Bybit x Santiment Biweekly Report: Platform Tokens Shine

In a historic month for crypto, August 2025 has seen Bitcoin (BTC) and Ethereum (ETH) each reach new all-time highs, creating a rising tide that has lifted much of the crypto market. Among the many sector assets benefiting from this renewed momentum, platform tokens have stood out for their ability to erupt with conviction. Backed by exchanges that are expanding their global reach and deepening product integration, these tokens have become more than just trading incentives — they’re now essential pillars of liquidity, governance and ecosystem growth.

Two tokens that exemplify this surge are Mantle (MNT) and OKX’s native token, OKB. Each one has leveraged the strength of major platforms like Bybit and Coinbase, which have increased these tokens’ availability and integration across derivatives, staking and structured products. Their rise highlights the way exchange-driven tokens can thrive in a bull market environment and secure lasting relevance in an increasingly competitive landscape.

Mantle’s exchange-driven momentum

Mantle has been making waves as a Layer 2 network that’s increasingly integrated into the operations of major exchanges. One notable factor behind its growing traction has been its connections to Bybit and Coinbase. Both exchanges have strategically positioned MNT as a token with multifaceted utility. The token first launched in July 2023 after rebranding from the BitDAO (BIT) ecosystem.

The coin is a Layer 2 scaling solution for Ethereum that’s built to improve speed and reduce costs for decentralized applications (DApps) while leveraging Ethereum’s security. Beyond exchange integration, Mantle’s protocol-level upgrades and developer tooling have made it an attractive option for DeFi builders seeking faster throughput and lower gas costs without sacrificing Ethereum’s security guarantees.

Coinbase made news on Aug 18, 2025 by adding MNT to its derivatives offerings. By supporting MNT in perpetual futures trading, Coinbase has unlocked new opportunities for institutional participants, including leveraged exposure and sophisticated hedging strategies. This move not only bolsters liquidity, but also elevates Mantle’s credibility within institutional trading circles.

