This Week in Crypto, Full Written Summary: W3 November

Crypto Sentiment Plunges After Bitcoin’s Drop to $80.6K

Executive Summary

Extreme Fear Grips the Market: Following Bitcoin's drop to $80.6K, social sentiment has plummeted to its lowest point of the year, indicating widespread panic among retail traders.

- Whales are Buying the Dip:** On-chain data shows a clear divergence: small retail wallets are selling off, while "mega whales" (holding 1,000-10,000 BTC) have started accumulating, a pattern often seen near market bottoms.

- Key Metrics Signal a Potential Rebound:** Metrics like the MVRV have entered the "opportunity zone," suggesting the market is undervalued. Historically, these levels have preceded significant recovery rallies.

- A Call for a Systematic Approach:** The experts stress the importance of having a data-driven trading system to avoid emotional decisions and identify accumulation zones during periods of high volatility.

Introduction

In this week's crypto summary, market experts Brian and Maksim analyze a market in turmoil. With Bitcoin dropping to $80.6K, fear is palpable. But is this the end of the bull run or a classic buying opportunity? Maksim, a trader since 2016, shares his hard-won psychological framework for surviving corrections. Brian presents compelling data showing that while retail investors are panicking, the largest "mega whales" are quietly starting to accumulate. This post breaks down their data-driven insights into the market's current state.

Serious Market Situation

Brian and Maksim began the stream by acknowledging the tough times in the market. They set a serious tone, noting that the bleeding had not stopped. The conversation moved away from jokes to address the significant price corrections and the psychological toll on traders.

