This Week in Crypto, Full Written Summary: W4 November

Is the "Black Friday" Crypto Rally Over?

Executive Summary

- Market Hits Pause: After a small recovery, the market is showing signs of exhaustion. The clear buying signals from last week have disappeared.

- Ethereum's Big Test: Ethereum is approaching a heavy resistance zone between $3,200 and $3,250. This level will be a critical test for the market's strength.

- Narrative Shift: The "buy the dip" social trend is over. It has been replaced by narratives of fear and potential liquidations, indicating a fragile market sentiment.

- Whales vs. Retail: On-chain data reveals that large Bitcoin wallets have slowed their buying, while smaller retail wallets are now accumulating—a pattern that often precedes a market downturn. The overall message is that this is a time for patience, not action.

Introduction

On this Black Friday, Maksim led the stream solo to offer his analysis. After seeing last week’s recovery, Maksim now suggests observation and patience. This session explores the critical signs showing why the recent crypto rally might be hitting a wall. We look at key resistance levels for Ethereum, the erosion of the "buy the dip" narrative, and what on-chain data reveals about the behavior of different wallet sizes.

(0:00) Black Friday Crypto: Last Week's Call & This Week's Caution

Last week's analysis pointed to a market recovery. Those who acted on that information saw positive results. This week, however, presents a completely different picture. Maksim explains that the extreme readings that signaled a buying opportunity are diminished. The current market lacks clear signals, suggesting that the best move is to wait and reevaluate later. The theme for this week is simple: it is better to be patient than to force a trade.

- Key Data: The primary signal from last week—"extreme readings" indicated a prime buying opportunity—are no longer present.

- Actionable Tip: Recognize when market conditions shift from clear opportunity to ambiguity. Having the discipline to do nothing when signals are unclear is a crucial skill.

(1:45) Ethereum's $3,200 Resistance: A Critical Zone to Watch

The focus shifts to Ethereum's price chart. A significant resistance zone is forming between $3,200 and $3,250. The price action is already becoming choppy, indicating a struggle between buyers and sellers. Maksim believes there is a good chance the market will test this level and then attempt to retest recent lows. This is a critical juncture where traders will need to re-evaluate market metrics once the price gets closer to this heavy resistance.

- Key Data: Ethereum faces a heavy resistance zone at the $3,200 - $3,250 price level.

- Actionable Tip: Pay close attention to price action and trading volume as an asset approaches a known resistance level. This can offer clues about whether a breakout or rejection is more likely.

