This Week in Crypto, Full Written Summary: W4 January 2026

Is the Crypto Bottom In? Bitcoin Hits $83k Amid Silver Crash

Executive Summary

- The Rotation back from Metal Hasn't Happened Yet: Despite a historic $6 trillion crash in Gold and Silver market cap, the expected liquidity flow into Bitcoin hasn't materialized, leaving crypto isolated with its own volatility as Bitcoin tests $83k.

- Whales vs. Retail Divergence: A concerning on-chain pattern has emerged where small retail wallets are aggressively buying the dip while "smart money" whales are selling—typically a signal that the correction isn't over.

- Sentiment Is The Silver Lining: While network fundamentals are stagnant, crowd sentiment has hit extreme negativity levels; historically, this excessive bearishness is a strong contrarian indicator that a local bottom could be near.

Introduction

The first month of 2026 has ended with a dramatic shift in market mood. After starting January with Bitcoin near $96k, the leading asset has tumbled back to $83k. The Santiment team gathered to analyze the data behind this volatility. With a historic crash in precious metals and retail traders trying to catch falling knives, the market is sending mixed signals. The analysts broke down on-chain metrics and social trends to see if a recovery is likely or if more pain lies ahead.

00:00 - Intro: Bitcoin Drops to $83k & January Recap

January 2026 has been a volatile month for crypto assets. Bitcoin opened the year with optimism and nearly reached $96k before sliding back to around $83k. The Santiment team noted that trading volume jumped 85% compared to the previous week. This surge suggests that traders are finally waking up from a “wait and see” period. Volatility has returned, and the market is currently deciding its next major direction.

- Key Data: Bitcoin price at ~$83k; Trading volume +85% week-over-week.

- Actionable Tip: High volume during a price drop often signals a climax in selling pressure—watch for stabilization.

02:22 - Why You Shouldn't Force Market Timing

During times of high volatility, the urge to predict the exact bottom is strong. Santiment's analysts advised against forcing trades based on gut feelings about timing. The crowd is rarely right about when a market turns. Instead of guessing, the team suggests waiting for more data to support your decision. A true bottom usually forms when multiple indicators—such as MVRV ratios, whale accumulation, sentiment, and more—indicate buy signals at the same time.

- Key Data: N/A (Strategic insight).

- Actionable Tip: Wait for at least two independent on-chain signals to align before entering a trade.

05:49 - Analyzing the Volume Spike & Market Cap Drop

The market saw a sharp 14.5% drop in total capitalization recently. This sell-off acted as a catalyst for activity. The sharp decline forced many traders to react which led to the massive spike in trading volume mentioned earlier. This volume increase indicates that the "boring" phase of the market is over. Bulls and bears are now actively fighting for control which typically leads to sharper price movements in the short term. The down trend seems to have accelerated.

- Key Data: Market Cap down 14.5%; Trading Volume up 85%.

- Actionable Tip: Use volume spikes to identify when a trend is exhausted or accelerating.

08:53 - The Gold & Silver Crash: Did Capital Move to Crypto?

A major narrative this week involved a major crash of gold and silver. They collectively experienced a $6 trillion loss in market cap over the course of a single day. Many in the crypto space hoped that profits from precious metals would immediately rotate into Bitcoin. However, the data suggests this rotation has not happened yet.

- Key Data: $6 Trillion erased from Gold/Silver market cap.

- Actionable Tip: Be skeptical of "rotation" narratives until you see on-chain proof of stablecoin inflows.

