Changing Retail Interests as Bitcoin Struggles to Keep Up With Precious Metals!

🌎 As uncertainty about the world's future landscape heightens, investors have very clearly made a shift toward precious metals. In the past year, price returns are as follows:

🥈 Silver: +214%

🥇 Gold: +77%

🪙 Bitcoin: -16%

📈 On one hand, this could be considered a bullish divergence for the lagging crypto markets. Over the past decade, prices of 'digital gold' vs. the real thing have alternated turns, with $BTC performing much better.

🐳 On the other hand, some are arguing that this shift to tangible assets may be the 'new normal'. The truth is in the numbers, and they remain showing a story of institutional investors accumulating crypto, dating back to late November.

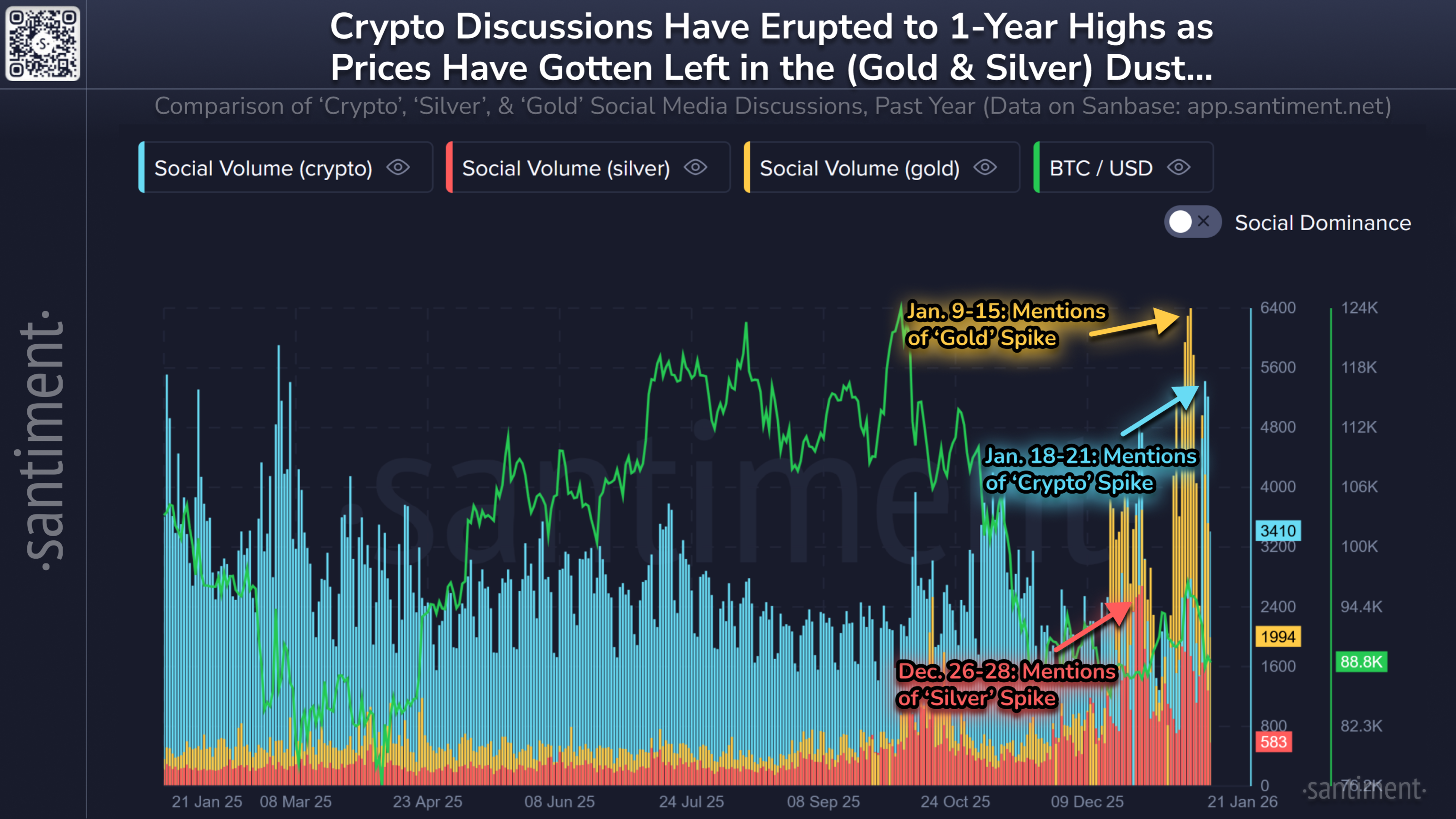

🔗 Based on social trends, keep track of where the FOMO and FUD lie for all 3 asset classes, using this chart!