Deep Dive: Retail Reacts Positively to FOMC's Confirmed Rate Cut, Then Gets Burned

The FOMC has once again lowered interest rates by 25bps, completing the trifecta of cuts at the end of 2025 (over the past 3 FOMC meetings) that investors and traders were hoping to see. Why does this matter? Lower rates mean businesses and individuals can borrow money at cheaper costs. This often leads to more spending and investing across the entire economy. Some of that extra money can flow into riskier assets, including crypto.

Rate cuts are also usually seen as the Fed trying to boost the economy. When people feel more confident, they’re more willing to take risks. Crypto tends to rise when institutional confidence rises. Also, lower interest rates can make the U.S. dollar less attractive compared to other currencies or assets. When the dollar weakens, assets priced in dollars, like BTC, can benefit.

When we last covered the cuts in detail back at the last meeting in October, we noted that Jerome Powell was taking a hawkish stance due to cautiousness over inflation and limited US growth. This caused some hesitation regarding how the rest of the year would play out regarding interest rate cuts. Polymarket

In the hours leading up to Powell's announcement, there was a fascinating mix of confidence from Polymarket voters, showing that there was an overwhelming amount of optimism.

Yet, as always, it wouldn't be an FOMC decision without a healthy mix of sensationalized panic due to some very abnormal on-chain activity. @DeFiTracer on X noticed that there was a whale selling off $100M in Bitcoin over the span of an hour, and this caused quite a stir.