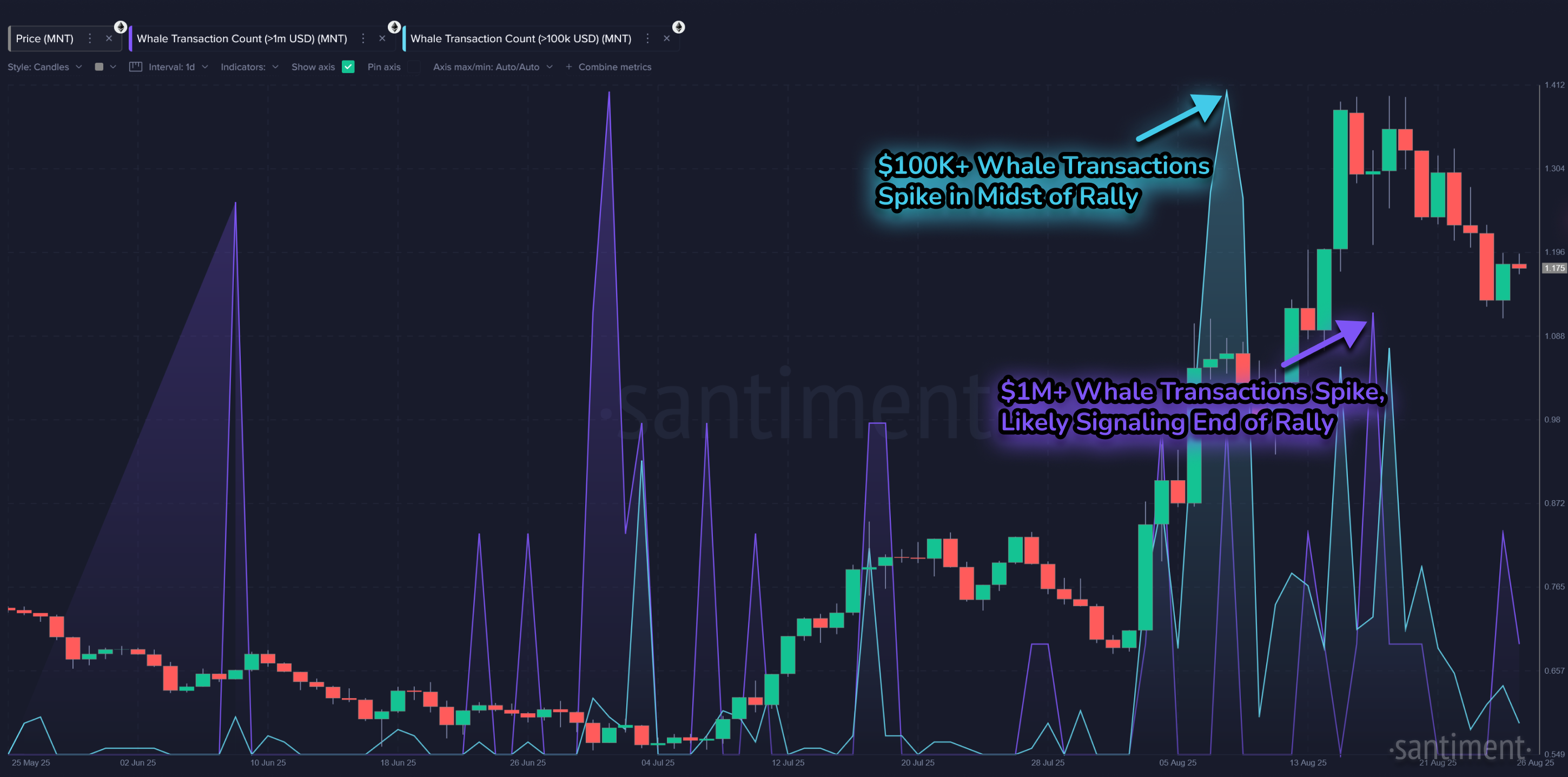

On-chain activity has confirmed this momentum. Santiment data shows spikes in $100K+ and $1M+ whale transactions during MNT’s rally. The $100K+ transactions often accompany strong price momentum, while the surge in $1M+ transfers typically signals distribution and a potential rally cooldown.

Meanwhile, the Bybit exchange has gone beyond just a simple listing, integrating Mantle deeply across its product suite — from enabling MNT as collateral in loan products to including it in innovative staking programs. Bybit’s MiCA-compliant staking framework for MNT (launched in Europe) underscores a broader trend of regulatory-aligned token use cases. This integration helps Mantle appeal to both traditional crypto enthusiasts and those seeking more structured, compliant yield opportunities.

Large holders also appear to be adjusting. Wallets with at least 1M MNT have slightly reduced their share of the total supply, indicating redistribution of tokens from whales to smaller participants. Such shifts often follow a rally and demonstrate how network adoption spreads beyond concentrated holders.

Beyond staking, Mantle’s incorporation into Bybit’s structured products and community initiatives demonstrates that a token can evolve beyond mere governance and speculation. Its presence in creator-focused programs signals a pivot toward real-world engagement and adoption, showing that Mantle is clearly positioning itself as a cornerstone of a vibrant ecosystem, rather than just another digital asset.

Market returns data reinforce this point. Both short- and long-term MVRV ratios have moved from deep negative territory (usually ideal entry points) into elevated positive zones. At one point, long-term returns for MNT reached over 90% for the first time since its inception, typically a signal of potential overheating. This progression highlights how quickly sentiment has flipped from undervaluation to potential overextension.

OKX token’s strength as a platform anchor

While Mantle’s rise has been fueled by ecosystem integration, OKX Token (OKB) illustrates the enduring power of exchange-native assets. As the native token of the OKX platform, OKB has consistently reinforced user engagement through tangible benefits, including trading fee reductions, exclusive access to token launches and participation in governance decisions shaping OKX’s road map.

OKB’s utility has grown far beyond trading incentives, as the token plays a role in OKX’s DeFi hub, cross-chain wallet and web3 ecosystem, giving it exposure to DApps and services outside the centralized exchange itself.