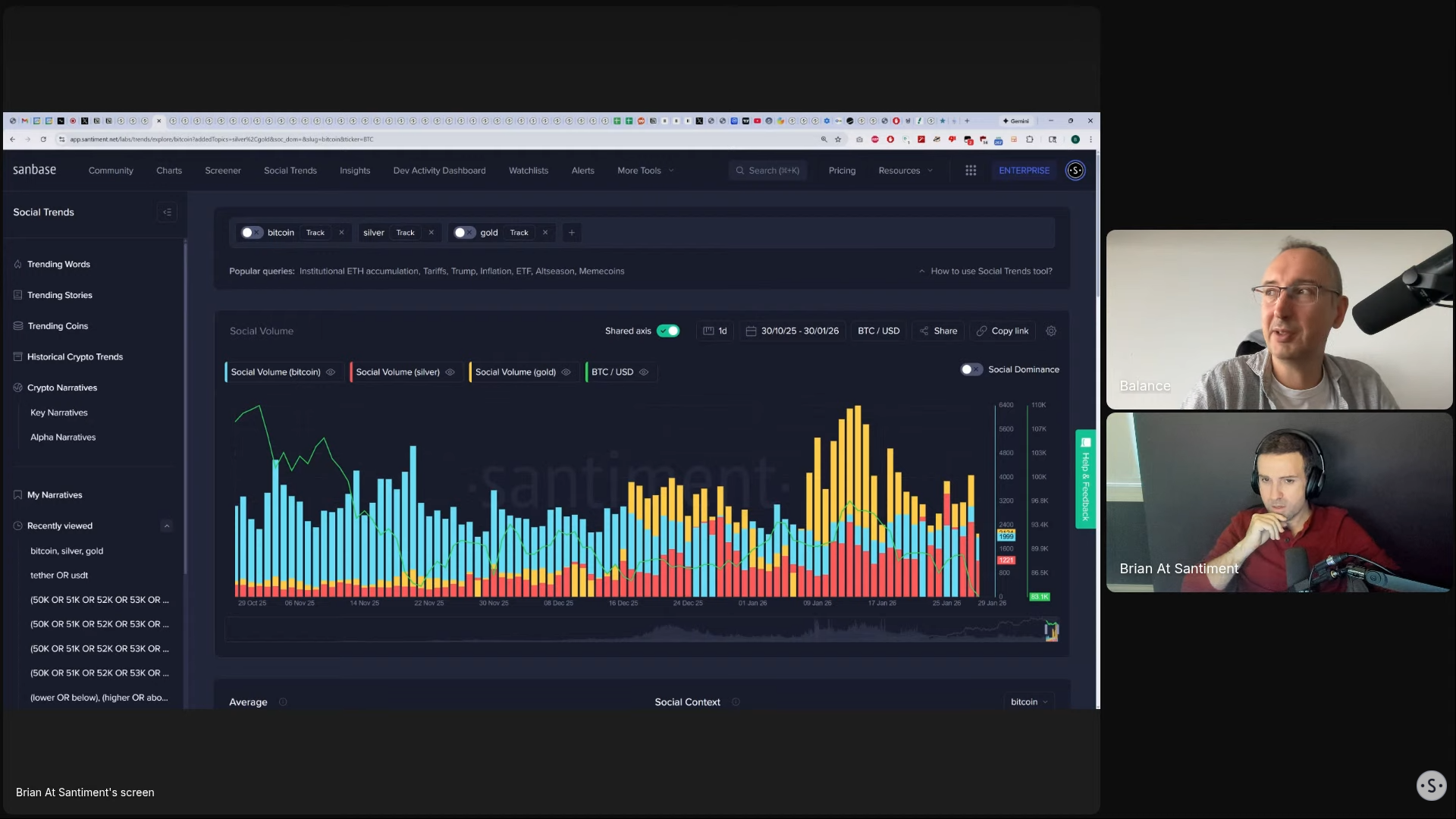

12:22 - Social Metrics: Tracking the Precious Metals Narrative

Santiment's social tools picked up a massive surge in discussions regarding gold and silver within crypto communities. When crypto traders focus heavily on other asset classes, it often signals a lack of confidence in their own holdings. The data shows that mentions of "Gold" and "Silver" spiked right as Bitcoin began to retrace. Historically, when the crowd gets distracted by shiny objects outside of crypto, it can indicate a local top or a period of capitulation.

- Key Data: "Gold" and "Silver" are top trending words in crypto social feeds.

- Actionable Tip: Use social trends to spot distraction; if crypto Twitter is talking about stocks or metals, sentiment is likely fearful.

18:37 - Trump’s Fed Nominee & Interest Rate Expectations

Political news continues to impact market sentiment. The nomination of Kevin Warsh as the potential new Fed Chair has sparked debate. Warsh is known for a hawkish stance on interest rates which typically pressures risk assets like stocks and crypto. However, the team noted that Warsh “believes in bitcoin”, as he has previously called Bitcoin "gold for those under 40."

- Key Data: S&P 500 up 36% since April 2025.