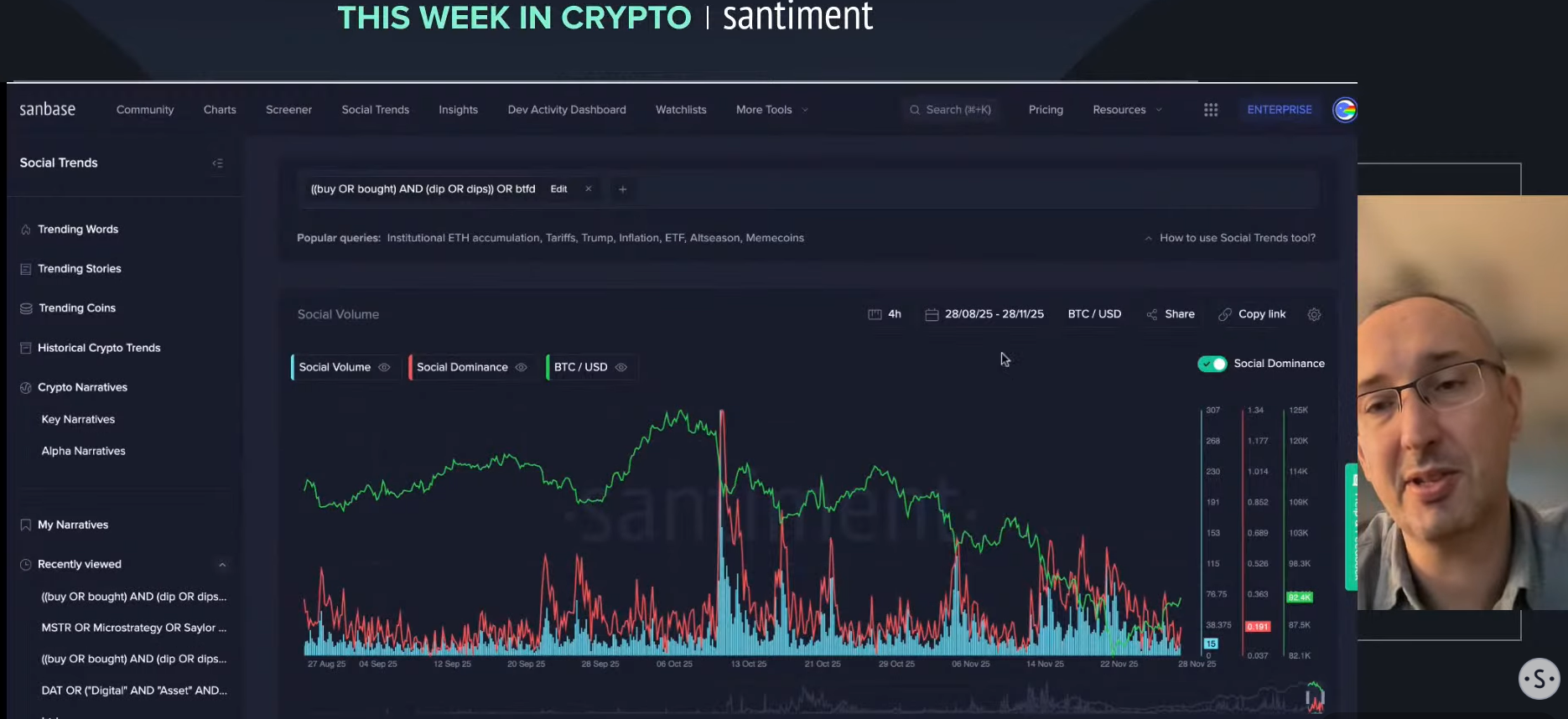

(3:52) The "Buy the Dip" Narrative is Dying: What's Replacing It?

A key insight from social metrics is the shift in market narratives. The popular "buy the dip" trend is fading. It has been replaced by concerns over companies like MicroStrategy and potential liquidations. Maksim notes this is a significant change. He explains, "Once you see that buying the dip is replaced with another narrative which can be a rationalization why we might go lower, it's a quite solid buy." While this supported last week's bottom, the level of concern remains high.

- Key Data: The social dominance for the new "liquidation" narrative reached 4%, a reading Maksim considers high and significant.

- Actionable Tip: Monitor dominant social narratives in the crypto space. A widespread shift from a positive narrative to a fearful one can be a powerful contrary indicator.