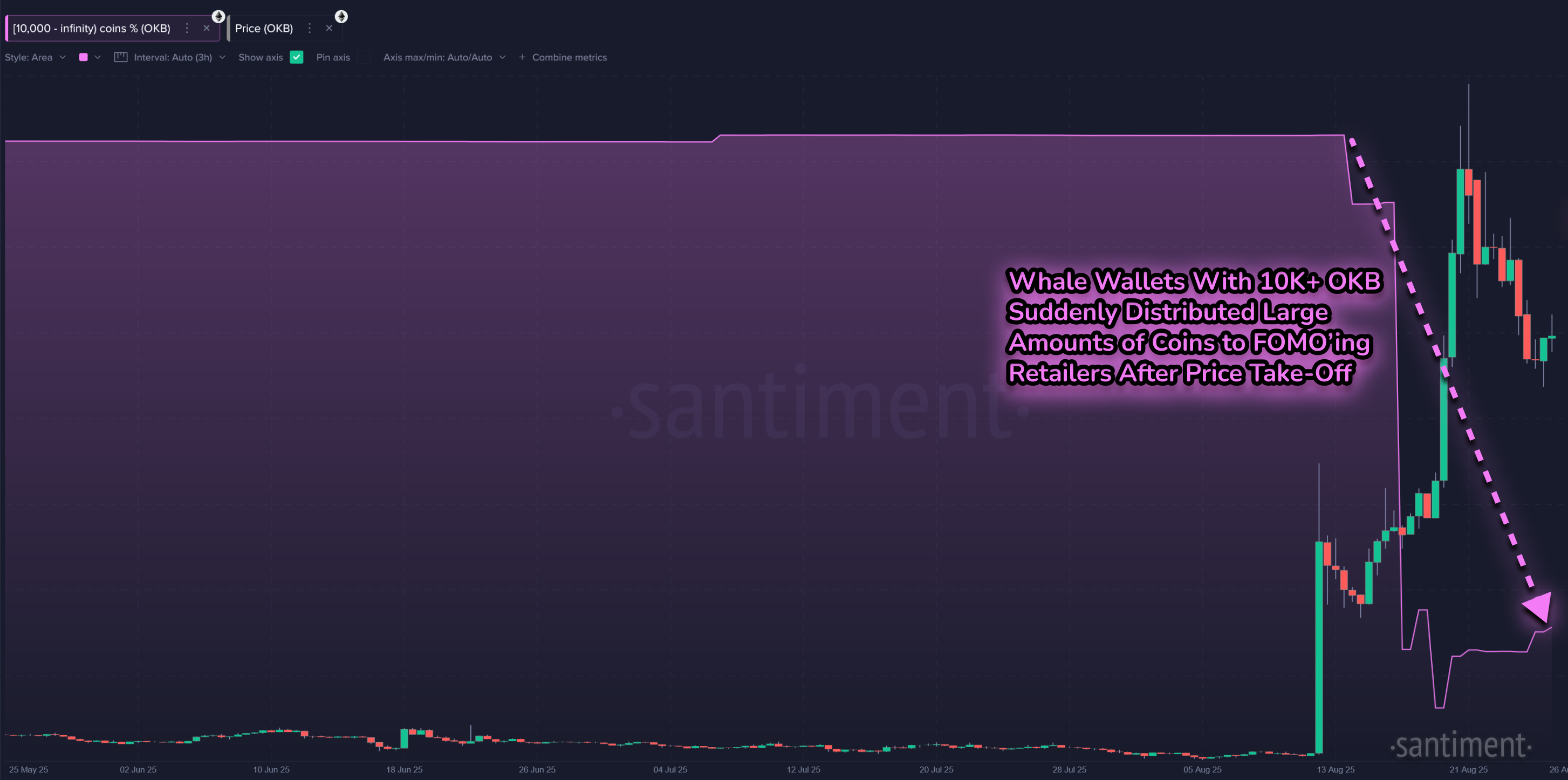

However, like Mantle, OKB’s on-chain story reveals nuances. Santiment charts show that whale wallets holding over 10K OKB have rapidly distributed tokens to retail traders after a sharp price surge, suggesting that whales took profits while FOMO-driven participants were entering the market — a dynamic often marking local tops.

OKX’s strategy has been to ensure that OKB isn’t just a symbol of loyalty, but also a critical component of platform utility. The token is tied to multiple layers of the OKX experience — from yield-earning products and DeFi integrations to its launchpad for new projects. This has fostered a virtuous cycle: as OKX grows, demand for OKB grows — and as OKB utility expands, it strengthens OKX’s competitive edge in the global exchange market.