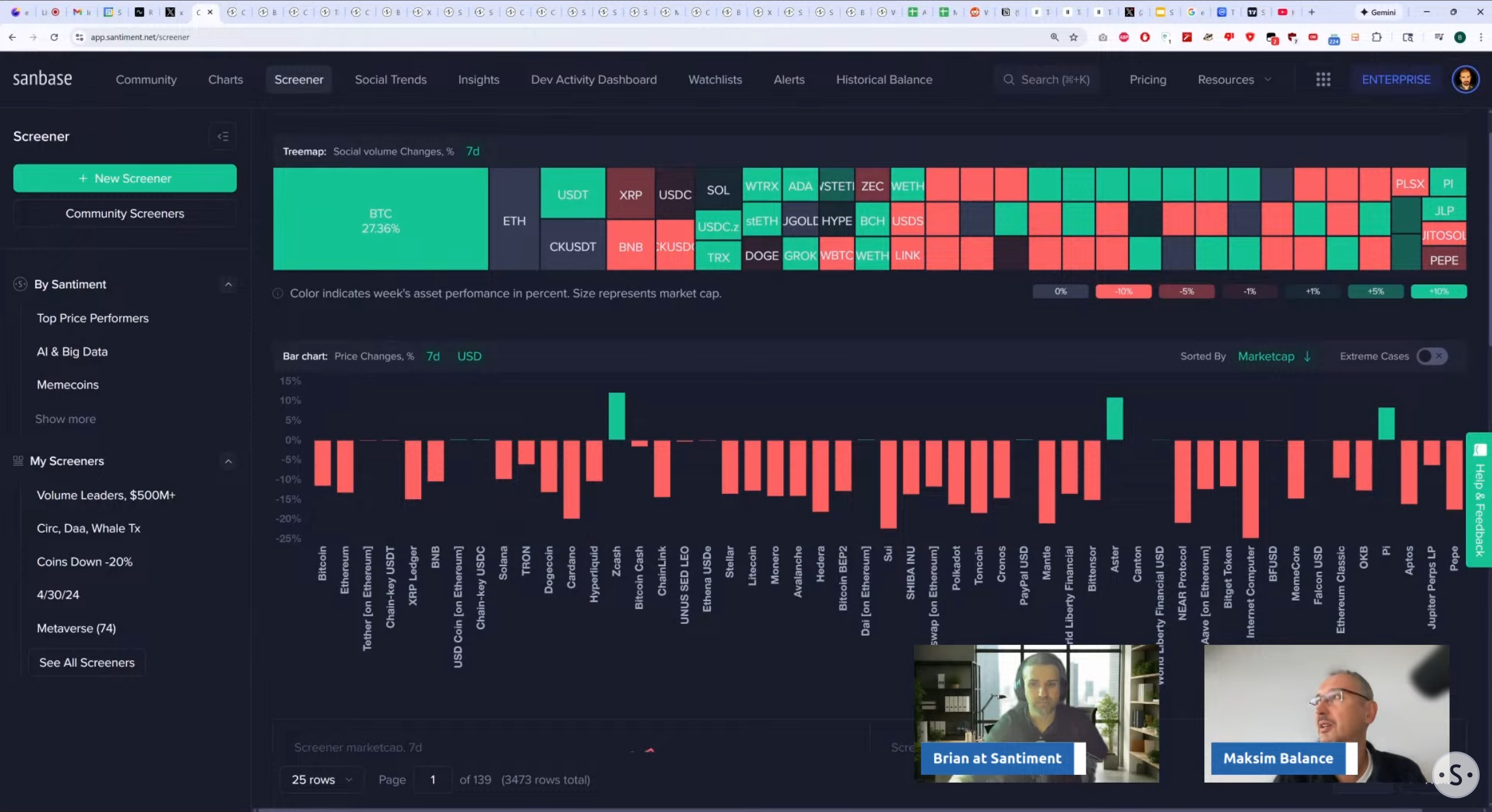

- Key Data: The market experienced significant price corrections, with Bitcoin down 11.5% and Ethereum down over 13% at one point.

- Actionable Tip: Recognize that market downturns are a normal part of the cycle and prepare psychologically for volatility.

[02:20] Trading During a Bloodbath

Brian and Maksim discussed how a rational trader handles a market bloodbath. Maksim explained that true rationality is built on understanding deep irrationality and emotion. He shared his approach to digesting major corrections by focusing on a systematic plan rather than emotional reactions.

- Key Data: The discussion highlighted the emotional impact of sharp price drops, such as an 11.5% fall in Bitcoin and over 13% in Ethereum.

- Actionable Tip: Develop a trading plan based on logic and data, not on fear or greed, to make sound decisions during market volatility.

[03:19] You Can't Time the Bottom

Maksim shared a core lesson from his nine years of trading: it is not possible to consistently pick the exact bottom. He explained that the true bottom often arrives when you lose interest or are too scared to buy. In his experience, successfully buying the bottom or selling the top is more about luck than skill, happening less than one time out of ten.

- Key Data: Maksim estimates that timing the exact market bottom or top successfully occurs less than 10% of the time, often relying on luck.

- Actionable Tip: Focus on entering and exiting positions within strategic ranges rather than trying to pinpoint exact price levels.

[05:39] Entering the "Buy Zone"

Based on his system, Maksim believes the market has entered an "accumulation buy zone." This does not mean prices cannot go lower. Instead, it signifies a period where the data suggests it is favorable to begin accumulating. This approach is based on identifying clear levels of panic and rational narratives that explain the downturn.

- Key Data: Maksim's system indicates the market is in an "accumulation buy zone," despite potential for further price drops.

- Actionable Tip: Consider adopting a strategy of gradual accumulation during periods of market fear, rather than waiting for a definitive bottom.

[07:17] Build Your Own System

A key piece of advice was for every trader to build their own system. Maksim shared that his approach works for his psychological profile, but others might need a more or less aggressive strategy. Whether it is dollar-cost averaging or another method, having a personal and systematic plan is crucial for navigating market battles without emotion.

- Key Data: The importance of a personalized trading system tailored to individual psychological patterns was stressed.

- Actionable Tip: Create and adhere to a trading system that suits your risk tolerance and emotional responses to market fluctuations.

[09:49] Watching the Mega Whales

Maksim presented a chart showing the behavior of "mega whales," or wallets holding between 1,000 and 10,000 BTC. He pointed out that the market struggles to rally when this group is selling. Recently, these large holders have stopped selling and started accumulating, a critical condition for a potential market recovery.

- Key Data: The holding patterns of wallets with 1,000-10,000 BTC (mega whales) are a key indicator; their balances had been declining, but recently started increasing.

- Actionable Tip: Track the accumulation or distribution trends of large wallet holders as a potential leading indicator for market direction.

[12:28] Whales Buy, Retail Sells

A clear divergence in behavior is visible between the largest and smallest players. While mega whales are buying early into the downturn, small retail wallets are decreasing their holdings. This pattern, where large, patient money absorbs the panic-selling from smaller holders, is a classic sign of a potential market bottom forming.

- Key Data: Mega whales (1k-10k BTC) are showing accumulation behavior, while small wallets (less than 0.01 BTC) are decreasing holdings.

- Actionable Tip: Observe the contrasting actions of large and small holders; increasing whale accumulation while retail sells can signal a shift in market sentiment.

[18:21] Have Retailers Capitulated?

