This Week in Crypto, Full Written Summary: W2 January 2026

Whales Buy the Dip While Gold Hits All-Time Highs

Executive Summary

- Whales Are Aggressively Accumulating: While retail traders panic sell, "smart money" wallets (holding 10-10k BTC) have bought over 34,000 Bitcoin in the last 5 days, a divergence that historically signals a market bottom (chart).

- The Macro Catch-Up Play: Bitcoin is currently lagging significantly behind Gold and the S&P 500, which are hitting all-time highs. This deviation suggests a massive reversion-to-mean opportunity for crypto to close the gap (chart).

- Supply Shock Triggered: A sudden outflow of 19,700 BTC from exchanges in a single 4-hour window, paired with record-breaking $19.6B ETF trading volume, points to a looming liquidity crunch (chart).

Introduction

Welcome to another market update from Santiment. In this special solo broadcast, Brian breaks down a volatile week for digital assets amidst a backdrop of political tension in the US. The crypto landscape in early 2026 remains complex as Bitcoin fights to reclaim ground while traditional assets like Gold soar. This week’s data reveals a striking divergence between retail traders and market whales that could signal the next major move. Here is what the on-chain metrics say about the path to 100K.

00:00 - Political Unrest & Its Impact on Crypto Markets

The US political climate continues to influence financial markets heavily as protests and investigations surrounding the Federal Reserve Chair create uncertainty. Brian notes that investors are fixated on the "will they, won't they" saga regarding interest rates, but political instability is currently acting as a central focus point for volatility. This external pressure causes price fluctuations that often have little to do with actual blockchain fundamentals or adoption.

- Key Data: Political unrest and Fed investigations are currently primary market drivers.

- Actionable Tip: Don't ignore geopolitical news headlines as they are triggering short-term volatility right now.

Photo Andrew Harrer Bloomberg via GettyImages

01:44 - 30-Day Recap: Bitcoin, Ethereum & Altcoin Leaders

Despite the noise on social media, the charts show a strong month with Bitcoin climbing 10.7% since mid-December. While BTC recovered from a low of 89.6K to touch 97.8K, altcoins have been the ones experiencing the largest percentage movements. Ethereum rose 16.3%, Solana gained 17.7%, and Monero surged 53% to a new all-time high(partly due to a laundered stolen funds), suggesting capital may be rotating into riskier, higher beta, assets despite broader economic fears.

- Key Data: Bitcoin +10.7%, Ethereum +16.3%, Monero +53% (30-day).

- Actionable Tip: Look for altcoin opportunities when Bitcoin price action stabilizes after a pump.

04:12 - Is X (Twitter) Suppressing Crypto Content?

You might have noticed fewer crypto posts on your feed recently due to suspected algorithm changes on the X platform. Brian highlights a noticeable drop in social volume for Bitcoin despite price increases, as the visibility of financial content appears suppressed. This lack of organic reach creates a "perceived disinterest" in crypto, dampening retail excitement even when market structures look healthy.

- Key Data: Bitcoin social volume is down significantly compared to mid-December despite price gains.

- Actionable Tip: Turn on notifications for your favorite crypto data accounts to ensure you don't miss intel due to algorithm suppression.

07:44 - Analyzing the Bullish vs. Bearish Sentiment Ratio

Sentiment analysis provides a clearer picture than raw volume, and currently, the ratio of bullish to bearish comments is slightly higher than average. While the market was pessimistic heading into the holidays, that mood shifted with the New Year rally, and Ethereum holders are particularly optimistic right now with sentiment hitting levels not seen since Christmas Eve.

- Key Data: Ethereum sentiment hit its 4th most bullish day in the last six months (chart).

- Actionable Tip: Watch for extreme bullish spikes as they can sometimes act as contrarian sell signals.

10:41 - Why Bitcoin Is Lagging Behind Gold & S&P 500

A major divergence has formed between crypto and traditional assets, with the S&P 500 and Gold hitting fresh all-time highs daily while Bitcoin lags behind. Gold is up 37% over the last six months compared to Bitcoin's 20% drop, as political unrest drives investors toward tangible safe havens. This lag suggests Bitcoin has significant room to grow if it reverts to the mean and follows equities higher.

- Key Data: Gold +37% vs Bitcoin -20% (6-month performance, chart).

- Actionable Tip: Consider this divergence a potential catch-up opportunity for crypto if equities remain strong.

14:45 - Trending Stories & The Monero Hack Explained

The biggest headline involves a massive $282 million theft of Bitcoin and Litecoin where the attacker quickly converted funds into Monero. This buying pressure caused Monero’s price to spike to an all-time high, but Brian warns that price surges driven by criminal laundering are rarely sustainable. It serves as a reminder that price action is not always driven by healthy organic growth or protocol development.

- Key Data: $282 million stolen in hardware wallet scam converted to XMR.