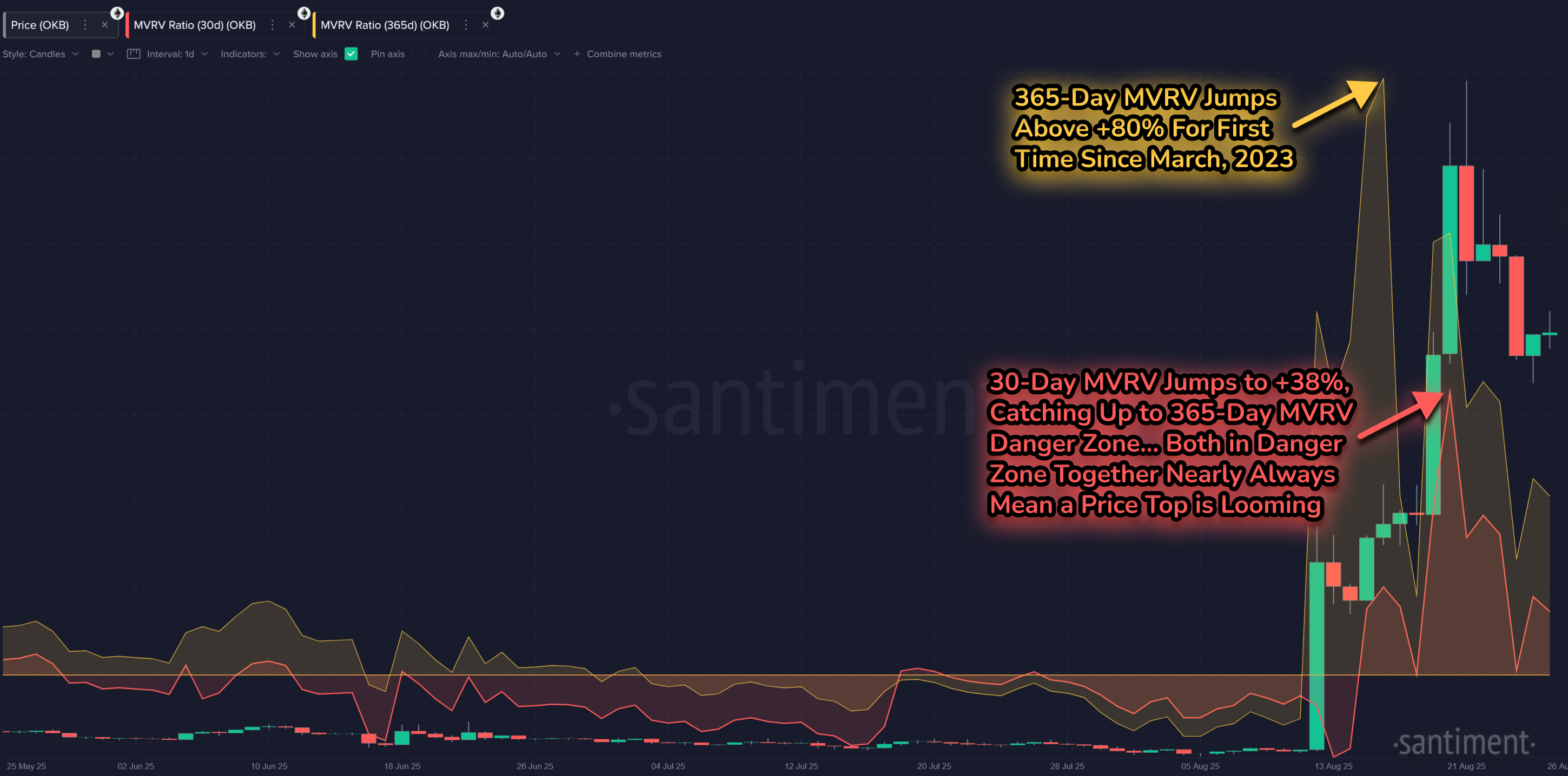

From a profitability perspective, both 30-day and 365-day MVRV ratios have surged into the “danger zone.” The short-term ratio has climbed above +38%, while the long-term ratio has jumped beyond 80% for the first time since March 2023. When both ratios sit in elevated territory, history shows that price tops frequently follow.

Moreover, OKX has taken deliberate steps to bolster OKB’s scarcity and long-term value perception through buyback-and-burn programs. These initiatives not only reduce circulating supply, but also signal a commitment to sustaining tokenholder value. Such mechanisms distinguish OKB as more than just a functional asset — it’s also a strategic financial instrument underpinning the platform’s growth strategy.

