This Week in Crypto, Full Written Summary: W4 July

Bitcoin Looks to Hang On, Ethereum Charging its Way to $4K!

Welcome to our summary of the latest "This Week in Crypto" livestream. Santiment's data experts, Brian and Maksim, sat down to analyze the market's recent roller coaster ride. While Bitcoin holds its ground after a new all-time high, all eyes are turning to Ethereum and its potential surge.

In this session, Brian and Maksim uncovered critical signals hidden in the data. They explored why massive ETF inflows might actually be a warning sign, how retail trader behavior could predict the next big move, and revealed a fascinating "legacy altcoin" indicator that has historically signaled major market tops. Let's look at the key insights from their conversation.

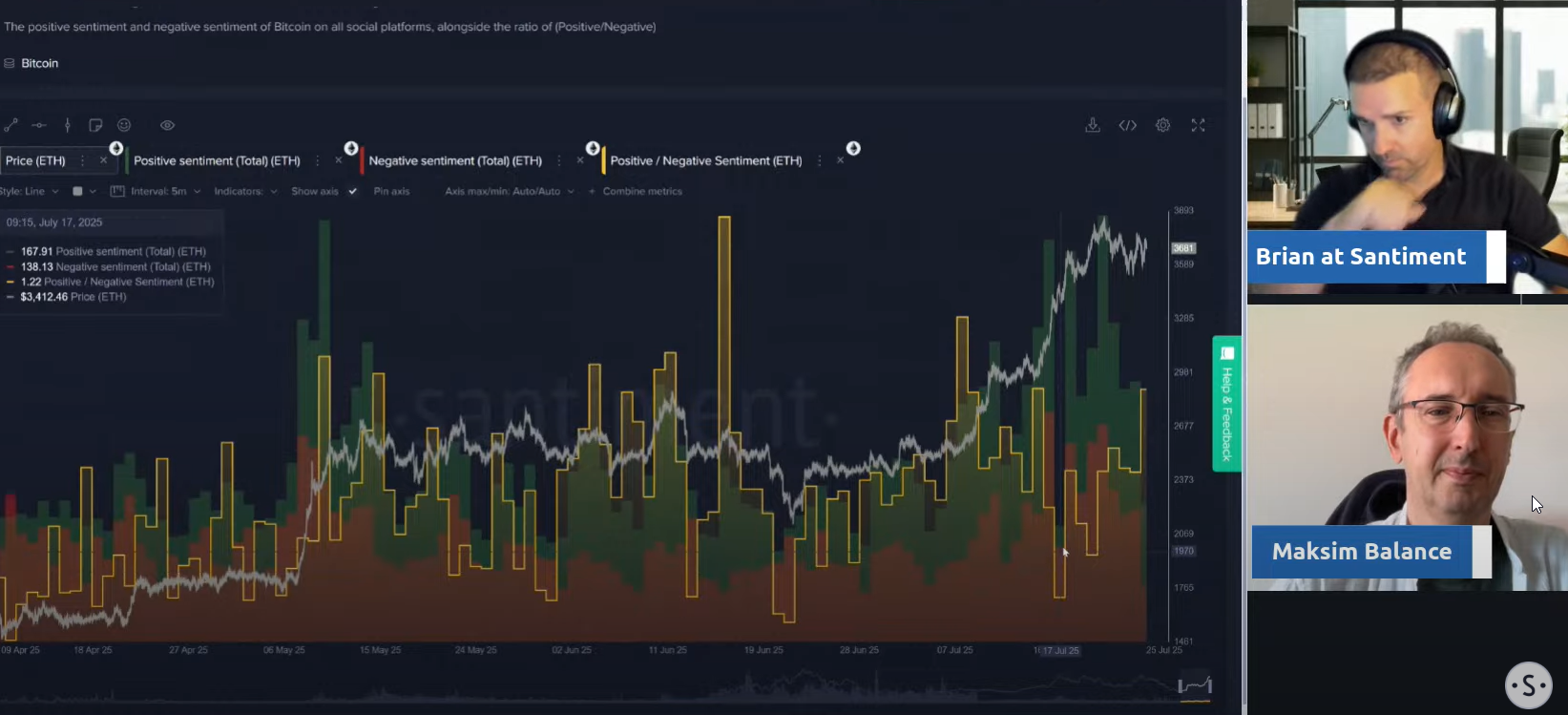

[00:49] Ethereum's Sentiment is Shifting: Is the Data Backing a Major Move?

