Bitcoin Key Stakeholders Still Having a Whale of a Time

Bitcoin’s largest key stakeholders, fondly referred to as whales, play a massive role in shaping the market because of the sheer size of their positions. When a single entity controls tens of thousands of coins, even relatively small moves can sway overall supply and demand. For smaller investors, these actions can look like sudden shocks to price charts, creating sharp swings that ripple across exchanges. This concentration of wealth means whales act as gravitational forces in a market that is still relatively young, and obviously very speculative-driven, compared to traditional assets.

And when whales make moves, it isn't just an outlier independent from how the rest of traders' plans go. Huge addresses making major transfers will often cause a significant green or red candle that creates a domino effect among how retail is perceiving the markets. When smaller traders notice large wallet movements, such as deposits to exchanges or major withdrawals to cold storage, it often sparks speculation about what’s coming next.

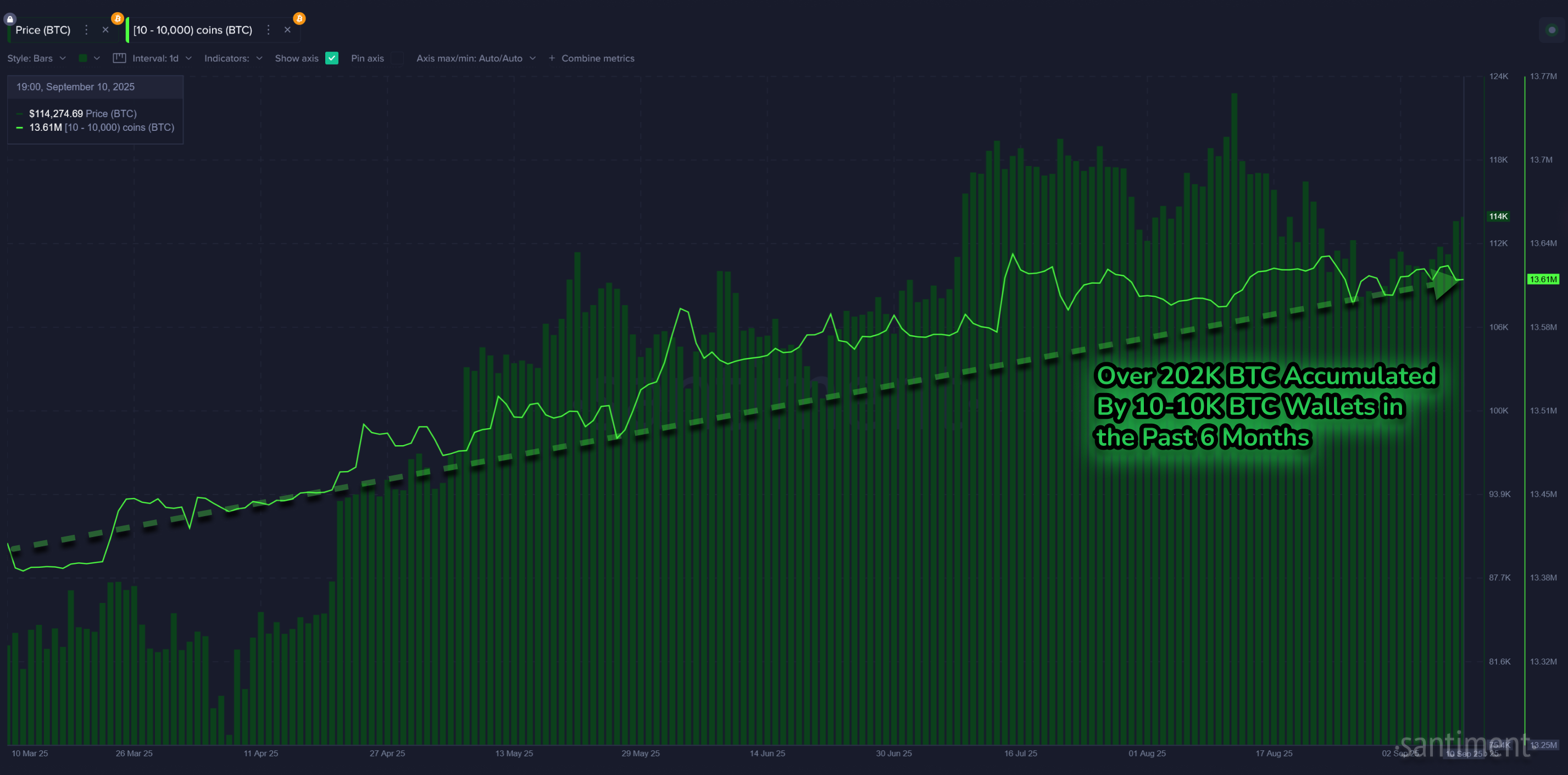

