This Week in Crypto, Full Written Summary: W2 December

Gold Soars While Bitcoin Stalls

Executive Summary

- Fed Rate Cut Disappoints: The Federal Reserve's third consecutive rate cut failed to ignite a crypto rally, triggering a classic "sell the news" event that caught many off guard.

- Gold Outshines Bitcoin: A massive performance gap has emerged in 2025. Gold has soared over 61% and the S&P 500 is up 17.5%, while Bitcoin has posted a slight loss for the year.

- Whales Accumulate, Retail Holds: On-chain data reveals a key divergence. Large investors have continued accumulating Bitcoin, while smaller holder balances remain flat, meaning they continue to hold their positions without capitulating.

Introduction

The Federal Reserve delivered its third consecutive rate cut, an event that typically excites markets. Yet, Bitcoin’s reaction was lukewarm, leaving many traders puzzled. In the final "This Week in Crypto" stream of 2025, Brian explored the complex market dynamics at play. This summary covers the key stories, from a classic "buy the rumor, sell the news" event to the shocking performance gap between Gold and Bitcoin this year. We also look at what on-chain data reveals about the actions of large and small investors.

Fed’s 3rd Rate Cut of 2025

The Federal Reserve cut interest rates by 25 basis points for the third time in a row. This move was widely expected by the market. Crypto has become very correlated with the S&P 500, so Fed decisions are impactful. After rate hikes in 2022 hurt the market, a series of cuts in 2023, 2024, and now late 2025 were expected to be positive.

- Key Data: The Fed delivered a 25 BPS interest rate cut, the third consecutive one since September 2025.

- Actionable Tip: Pay attention to Federal Reserve (FOMC) meetings. Their monetary policy decisions continue to heavily influence crypto market sentiment.

"buy the rumor, sell the news" Shakes Retail

Following the Fed's announcement, the market saw a classic "buy the rumor, sell the news" reaction. Many retail traders anticipated a price surge after the rate cut was confirmed. While there was a brief initial jump, prices quickly fell, catching hopeful investors off guard. This pattern is common, where the market prices-in an expected event before it happens.

- Key Data: After the news, Bitcoin saw a brief 2-3% jump before prices fell, while Ethereum saw a slightly stronger upward movement of 12% before dropping right back down.

- Actionable Tip: Be cautious around highly anticipated news events. The market often prices in the outcome beforehand, leading to unexpected price action.

FUD Alert: Did Binance Dump $100M in BTC?

Just before the Fed's decision, a post on X from DeFiTracer caused a stir. It claimed that Binance sold over $100 million in Bitcoin within an hour. This sparked fear that insiders knew something. The post turned out to be fear-mongering, since this kind of activity is part of market making operational processes. This highlights the propensity for drama that surrounds major economic announcements.

- Key Data: An unverified claim on X stated that Binance sold over $100 million in Bitcoin in just one hour.

- Actionable Tip: Verify information from social media sources before acting on it. Unverified or misrepresented claims, often called FUD (Fear, Uncertainty, and Doubt), can be used to manipulate market sentiment.