Brian addressed the central question: have retail traders given up? The data suggests the answer is yes. Small holders have been dumping their coins for the past five to six days. This capitulation, combined with whale accumulation, strengthens the case for an upcoming price reversal as selling pressure from the crowd subsides.

- Key Data: Retail investors have been selling off for approximately five to six days, indicating potential capitulation.

- Actionable Tip: Recognize that widespread retail selling can be a contrarian indicator, often preceding a market bottom as the most fearful participants exit.

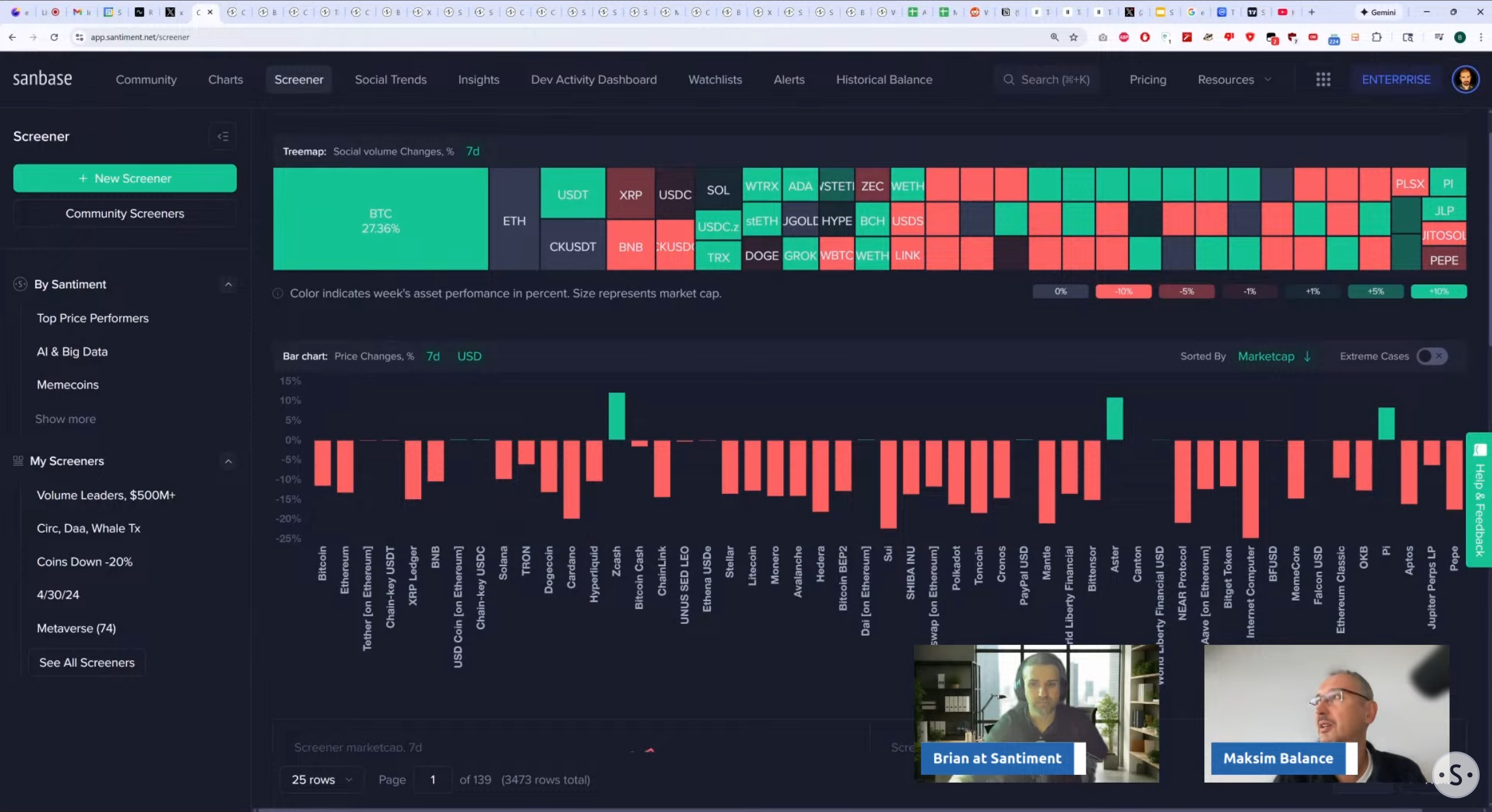

