This Week in Crypto, Full Written Summary: W3 January 2026

Can Crypto Make a Rally After Retail Fled?

Executive Summary

- Retail Capitulation is Underway: A lot of smaller traders are dumping coins to chase gold and silver at record highs. That kind of mass exit, or “vacating of the hodl,” has often shown up near market bottoms in past cycles.

- The "Bottom Checklist" is Incomplete: Prices are down, but some of the usual on-chain stress signals still haven’t fired. In particular, there hasn’t been a clear spike in network realized losses or a wave of long liquidations. Until those appear, stepping back in may be early.

- Contrarian Signal in Solana: Bitcoin and Ethereum are getting hammered by FUD, while Solana barely gets mentioned. Its social dominance is near cycle lows, which often lines up with seller exhaustion. Historically, that kind of silence has marked decent value-entry windows.

Introduction

The week leading up to January 23, 2026 felt strange. Stocks, gold, and silver kept pushing higher, while crypto barely moved and, at times, slid backward. The Santiment team dug into the data to figure out why the gap is widening, why retail traders seem to be walking away, and what the on-chain signals are actually saying about the weeks ahead. This summary breaks down their conversation to help you understand the current market landscape minus the noise.

00:00 - Intro: Why Retail Traders Are Fleeing

The conversation kicked off noting a tangible shift in market participation, with data indicating that retail traders are departing the crypto space following a week of downward price action and significant FUD. Bitcoin has struggled to reclaim the $90,000 mark for over a week, and the excitement that usually drives retail volume just isn’t there.

- Key Data: Bitcoin struggling to cross back above $90k; retail trading volume dropping (chart).

- Actionable Tip: Watch for extreme drops in retail participation as a potential contrarian "buy" signal.

01:40 - Gold & Silver Break Records While Crypto Lags

The gap between crypto and precious metals has widened significantly, with gold and silver consistently hitting new all-time highs while Bitcoin remains down roughly 8-9% over the last year. Investors are noticing this lag, and the correlation between the "digital gold" and “physical gold”(and other metals) is currently gone.

- Key Data: Gold up ~80% in the last year; Silver up ~3x in 10 months; Bitcoin down ~9% in the same period.

- Actionable Tip: Watch closely for changes to the price correlation between these assets, there is some probability that this will change. Though it is unclear when and by what trigger.