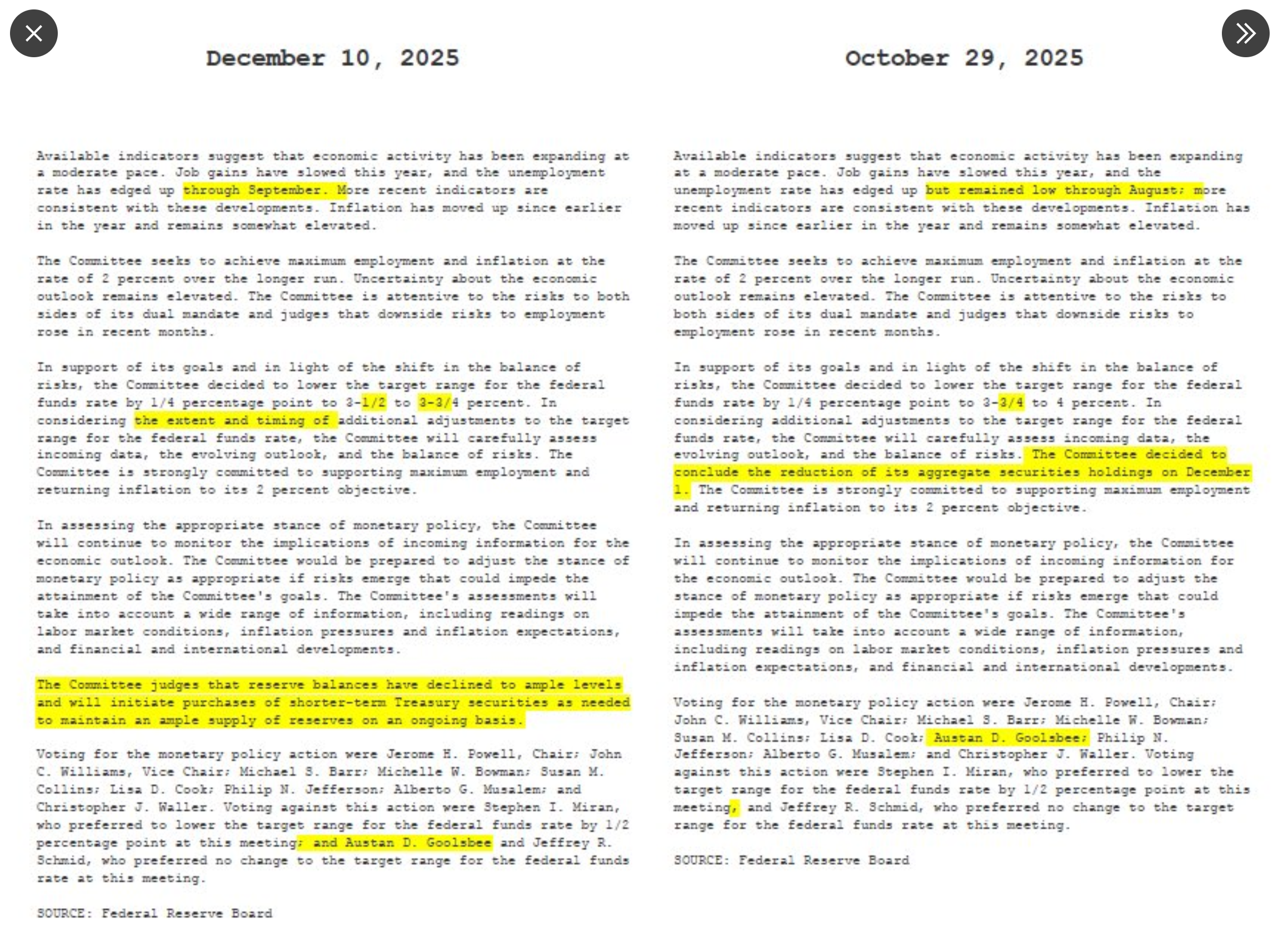

But nevertheless, the overwhelmingly high expected outcome came to fruition. In the transcripts of each decision, there were several notable similarities (that show the US Fed continue to kick some things down the road), as well as differences:

Both statements describe an economy growing at a moderate pace, with inflation still above the Fed’s long-term goal. In each case, the Federal Reserve lowered interest rates by 0.25 percentage point because it believed the balance of risks (like slowing job growth) supported easing policy. In both meetings, the Fed emphasized that it would continue to watch incoming economic data closely and was prepared to adjust interest rates again if needed. The overall tone in both statements shows the Fed trying to keep inflation moving toward 2 percent while still supporting employment.

The main change from October to December is the Fed’s view on liquidity and its balance sheet. On October 29, the Fed decided to slow down the reduction of its securities holdings starting December 1, meaning it was reducing how quickly it shrank its balance sheet. But by December 10, the Fed said bank reserve levels had fallen too much, so it would begin buying short-term Treasury bills again to keep reserves “ample.” This marks a shift from shrinking the balance sheet in October to adding money back into the system in December. Another difference is the Fed’s description of the labor market: in October, unemployment “edged up but remained low,” while by December it had continued rising “through September,” signaling more concern about job softness.