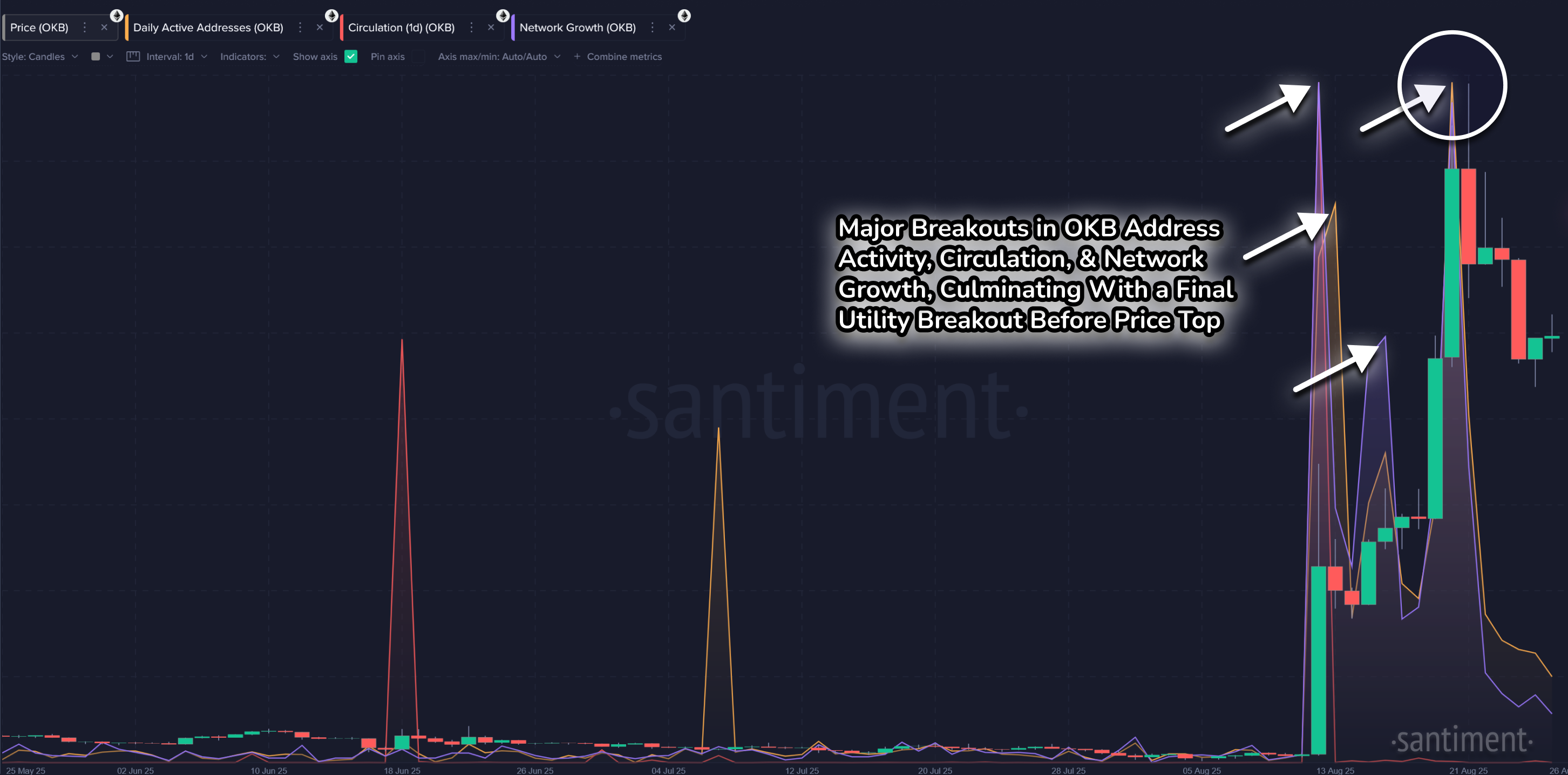

Supporting this view, OKB has experienced synchronized spikes in address activity, circulation and network growth right before the recent peak. Such simultaneous on-chain breakouts typically indicate maximum utility and participation, which often culminate in temporary overheated conditions.

The global nature of OKX’s operations adds another layer of resilience to OKB’s appeal. By serving a wide spectrum of markets and integrating with decentralized platforms, OKB has transcended being a mere exchange token to become a multi-utility asset spanning both centralized and decentralized crypto ecosystems.

The era of platform tokens

No matter what short-term or mid-term charts might be signaling — whether it’s profit-taking whales, overheated MVRV ratios or spikes in trader activity — Mantle and OKX Token have carved out a space that isn’t going away anytime soon.

Both tokens are directly tied to platforms with growing global footprints. Bybit and Coinbase’s integration of MNT and OKX’s deep ecosystem reliance on OKB mean that these assets aren’t just speculative plays — they’re baked into the daily operations and user incentives of their exchanges. That kind of embedded utility creates staying power.

Platform tokens like MNT and OKB also benefit from being “network effect” assets: as their ecosystems attract more users, traders and developers, the demand for the tokens naturally scales. This flywheel effect ensures that even when momentum cools off, the long-term trajectory remains intact.

While traders may argue about short-term tops and bottoms, with savvy ones profiting from using these above signals effectively, Mantle and OKX Token have already proven that they belong among the cornerstones of modern crypto infrastructure.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

This full article is also available on Bybit's website!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.