- Actionable Tip: Be extremely cautious investing in assets pumping solely due to hack-related liquidity.

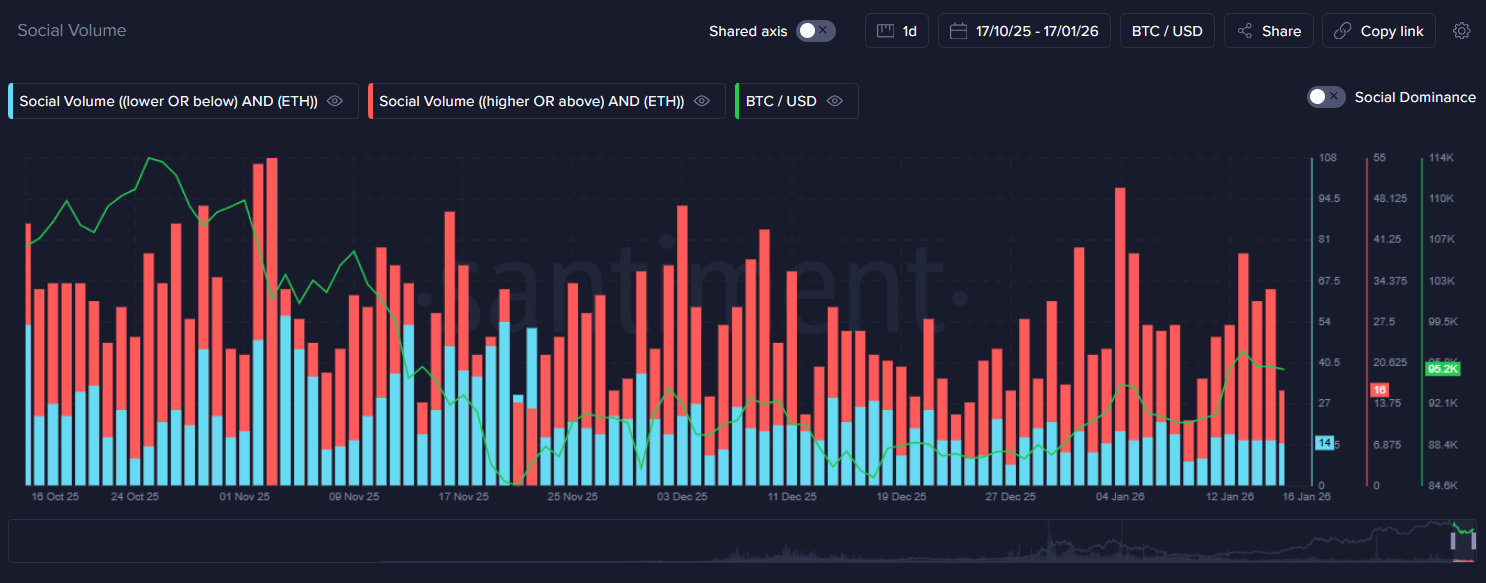

19:39 - Social Trends: "Higher" vs. "Lower" Price Calls

Traders are increasingly calling for higher prices, with mentions of "higher" or "above" far outpacing "lower" or "below" across social platforms. This trend started gaining traction in mid-December on Telegram and Reddit, indicating that the average participant expects the market to recover. While optimism is good, extreme consensus can sometimes precede a correction if the crowd gets too greedy.

- Key Data: "Higher" keywords trending up since mid-Dec; "Lower" keywords trending down (chart).

- Actionable Tip: Monitor crowd consensus; if everyone is certain the price is going "higher," prepare for a potential fake-out.

21:30 - Whales vs. Retail: The Strongest Signal for 100K

The most bullish signal currently is the behavior gap between whales and retail, where wallets holding 10 to 10,000 BTC are accumulating while retail traders dump. History shows prices tend to follow whale activity, and this transfer of wealth from weak hands to strong hands supports the argument for Bitcoin reclaiming the 100K mark soon.

- Key Data: Retail (<0.1 BTC) selling since Saturday; Whales (10-10k BTC) accumulating (chart).

- Actionable Tip: Align your strategy with whale movements rather than reacting to retail panic selling.

25:49 - Data Reveal: Smart Money Accumulation

The on-chain data visualizes this accumulation clearly, with whales adding over 34,000 Bitcoin to their holdings since January 10th. In that same five-day window, retail investors reduced their collective holdings by 0.34%, marking a massive shift of capital from impatient traders to long-term stakeholders.

- Key Data: Whales bought 34,666 BTC in the last 5 days.

- Actionable Tip: Watch the wallet balance charts to learn about sentiment from different sized holder classes. Note: Santiment PRO subscription is required for realtime data.