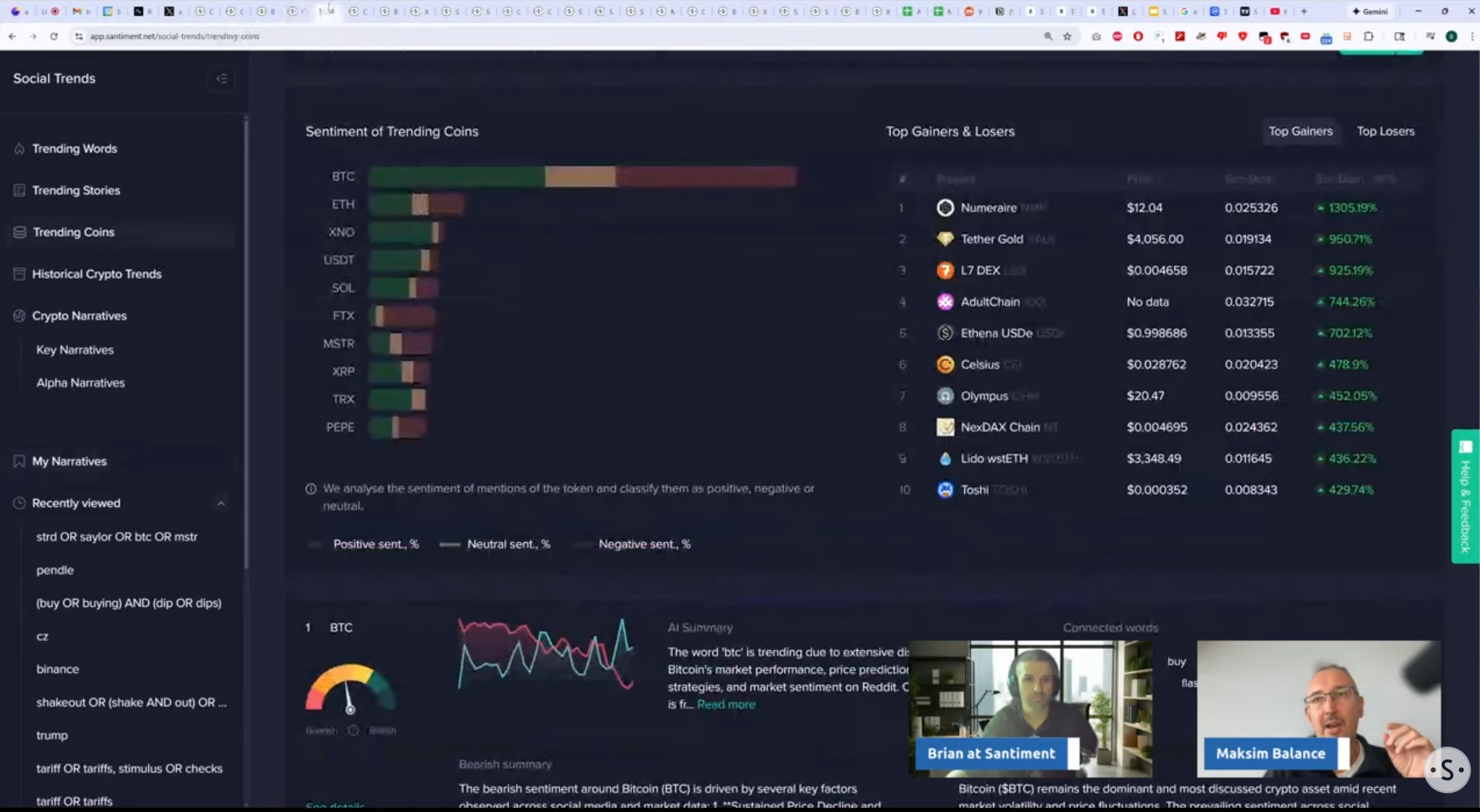

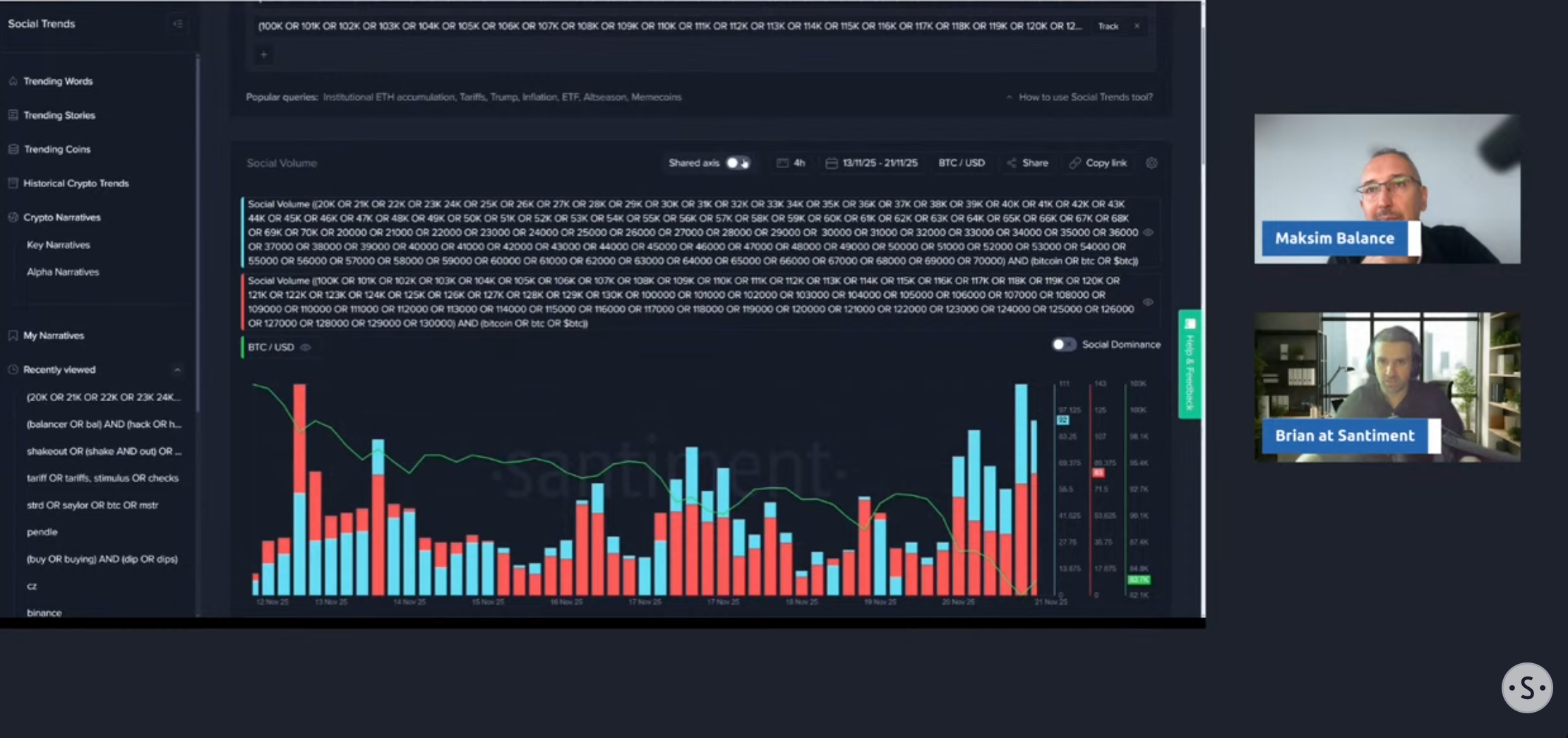

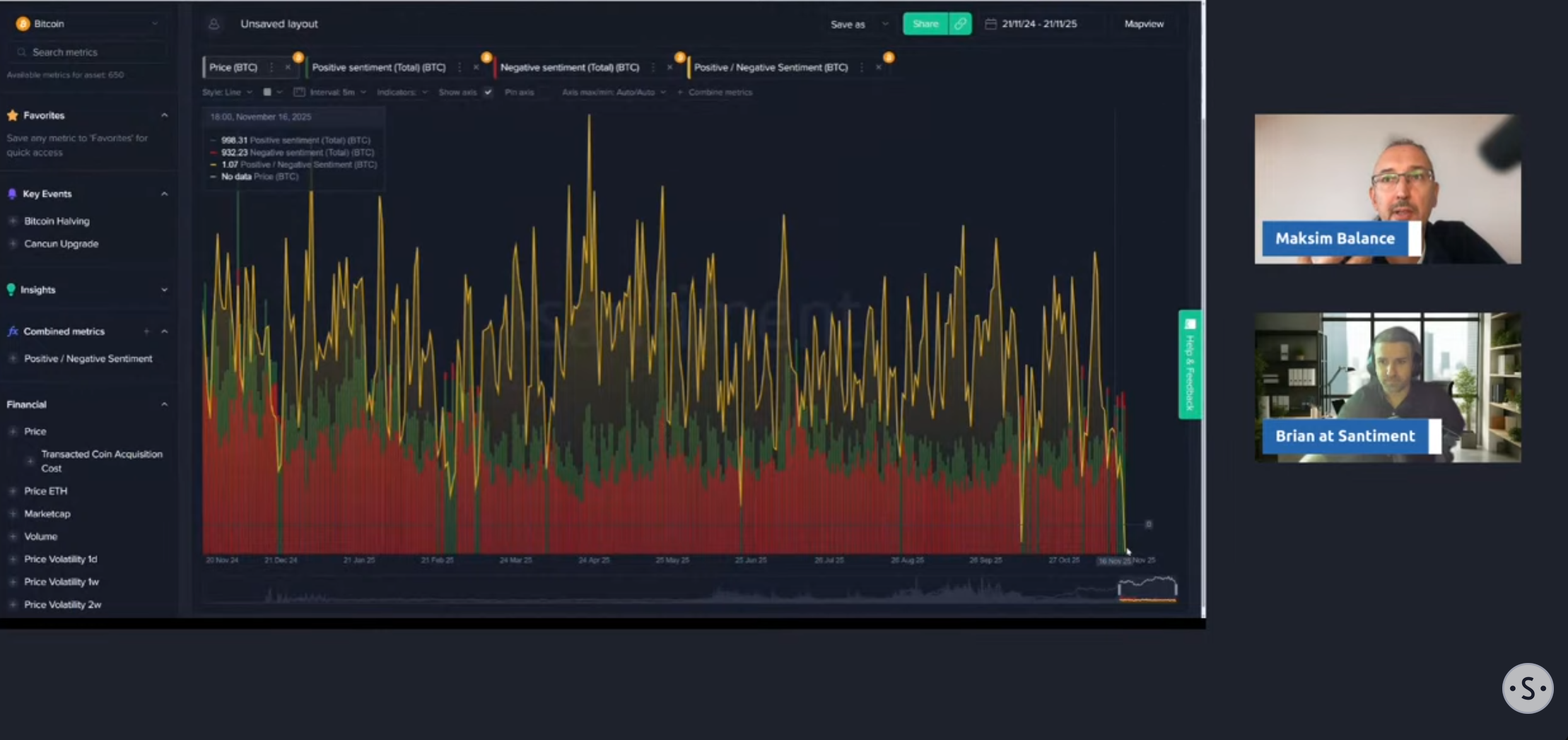

[20:59] Sentiment Hits Yearly Low

Social sentiment data paints a grim picture. Brian showed a chart revealing that the ratio of bullish to bearish comments has plummeted to 0.69, the lowest level seen all year. This extreme level of fear and negativity across social platforms is a strong contrarian indicator, often appearing just before a market bounce.

- Key Data:** The bullish-to-bearish sentiment ratio has dropped to 0.69, the lowest point of the year.

- Actionable Tip:** Pay attention to extreme negative sentiment as it can signal a potential buying opportunity, as the market may have overreacted.

[22:38] MVRV Signals a Rebound

The Market Value to Realized Value (MVRV) metric further supports the idea of a potential recovery. The 30-day MVRV is at -16.5%, and the long-term MVRV is at -20%. Both figures are deep inside the "opportunity zone," indicating that average traders are holding significant losses. Historically, such low MVRV levels have preceded strong recovery rallies.

- Key Data: The 30-day MVRV is -16.5% and the long-term MVRV is -20%, both indicating an "opportunity zone."

- Actionable Tip:** Use metrics like MVRV to identify potential undervalued market conditions that historically lead to recovery rallies.

[25:25] Will the Fed Cut Rates Again?

The possibility of a third interest rate cut from the Federal Reserve was also discussed. The odds are currently a coin flip, around 50/50. While previous rate cuts helped fuel market rallies, Brian and Maksim noted that its potential impact this time is less certain and may not be the primary market driver.

- Key Data: The market is split on the likelihood of a third Fed rate cut, with odds around 50/50.

- Actionable Tip: Stay informed about macroeconomic factors like interest rate decisions, but don't rely on them as the sole driver of crypto market movements.