The conversation started by noting a significant shift in market focus. While Bitcoin has been in the spotlight, attention is now moving toward Ethereum. Brian and Maksim observed that this isn't just a feeling; the on-chain and social data confirm a growing interest in ETH. This change in sentiment often precedes major price action, making it a critical trend to watch.

Actionable Tip: Keep an eye on the ETH/BTC price chart and compare the social volume of both assets. A sustained uptrend in these metrics can confirm that market focus is genuinely shifting.

[03:31] Crowd Psychology: Why Doubt Signaled Ethereum's Rise & Optimism Signals a Top.

Crowd psychology plays a huge role in market cycles. Brian highlighted a fascinating dynamic in Ethereum's recent price action. About a week ago, the crowd showed significant doubt, with many taking profits too early. This lack of widespread euphoria allowed the price to continue its upward climb. Now, the crowd is optimistic, with widespread talk of an "inevitable jump to 4k and beyond," which is a classic contrarian signal.

Actionable Tip: Use a sentiment analysis tool to track crowd emotion. When discussions become overwhelmingly positive and euphoric, it often signals that a local top is near.

[06:39] The Fed Doesn't Lead, It Follows: A Key Insight Into Macro Market Dynamics.

Many believe the Federal Reserve dictates market conditions, but Maksim offered a powerful counter-perspective. He explained that the Fed's decisions are often a reaction to what the market is already doing. He pointed to U.S. Treasury Bond yields as a leading indicator, stating that the Fed typically acts months after the bond market has signaled a change.

Actionable Tip: Watch U.S. Treasury yields (like the 10-year) as a leading indicator. Significant moves in the bond market can foreshadow future Fed policy changes months in advance.

[09:04] Why Fed Rates Are the Ultimate Puppet Master for Crypto Cycles.

For anyone wondering why crypto traders watch the Fed so closely, Brian provided a clear history lesson. The crypto market's movements have been tightly linked to interest rate decisions. When the Fed started raising rates in early 2022, crypto markets crashed. Conversely, when they began cutting rates in late 2023, it fueled a huge bull cycle.

Actionable Tip: Mark Federal Reserve meeting dates on your calendar. Understanding the market's expectations for rate changes beforehand can help you anticipate volatility, as the biggest price moves often happen when the Fed's decision surprises the market.

[12:37] A Top Signal? How Massive ETF Inflows Can Be a 3-Day Warning for Bitcoin.

While large inflows into Bitcoin ETFs seem bullish, Maksim revealed a pattern that suggests they could be a short-term top signal. Looking at the data, he noticed that significant spikes in ETF inflows often precede a market cooldown or correction by about two to three days.

Actionable Tip: When major news outlets report record-breaking ETF inflows, view it as a potential short-term exhaustion signal. This can be a good time to review your positions, as a 2-3 day cooldown often follows.

[15:15] The Market's Secret: Front-Running ETF Buys & The "Sell the News" Effect.

Taking the ETF analysis a step further, Maksim proposed a theory on how the market really works. He suggested that large, informed traders are likely "front-running" the ETF purchases. By the time the news of a large inflow is public, the initial price move may have already happened, turning it into a "sell the news" event.

Actionable Tip: Pay more attention to the price action in the days before a major ETF inflow announcement. A strong rally ahead of the news can indicate a "sell the news" event is likely once the data becomes public.

