Deep Dive: Checking in On Sentiment For Crypto's Elite

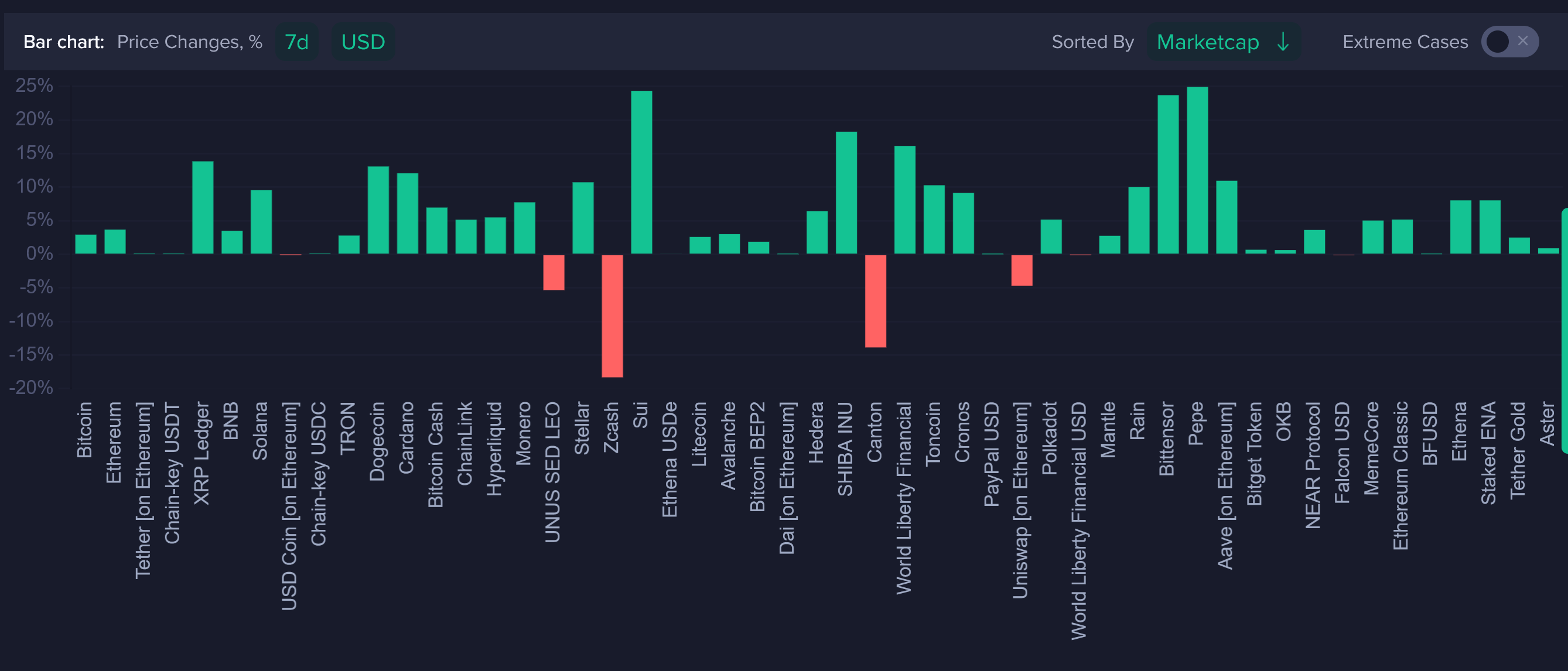

2026 has been a breath of fresh air for traders that suffered mightily ever since the correction that began after the October 6th Bitcoin all-time high. Several altcoins have gotten back on track, such as Sui. And meme coins like Dogecoin, Shiba Inu, and Pepe have also enjoyed healthy rebounds. According to Santiment's data screener, it has mostly been a sea of green for the first time in a while.

But how has the crowd been shifting their views on crypto? As we know, prices of any respective asset typically goes the opposite direction of the market's expectations. Retail traders are responsible for the vast majority of comments across X, Reddit, Telegram, etc. The large whales are typically moving in silences.

