Deep Dive: Is Binance Just a Scapegoat For Pissed Off Traders, Or is the Hot Seat Deserved?

The October 10th, 2025 crypto collapse, now infamously referred to by traders as “10/10”, became one of the most emotionally charged liquidation events since 2022. Prices fell fast, liquidity disappeared, and leveraged positions were wiped out across multiple exchanges in minutes. This crash occurred less than five days after traders were celebrating Bitcoin's $126K all-time high. But as you've likely seen by now, things can change in a hurry with cryptocurrency markets.

It’s important to understand that this was not a slow bear market decline. It was a sudden -14% retrace for Bitcoin in the span of just under 8 hours, where forced liquidations fed into more forced selling. When leveraged traders cannot maintain enough collateral, exchanges automatically close their positions. Those closures become market sell orders, pushing prices lower, which then triggers more liquidations. This feedback loop is what turned a sharp selloff into a historic flash crash.

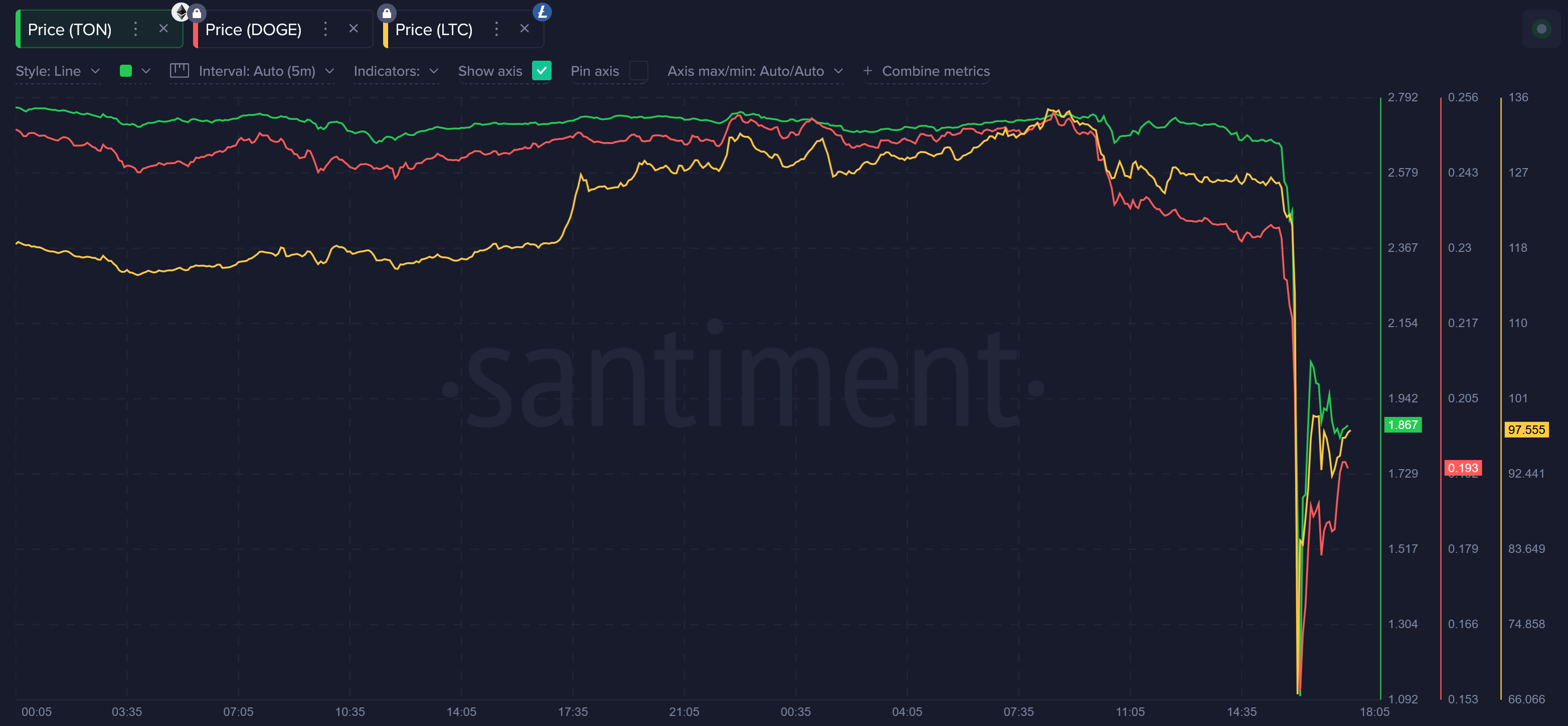

And over the span of less than an hour, we saw market cap collapses from several other top caps, temporarily seeing flash crashes of:

- Litecoin $LTC -51%

- Toncoin $TON -41%

- Dogecoin $DOGE -39%

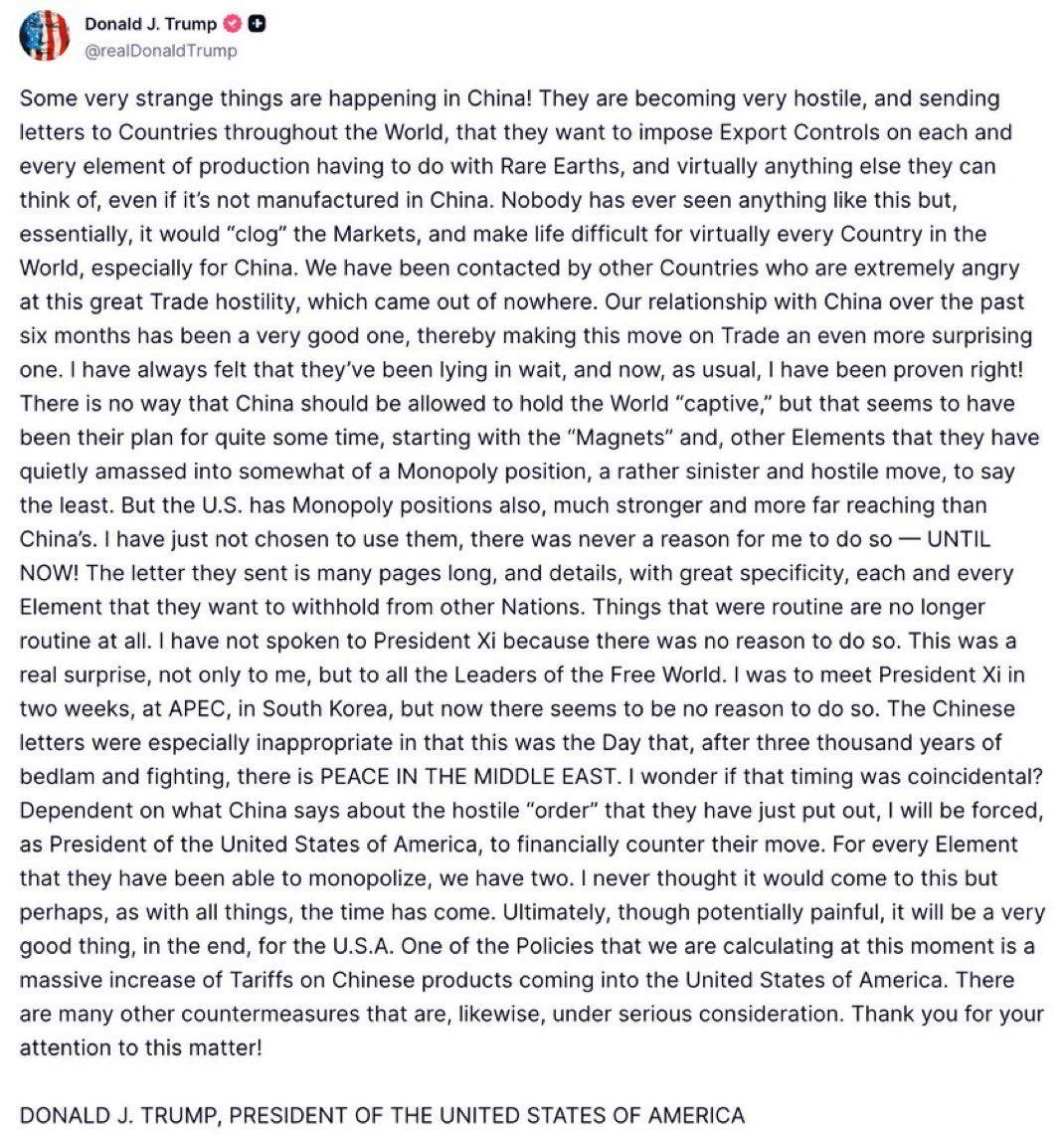

At the same time as these flash crashes, there was a major geopolitical shock that came in and arguably could have impacted crypto markets, more organically causing crypto's swift downfall. It all began with a post from U.S. President Trump on Truth Social, where he threatened immediate tariffs against China and President Xi:

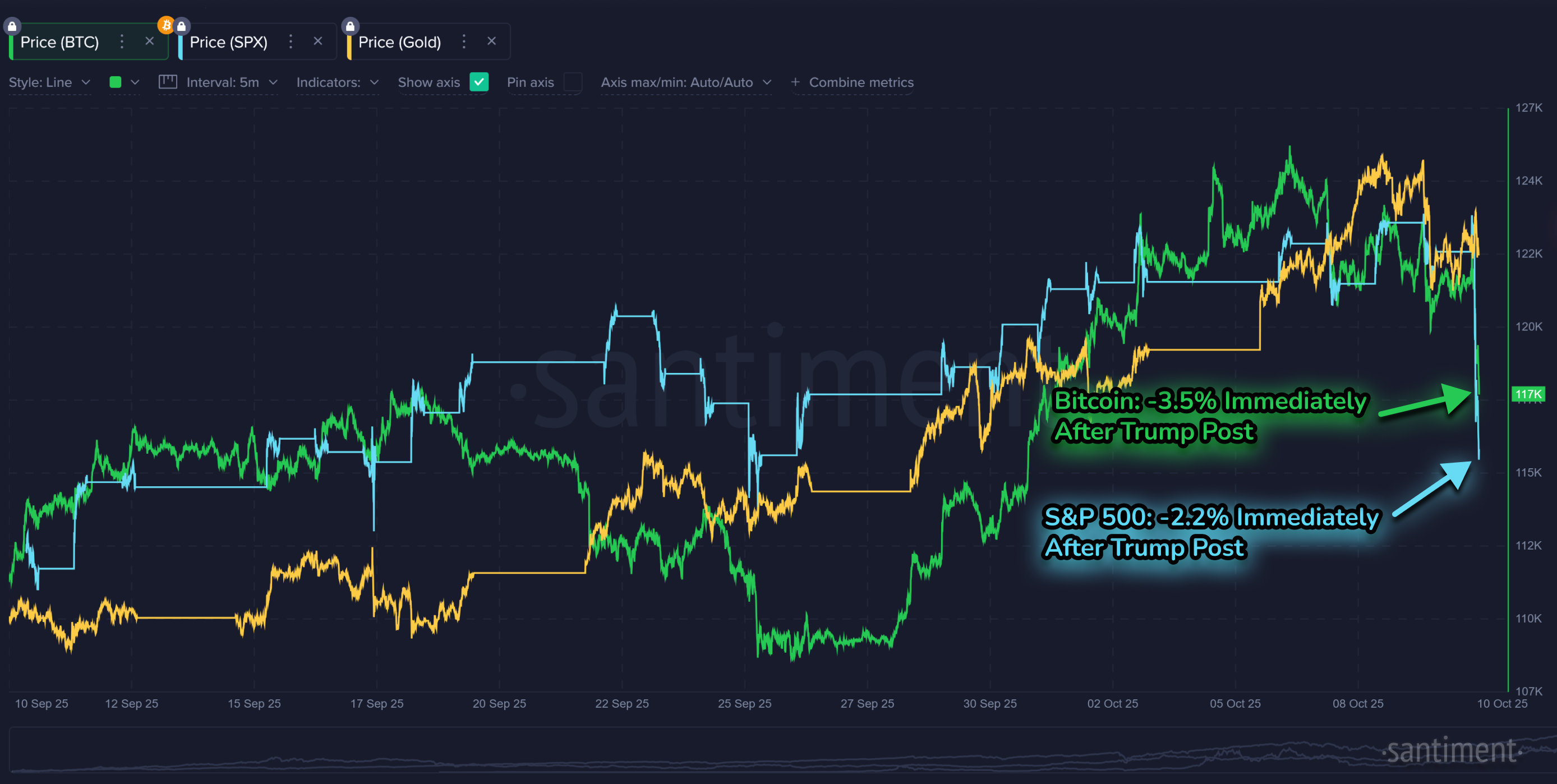

We have to remember that at the time of this 10/10 crash, America and the rest of the world were still just under 6 months from the huge tariff drama in April, 2025. And the initial reaction to this post from Trump was that we were about to see a bloody repeat of what we had seen back then. Within the first hour, this was the result of both the S&P 500 and Bitcoin, clearly showing a direct reaction to this news:

And just recently, as Binance has come under fire over the 10/10 crash, this is exactly what Binance co-CEO, Richard Teng, argues was the true catalyst. It was market sensitivity to tariff fears. Not some sort of plotted market manipulation that inorganically manipulated markets and forced unnecessary trader liquidations to occur.

Regardless, many traders focused their frustrations on Binance because a large portion of liquidations appeared to disproportionately happen there compared to other exchanges. Some assets used as collateral also briefly showed abnormal price swings on Binance compared to other exchanges. Even small pricing differences can matter when leverage is involved. If a trader is using 10x or 20x leverage, a short-lived price spike or drop can erase their margin instantly. Traders claimed they could not react in time, and some reported difficulty managing positions during peak volatility.

