Key Macro Topics That Will Continue Impacting Crypto For the Foreseeable Future!

Watching how people talk about big economic topics on social media can help reveal the true sentiment of the crowd. And more importantly, it has often signaled when market reversals are about to happen.

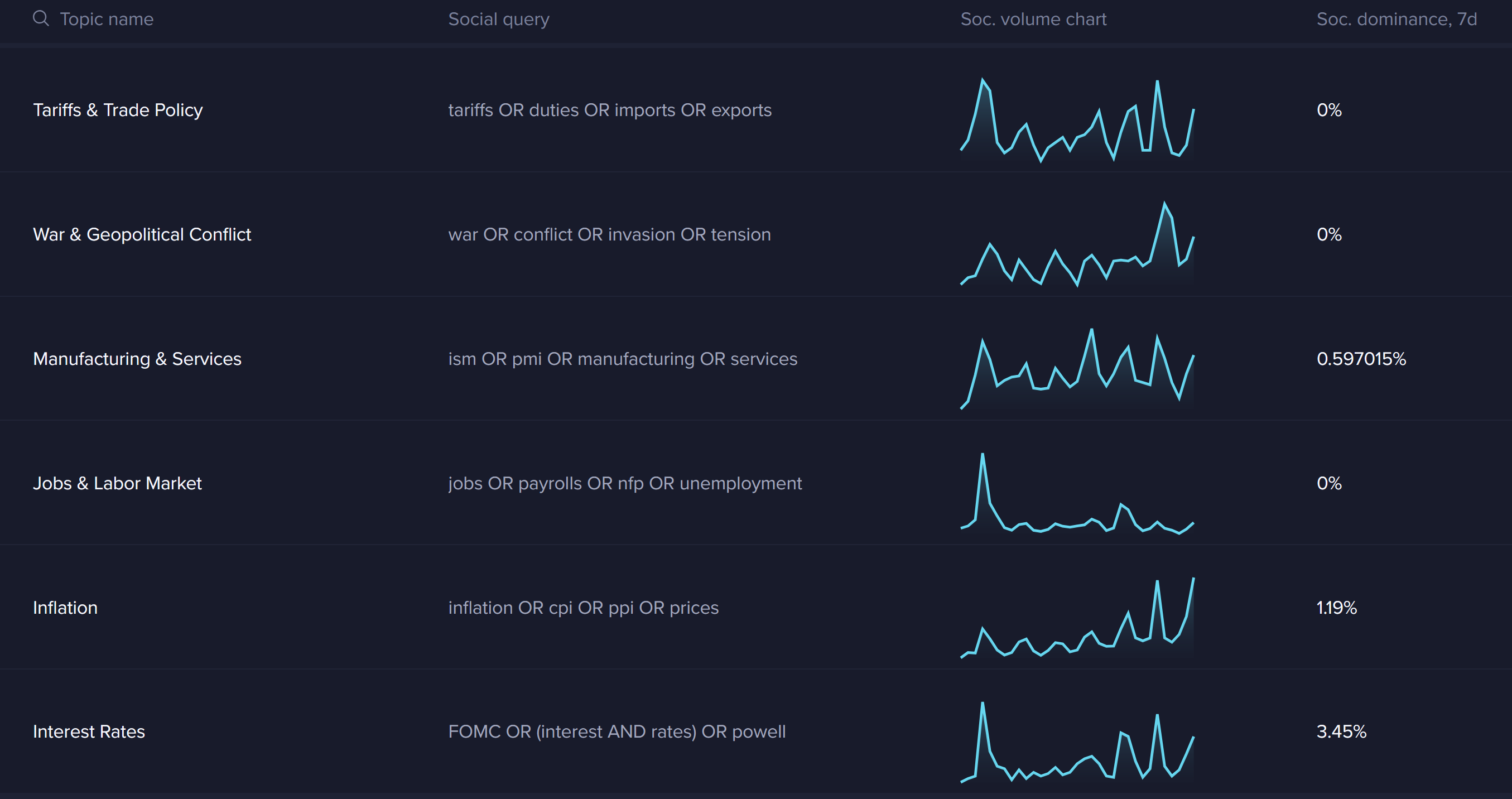

Each topic in the below chart is a frequently discussed economic topic. You'll see subjects like 'Tariffs & Trade Policy' or 'Inflation'. By identifying when these topics have outlier discussion rates on platforms like X, Reddit, and Telegram, you can see when traders are entrenched on a given story that is changing their perception about economic conditions. When spikes happen on one of these toipcs, it usually means one has a strong chance of being a catalyst for sudden crypto market volatility:

Most of these topics are US-based, as America has traditionally been the most centered focused economy, worldwide. The US has the largest amount of crypto trading and investing, so its economic policies can affect the whole world. It's also simply one of the largest world economies that has a cascading effect on other economies. When new tariffs are announced, job numbers are released, or inflation reports are shared, the impact often spreads to other countries. Currencies, stock markets, and crypto prices in many nations can all react to these changes.

Below, you'll see how we organize each economic topic, with a few specific keywords that typically don't have overlap with other topics. When any of the words in the social queries for each topic are mentioned, it adds to the tally of discussions being had for that topic:

So what we can learn, taking a cursory look at these topics? Well, unsurprisingly, times of fear often create price bottoms. For example, when former president Donald Trump announced new tariffs in April 2025, mentions of trade duties and imports quickly spiked. Bitcoin dropped at the same time. Yes, tariffs were gradually put on pause throughout the next couple of months. But events like this often mark the end of a selloff because most small traders have already sold, leaving fewer sellers and allowing prices to bounce back. Take a look at how many traders were mentioning Bitcoin dumping or crashing alongside the topic of tariffs during the first two weeks of April, even after prices were already beginning to rebound. This panic simply fueled prices higher:

On the contrary, times of excitement can create price tops. In late August 2025, people talked a lot about possible interest rate cuts, and Bitcoin moved higher. But when everyone expects good news, there are not many buyers left to push prices even higher, and markets often fall soon after. This pattern shows up again and again when traders become too hopeful about things like easier money policies or strong job reports.

This happens because most of the noise comes from retail traders, who are the smaller investors. They often react emotionally and chase headlines, while large holders, also called whales, quietly take the opposite side. Prices often move against the crowd once the excitement or fear fades away. Some are savvy enough to see these crowd reactions come, and be a contrarian. Are you?

By following these topic trends, traders can see when the market is too scared or too greedy. It is not a perfect timing tool, but it gives helpful clues. To explore these patterns yourself, you can visit https://app.santiment.net/social-trends/my-narratives

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.