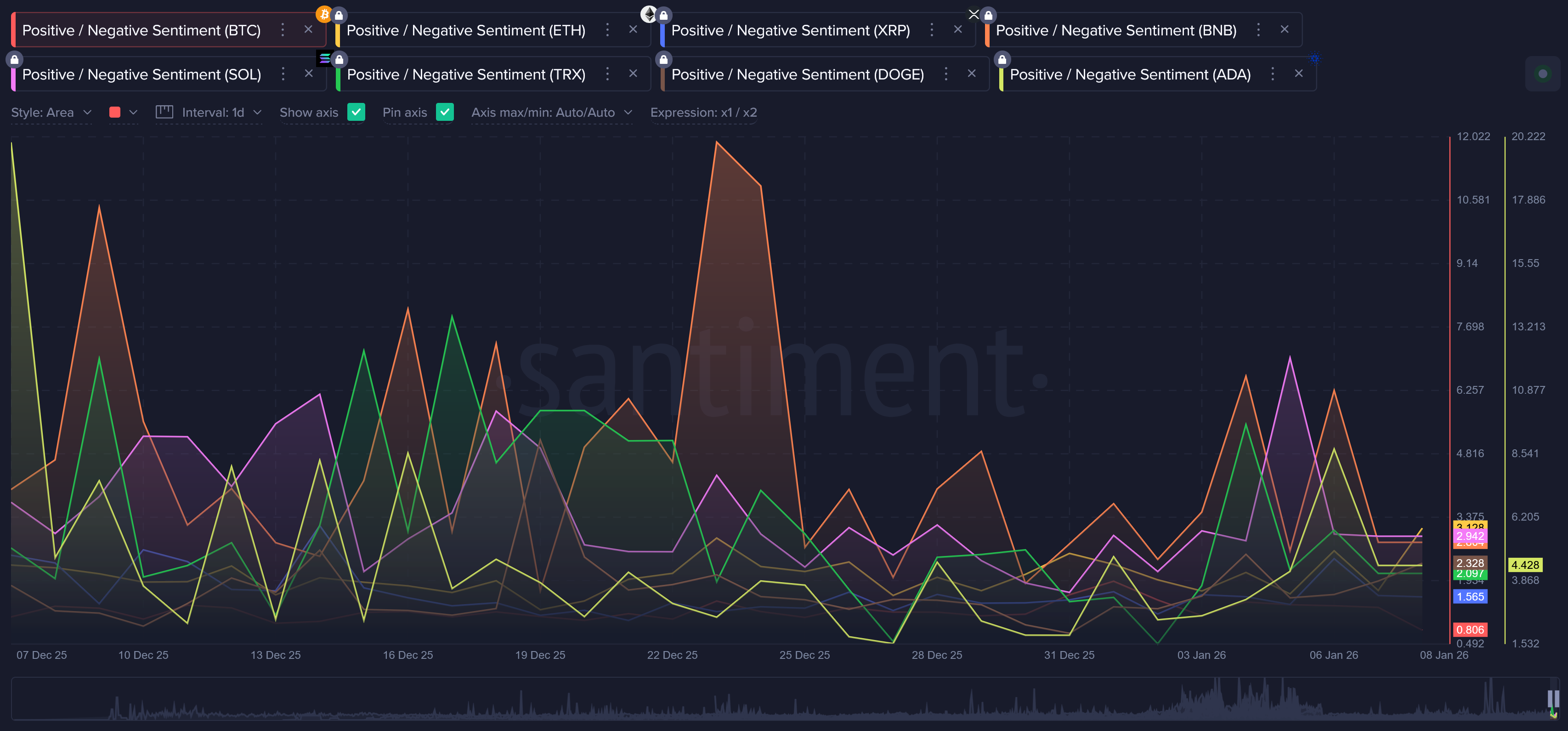

And according to the positive/negative sentiment ratio comparison chart, we've seen a few anomalies (such as Binance Coin's major retail euphoria right before Christmas or Cardano's mega bullish spike last month).