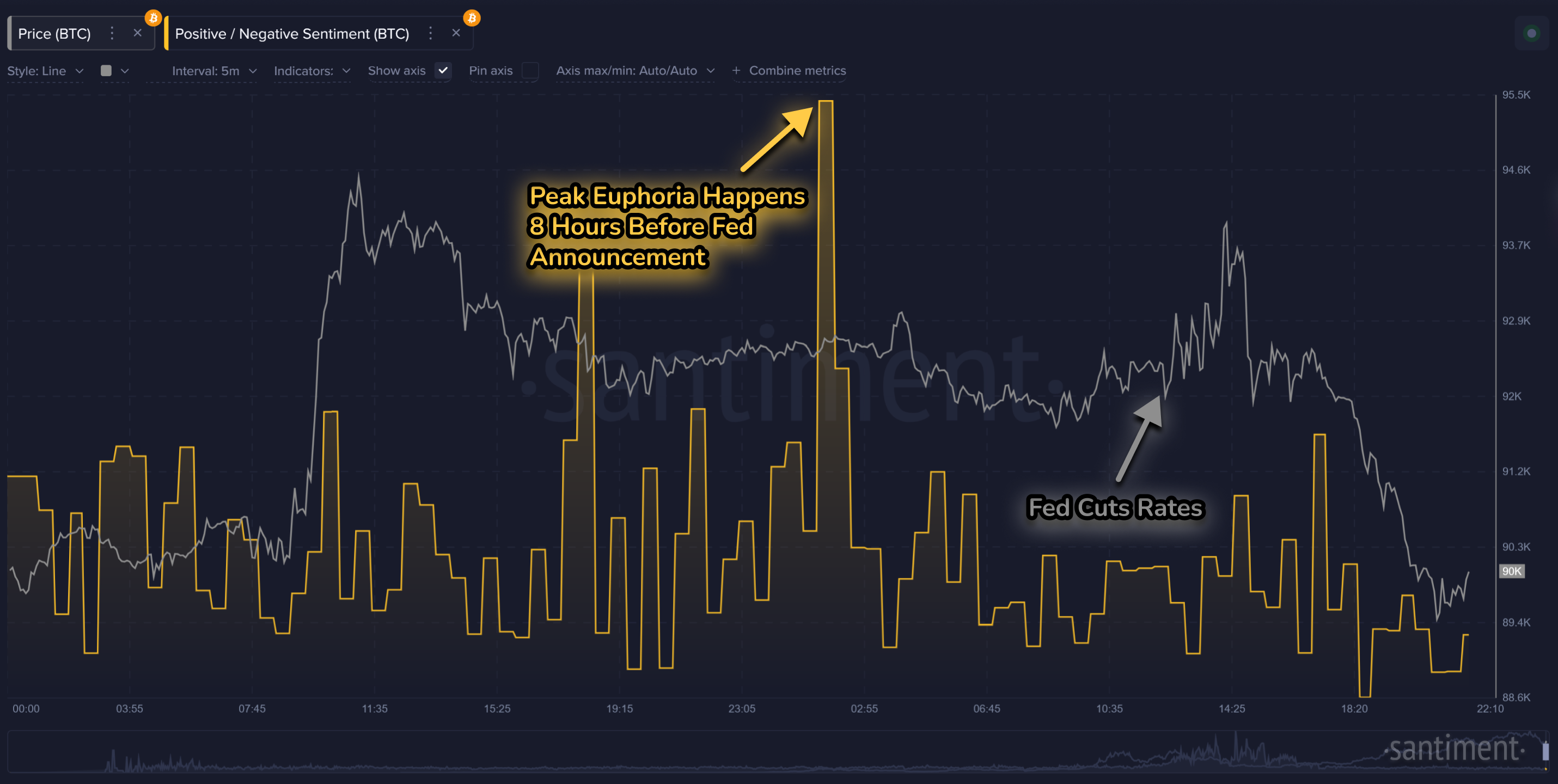

Now that the decision has been made, here is how the positive vs. negative commentary ratio looks across social media for Bitcoin. Notice how the anticipation peaked far before the actual rate cuts occurred. Bitcoin traders were actually quite modestly reactive to the price jumps following the Fed's news, even as it jumped up to a top of $94,044.