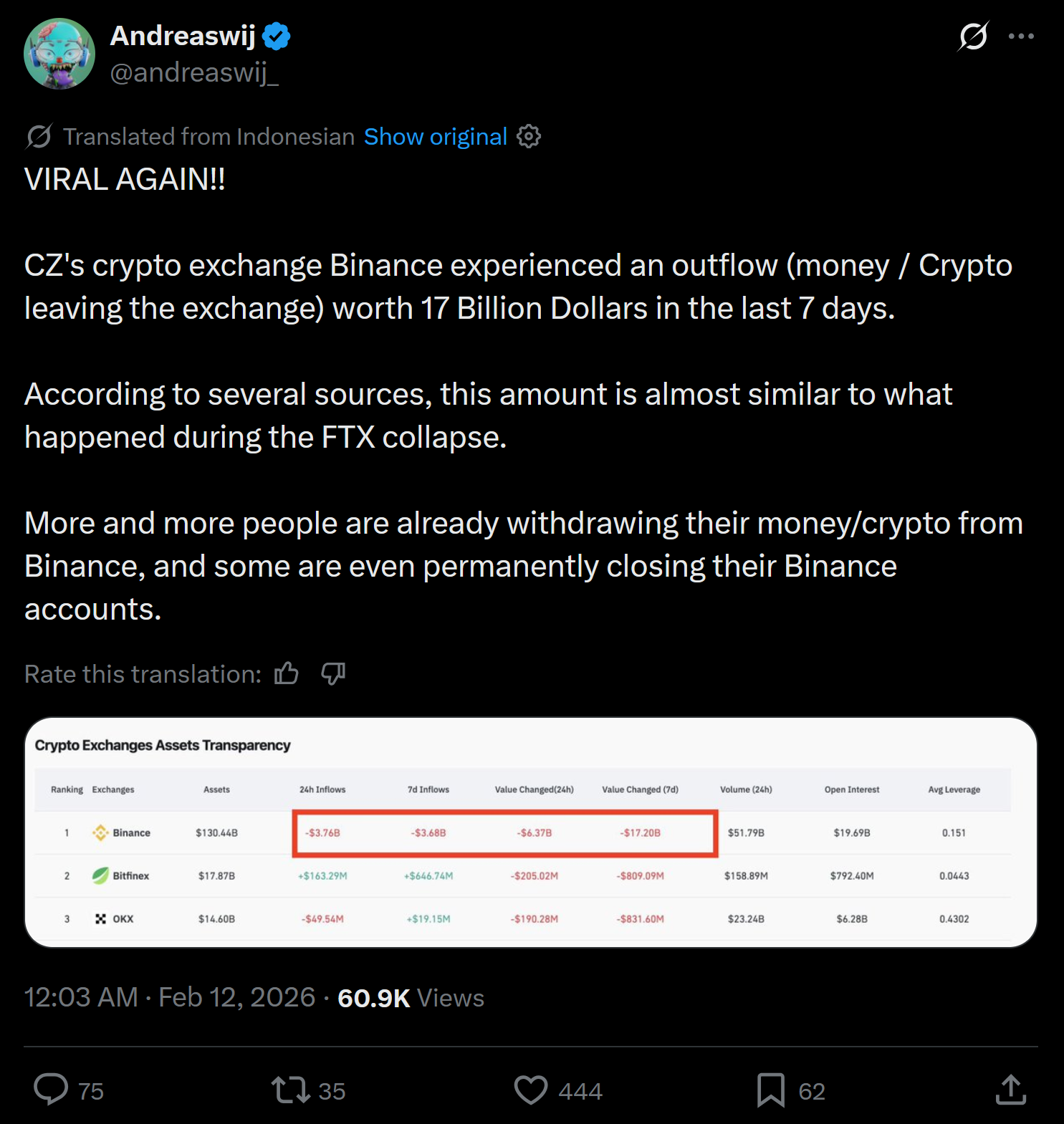

There was a separate report of claims that quickly spread about Binance facing $17B in outflows, drawing comparisons to the FTX collapse. Many traders are understandably still angry about losses from 10/10 and were already suspicious of Binance. So when social media posts suggested billions were suddenly leaving the exchange, people quickly connected it to the earlier liquidation event. The fear was that Binance might have been financially stressed back in October and that this hidden weakness helped make the crash worse. In other words, traders believed the February withdrawal headlines were proof that the exchange had been unstable all along, which reopened emotional wounds from the original collapse.

Binance responded by saying the $17B figure was not real customer withdrawals but a reporting error from data aggregation sites like Coinglass and DefiLlama. According to them, during a falling market, the dollar value of assets held on exchanges drops along with prices. Some dashboards accidentally counted those valuation changes and internal wallet transfers as if money were leaving the platform. When analysts checked the raw blockchain transactions, the real seven day net outflow was closer to $19M, which is just 0.11% compared to what the initial shocking number being reported was.

Even so, critics have pointed out that trust issues go beyond just dashboard errors. One accusation that resurfaced from the October 10, 2025 crash was that platform slowdowns and internal transfer delays made it harder for traders to react during peak volatility. While Binance says trading itself stayed live, some users claim the lag between wallets effectively trapped their collateral at the worst possible moment. Another complaint involves sharp, exchange specific price spikes on certain trading pairs that traders believe triggered liquidations faster than prices were moving elsewhere. Binance has not admitted to manipulation, but the perception that its systems amplified liquidations is part of why the distrust continues.