But as prices have flattened in just the past couple of days and Bitcoin is testing $90K, some interesting developments have occurred. We break down the sentiment for the 8 largest non-stablecoins in our latest social metric analysis:

Bitcoin $BTC: +3.0% in the Past Week

Bitcoin’s first full week of 2026 has been shaped by ETF flow headlines and “risk-on / risk-off” macro mood swings. On Thursday, Bitcoin slid back toward the low-$90K range after briefly pushing higher earlier in the week, with U.S. spot Bitcoin ETFs showing a large one-day net outflow led by big products like BlackRock and Fidelity.

The bigger takeaway is how traditionally “Wall Street” plumbing is now one of the main short-term drivers. Coverage tied the move to traders de-risking ahead of key U.S. economic data (like the jobs report) and shifting rate-cut expectations. Bitcoin is leading the narrative (so far, backed by evidence in 2026) of crypto reacting more like a macro asset than a niche market.

Bitcoin sentiment is clearly getting more and more positive not that the bleeding has at least shown mild signs of reversing. The $90K level is going to be crucial for retailers to stay positive. Don't be surprised if we see a couple more dips in the $80K's, potentially down to $85K, which causes traders to start selling at a loss and giving the necessary FUD for crypto to really blast off later in the year.

Ethereum $ETH: +3.7% in the Past Week

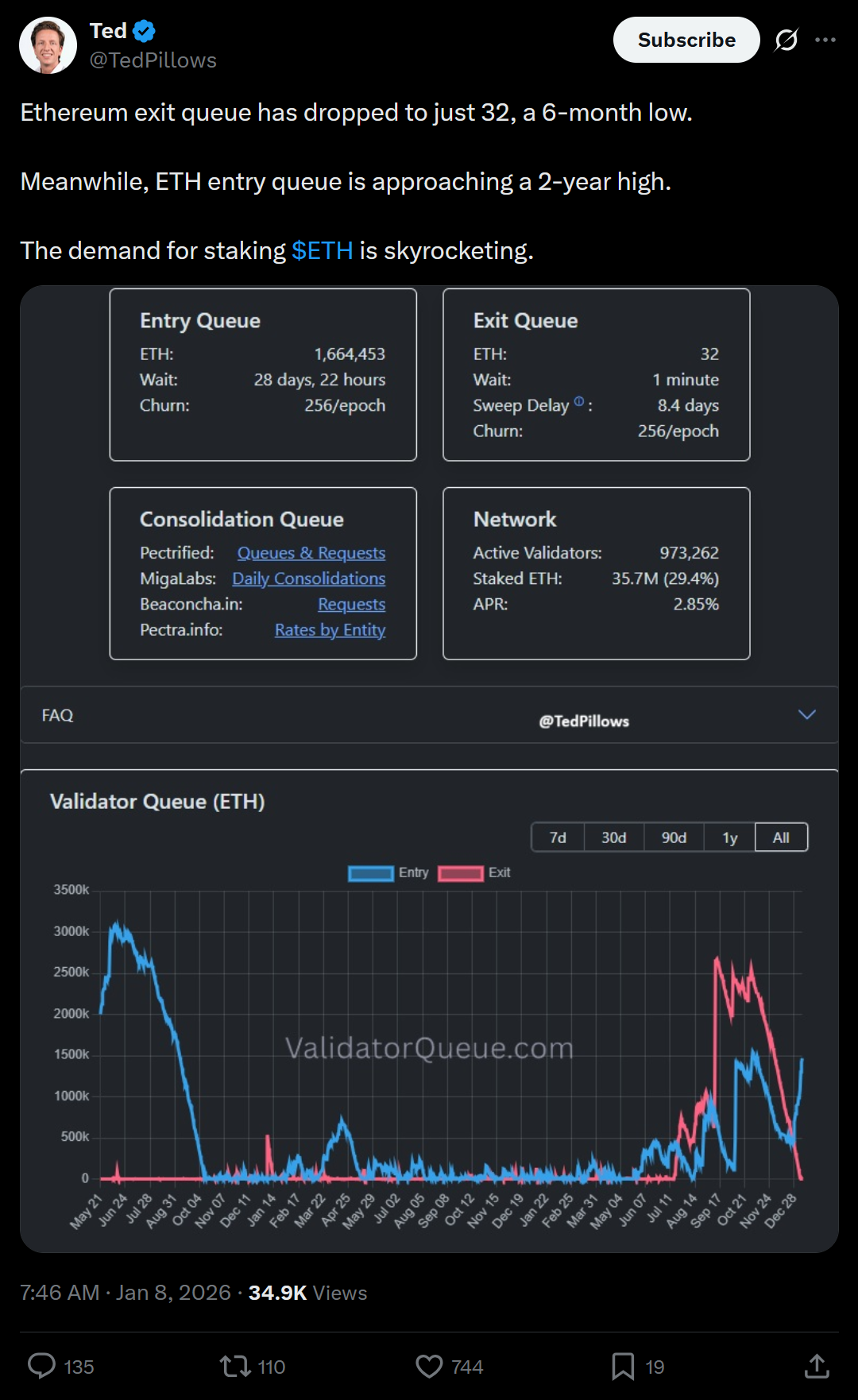

Ethereum’s story has been less about a single “upgrade day” and more about staking becoming more mainstream through regulated products. Reports this week highlighted staking-related developments inside ETH investment products, including payouts/distributions tied to ETH staking rewards and discussion of what that means for how investors may treat ETH (not just as a price bet, but as an asset with potential yield).

At the same time, market coverage has focused on how Ethereum’s staking mechanics can change the supply-and-demand narrative. For example, there have been some changes in staking queues and what that does to the popular “supply shock” framing, making ETH trading feel more nuanced than “less supply = up only.”

Sentiment toward Ethereum appears to be scattered, and not showing any consistent trends as of now. There clearly has been an increase in the amount of people interested in staking. But that is mainly due to the increase in options. Unless ETH begins to break out again like it did in mid-2025, crypto's #2 market cap is blending in for the time being, and its sentiment should as well.