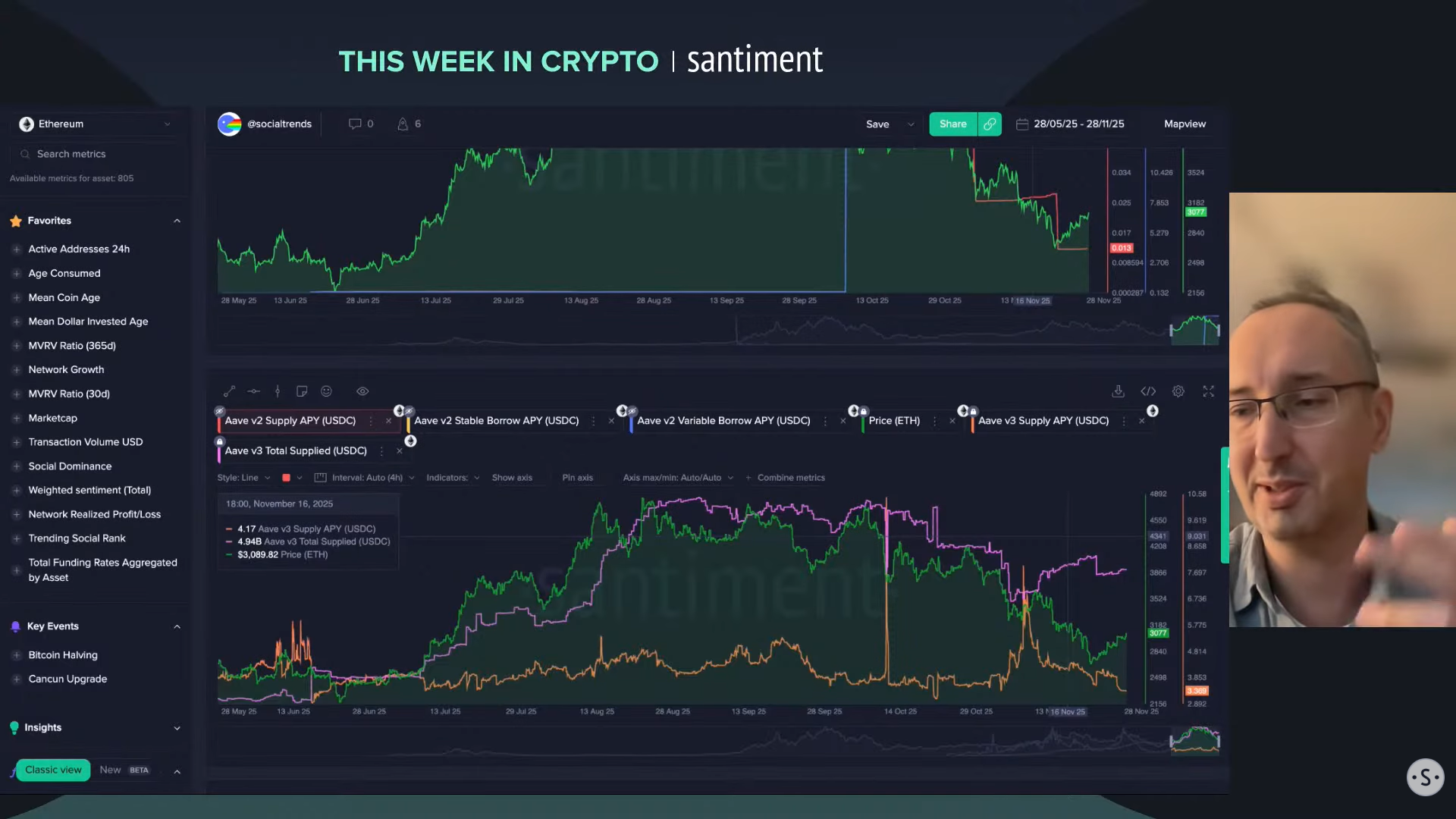

(5:29) Decoding Market Fear: Analyzing Debt Repayment Spikes

An interesting chart shows the total debt on major lending protocols. Spikes in debt repayment often signal that market participants are concerned. People pay back loans to avoid liquidation when they expect prices to fall. Last week saw a large negative spike in net debt, indicating widespread fear and a market bottom. In contrast, the chart for the current week shows no significant activity. It is effectively noise. Maksim states, "When there is nothing to act on, you don't do anything."

- Key Data: Last week showed a strong negative spike in net debt (more debt repaid than created). The current week's reading is near zero, indicating no strong market-wide opinion.

- Actionable Tip: Watch the net flow of debt on lending platforms like Aave and Morpho. A large spike in repayments can signal market panic and potential buying opportunities.

(7:52) Stablecoin Yields vs. Market Tops: Are We There Yet?

Market health can also be gauged by the yields on stablecoins in lending protocols. High yields suggest strong demand for borrowing, which often happens during speculative tops. Currently, yields are low, around 4%. This indicates the market has not reached a major top and could still push higher. This is the primary reason Maksim believes prices may still try to reach the $3,200 resistance level for Ethereum.

- Key Data: The average yield on stablecoins across major, safe protocols is low, around 3.9% to 4.5%.

- Actionable Tip: Keep an eye on stablecoin lending yields. A rapid increase in yields can signal a rise in speculative leverage, a common feature of market tops.

