-traded funds (ETFs) tied to SOL have launched. Several firms have launched or filed for Solana ETFs, giving regular investors a simpler way to buy exposure to SOL without holding the coins directly. This includes staking-based and spot-price ETFs.

These ETF developments matter because they can bring in large, institutional money. When big funds invest, it adds credibility and liquidity to Solana. That boost in institutional support may help stabilize SOL’s price long-term, and some believe it could lead to renewed interest in Solana’s blockchain ecosystem overall. Normally, this would be seen as bigger news for a coin, but because Solana's market cap is -44% in 2 months, enthusiasm has understandably been a bit more tempered.

Crowd Sentiment: Neutral

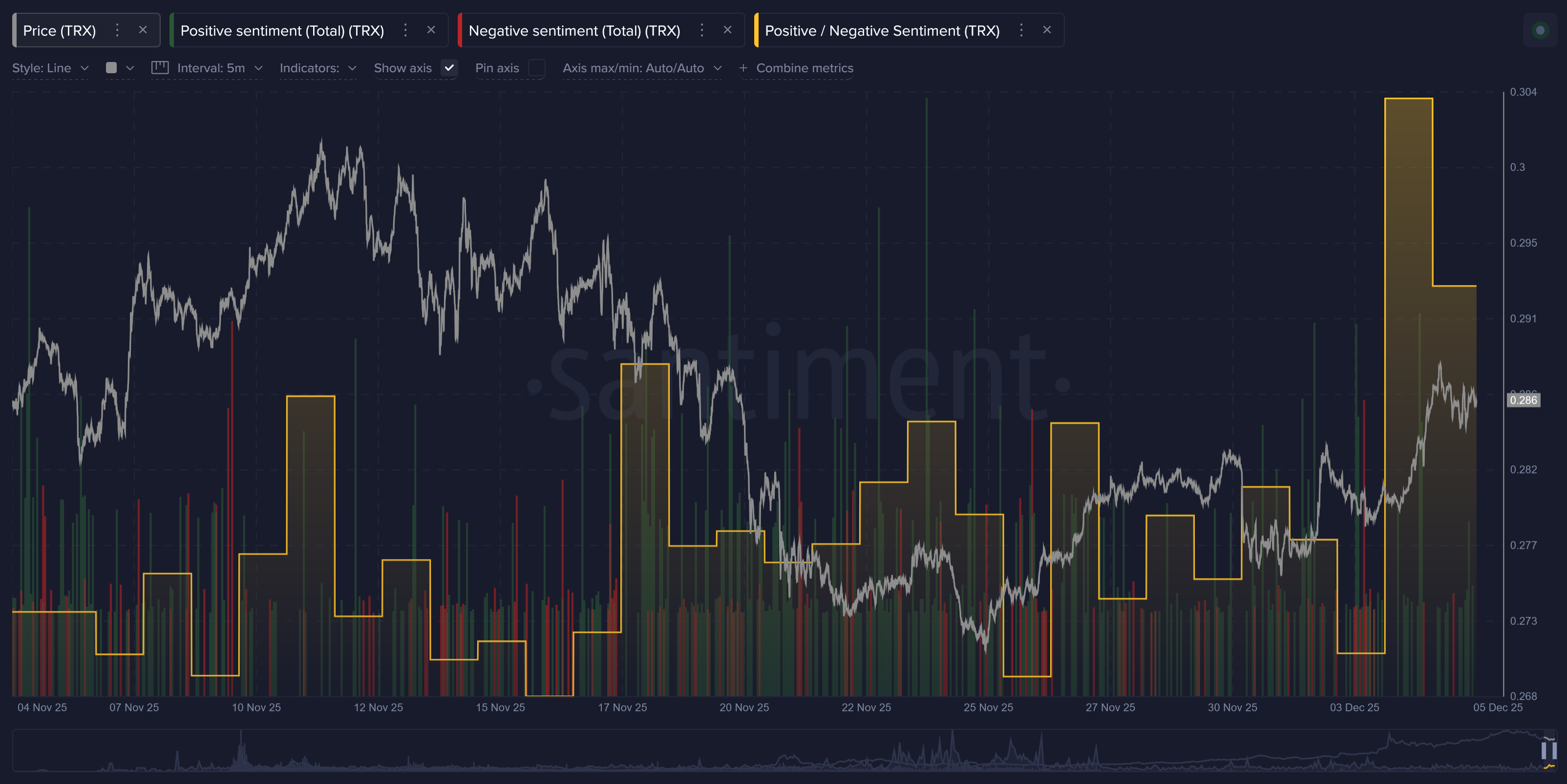

Tron

TRON has had a number of developments lately that have caught retail's attention. On December 4, 2025, the TRON network reportedly surpassed 350 million accounts, showing a sharp increase in users and daily activity. A day before that, on December 3, 2025, a wallet linked to founder Justin Sun withdrew 100 million TRX from exchanges, a move often seen as a sign of long-term holding rather than selling.

Also, on November 17, 2025, TRON partnered with a real-estate platform to launch a campaign offering 50,000 USDT in holiday-time rewards for homebuyers who pay using USDT on TRON. This shows real-world use of TRON beyond trading or speculation.

These developments matter because growing user numbers and network activity can strengthen TRON’s claim as a practical blockchain for stablecoins, payments, and real-use transactions. Large withdrawals by insiders reduce circulating supply, which could support price stability or growth. And steps like using TRON for real estate payments suggest its ecosystem keeps expanding beyond crypto-native use.

Crowd Sentiment: Very Bullish

Remember that crowd sentiment is just one small piece of the pie when it comes to making informed trading and investing decisions. Stay tuned as we bring you more on-chain updates for these assets and more, soon!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.