- Actionable Tip: Monitor Fed announcements closely, as changes in interest rate policy often lead crypto market moves.

21:50 - Warning Sign: Retail Is Buying, Whales Are Selling

One of the most concerning on-chain metrics right now is the behavior of different wallet tiers. The data shows that small retail wallets holding between 10 to 10k USD in crypto are aggressively buying the dip. Conversely, larger shark and whale wallets are selling. This is the opposite of what investors want to see for a sustainable rally. Typically, price increases are fueled by smart money accumulation while retail sells in fear.

- Key Data: Retail wallets (10-10k USD) increasing; Whale wallets decreasing.

- Actionable Tip: Exercise caution when retail is the only group buying; wait for whales to join the bid.

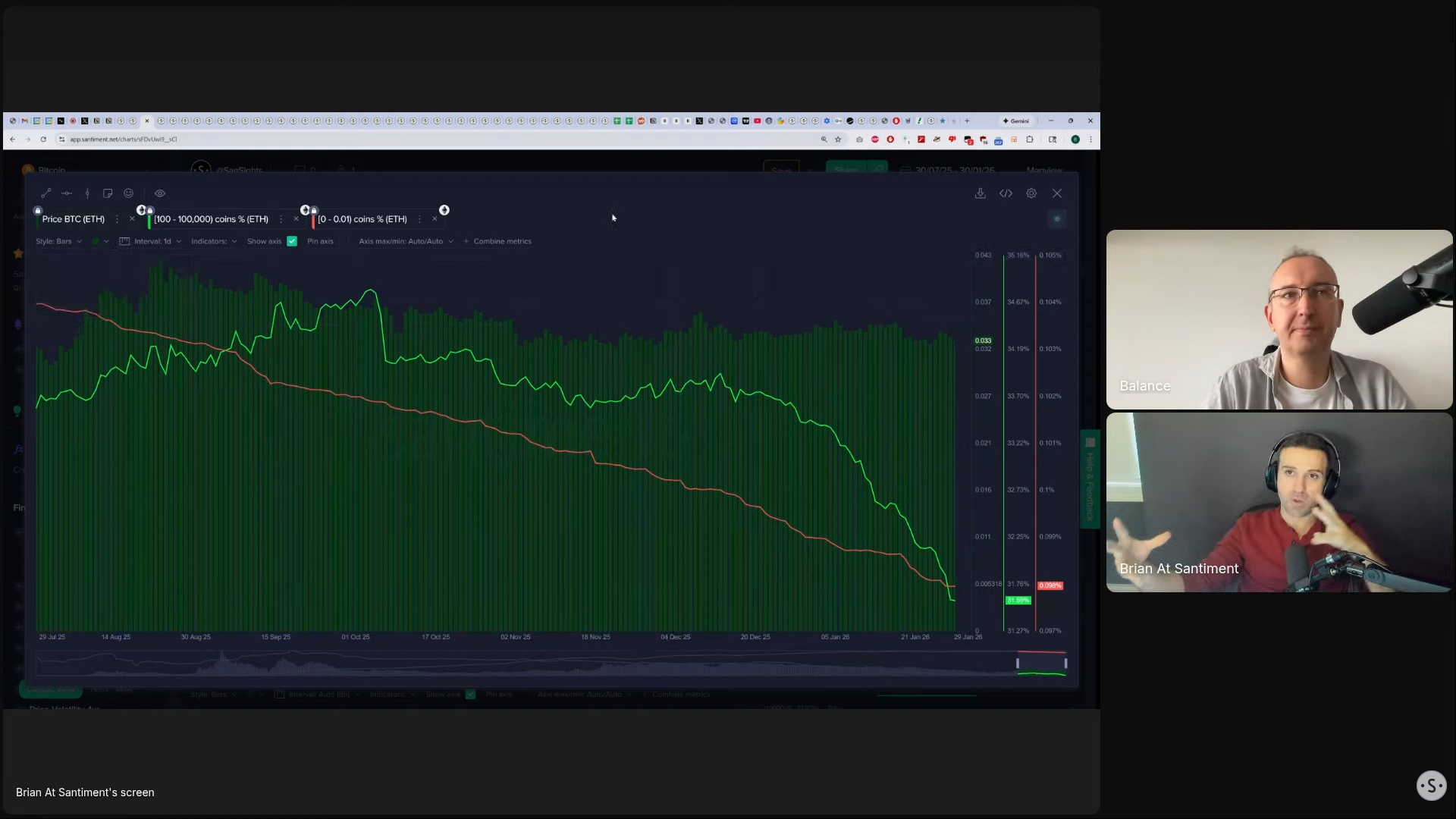

24:09 - Ethereum Supply Shock: Staking vs. Selling

Ethereum is showing a different pattern than Bitcoin. While large wallets appear to be dropping in number, the analysts clarified this is likely due to staking. Large holders are consolidating funds into staking contracts rather than selling on exchanges. This creates a supply shock that could be bullish in the long term. However, for now, the price action remains tied to Bitcoin and the broader market which is currently bearish.

- Key Data: Sharp decline in 100-100k ETH trading wallets.

- Actionable Tip: Distinguish between selling pressure and staking lockups when analyzing ETH wallet declines.

26:49 - On-Chain Data: Network Activity & Utility Decline

The underlying health of the Bitcoin network appears to be weakening. Transaction volume, daily active addresses, and network growth are all trending downward (chart). For a sustainable bull run, network utility needs to increase. The current stagnation suggests that despite the price drop, there is no rush of new users or increased usage of the Bitcoin blockchain.

- Key Data: Daily Active Addresses and Transaction Volume trending down.