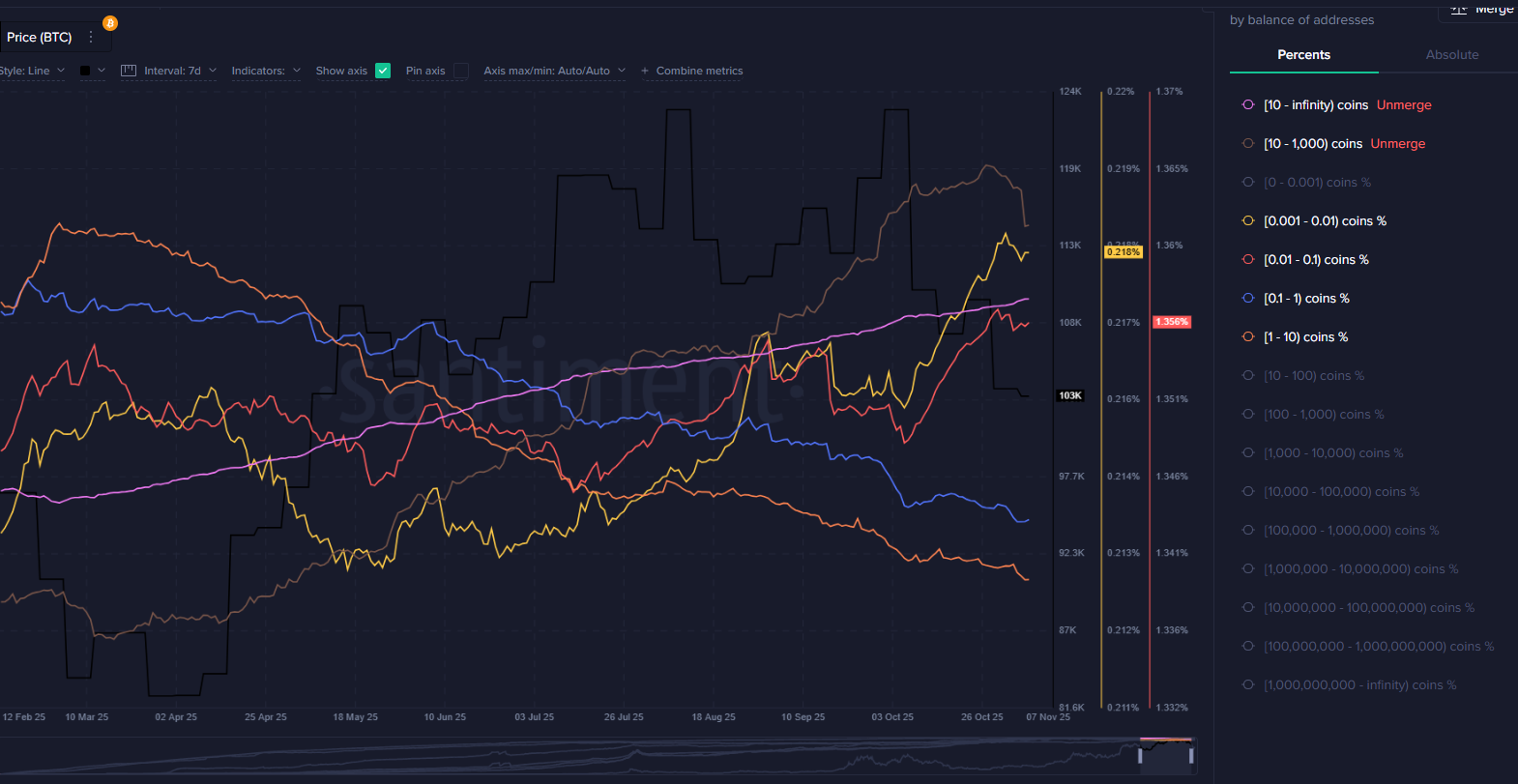

(9:47) Bitcoin Whales vs. Retail: Who is Accumulating Now?

On-chain data for Bitcoin reveals a mixed picture. Large wallets, which were accumulating during the recent drop, have started to decrease their activity. At the same time, very small wallets (holding up to 10 Bitcoin) have begun to increase their balances. This pattern is not typically a sign of a strong, sustainable rally. It suggests that larger, more informed players are becoming cautious while smaller retail participants are buying in.

- Key Data: Large Bitcoin wallets have slowed their accumulation, while balances for wallets holding 10 BTC or less are growing.

- Actionable Tip: Analyze the behavior of different wallet cohorts. Market strength is often more sustainable when large wallets ("whales") are accumulating alongside or ahead of retail.

(11:37) The Waiting Game: Why Doing Nothing is the Smartest Move

All the data points to one conclusion. The market does not currently offer a clear, high-conviction opportunity. While there is still potential for prices to move slightly higher, the warning signs are present. There is not enough "heat" in the market, shown by low borrowing demand. The accumulation patterns are also not ideal. Therefore, this is likely a time for patience.

- Key Data: A convergence of indicators—low borrowing demand, retail-driven accumulation, and proximity to resistance—suggests a weak market structure.

- Actionable Tip: When multiple key indicators across different categories (social, on-chain, lending) fail to align, it signals a low-conviction environment where patience is often the best strategy.

(13:20) Behavioral Analytics: A Deep Dive into Market Psychology

This session was a condensed look at behavioral analytics. By combining social data, on-chain metrics, and lending protocol activity, it is possible to build a comprehensive view of market sentiment. The analysis shows that while there is still some upside potential, it is not large. History suggests that such growth is often retraced. The key is to watch for the market's reaction as it approaches key resistance levels.

- Key Data: In past scenarios, similar market growth has been retraced 80% of the time, with the price typically falling at least 50% of the way back to the bottom.

- Actionable Tip: Build a holistic view by combining different types of data. Relying on a single indicator can be misleading, whereas a multi-faceted approach provides a more robust market thesis.

(14:53) Black Friday Discount Announcement

For those interested in using our tools, a Black Friday promotion is available. The discount applies to any subscription plan for one billing cycle, whether it is for one month or one year.

To access the charts and metrics discussed in the stream, you can use the Black Friday discount. Get 30% off your Santiment PRO plan with code BLACKFRIDAY30.

https://app.santiment.net/pricing

Conclusion

This week’s crypto analysis delivers a clear message: caution is key. After a small bounce, the market is now facing significant hurdles with weakening conviction from key players. The data suggests that waiting for a clearer signal is the most prudent approach. Understanding the market through a data-driven lens provides a powerful advantage. It helps identify when to act and, just as importantly, when to step aside.

To get the full analysis, be sure to watch the complete livestream. To get more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.