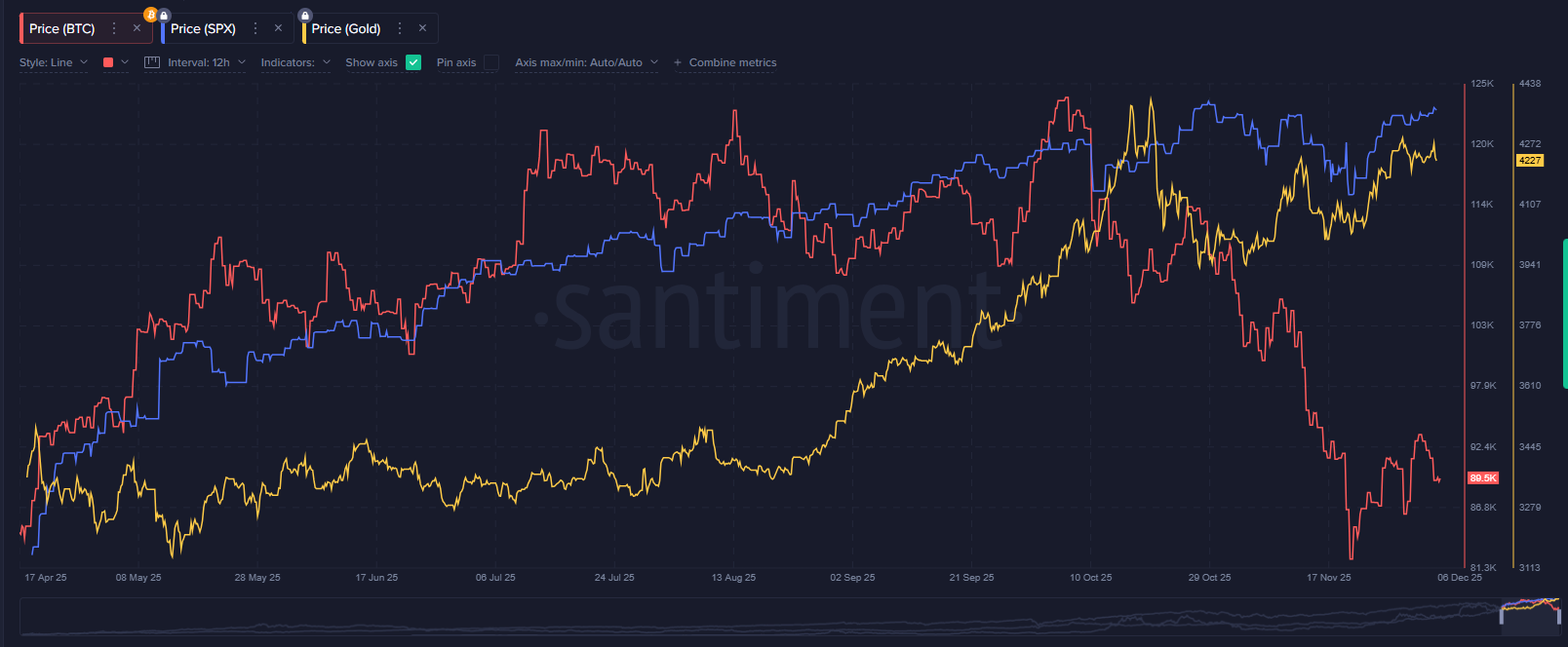

Performance Gap: Gold vs. S&P 500 vs. Bitcoin

A look at year-to-date performance reveals a surprising trend. Gold has surged over 61%, and the S&P 500 is up a healthy 17.5%. In stark contrast, Bitcoin is down about 3.5% on the year. This divergence is frustrating for crypto investors, especially as gold, the original safe-haven asset, is performing so strongly.

- Key Data: Year-to-date performance: Gold +61%, S&P 500 +17.5%, and Bitcoin -3.5%.

- Actionable Tip: Look at the financial markets as a whole and compare crypto's performance to other asset classes like stocks and commodities to gauge relative strength and perform macro analysis.

Whale Watch: Large Wallets Resume Accumulation

On-chain data offers a clearer picture of investor behavior. Wallets holding 10 to 10,000 BTC began accumulating again around November 30th. This group had been selling heavily since early October, a period when Bitcoin's price dropped significantly. Their renewed buying is a potentially positive sign, as their movements often lead the market.

- Key Data: Wallets holding 10 to 10,000 BTC began accumulating after Nov. 30th, following a massive sell-off that started Oct. 8th.

- Actionable Tip: Track the supply held by large wallet tiers. A shift from distribution to accumulation by these "whales" can be a leading indicator of market direction.

Retail Sentiment: Are Small Holders Capitulating?