- Actionable Tip: Look for a reversal in Daily Active Addresses as a leading indicator for price recovery.

31:11 - Realized Profit/Loss: Why Holders Aren't Selling

Despite the price drop, there has been no massive spike in realized losses. This indicates that long-term holders are not panic selling yet. They are holding onto their positions and perhaps waiting for a recovery. The 365-day MVRV (Market Value to Realized Value) ratio sits at roughly -11%. This places Bitcoin in a historically lower-risk zone compared to when the metric is positive.

- Key Data: 30-day MVRV at -2%; 365-day MVRV at -11%.

- Actionable Tip: Negative MVRV often presents a better risk/reward ratio for long-term accumulation.

36:50 - Smart Money Trends: Whale Wallets Are Shrinking

Since early December, the number of wallets holding 10 or more Bitcoin has dropped by nearly 600. This is a clear sign of distribution from the smart money tier. Until this trend flattens or reverses, it is difficult to build a bullish case. The Santiment team emphasizes that they need to see these key stakeholders return to accumulation mode before calling a definitive bottom.

- Key Data: -582 drop in wallets holding 10+ BTC since Dec.

- Actionable Tip: Do not fight the trend if the largest holders are reducing their exposure.

40:26 - Why We Haven't Seen Full Capitulation Yet

A true market bottom often comes with a "shared fear" narrative—a specific story that makes everyone panic, like tariffs or geopolitical conflict. Currently, the fear in the market is vague. The analysts noted that without a concrete narrative driving panic, the market may simply drift lower or sideways. We have not yet seen the type of sharp panic-driven capitulation that usually marks the absolute end of a major downtrend.

- Key Data: Total non-empty wallet count remains flat.

- Actionable Tip: Be patient; the best buying opportunities often come during peak "shared fear" events.