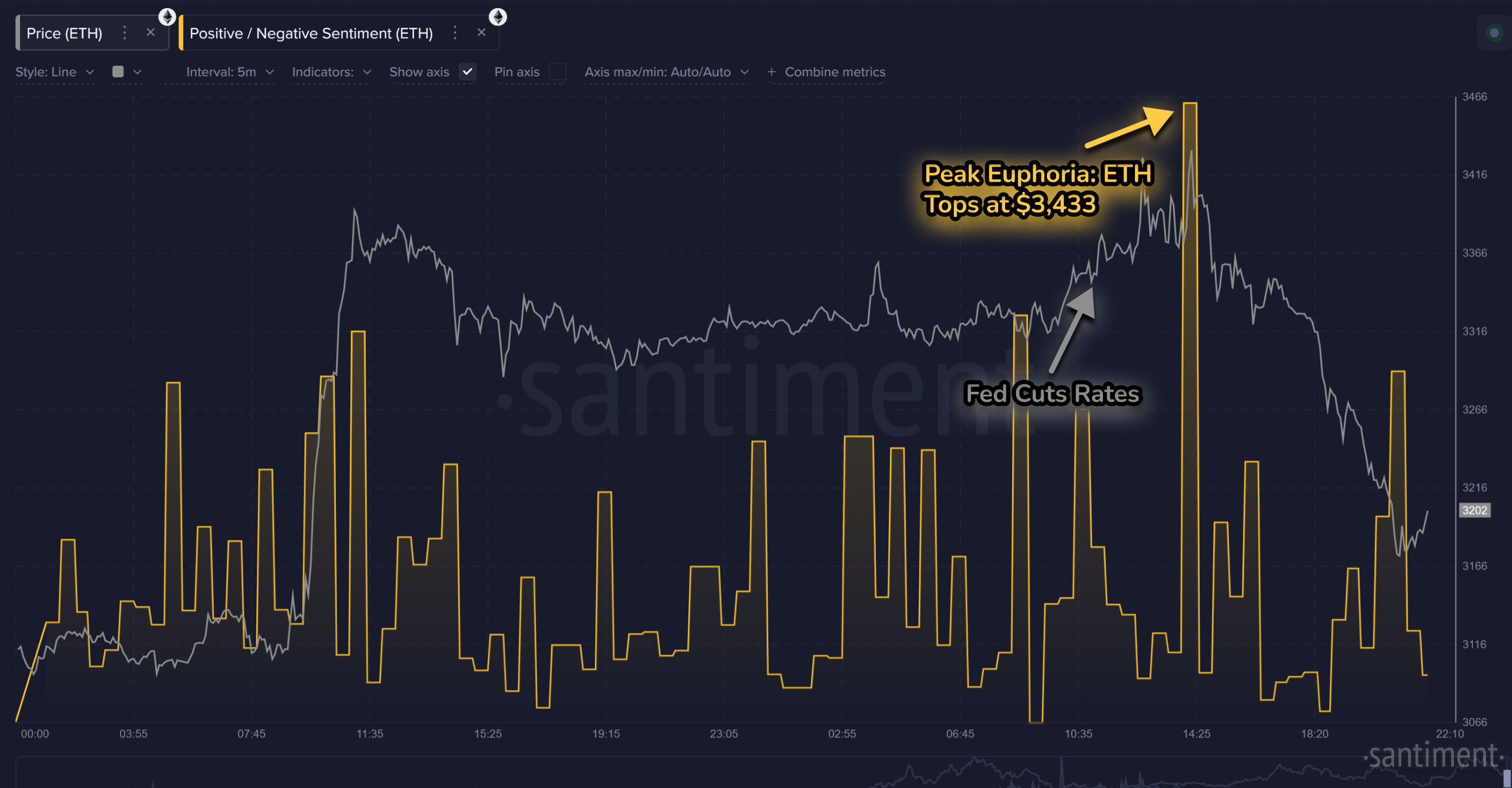

And here is the same 24-hour period for Ethereum. This one's a LOT more interesting. When Ethereum eventually hit its top of $3,433, notice how high the ratio of positive vs. negative comments were for the #2 market cap in crypto. This is a coin that saw a lot of FOMO after a mini surge immediately after Powell spoke. And many of the traders who bought in here, eventually got burned when ETH fell back down to $3,170.

However, we may see a quick change to a bullish crowd sentiment if we see a quick bounce back. Just as we saw in previous rate cut confirmations, there is typically a "buy the rumor, sell the news" effect. What is supposed to be bullish news actually sees a short-term bearish effect due to all of the retail traders buying and larger whales gladly selling off their coins to them on the mini rally that is caused by a US rate cut.