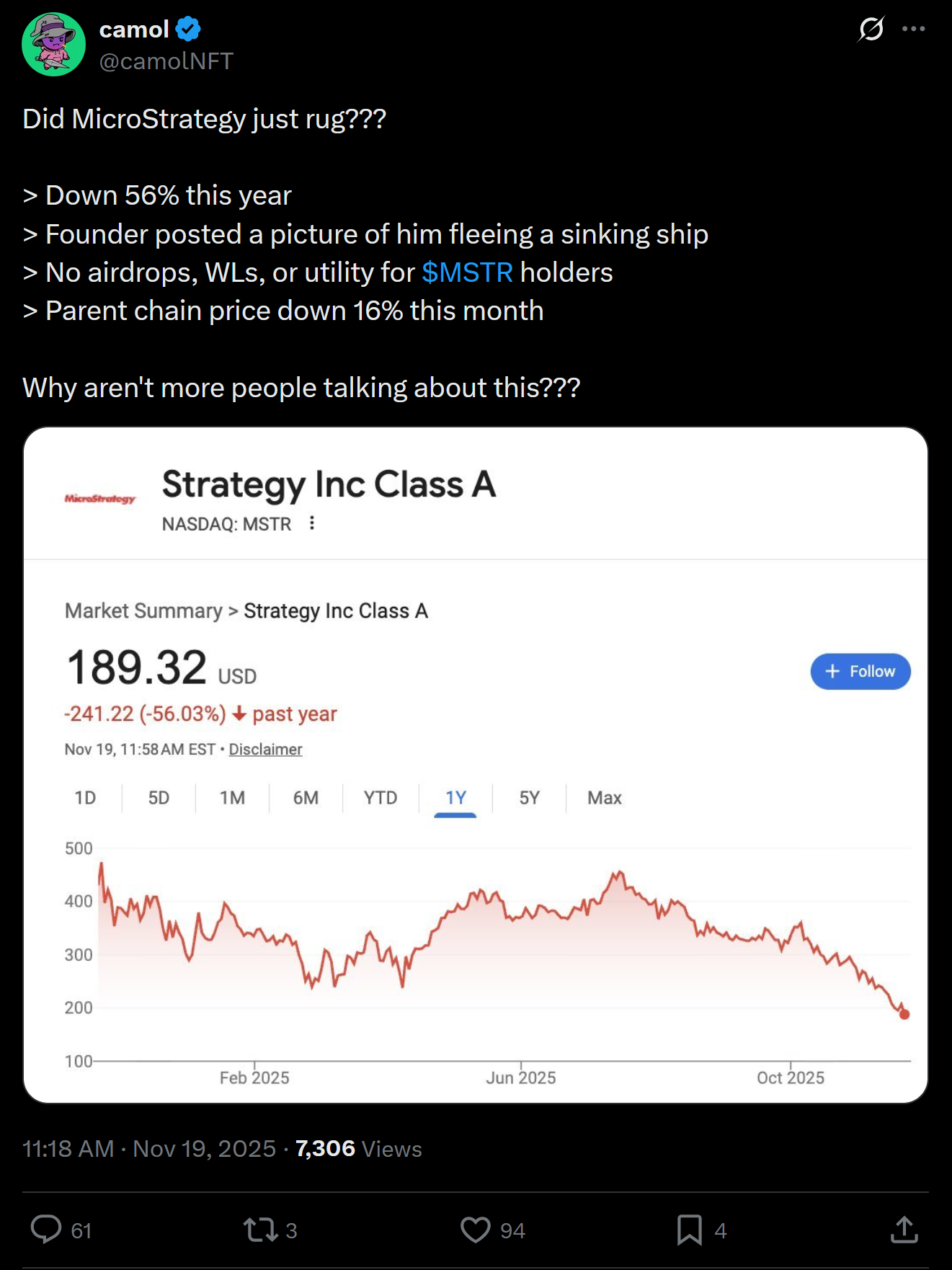

[27:03] Microstrategy Liquidation Risk

Looking at bigger topics, Maksim raised the idea of a future Microstrategy liquidation event. He suggested that if the market remains suppressed long enough, large corporate Bitcoin holders could face pressure. While not an immediate threat, it is a long-term narrative that traders are beginning to consider.

- Key Data: There is ongoing discussion about the potential for large corporate Bitcoin holders, like Microstrategy, to face liquidation if the market stays suppressed.

- Actionable Tip: Consider the financial health and leverage of major crypto-holding companies as a potential factor in market stability.

