Expected Interest Rate Cuts, But a Whole Lot of "But's"

The Federal Reserve cut its main interest rate by 0.25%. This move was widely expected from both experts and the retail crowd, but what caught investors off guard was what Jerome Powell said afterward. During his press conference, the Fed Chair warned that another cut in December is not guaranteed. He explained that inflation is still higher than the Fed would like, and that the government shutdown has made it harder to read the latest economic data. In short, Powell said the Fed is being careful, not confident, about where the economy is headed.

In economic terms, the language of Powell's speech is typically defined as "hawkish", meaning he's warning the public and being highly cautious of inflation and limited US growth. But what really matters here? Well, traders got their wish and saw the second of (hopefully) three 25bps rate cuts to end 2025. But because of Powell's hawkishness, the responded with a mild decline thus far.

For crypto traders, US interest rates have factored in heavily. Particularly since interest rates rose in 2022, we've consistently seen a major connection between crypto and equity prices. Lower interest rates usually make riskier investments like Bitcoin more attractive because borrowing is cheaper and there’s more money flowing through the system. But when Powell suggests the Fed might slow down rate cuts, it cools that excitement. After his comments, Bitcoin fell about 5% within a day, dropping below $110,000. What should have been good news—a rate cut—ended up turning negative because investors were expecting the Fed to go further.

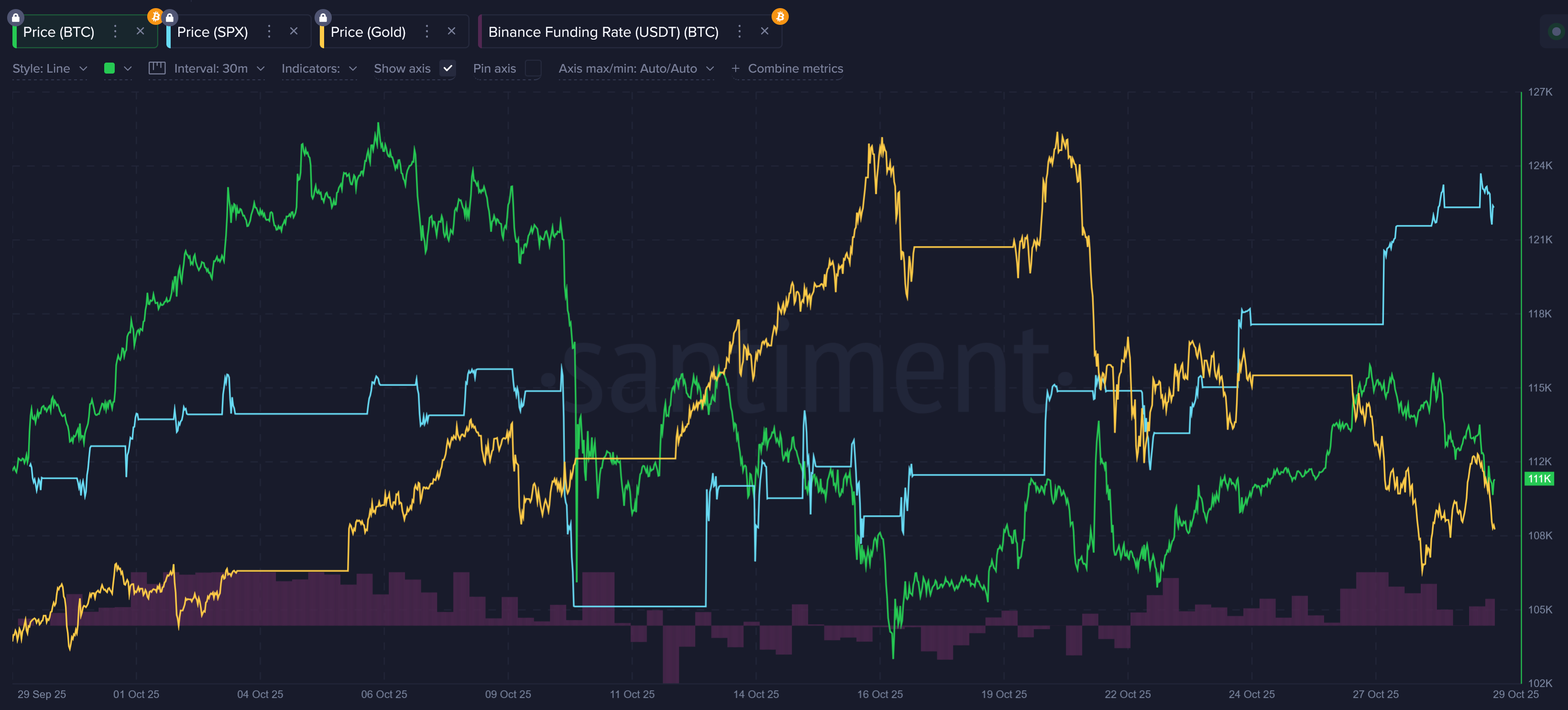

Stocks reacted the same way. The day started with modest gains, but as Powell’s words sank in, prices turned lower. The 10-year Treasury yield moved higher, and the U.S. dollar gained strength. When the dollar rises and bond yields go up, it often puts pressure on assets like crypto and tech stocks that depend on optimism and liquidity. The sudden change in market mood showed that investors were not just reacting to the cut itself but to Powell’s tone about what comes next. What's interesting is that Bitcoin's price movements are more in line with gold than the S&P 500 for now. But this pattern is usually temporary. So in the next 16 hours or so, we will likely either see:

- The currently closed S&P 500 open up in the red (catching up with Bitcoin)

- Bitcoin sharply rise and catch up with the S&P 500, which stayed afloat well despite Powell's speech due to less volatility and less emotional trading

For Bitcoin specifically, the price drop reflected a in expectations. Many traders had positioned themselves for a dovish message from the Fed and were betting that cheap money would continue into year-end. When Powell pushed back on that idea, those bets began to unwind. Liquidations across crypto exchanges added to the sell-off, and funding rates are pretty neutral. Ideally, exchanges will start to see a growing amount of shorts, leading to short liquidations that can propel Bitcoin back up to $115K and beyond.

