This Week in Crypto, Full Written Summary: W5 August

Whales, FOMO, and Market Tops: A Data-Driven Look at This Week in Crypto

Executive Summary

- How to Spot a Market Top: Brian and Maksim walk through the three key on-chain metrics (Active Addresses, Social Dominance, Network Growth) that signaled the peak of the Crypto.com (CRO) rally before its price fell, revealing a classic "latecomer punishment" pattern.

- Whales Signaled the Pump in Advance: Massive whale transactions moving CRO to exchanges preceded the price surge, confirming that tracking large wallets is a powerful leading indicator, especially for altcoins.

- The Real Sign of a Market Bottom: A true bottom is often marked not by price, but by a shift in social narrative from "buy the dip" optimism to widespread fear, creating a strong bearish case that discourages buying.

- A Hidden Bearish Signal for Ethereum: A record-high queue of users unstaking their ETH has created a massive, under-the-radar wall of potential sell pressure that could impact its price in the near future.

Introduction

In this week's analysis, host Brian and our founder and CEO, Maksim, sat down to make sense of the market. While many traders were watching prices, they looked at the underlying data to see what was really happening. From Bitcoin's struggles to the explosive rise of platform tokens like Crypto.com (CRO), this session was full of great insights. Discover the three key metrics Maksim uses to spot a market top and see how whale wallets signaled a major price move before it even happened.

Market Outlook: Expecting Lower Levels for Bitcoin

The conversation started with a look at the broader market. Maksim shared his view that he was "expecting lower levels for Bitcoin." [00:54] He noted that while Bitcoin was struggling, other coins like Ethereum, Solana, and platform tokens were capturing the hype. This set the stage for a deeper look into one of the week's biggest movers, Crypto.com's CRO token, which had just experienced an impressive run.

- Key Data: Bitcoin’s price action was lagging while hype and capital rotated into assets like Solana, CRO, and various platform tokens.

- Actionable Tip: Look beyond Bitcoin's price to identify where market attention and capital are flowing. Use Santiment’s Social Trends features to do so. Following the hype can reveal the market's next potential movers.

Pro Analysis: Top 3 Metrics for Spotting a Market Top

When a coin is pumping, how can you tell when the top is near? Maksim shared the three core metrics he always analyzes first. [02:41] He explained, "I typically start always from three sets of metrics... It's active addresses... social dominance... and then of course, on a longer time frame, network growth." For CRO, these metrics revealed a clear divergence as the price made a final push higher while on-chain and social activity did not follow.

- Key Data: The three key metrics to watch for a top are Active Addresses, Social Dominance, and Network Growth.

- Actionable Tip: Use on-chain metrics to check for divergences with price. If price is rising but network activity or other metrics are falling, it can be a strong signal that a rally is losing momentum.

The Market's Punishment for 'Latecomers' & FOMO

That final price surge was what Maksim calls a "latecomers push." [05:18] The data showed that the last people to join the rally were not new users but rather those who were already active. This created a fragile top. Maksim explained a classic market lesson: "The moment you identify there are latecomers... market always likes to punish them." [05:28] The price retraced heavily right after this pattern.

- Key Data: The final rally was driven by existing network participants, not an influx of new users, signaling market exhaustion.

- Actionable Tip: Be cautious when a price rally isn't supported by new user growth (Network Growth). This often indicates that latecomers are buying in, which can precede a sharp correction.

Buy the Rumor, Sell the News: Timing the Top

The CRO pump was driven by a major announcement, creating a classic "buy the rumor, sell the news" scenario. Maksim noted that once a big announcement is public, there is "typically not much time left until the top is out." [07:56] Traders who wait for the official news often become the exit liquidity for earlier investors.

- Key Data: Disbelief among traders was high, leading to many short positions being liquidated, which added fuel to the rally before the final drop.

- Actionable Tip: Understand that major announcements often mark the climax of a price move. Consider the risk that the positive news is already priced in by the time it becomes public.