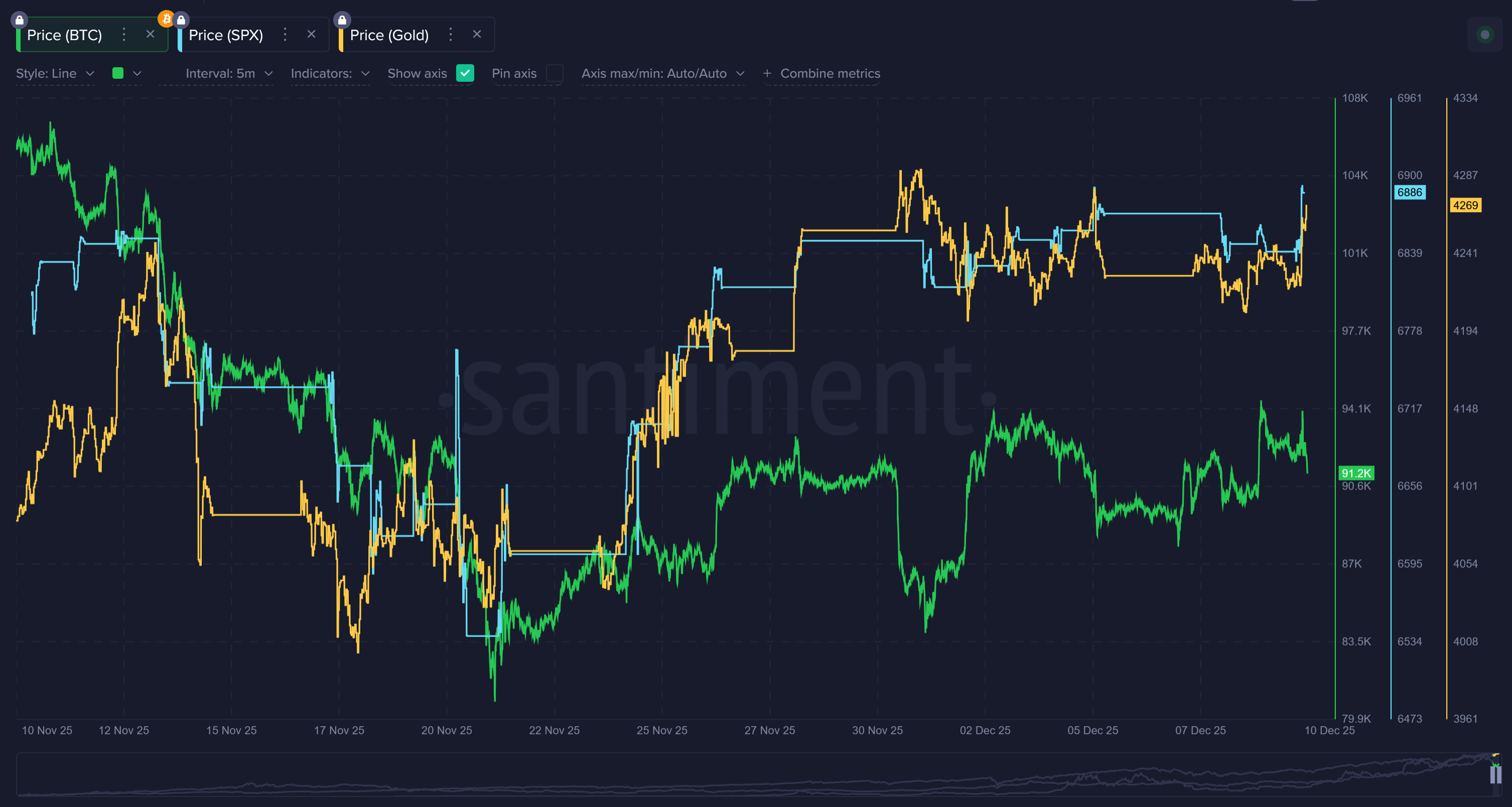

There is still an argument that Bitcoin and crypto can play "catch-up" after it failed to match the bounces of the S&P 500 and gold back in late November. Year to date, these are how each sector has fared:

Bitcoin: -3.6%

S&P 500: +17.6%

Gold: +61.1%

It's quite the dramatic difference. So a regression to the mean for BTC would be justified. And with today’s rate cut confirming the third straight easing move, that “catch-up” case becomes even stronger. Crypto has historically reacted later than equities or commodities when macro trends shift, especially after long stretches of uncertainty. Now that the Fed has provided clearer direction and eased some of the pressure on liquidity, traders may feel more comfortable rotating back into risk assets.

If Bitcoin even partially closes the performance gap with stocks or gold, it could set the stage for a stronger start to 2026. Of course, nothing is guaranteed, and short-term volatility is almost certain. But with improving liquidity conditions, rising investor confidence, and a market that still appears undervalued relative to traditional assets, the setup heading into the new year is far more encouraging than where things stood just a couple of months ago.