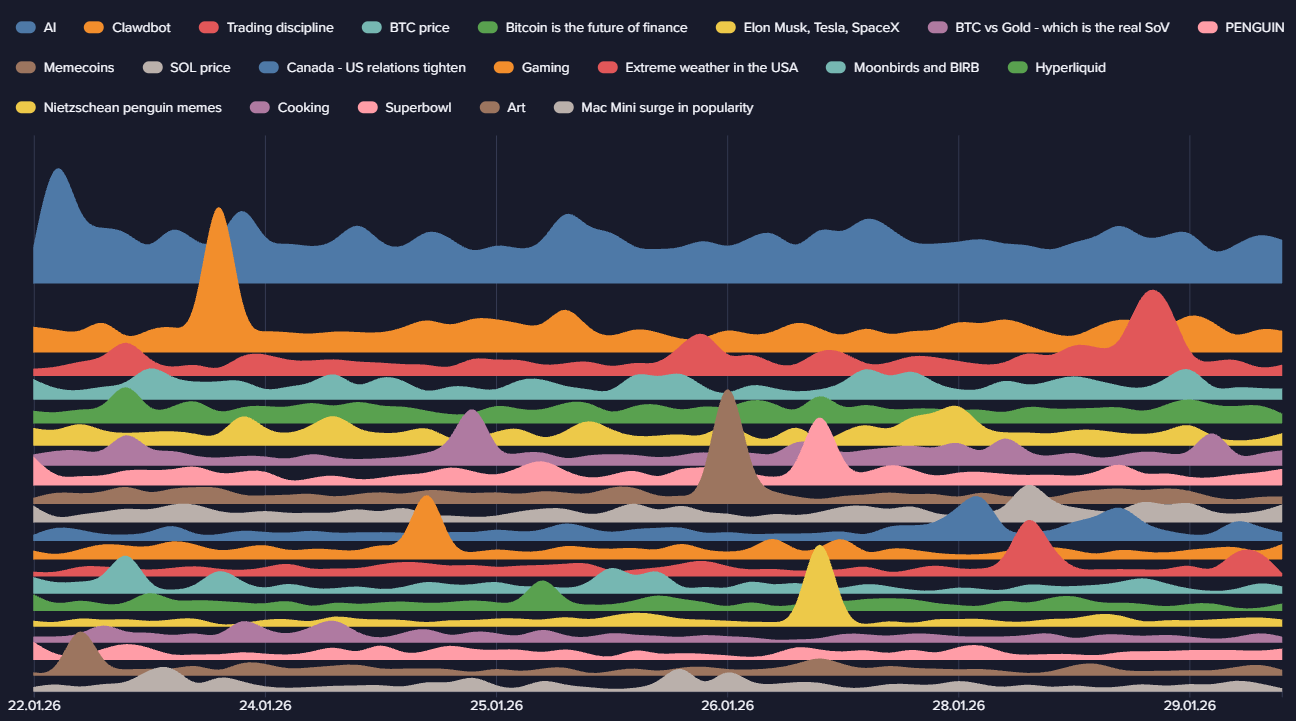

43:54 - Alpha Narratives: "Trading Discipline" Spikes

An interesting trend in the data is the rise of the topic "Trading Discipline." It seems the crowd is trying to remain rational and avoid emotional trading. While positive in theory, the analysts warned that markets often test this discipline. The fact that traders are actively discussing how to stay calm suggests they are feeling the pressure. Maximum pain often occurs when this discipline finally breaks.

- Key Data: "Trading Discipline" is the #1 rising topic in Santiment’s Alpha Narratives tool, which shows the top 10 narratives of the week by social volume.

- Actionable Tip: When the crowd talks about needing discipline, it usually means they are on the verge of making emotional mistakes.

46:42 - Sentiment Check: Extreme Negativity

A silver lining is the extreme negativity on social media. The ratio of bearish to bullish comments is heavily skewed toward fear. Historically, crypto markets move in the opposite direction of the crowd's expectations. When the majority is convinced prices will go lower, it often sets the stage for a rebound. This sentiment data is currently one of the few strong bullish signals available.

- Key Data: Bearish sentiment outweighs bullish (Ratio ~0.8).

- Actionable Tip: Look for extreme negative sentiment as a signal to start looking for long entries.

50:10 - Summary: Missing the Final Bottom Signals

To summarize, the crypto market is in a precarious spot. While sentiment is negative enough to suggest a bottom, on-chain data remains weak. Whales are selling, network activity is low, and retail is trying to catch a falling knife. The Santiment team concluded that while we may be close to a bottom, key confirmation signals like on-chain liquidations are missing.

- Key Data: Low on-chain liquidations compared to historical bottoms.

- Actionable Tip: Wait for a spike in liquidations or whale accumulation to confirm the coast is clear.

Conclusion

This week's data paints a picture of a weak market capitulating and feeling the pressure of the downtrend. The combination of falling prices, smart money distribution, and stagnant network growth warrants caution. However, the extreme negative sentiment suggests that a contrarian bounce could happen at any time. Keep an eye on the data, not just the price, to make smarter decisions in the weeks ahead.

Spotting, analyzing, and understanding the markets is easier with the right tools and a strong like-minded community. Sign up for app.santiment.net and join our discord for more frequent and timely analysis of the crypto markets.

For more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.