Looking forward, much depends on whether inflation keeps cooling and how the job market holds up. If inflation stays under control and unemployment starts to rise, the Fed could return to cutting rates again, which would likely lift Bitcoin and other risk assets. But if inflation stays sticky or economic growth rebounds too strongly, Powell may hold rates steady for longer, keeping pressure on markets. That’s why traders are watching every new data release so closely.

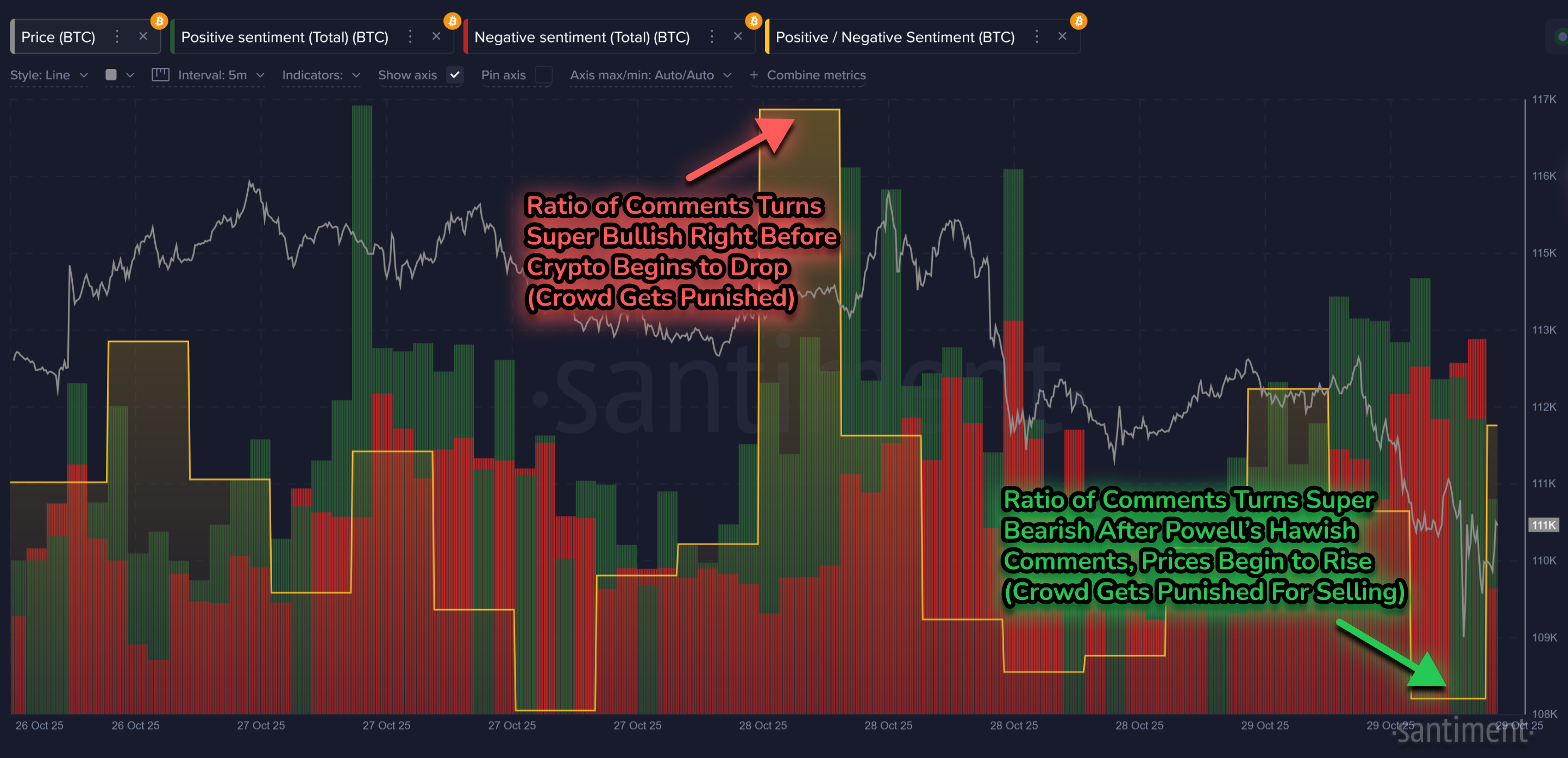

Keep an eye on how traders over-emphasize how "good" or "bad" the latest Fed decision was. The first two days after any FOMC meeting has typically resulted in short-term volatility but still the potential for strength later if policy turns more supportive. Powell’s message was clear: don’t expect fast or automatic cuts. Until the data gives the Fed confidence to ease more, both crypto and stock traders will need to stay patient, and cash in on being a contrarian when the crowd gets overly fearful toward a result that was ultimately exactly what was expected.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.