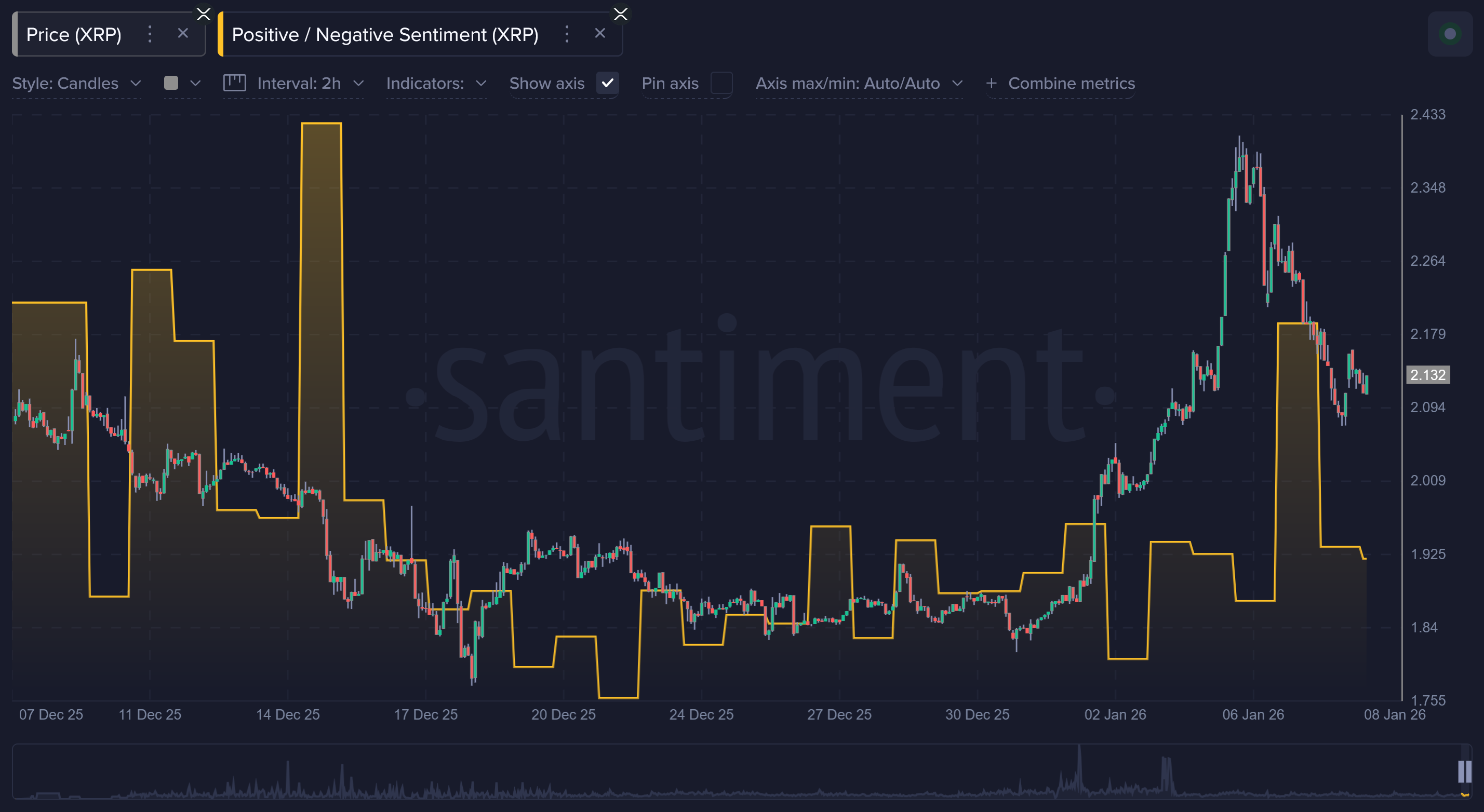

XRP $XRP: +13.9% in the Past Week

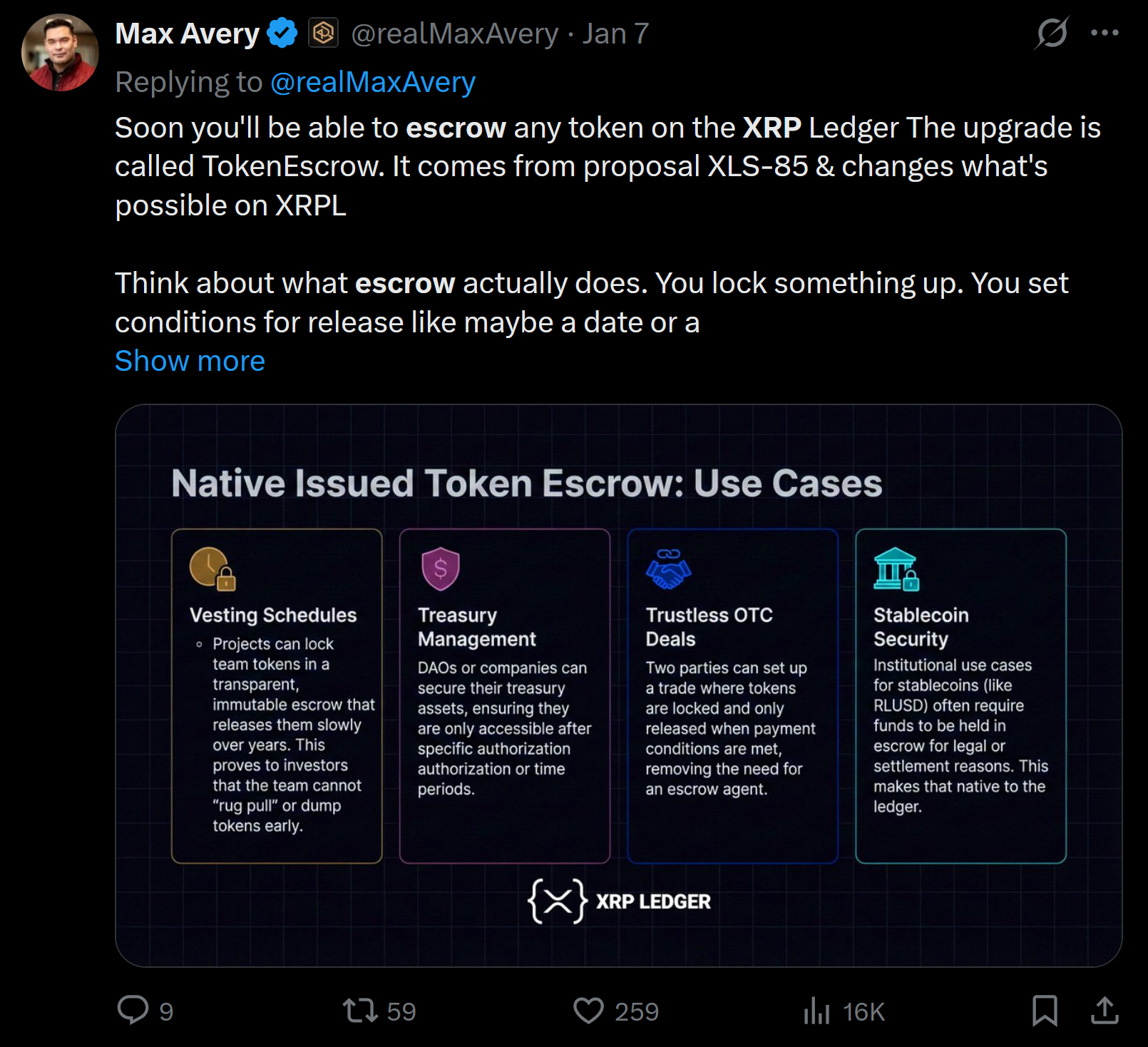

XRP’s early-2026 news cycle has leaned heavily on token supply events and renewed trader attention. Multiple market pieces pointed to the January escrow unlock (1 billion XRP released, with a large portion reportedly re-locked) as a concrete, scheduled event traders watch because it can affect near-term supply and sentiment.

The second theme is that XRP has been moving with stronger-than-usual momentum in the first week of 2026, and coverage has tried to explain why. The explanations vary by outlet, but they generally connect XRP’s rally to a mix of market structure (liquidity and flows), investor positioning, and the idea that “known catalysts” like escrow releases can concentrate attention in short time windows.

XRP started 2026 on a major surge, reaching to ~2.40 before it began to correct again over these past couple of days. Initially, there was quite a bit of crowd disbelief toward the rally. But when small traders saw a dip buy opportunity, we can see where there was a sudden surge of positive sentiment as they tried to "time the bottom". As usual, the crowd consensus was incorrect, and the asset has bled a bit more since. Expect that FUD becomes prevalent if XRP starts to test $2.00 once again.

Binance Coin $BNB: +3.5% in the Past Week

For BNB, one of the most specific “since Jan 1” developments is Binance’s regulatory/operational transition tied to Abu Dhabi Global Market (ADGM) that took effect January 5, 2026 (UTC), alongside updated terms and an operating structure under ADGM supervision. That kind of headline matters to BNB traders because Binance’s regulatory footing can impact confidence.

Separate from pure regulation, BNB also caught attention through an early-January corporate/treasury narrative. There was a reported governance fight tied to a company’s BNB treasury strategy, which is the kind of story that can pull BNB into the “treasury asset” conversation (similar to how Bitcoin treasuries influence BTC headlines).

BNB has never been the kind of asset to generate huge headlines for its price action. The excitement surrounding it mostly coincides with what Binance itself is doing. Nevertheless, BNB has been one of the better performing assets since it bottomed around Christmas. A $1,000 market value is where it typically will make headlines and bring back tons of retail FOMO, if it can make it that far in the next couple of months.

