Could Constantinople delay propel an increase in alts?

Kind of surprised that the recently discovered vulnerability in the Constantinople upgrade isn't trending today. But then again perhaps the crowd is taking that as the 'obvious' after the fact reason for ETHUSD recent decline.

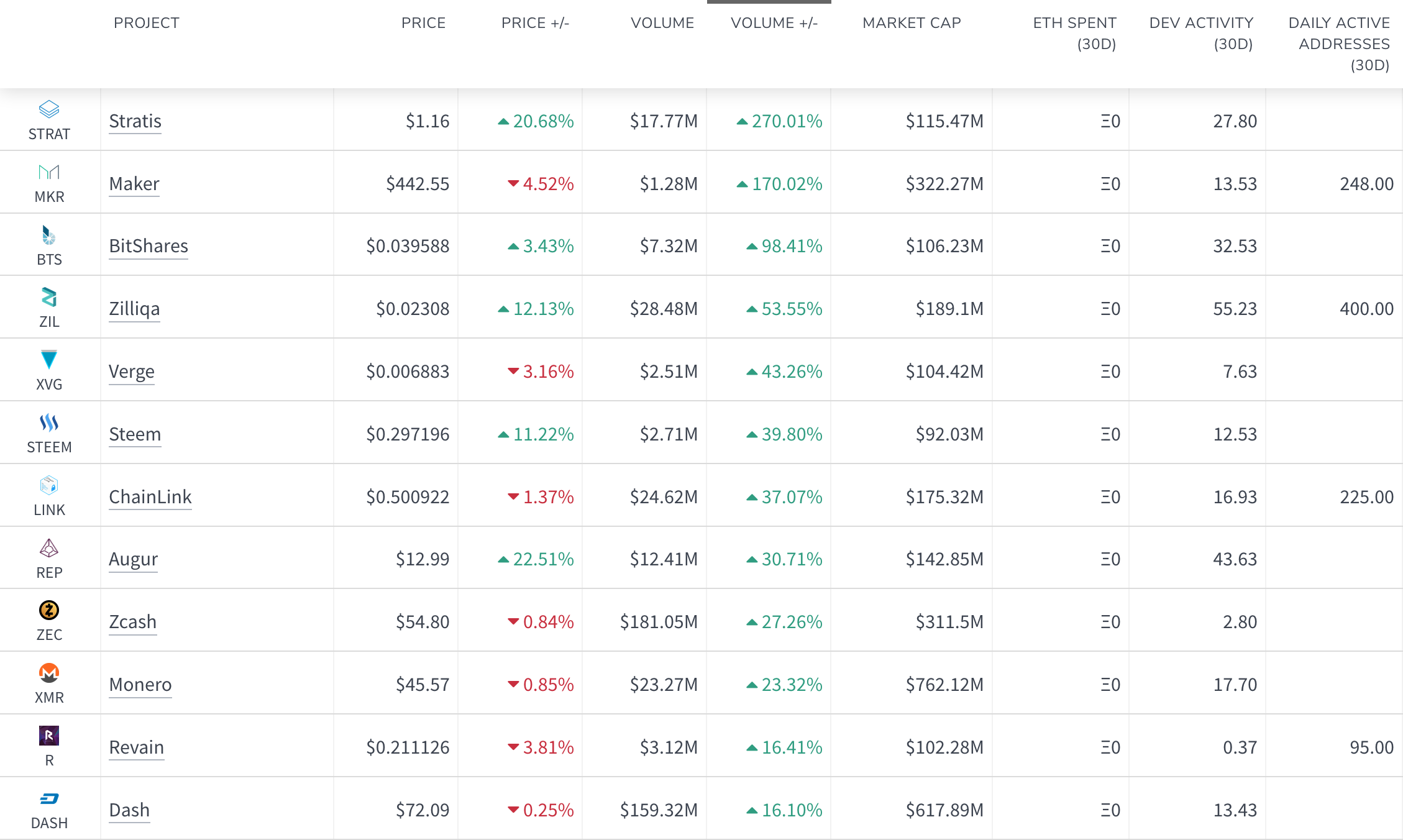

Either way, with the fork delayed and alts gaining some attention in conversations and trade, we could see some increased valuation across alt pairs. In order to test this theory I put together a watchlist of alts with market caps >$100M but <$1B. I thought this may be a decent representation of alts that could possibly sustain moves upwards rather than lower caps which tend to pump and dump easier. Also, by excluding those that are pretty much among the top ten in market cap valuation I felt it might help to produce a possible signal quicker.

There has certainly been an increase in activity as we can see above. Although at the moment this is not correlating to an average increase in price. But the crowd is generally late to their own party so I wouldn't expect that right away. What remains to be seen is if the assets in this watchlist can pick up some momentum and therefore attract more attention.

All in all I'm just curiously playing around with santiment data here. I think it is important to explore creative ways to sort, view and analyze any metric we have available. Maybe this generates a decent signal to move into a trade, or maybe it doesn't. Regardless I'm sure there is insight to be gained given the right perspective.