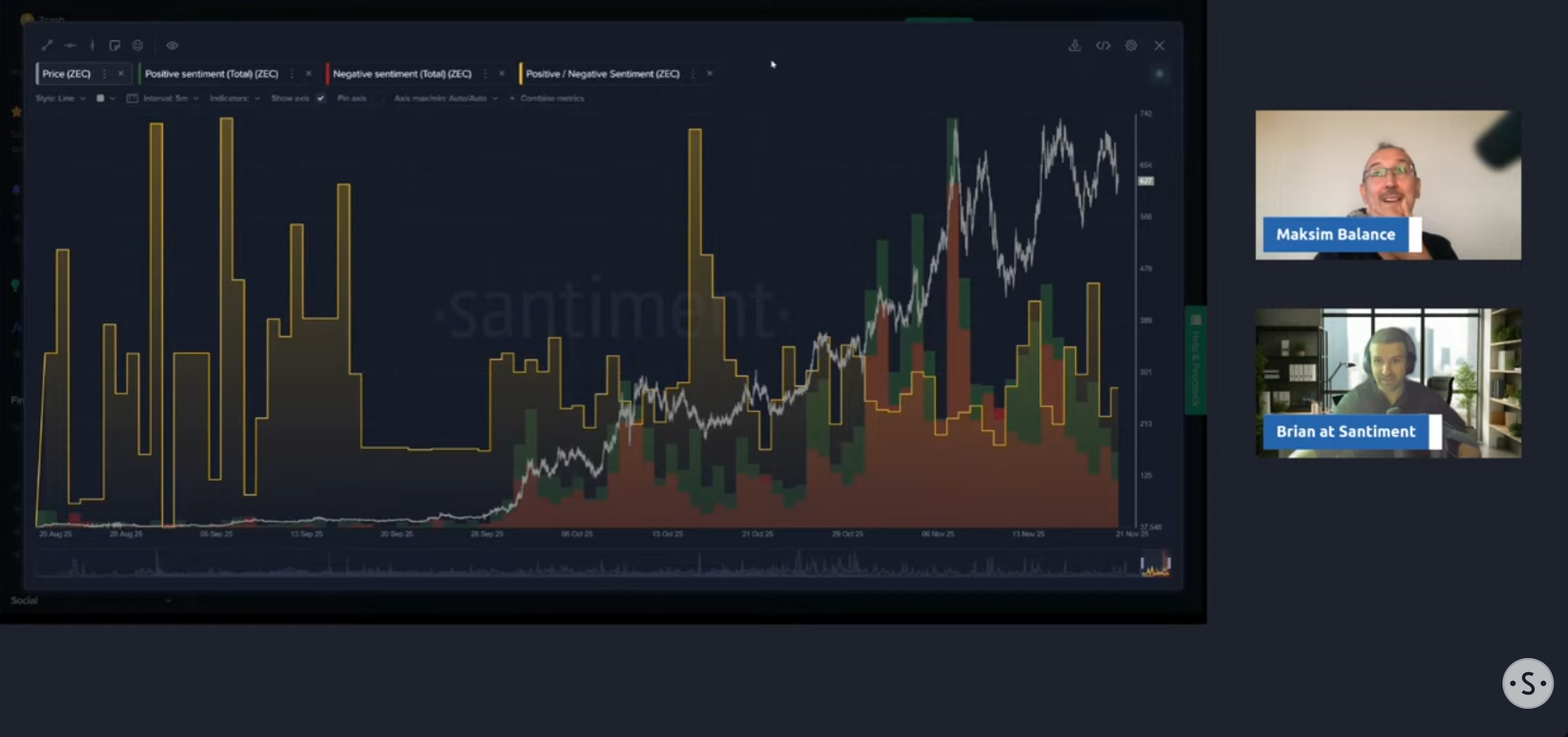

[33:19] Zcash's Surprising Rally

In a surprising turn, Zcash has been one of 2025's strongest performers. The coin, which many considered a "dinosaur," has rallied an incredible 1128% in the last two months. This unexpected surge shows that opportunities can arise from forgotten corners of the market.

- Key Data: Zcash has seen an extraordinary 1128% price increase in the last two months, outperforming many major cryptocurrencies.

- Actionable Tip: Keep an eye on less-discussed altcoins, as significant price movements can occur unexpectedly, rewarding patient holders.

[43:14] Is a Relief Rally Coming?

Both Brian and Maksim concluded that the data points toward a market nearing a bottom. The combination of retail capitulation, low sentiment, whale accumulation, and key metrics in the opportunity zone suggests a relief rally could be near. While long-term direction is uncertain, conditions appear favorable for a short-term rebound.

- Key Data: A combination of factors, including retail capitulation and positive on-chain metrics, suggests a potential short-term relief rally.

- Actionable Tip: Be prepared for a potential short-term upward price movement, but remain cautious about long-term market direction until more sustained trends emerge.

Conclusion

This livestream offered a masterclass in using data to maintain a level head during a chaotic market. The key takeaways are clear: retail sentiment is at rock bottom, large investors are buying, and multiple on-chain metrics are flashing buy signals. By focusing on a systematic, data-driven approach, traders can better understand market dynamics beyond the fear and hype.

To get more insights like these, be sure to watch the full video and tune in for the next weekly summary.