Solana $SOL: +9.6% in the Past Week

Solana’s biggest clear-cut January 2026 headline has been institutional product momentum. On January 6, 2026, Reuters reported that Morgan Stanley filed with the SEC for ETFs tied to bitcoin and solana, a notable step because it signals a major bank pushing further into “spot-style” crypto exposure beyond the usual asset-manager crowd.

In parallel, 2026 is being perceived as a year where Solana’s growth story depends on network hardening and DeFi readiness. There are questions as to whether Solana can keep scaling without the stability worries that have followed it historically. That “performance + resilience” narrative is part of why ETF headlines can hit extra hard for Solana: they amplify the stakes of execution.

Solana's been surging with positive sentiment in just the past 24 hours. The Morgan Stanley ETF hype appears to be the main culprit, along with an impressive price performance that is now seeing SOL revisit $140 again. An important resistance level of $143 is what to watch for, as many traders see this as a breakout price if exceeded.

Tron $TRX: +2.8% in the Past Week

Tron’s early-2026 news has been heavy on payments and fintech integration. There are reported partnerships aimed at making TRON-based assets spendable in more everyday contexts (payment layers / infrastructure work), which fits TRON’s long-running identity as a high-throughput rail for stablecoin-like activity.

Another headline thread is wallet and product integration: announcements highlighted wallet support expanding to TRON with a stablecoin payments angle. Even when these are partly “company announcement” stories, traders watch them because distribution (more apps supporting TRON) can matter as much as pure tech upgrades for real usage.

Tron is always seeing a fair amount of partnership talk, so it's not a surprise to see that it hasn't really moved the needle too much for the crowd. Breaching a $0.30 price level would get many more excited, though. So expect FOMO to pour back in on the #8 market cap asset if it's approached.