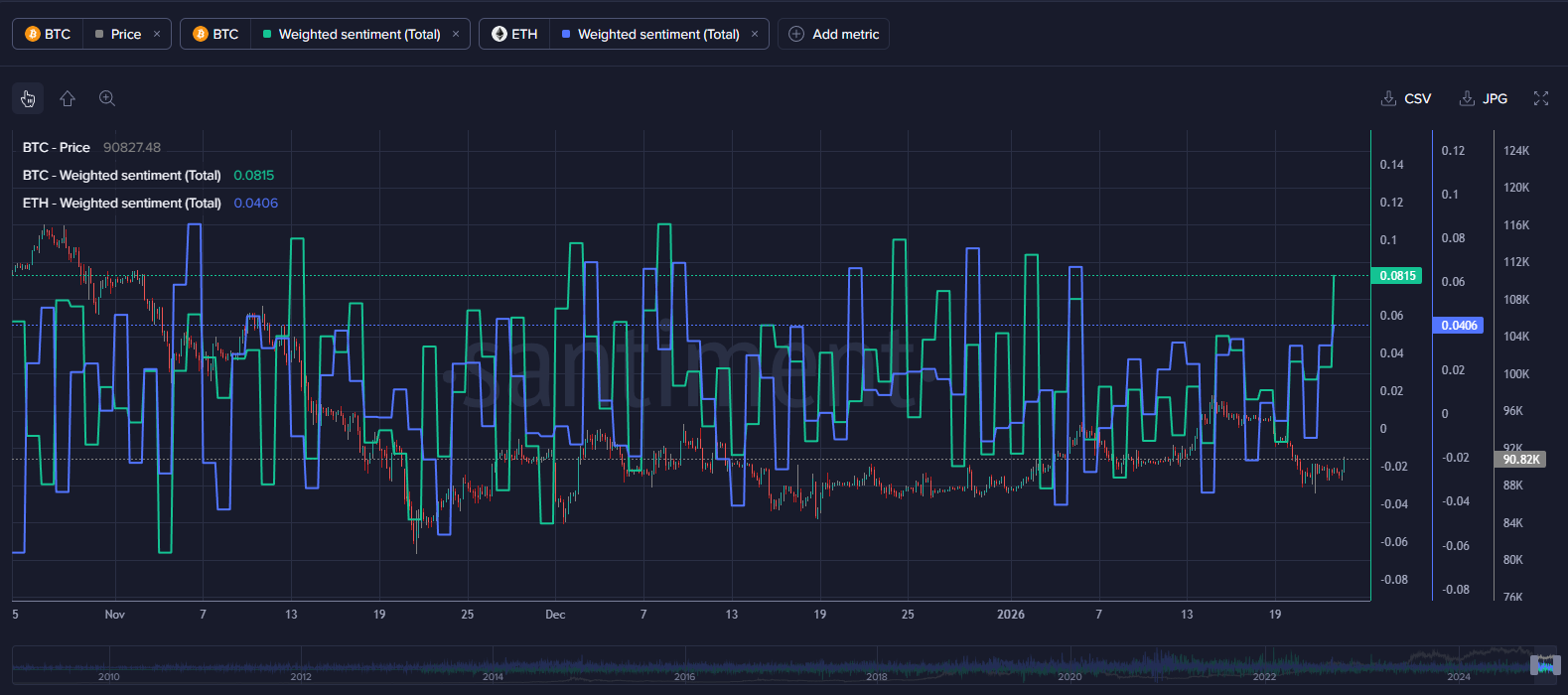

06:29 - Maksim: Trading During Uncertain Periods is Unwise

Maksim explains the psychological difficulty of trading during these disconnects, noting that timing is always a "moving target" and markets can remain irrational longer than expected. His take-away is simple, stick to the data—specifically weighted sentiment metrics—until new data changes things, reacting to market states of high uncertainty is just emotion dressed up as strategy.

- Key Data: Weighted sentiment hit near-record highs two weeks ago (a bearish top signal) before the drop (chart).

- Actionable Tip: Trust data over emotion; if sentiment hits extreme highs, prepare for a correction even if price pushes one leg higher.