At Santiment, we often will look at the collective balances of wallets holding anywhere between 10 to 10,000 BTC. This is a rough estimation of the key stakeholders that are truly being active and carrying weight on future price movements. Looking below 10 BTC wallets often leads to too many retail traders with not enough capital to impact prices. Looking above 10,000 BTC leads to analyzing many exchange wallets and liquidity providers that don't particularly exist for investing or trading purposes.

But what we do see now is a bit over 202K BTC accumulated over the past six months by these wallets holding between 10 to 10K BTC. And prices have generally correlated with this line fairly well, providing evidence that there is quite a bit of control by these wallet tiers:

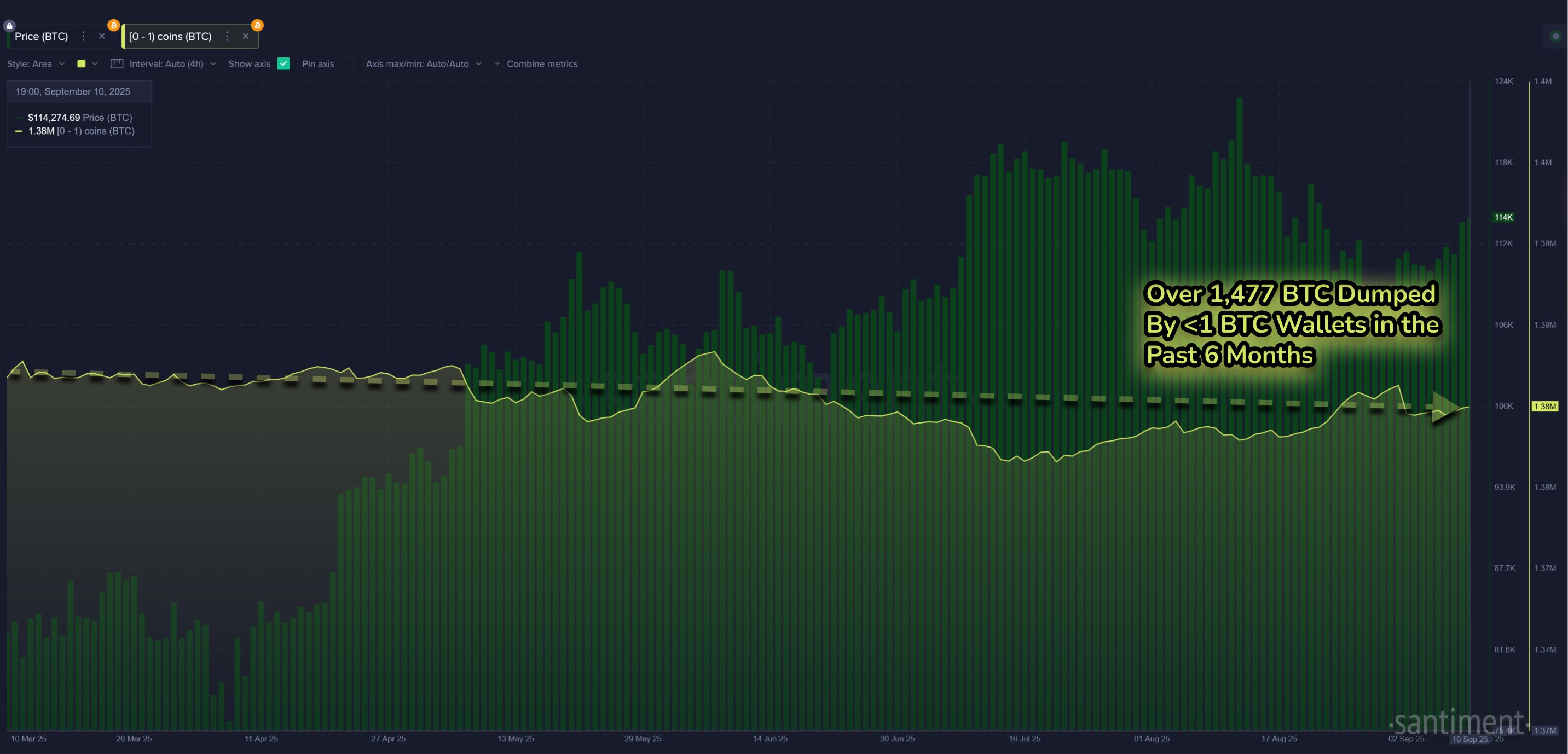

In contrast, take a look at the small holders (with less than 1 BTC), and the collective coins dropped over the past six months. For the most part, they have been dropping coins pretty consistently throughout 2025. Recently, however, there have been some dip buying efforts:

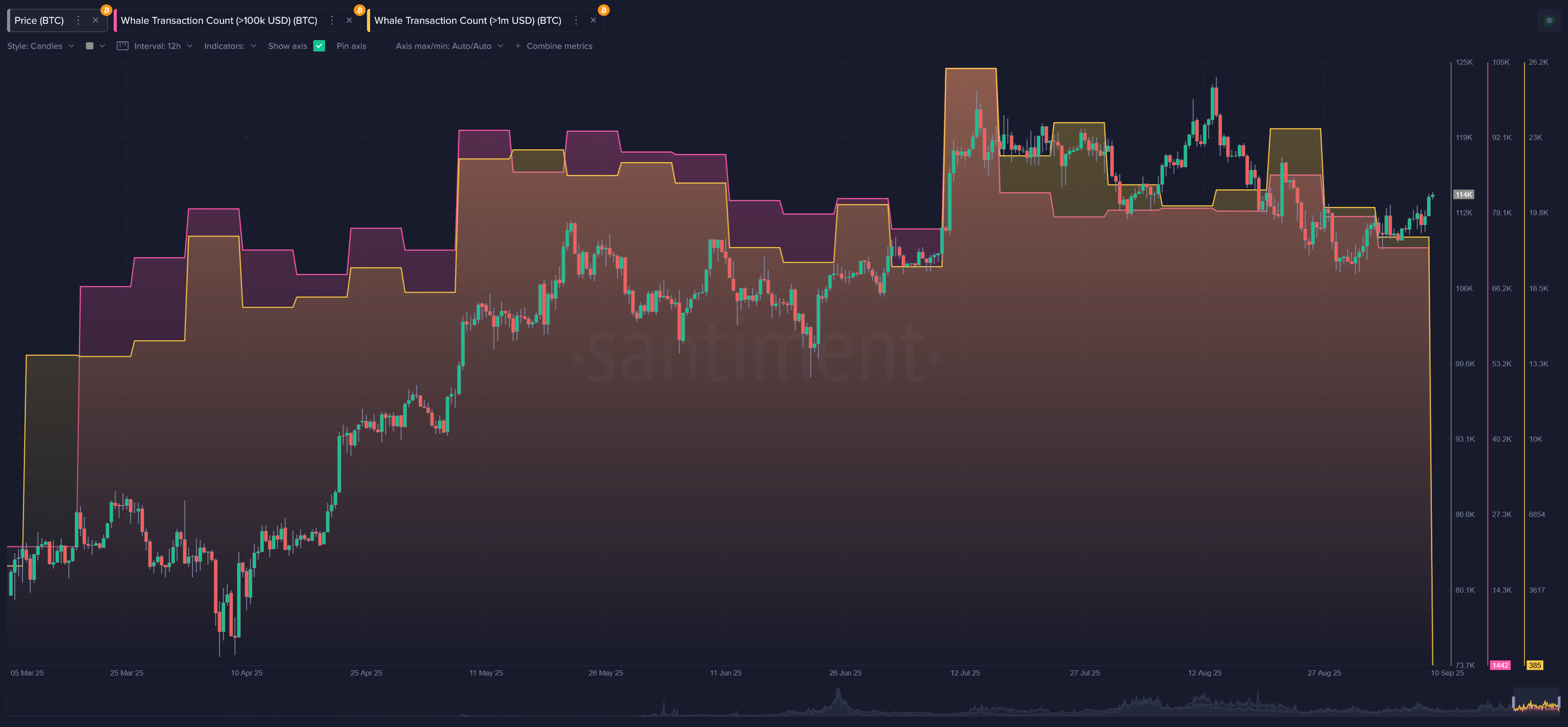

Overall, the level of whale activity shows that large wallets became more and more active up until the first all-time high wave in mid-July. The level of transactions has dropped mildly since, but is still significantly higher than where we saw their activity six months ago.