Whale Watching: How Large Wallets Predicted the CRO Pump

Brian and Maksim investigated whether large wallets, or "whales," were accumulating CRO before its big run. In the one to two weeks before the pump, several top wallets moved massive amounts of CRO to centralized exchanges. [09:52] One transaction alone was for 185 million CRO, worth between $40 to $50 million. [13:26] Maksim concluded they were "preparing for announcement... Get ready to make money." [13:19]

- Key Data: A whale wallet moved 185 million CRO to an exchange just weeks before the major price pump.

- Actionable Tip: Track large wallet transactions, especially movements to exchanges. This on-chain activity can be a leading indicator of a major price event.

A Whale's Playground: Who Really Controls Crypto Markets?

This activity from large CRO holders serves as a powerful reminder. Brian stated, "This is just an example of how whales control markets, it will always be a whale's playground in crypto." [13:40] He added that "the smaller the asset, the more likely that is to be the case." [13:48]

- Key Data: The influence of whale activity is magnified in smaller-cap altcoins compared to large-cap assets like Bitcoin.

- Actionable Tip: When analyzing smaller-cap altcoins, place a greater weight on on-chain whale movements, as their actions can have a more direct and immediate impact on price.

Is This the Bottom? Analyzing 'Buy the Dip' Mentions

The conversation shifted back to the overall market, which saw an 8% drop in total market cap. [14:36] Brian and Maksim looked at social media mentions of "buy the dip" and found that these calls were spiking. [16:41] However, a real bottom often forms when the crowd loses hope and becomes afraid to buy.

- Key Data: The total crypto market cap fell by 8%, while social media mentions of "buy the dip" increased significantly.

- Actionable Tip: Don't interpret "buy the dip" chatter as a definitive bottom signal. A true market floor often coincides with widespread fear and a lack of interest in buying.

Bitcoin vs. S&P 500 & Gold: A Surprising Divergence

Looking at traditional markets, Brian pointed out a growing separation between Bitcoin and the S&P 500. [17:24] While Bitcoin dropped, the S&P 500 was nearly flat. At the same time, gold was "going nuts," hitting a new all-time high, suggesting a weakening dollar and rising global economic fears. [17:42]

- Key Data: Gold hit a new all-time high, rising 5% in the last 10 days, while Bitcoin decoupled from a flat S&P 500.

- Actionable Tip: Monitor crypto's correlation with traditional markets. A decoupling can signal a shift in how investors view digital assets, whether as risk-on or safe-haven assets.

The Key Signal for a True Market Bottom (It's Not Price)

Maksim shared a crucial insight about identifying market bottoms. He said the key is when the popular narrative shifts from optimism to fear. The current "buy the dip" chatter needs to be "suddenly replaced by discussion of the narrative which supports the bearish case." [20:31]

- Key Data: A true bottom is often marked by a narrative shift from optimism ("buy the dip") to a strong, rationalized bearish case that causes fear.

- Actionable Tip: Pay close attention to the dominant social narrative. When the conversation shifts from hopeful buying to widespread fear, it can be a stronger bottom signal than price alone.

Fed Rate Cut Hopes: The Real Driver of the All-Time High?

The recent all-time high was largely attributed to optimism about a potential Fed rate cut. [22:37] Brian warned that if it becomes clear a rate cut won't happen, the market could see a "landslide," [22:49] as the rally was built on this hope.

- Key Data: Fed Chair Powell's term does not end until 2026, making rumors of his imminent replacement likely overstated.

- Actionable Tip: Be aware of the macroeconomic narratives driving crypto prices. If the fundamental story changes (e.g., rate cut expectations fade), the market's direction could reverse quickly.

Sentiment Check: Bullish on Ethereum, Bearish on XRP & Solana?

A look at sentiment data for top altcoins revealed interesting trends. Ethereum sentiment has remained relatively low, which is an encouraging long-term sign. [27:46] Conversely, XRP and Solana are seeing extremely high levels of bullish sentiment. [28:36, 30:00]

- Key Data: A recent poll showed 38.6% of respondents believe XRP will have the best performance for the rest of 2025, indicating extreme crowd optimism.

- Actionable Tip: Use social sentiment as a contrarian indicator. When the crowd becomes overwhelmingly bullish on a specific coin, it can often signal that a local top is near.