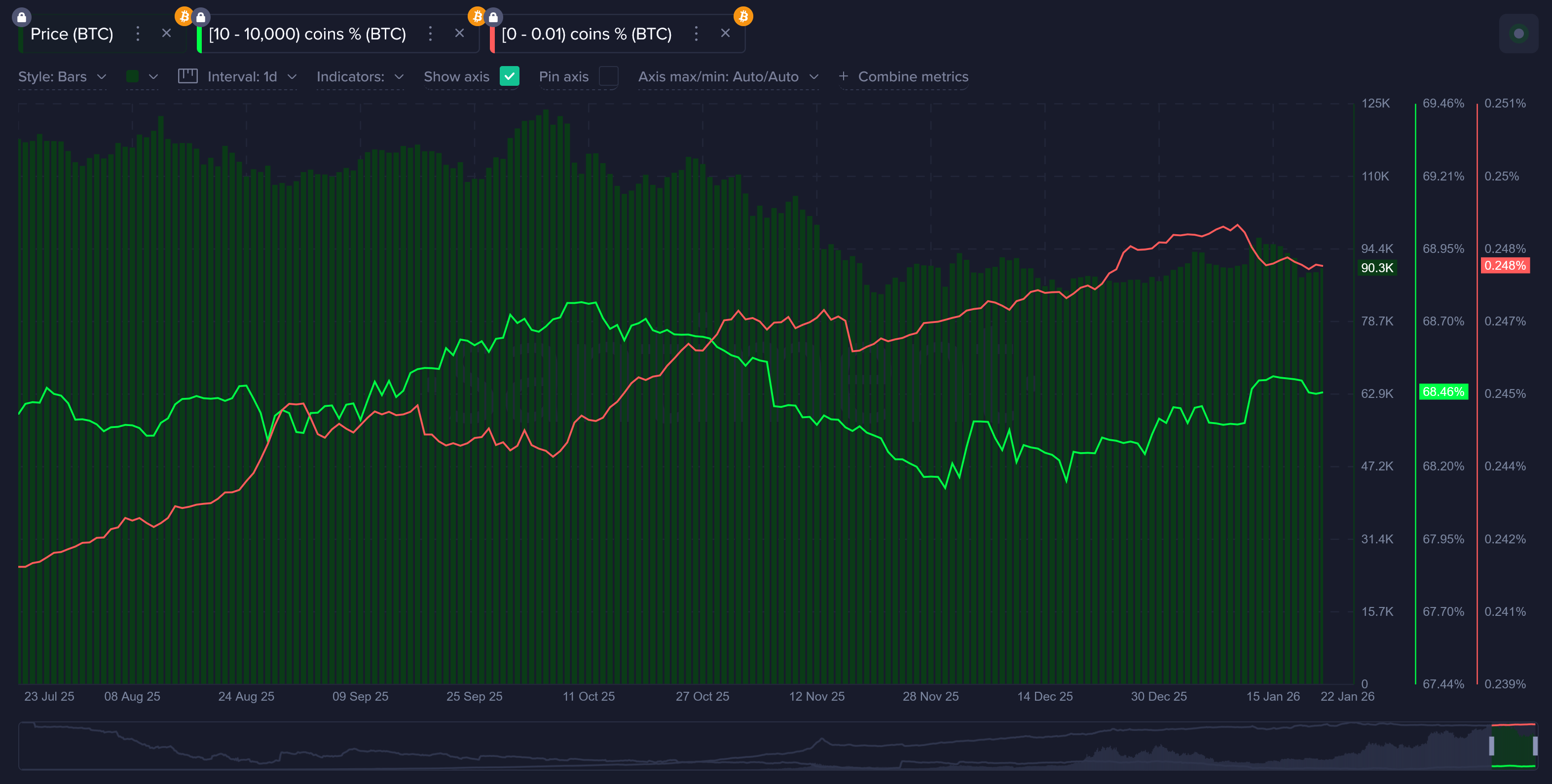

10:06 - Evidence of Minor Retail Capitulation

To add onto the opening point of today’s analysis, Maksim monitors retail behavior through supply distribution charts, which currently show a decline in retail holdings for Bitcoin. This "vacating of the hodl" show a small change in that the very small holders are selling their positions, a sign of some capitulation. Capitulation often occurs before market recoveries.

- Key Data: Visible decline in small wallet holdings (retail tier) on supply distribution charts.

- Actionable Tip: Monitor small wallet balances; when they aggressively sell, the market floor is often near.

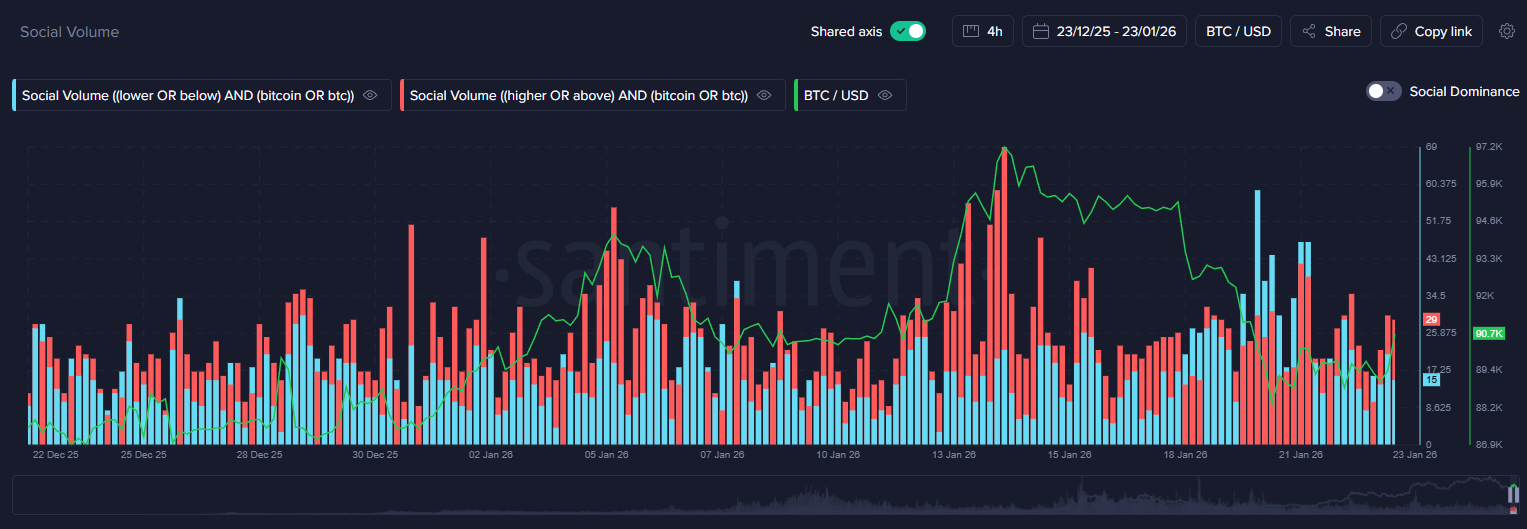

13:39 - The "Higher vs Lower" Social Metric Signal

A look into a social metric dashboard tracking the frequency of the words "higher" versus "lower" on social media to gauge crowd expectations. Currently, the signal is neutral because a small price bounce neutralized the fear, meaning the market still lacks the massive spike in "lower" predictions required for a strong bottom case.