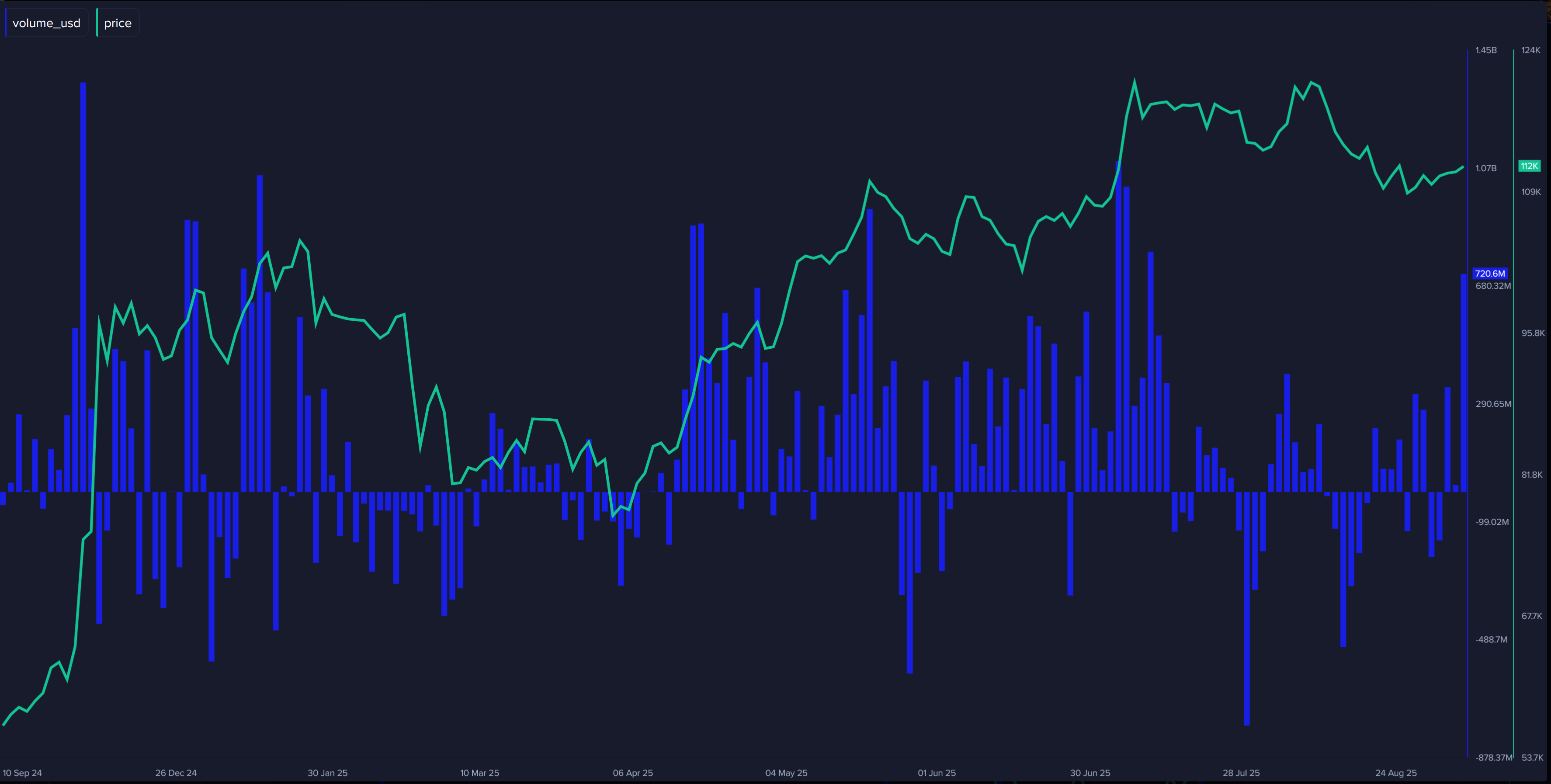

And it's also important to keep tabs on how Bitcoin's ETF inflows and outflows are looking. Yesterday, we saw over $720.6M in net inflows, which is by far the highest level of money moving into ETF's since mid-July. This is significant considering many of the large moves are happening due to institutional and whale decisions and behaviors.

Whales represent a kind of anchor for Bitcoin’s price stability over the long run. Many of them are early adopters or institutional investors who believe strongly in Bitcoin’s future, and their willingness to hold through downturns provides a foundation of support. At the same time, their occasional rebalancing or profit-taking ensures volatility never disappears completely. Remember, crypto is and will always be a whale's playground. Instead of viewing them as enigmas, follow their behaviors through Santiment's data, and treat them as free paths to making more profitable decisions.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.