Top Trending Stories Dashboard On Santiment is Your New Go-To Morning Dashboard!

🥳 We are pleased to announce that the FREE Santiment Trending Stories dashboard is live! Keep tabs on what crypto stories are driving markets and generating the most hype on a daily basis: https://app.santiment.net/social-trends/trending-stories?utm_source=youtube&utm_medium=post&utm_campaign=youtube_trending_stories_b_072825/&fpr=twitter

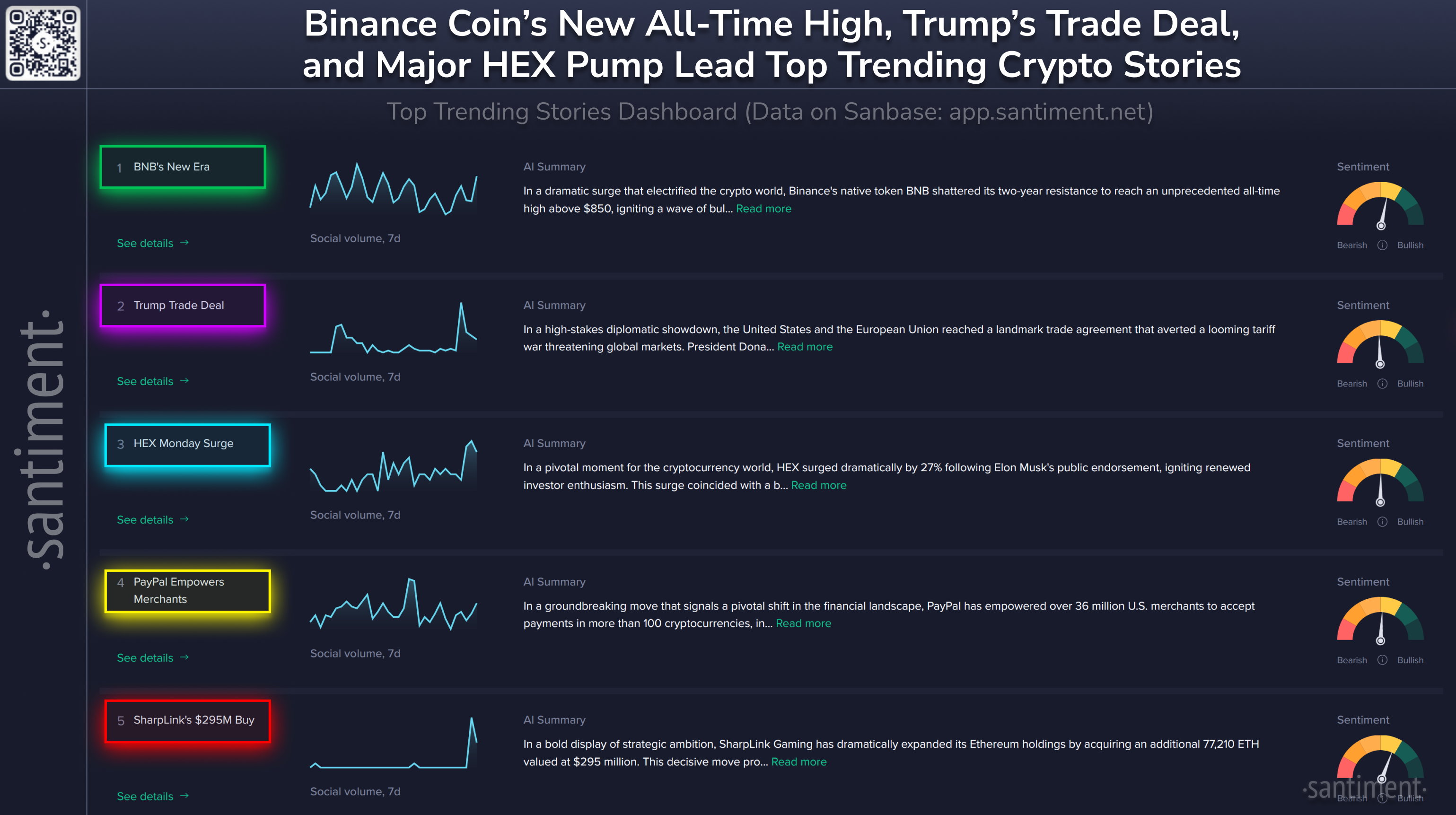

🗣️ As for today, the top 5 stories are:

🆕BNB's New Era: In a dramatic surge that electrified the crypto world, Binance's native token BNB shattered its two-year resistance to reach an unprecedented all-time high above $850, igniting a wave of bullish momentum across the market. This breakthrough was not just a price milestone but a pivotal moment that propelled Binance founder CZ's net worth to an astonishing $75 billion, positioning him among the world's wealthiest individuals. Holding 64% of the circulating BNB supply, CZ's influence grew as institutional investors poured billions into BNB, driving daily volumes to new heights and crushing short sellers. Meanwhile, Bitcoin and Ethereum also rallied, with Bitcoin's hashrate hitting record levels and prices soaring, signaling robust network security and investor confidence. The market's frothy enthusiasm was fueled by a mix of strategic corporate acquisitions, growing institutional adoption, and a broader crypto recovery narrative. This turning point marked a shift from skepticism to optimism, as BNB's ascent challenged traditional financial hierarchies and hinted at a future where digital assets could redefine wealth and power. Analysts now eye a potential $1,000 BNB by year-end, underscoring the token's transformation into a blue-chip asset and the dawn of a new era in cryptocurrency.

🇺🇸 Trump Trade Deal: In a high-stakes diplomatic showdown, the United States and the European Union reached a landmark trade agreement that averted a looming tariff war threatening global markets. President Donald Trump and European Commission President Ursula von der Leyen, after months of tense negotiations, struck a deal imposing a 15% tariff on most EU exports to the US, while exempting critical sectors like aircraft, semiconductors, and pharmaceuticals. Central to the agreement was the EU's commitment to purchase $750 billion worth of American energy over three years and to increase investments by $600 billion, signaling a strategic economic partnership. This deal emerged as a pivotal turning point, driven by mutual interests to stabilize transatlantic trade relations and prevent economic fallout from escalating tariffs. Simultaneously, the US and China extended their tariff truce by 90 days during talks in Stockholm, reflecting a broader effort to ease global trade tensions. The agreement not only calmed investor fears but also set the stage for renewed market optimism, highlighting the complex interplay of diplomacy, economic strategy, and political maneuvering shaping international trade in a volatile era.

📈 HEX Monday Surge: In a pivotal moment for the cryptocurrency world, HEX surged dramatically by 27% following Elon Musk's public endorsement, igniting renewed investor enthusiasm. This surge coincided with a broader bullish wave across the PulseChain ecosystem, fueled by strategic developments such as the launch of Nucleus AI's DApp Testnet and significant geopolitical progress with Thailand and Cambodia agreeing to a ceasefire, easing market tensions. Key players, including influential architects and institutional investors, seized the opportunity to push PulseChain Core Coins higher, anticipating a breakout fueled by upcoming macroeconomic events like the U.S. Federal Reserve's rate decision and major tech earnings. HEX, positioned as a 'Better Bitcoin,' faced resistance but showed promise of surpassing previous benchmarks, driven by community momentum and strategic marketing. Meanwhile, the crypto market braced for volatility amid regulatory shifts and economic data releases, setting the stage for a transformative week. This convergence of technological innovation, market dynamics, and geopolitical stability marked a turning point, signaling a new chapter of growth and opportunity in the crypto narrative.

💸 PayPal Empowers Merchants: In a groundbreaking move that signals a pivotal shift in the financial landscape, PayPal has empowered over 36 million U.S. merchants to accept payments in more than 100 cryptocurrencies, including Bitcoin, Ethereum, and a variety of altcoins. This decision was driven by the growing demand for digital currency adoption and the desire to streamline cross-border transactions with significantly reduced fees. By integrating its own stablecoin, PYUSD, PayPal ensures instant conversion and settlement in U.S. dollars, mitigating volatility concerns for merchants. This bold step not only accelerates mainstream acceptance of cryptocurrencies but also challenges traditional payment systems, marking a turning point where digital assets transition from niche investments to everyday commerce tools. The move reflects PayPal's strategic vision to lead in the evolving digital economy, responding to consumer enthusiasm and the expanding crypto ecosystem, ultimately reshaping how money moves in the modern world.

🤑 SharpLink's $295M Buy: In a bold display of strategic ambition, SharpLink Gaming has dramatically expanded its Ethereum holdings by acquiring an additional 77,210 ETH valued at $295 million. This decisive move propels their total stash to 438,017 ETH, worth approximately $1.69 billion, marking them as the second-largest public holder of Ethereum. The timing is critical, as this purchase surpasses the total new ETH issued in the past month, signaling SharpLink's aggressive bet on Ethereum's future growth and dominance. Meanwhile, across the Pacific, Japan's Metaplanet mirrors this bullish momentum by snapping up 780 Bitcoin for $93 million, pushing their total Bitcoin reserves to 17,132 BTC valued at over $2 billion. Both companies, driven by visionary leadership and a hunger to cement their positions as institutional powerhouses in the crypto space, are reshaping the landscape of digital asset ownership. This surge in corporate accumulation reflects a broader trend of institutional confidence and signals a pivotal turning point where cryptocurrencies are increasingly embraced as core treasury assets, setting the stage for a new era of market dynamics and investment strategies.