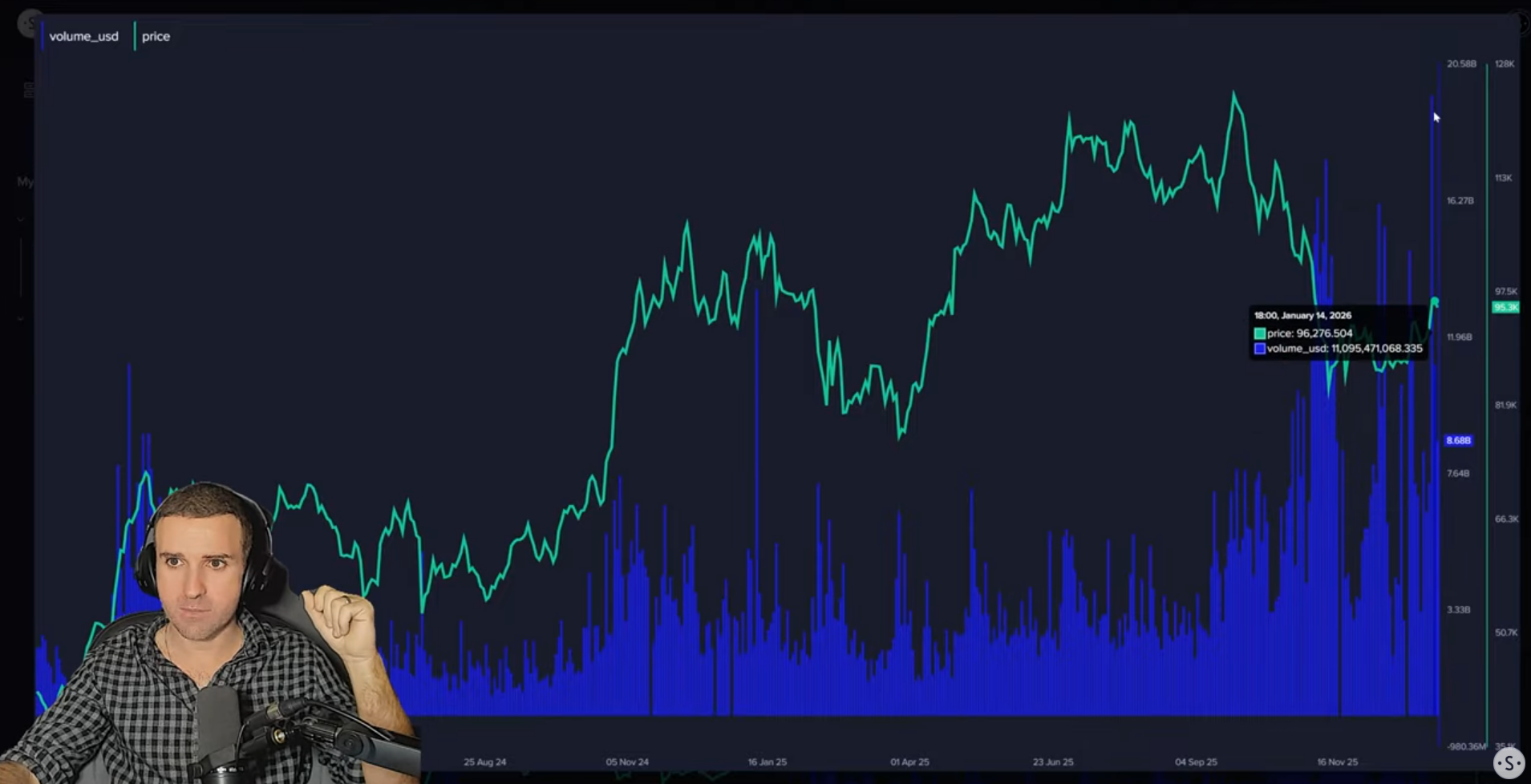

28:23 - ETF Update: Record Volume & Inflow Analysis

Institutional interest remains hot as Bitcoin ETFs saw their highest volume day ever this week with over $19.6 billion traded. While volume spikes often correlate with inflows, Brian cautions that sudden, massive volume records can sometimes mark local tops. Consistent, moderate inflows are generally healthier for sustained growth than single-day frenzy records.

- Key Data: ATH $19.6 Billion ETF volume on Wednesday (chart).

- Actionable Tip: Treat massive volume spikes as a potential short-term cooling-off signal.

33:18 - MVRV Metrics: Is Bitcoin Currently Overvalued?

The Market Value to Realized Value (MVRV) ratio is currently neutral, with the 30-day metric at +5% and the 365-day metric at -5%. This indicates the market is neither overbought nor oversold, sitting in a middle ground that allows for movement in either direction. The best buying opportunities typically occur when both lines dip deep into negative territory.

- Key Data: 30-day MVRV (+5%); 365-day MVRV (-5%) (chart).