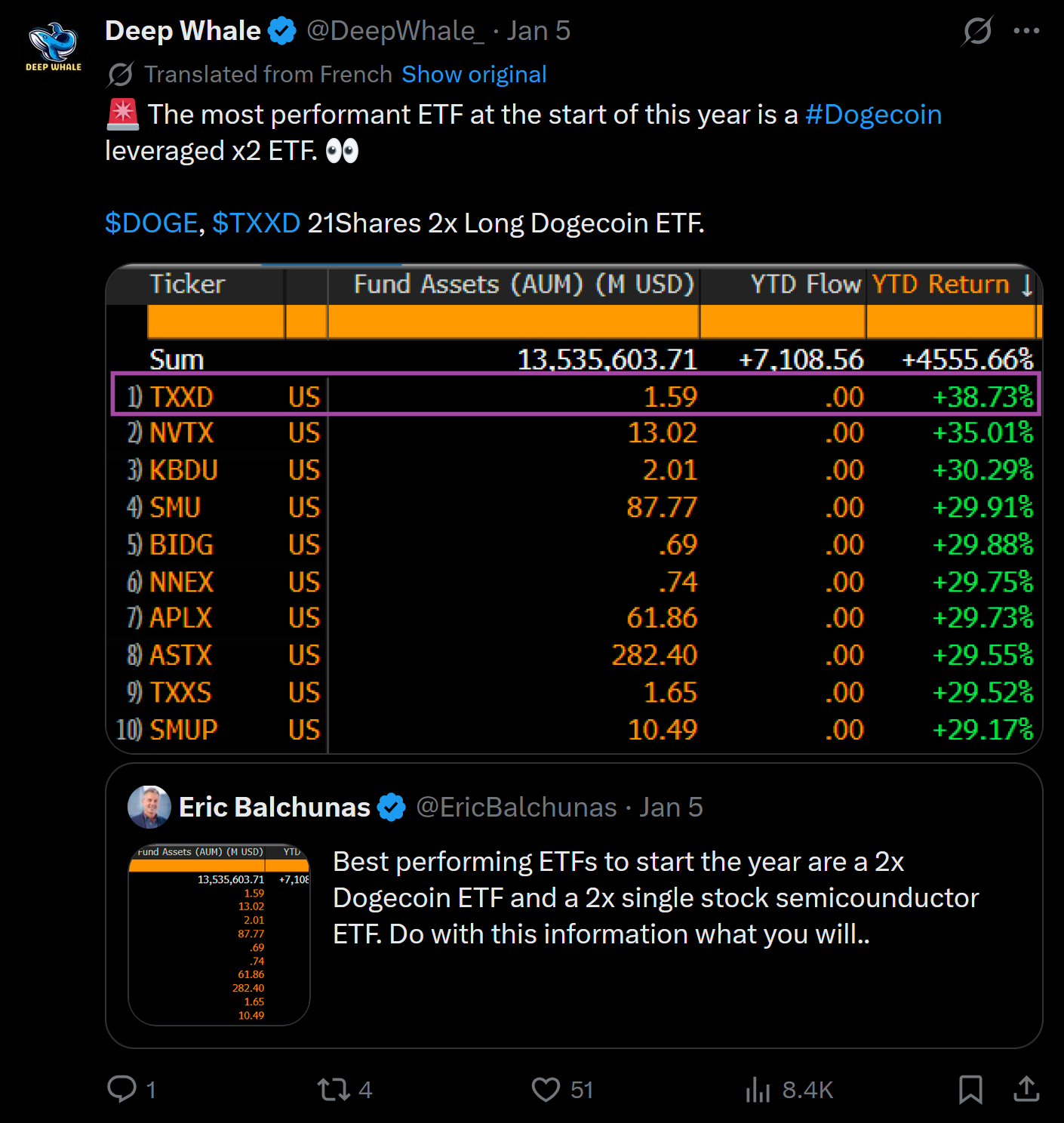

Dogecoin $DOGE: +13.1% in the Past Week

The leveraged (2x) Dogecoin ETF that’s been one of the top-performing ETFs to start 2026 is the 21Shares 2x Long Dogecoin ETF (ticker TXXD). It’s structured to deliver twice the daily price movement of Dogecoin (before fees and expenses), meaning it gains about 2× as much as DOGE does on days when the token rises—but also loses 2× when DOGE falls.

The ETF has gained attention from traders seeking high-beta exposure to meme-coin moves. Through January 8, 2026, this leveraged ETF has posted notable positive performance, generating approximately a ~38–39% in the few days of 2026 thus far. That strong showing is part of what’s put it near the top of early-2026 ETF performance lists, outpacing many other exchange-traded funds during that same period. This has had ripple effects on a moderate meme coin "boom" to start the year, as well.

Dogecoin is still the "king" of the meme coins. And you've likely been seeing just how many strong performers there have been in that sector. After sentiment toward DOGE bottomed out at the beginning of the year, there were clearly signs that the coin could rally to punish all of the December panic sellers. Though it would have been tough to project that the rally would be quite this strong. Even after FOMO returned a bit on Monday and prices began to predictably fall back down, it looks like optimism is staying a bit high thanks to many dip buyers.

Cardano $ADA: +12.1% in the Past Week

Cardano’s January 2026 headlines have centered around “tradfi access” speculation and roadmap progress. Market coverage pointed to a sudden burst of derivatives positioning (open interest rising quickly) alongside talk that an ADA-related ETF decision/trajectory could become a 2026 catalyst for traders to hype up, resulting in some potential "buy the rumor" price surges.

On the development side, the team has reportedly had ongoing work toward Ouroboros Leios (a scalability-focused effort) and other exciting initiatives that have excited the Cardano faithful. The practical impact is that ADA’s rallies can become a blend of “tech roadmap hope” plus “access narrative” (ETFs).

Cardano's sentiment has risen a bit, but is still fairly low compared to what we saw on December 7th and 8th (right when ADA topped out). Even the upswing to start the year hasn't really been enough to significantly excite the retail community. However, more scalability breakthroughs in 2026 could create a wave of optimism, even if price isn't instantly going to follow them.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.