While large players accumulate, small retail holders (with less than 0.01 BTC) have been buying the dips since the October highs. They are acquiring more coins as prices fall. For a true market bottom to form, we often see these smaller wallets show signs of giving up or capitulating. Currently, they are still holding on and even adding to their positions.

- Key Data: Small wallets have been steadily increasing their holdings since the October all-time high, even as prices have fallen.

- Actionable Tip: Contrast the behavior of small wallets with large wallets. A divergence, where whales buy and retail sells (capitulates), has historically signaled market bottoms.

Do Kwon sentenced to 15 years for Terra fraud

In major industry news, Terra founder Do Kwon was sentenced to 15 years in prison for his role in the $40 billion fraud related to the collapse of TerraUSD. This news brought a sense of justice for the many investors who suffered massive losses.

- Key Data: The sentence relates to a $40 billion fraud from the collapse of the TerraUSD stablecoin.

- Actionable Tip: Stay informed about major legal and regulatory outcomes in the crypto space, as they can impact investor confidence and project legitimacy.

Is the 4-Year Cycle dead? 2026 predictions

There is a growing debate about the reliability of Bitcoin's historical four-year cycle. The theory suggests predictable market behavior based on Bitcoin's halving events. However, 2025 did not follow the bullish pattern of past post-halving years like 2017 and 2021. With institutional involvement and wider adoption, the market may no longer follow old patterns.

- Key Data: 2025 was a break-even year for Bitcoin, unlike historically bullish post-halving years (e.g., 2017, 2021).

- Actionable Tip: Use historical cycles as a guide, not a guarantee. The market evolves as it grows and old patterns may not indicate future outcomes.

Warning: Bitcoin network growth is declining

A look at long-term utility metrics presents a concern. The number of daily active addresses on the Bitcoin network has dropped by about 35% from its peak in May 2021. Other key metrics like network growth and token circulation are also trending down over time. A positive signal would be more users and activity.

- Key Data: Daily active addresses have dropped ~35% from their May 2021 peak of over 1.1 million to an average of 718k.

- Actionable Tip: Monitor on-chain utility metrics like active addresses. A sustained increase in user activity is a positive sign for long-term value.