- Key Data: "Lower" mentions spiked 3 days ago but vanished quickly; current sentiment is indecisive.

- Actionable Tip: Wait for a surge in "expecting lower" mentions on social platforms before considering long positions.

16:52 - Surprise Rally in Gaming & NFT Sectors

Despite the broader market slump, the gaming and NFT sectors are defying the trend, with tokens like The Sandbox($SAND) seeing significant gains. Maksim views this as an anomaly common in late-stage market cycles, where speculative money rotates into high-risk legacy assets before a broader correction or reset occurs.

- Key Data: The Sandbox (SAND) up ~50% YTD; outperformed Bitcoin by 48% in the last week.

- Actionable Tip: Consider sudden pumps in older altcoin sectors (like 2021 gaming coins) as a potential as a possible late-cycle warning sign.

23:01 - Theory: Is Crypto Predicting a Stock Market Crash?

The Santiment team briefly considered a contrarian theory that crypto isn't lagging behind stocks and gold, but rather that crypto crashed first and is acting as a leading indicator for a coming stock market correction. In this view, the S&P 500 and precious metals are the ones lagging behind the economic reality that crypto has already priced in. However, beware that this is just a theory and before you believe it deeper analysis should be performed. The reality is that the traditional markets have powerful forces behind them, so although it’s possible the market “should have crashed”, there’s political, microeconomic, and macroeconomic reasons why it didn’t and why it might not in the future.

- Key Data: S&P 500 near ATHs while Bitcoin is down ~16% since November 10th.

- Actionable Tip: Use crypto's weakness as a cautionary signal for your traditional equity positions.

29:16 - Historical Data: How Tariffs Impact Market Bottoms

The conversation shifted to geopolitical news, with a review of historical data showing that when tariff-related discussions reach 5% of social volume, it often marked a bottom. Current tensions around Greenland and European tariffs could create a similar "buy the fear" opportunity if the social volume hits that threshold.

- Key Data: Historical bottoms formed when "tariff" mentions hit ~5% of total social volume.

- Actionable Tip: If political "tariff" fear spikes on social media, look for an entry point once the news cycle peaks.

33:17 - ETF Flows: Tracking the Heavy Outflows

Institutional interest is waning according to ETF data, with Ethereum recording its largest outflow day since September just two days prior. Solana ETF flows remain neutral, confirming that institutions are derisking alongside retail traders and validating the broader bearish sentiment.

- Key Data: Ethereum ETFs saw the largest single-day outflow since September on Jan 21 (source).

- Actionable Tip: Watch for ETF flows to stabilize or turn positive for consecutive days before assuming the institutional sell-off is over.

43:13 - Solana Analysis: Why Silence Is Bullish

The analysis concludes with a look at Solana, where social dominance has hit year-low levels and people have stopped talking about it almost entirely. Maksim considers this "silence" potentially bullish, as it indicates selling pressure is exhausted and the crowd has lost interest, often a precursor to a recovery.

- Key Data: Solana social dominance metric at 1-year lows (chart).

- Actionable Tip: Look for assets with low social volume ("nobody is talking about it") for potential value entries.

Conclusion - Wait and Watch

Today’s analysis shows that the market is an a phase of uncertainty. Retail traders are heading for the exits, while money and attention are flowing to more traditional assets. At the same time, quieter signals like supply distribution and the lack of social chatter hint that a bottom may be taking shape.

That said, this doesn’t look finished yet. The cleaner turning points usually come after a visible flush: realized losses hitting extremes and a wave of liquidations. Until then, the best move is probably patience. Tuning out the day‑to‑day noise and sticking with the on‑chain data makes it easier to spot when the tide actually starts to turn back toward crypto.

Spotting, analyzing, and understanding the markets is easier with the right tools and a strong like-minded community. Sign up for app.santiment.net and join our discord for more frequent and timely analysis of the crypto markets.

For more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.