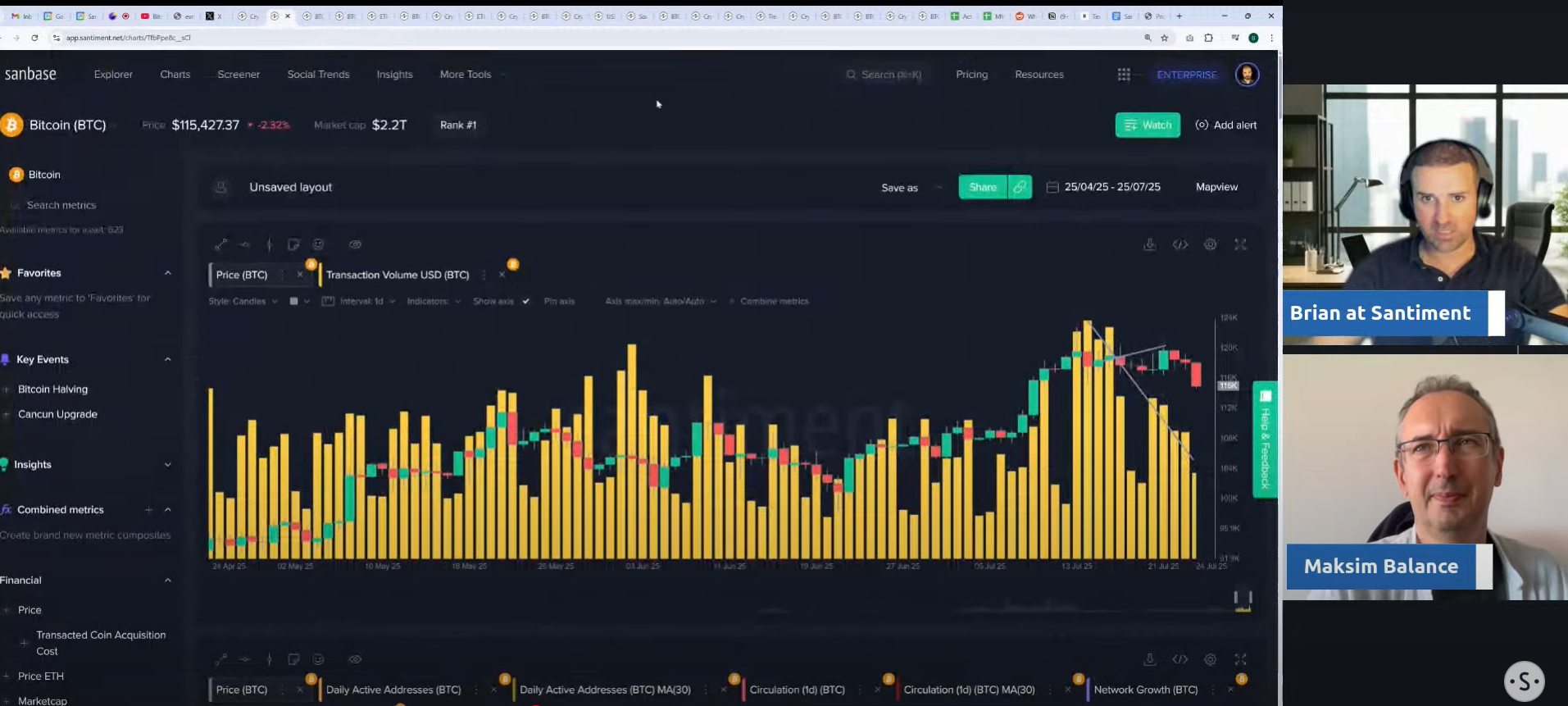

[17:48] Bearish Divergence: Bitcoin's On-Chain Activity Fails to Confirm New Highs.

A healthy rally is supported by growing network usage. However, Brian pointed out a concerning bearish divergence in Bitcoin's data. As Bitcoin's price pushed to a new all-time high, key on-chain metrics like transaction volume and network growth were actually declining.

Actionable Tip: Regularly compare the price chart with a chart of Daily Active Addresses. If the price is rising but the number of active addresses is falling, it's a classic bearish divergence that signals a weakening trend.

[22:35] Whales May Signal the Top: Analyzing the Massive Transactions at Bitcoin's ATH.

Whale activity provides a glimpse into what the market's largest players are doing. Brian highlighted a massive spike in whale transactions (over $1 million) that occurred precisely when Bitcoin hit its all-time high. This is a strong indicator of profit-taking.