- Actionable Tip: Wait for MVRV to turn negative for the safest, high-probability entry points.

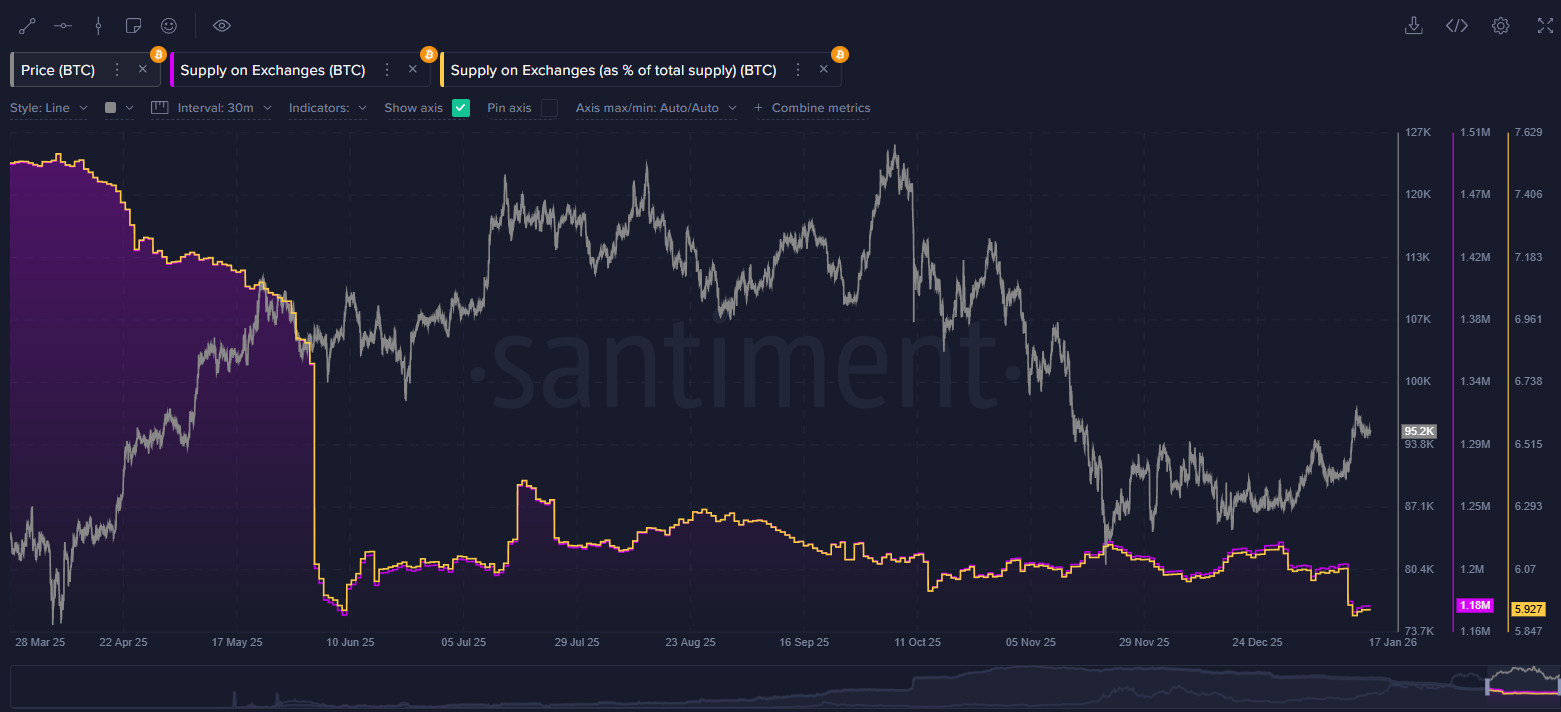

35:50 - Supply Shock: Massive Bitcoin Outflows from Exchanges

A significant supply shock occurred this week when over 19,700 Bitcoin moved off exchanges in a single four-hour span. This was the second-largest outflow spike in six months, leaving only 1.18 million BTC on exchanges. This declining supply creates a scarcity effect that supports upward price action if demand from ETFs continues.

- Key Data: 19,720 BTC outflow in 4 hours; Exchange supply down to 1.18M (chart).

- Actionable Tip: Monitor exchange supply; continued outflows suggest reduced sell pressure for the near future.

Conclusion

The data paints a picture of a market leaning towards the upside. While political unrest and retail fatigue create noise, the underlying signals are strong. Whales are buying, supply on exchanges is plummeting, and institutional ETFs are seeing record volume. Bitcoin may be lagging gold for the moment, but the smart money is positioning for a catch-up rally.

Spotting, analyzing, and understanding the markets is easier with the right tools and a strong like-minded community. Sign up for app.santiment.net and join our discord for more frequent and timely analysis of the crypto markets.

For more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.