Regardless of where the truth lies about these recent withdrawals, it has revived the narrative that Binance can't be trusted, which is why the controversy exploded again months after the original crash. Here was how the exchange officially responded on Wednesday, February 11th, in the heat of the rising controversy:

You can obviously guess how a post like this with a "shrug" emoji was received by a crypto community that has seen immense losses over the past four months... not so hot.

For traders trying to interpret this situation, it’s important to separate three layers of reality: market mechanics, corporate responsibility, and public narrative. The liquidation cascade was real and painful. Many people lost money quickly, and it is natural to search for a party to blame. But leveraged markets are designed in a way that punishes crowded positions. Was there something a bit "extra" going on that may have forced an unreasonable level of liquidations? Only a small group of people will likely ever know this answer with absolute certainty.

The lasting lesson of 10/10 is less about one exchange and more about how fragile leveraged markets become during stress. When fear spreads, liquidity disappears, rumors travel faster than data, and trust becomes the most valuable asset. Whether Binance ultimately deserves the “hot seat” is still being debated in courts, media, and online communities. What is clear is that crypto remains a high-risk environment where emotional reactions can magnify financial damage. If you are considering trading with leverage, remember that you are putting your fate much moreso in the hands of trusted (or untrusted) exchanges, compared to much more safely "hodling" for the long-term.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.