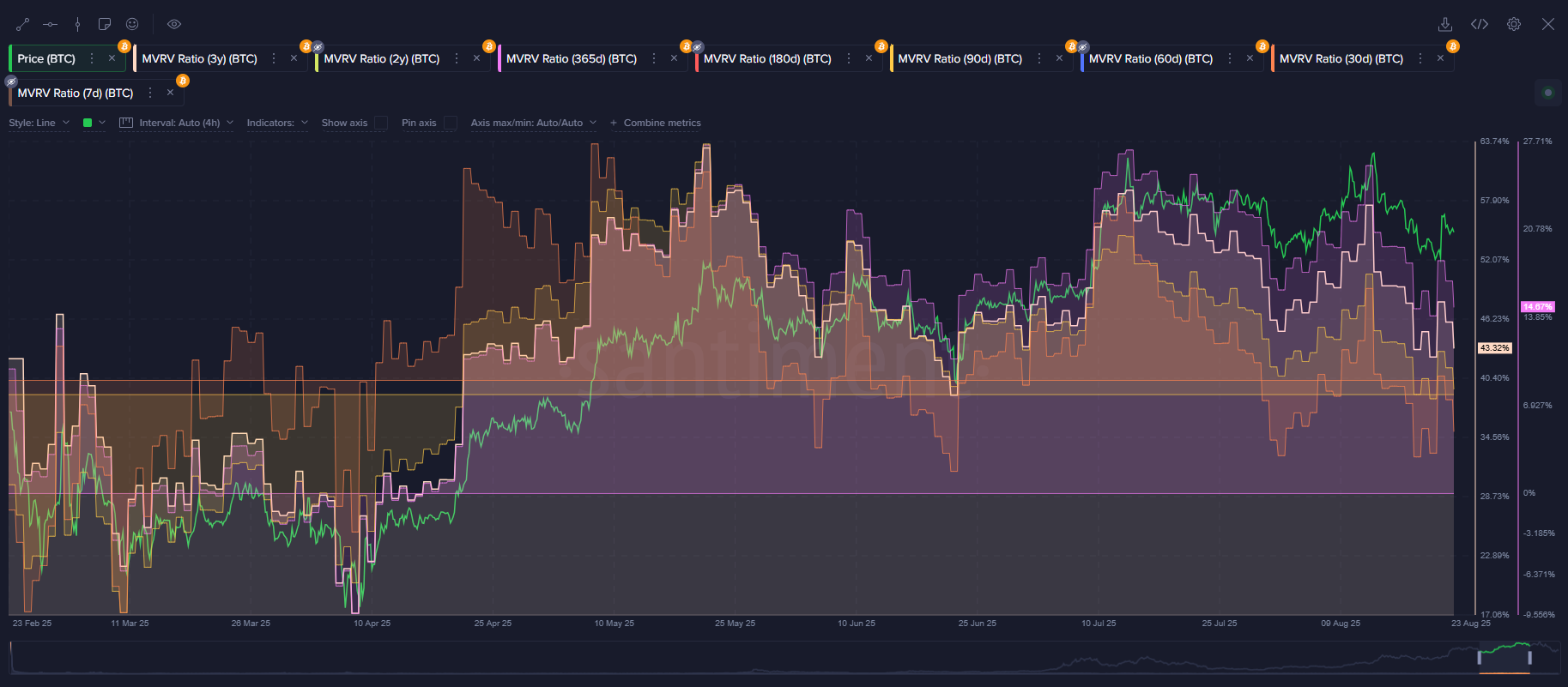

MVRV Analysis: Identifying "Buy Low" zones

The Market Value to Realized Value (MVRV) ratio shows an approximation of the average profit or loss of traders over a specific period of time. In late November, the MVRV for Bitcoin, Ethereum, and other top assets was extremely negative, indicating that average traders were significantly down (chart). This period of "pain" represented a low-risk buying opportunity.

- Key Data: In late November, MVRVs for top assets were in double-digit negative numbers, indicating widespread trader losses.

- Actionable Tip: Use the MVRV ratios to gauge the state of current holders. Extremely negative values suggest trader pain and potentially lower-risk entry points, while high positive values signal euphoria and higher risk.

Trending: Solana, Aave, and Chainlink News

Several other assets are trending due to specific developments. Solana is gaining attention from its upcoming Breakpoint 2026 conference in London. Aave is in the spotlight for debates on its fee allocation, and Chainlink was selected by Coinbase for a major cross-chain protocol integration.

- Key Data: Coinbase selected Chainlink's protocol to bridge over $7 billion in wrapped assets.

- Actionable Tip: Follow trending topics for specific assets. Fundamental developments, partnerships, and events can be significant price catalysts.

Grayscale XRP Trust & institutional adoption

XRP is also making headlines with the launch of the Grayscale XRP Trust. This move provides another way for institutional and accredited investors to gain exposure to XRP, signaling continued interest from traditional finance in digital assets.

- Key Data: The launch of a new Grayscale XRP Trust is a top trending story for the asset.

- Actionable Tip: Keep an eye on new products from major institutional players like Grayscale. These launches can signal growing institutional demand.

Conclusion

This week showed that the crypto market is driven by more than just headlines. While the Fed's rate cut was the main event, on-chain data revealed a deeper story of whale accumulation and resilient retail holders. The significant performance gap between Bitcoin and traditional assets like gold reminds us that market dynamics are always changing.

Understanding the market requires looking at data-driven metrics like network growth and trader profitability. These tools provide insights that price charts alone cannot.

To get more data-driven crypto analysis, subscribe to our YouTube channel, our Substack, or follow us on Santiment Insights.