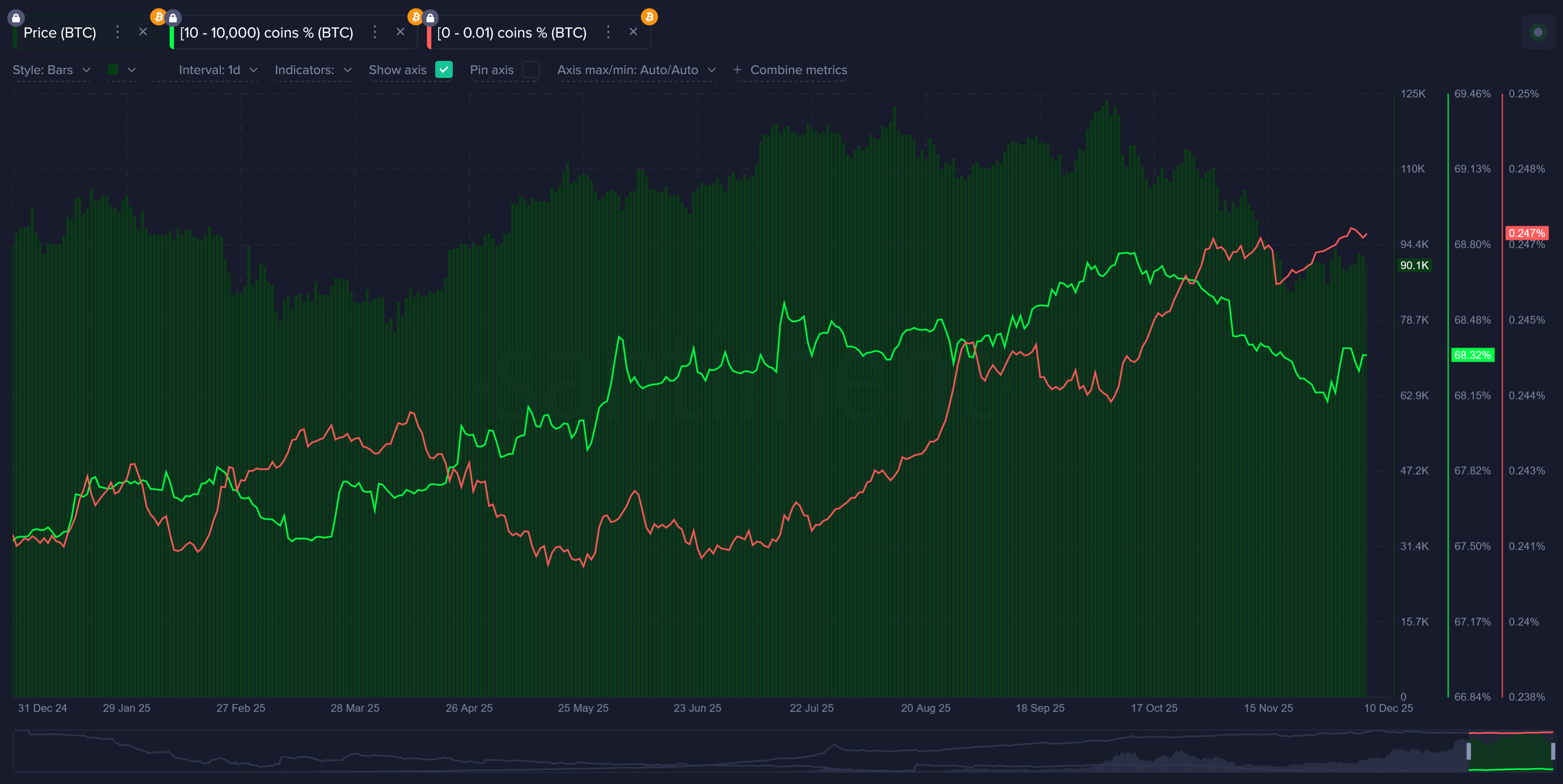

So far, early signs point to the turn from 2025 to 2026 being bullish for Bitcoin and crypto. Below, we can see that smart money wallets (10-10K Bitcoin wallets) have accumulated back 42,565 BTC since November 30th. What still remains is a notable dump from retail, which would be indicative of the perfect recipe for a major bull run. For now, expect retail to run on fumes from this positive news of rates getting cut, for at least a couple of days.

Overall, the final FOMC decision of 2025 reinforces a narrative of gradual easing, improving liquidity, and a cautiously supportive environment for risk assets. Crypto may still face its usual waves of volatility, especially as traders digest mixed signals from whales, sentiment spikes, and macro uncertainties. But after a tumultuous 2025 for cryptocurrencies, ending the year with three consecutive rate cuts from the Fed is a strong sign. If US inflation continues drifting toward target and economic data remains stable, 2026 could give digital assets the breathing room they’ve been waiting for. As always, disciplined analysis and patience will matter far more than chasing the initial reaction.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.