Bitcoin Whales Are Holding Steady: What Does It Mean?

Despite the market dip, Bitcoin whales (wallets holding 10 to 10,000 BTC) have not been selling off in any significant way. [31:36] Maksim noted that historically, when these wallets do decrease their holdings, it can lead to "postponed price suppression weeks thereafter." [32:29]

- Key Data: The supply held by wallets with 10k-100k BTC has remained stable, showing no major sell-off from large holders during the recent dip.

- Actionable Tip: Monitor the holdings of large Bitcoin wallets. A lack of selling from whales can indicate underlying strength, while a significant drop can be a warning of future price weakness.

When Old Coins Move: Decoding Long-Term Holder Behavior

Another important metric, Mean Dollar Invested Age, shows whether dormant coins are starting to move again. [35:14] This indicates that long-term holders are becoming more active. When these experienced holders get "too confident, they got too relaxed," the market often punishes them. [35:25]

- Key Data: The Mean Dollar Invested Age metric is dropping for BTC, indicating that long-held, dormant coins are re-entering circulation.

- Actionable Tip: Watch metrics that track the age of coins. Increased movement from long-term holders can signal a shift in market conviction and potential volatility ahead.

Top Crypto News: Chainlink, Offshore Trading & Altcoin ETFs

The stream wrapped up with a look at the week's trending stories. Top stories included Pyth becoming an official data oracle for the U.S. government, [40:42] rule clarifications for U.S. citizens on offshore exchanges, [40:44] and rumors of altcoin ETFs targeting Q4 2025 approval. [41:27]

- Key Data: Rumors are circulating that ETFs for major tokens like Solana, XRP, and Cardano are targeting approval in Q4 2025.

- Actionable Tip: Keep track of major industry news and rumors with our daily trending stories tool. Events like potential ETF approvals can create short-term volatility and classic "buy the rumor, sell the news" trading opportunities.

The Hidden Bearish Signal for Ethereum Nobody is Talking About

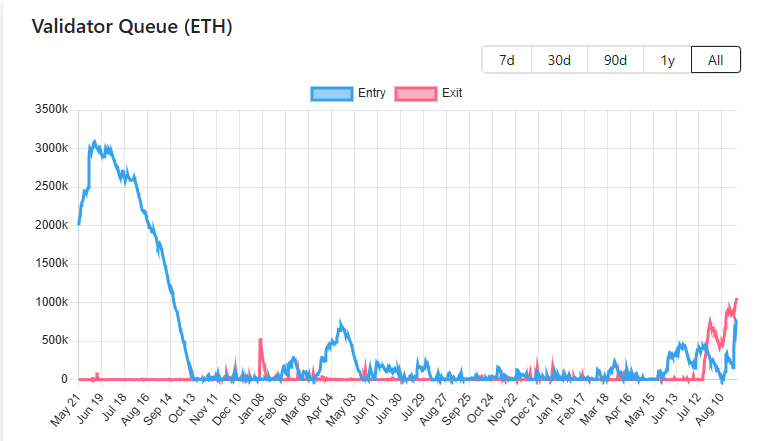

Maksim revealed a significant, under-the-radar trend for Ethereum: the queue for unstaking ETH has hit a record high. [48:44] He asked, "Why people unstake? Well, they probably want to realize profits." This creates a massive wall of potential sell pressure that the market will have to absorb.

- Key Data: The queue to exit staked Ethereum positions has reached its highest recorded level, signaling a large amount of ETH waiting to be sold.

- Actionable Tip: Look for less-obvious on-chain data, like staking and unstaking queues. A large exit queue can signal future sell pressure that isn't yet reflected in the current price.

Conclusion

This week's discussion highlights a clear theme: the crypto market is often driven by forces that lie beneath the surface. While price action tells one story, on-chain data, whale activity, and social sentiment provide a much fuller picture. From the predictable pump-and-dump of CRO to the hidden sell pressure building for Ethereum, the insights from Maksim and Brian show the power of a data-driven approach. By looking past the noise, traders and investors can better understand the true state of the market.

For more analysis and to see the charts for yourself, watch the full livestream recording.