Actionable Tip: Use a tool to monitor whale transaction counts. A sudden spike in transactions over $1 million during a price rally is a strong, real-time signal that large holders are selling into market strength.

[25:34] The Contrarian Signal: Why Retail Selling Is a Bullish Sign for Bitcoin.

In a fascinating contrarian insight, Brian and Maksim looked at the holdings of smaller wallets (0.1 BTC or less), which represent retail traders. The data shows this group has been steadily selling or holding flat since early June. This is often seen as a bullish sign because it reduces potential sell pressure.

Actionable Tip: Monitor the supply distribution among different wallet sizes. When the percentage of supply held by small wallets (retail) is decreasing, it can be a contrarian bullish sign.

[29:11] Is Ethereum Too Hot? Social Dominance Hits Euphoric Levels.

The conversation returned to Ethereum, where social metrics are flashing warning signs. Since early May, Ethereum's price ratio against Bitcoin has surged by an incredible 70%. This has led to extreme euphoria and a massive spike in social dominance, which is often a red flag.

Actionable Tip: Track the Social Dominance of an asset. When it spikes to unusually high levels, it suggests the asset is over-hyped and the trade is becoming crowded, increasing the risk of a price correction.

[33:37] Not Your Typical Top: Why Low Meme Coin Hype Suggests This Rally Has Legs.

While Ethereum's hype is high, the broader market may not be at peak frothiness yet. Brian showed that social dominance for meme coins is currently quite low. A true market-wide top is often characterized by widespread, irrational speculation, and the absence of that could suggest this rally isn't over.

Actionable Tip: Monitor the combined social volume of a basket of top meme coins. A low level of chatter suggests the market hasn't reached peak speculative fever, while a massive spike can signal a market-wide top is approaching.

[42:31] The Next Big Narrative: Will a "Michael Saylor for Ethereum" Drive the Final Pump?

Every market cycle is driven by powerful narratives. Maksim identified what could be the next major story to fuel the market: the idea of a "Michael Saylor for Ethereum," where corporations begin adding ETH to their balance sheets. He believes this narrative could provide the rationale for a final push to new highs.

If you’d like to see a particular narrative featured on the Historical Crypto Trends tool, let us know! Comment on this insight what you would like to see there.

Actionable Tip: Use a social trend tool to track keywords related to emerging narratives, such as "corporate treasury" combined with "Ethereum." Spotting these discussions early can give you insight into the market's next major driver.

[46:10] The "Legacy Alt" Indicator: When These Coins Pump, It's Time to Run.

Maksim shared a powerful top indicator he tracks. He explained that when older, large-cap altcoins like Doge, Ripple, and Cardano begin to pump aggressively against Bitcoin, it's a sign that market greed has reached its peak and you may have "one or two weeks left" before a significant correction.

Actionable Tip: Create a chart that tracks the performance of a basket of "legacy altcoins" (e.g., XRP, DOGE, ADA) against Bitcoin. A sharp, simultaneous rally in this group is a classic indicator that market greed is reaching its peak.

[52:24] Final Price Targets: Here's Where Bitcoin & Ethereum Could Top Out.

To conclude, Maksim shared his personal price levels of interest where the market might face a major turning point. He is watching for $125,000 for Bitcoin and $4,050 for Ethereum as areas where the current market structure could lead.

Actionable Tip: Identify key psychological price levels (like $125k for BTC) on your charts. These round numbers often act as magnets for price and can be significant areas where profit-taking or reversals occur.

Conclusion

This livestream offered a masterclass in using data to cut through the market noise. The key takeaways are clear: Ethereum's sentiment is running hot, whale activity is an important top signal, and the behavior of both retail and institutional players is telling a complex story. By watching ETF flows, social trends, and unique indicators, investors can develop a more nuanced view of the market.

The insights from Brian and Maksim show the power of a data-driven approach. Instead of relying on emotion, using on-chain and social metrics can help you understand the forces shaping the crypto landscape if you decide to be a “cold blooded behavioral analyst.”

What are your thoughts on these indicators? Let us know in the comments below, and be sure to join the next "This Week in Crypto" for more data-driven analysis.