This Week in Crypto, Full Written Summary: W3 August

Crypto Market Analysis August 15th: All-Time High Letdown?

Executive Summary

Bitcoin's new all-time high has captured the market's attention, but on-chain data reveals a complex and risky picture beneath the surface. For those short on time, here are the key takeaways from this week's analysis:

- A Weak Foundation: Bitcoin's record-breaking price was accompanied by declining on-chain transaction volume, creating a significant bearish divergence that questions the rally's strength.

- Whales vs. Retail: While large "whale" wallets continue to accumulate Bitcoin (a bullish sign), a surge in new, small wallets indicates widespread retail FOMO—a classic warning signal for a market top.

- Ethereum's Overheating: Key metrics show Ethereum is in a far riskier position than Bitcoin, with trader profitability (MVRV) reaching extreme levels that have historically preceded major corrections.

- Greed is Back: Social media sentiment, a rotation of ETF funds into Ethereum, and rising "altcoin season" chatter all point to accelerating greed in the market.

Introduction

The crypto market was electric this week as Bitcoin soared to a new all-time high, pulling Ethereum and other altcoins along for a thrilling ride. But just as euphoria began to set in, the market pulled back. Was this a healthy correction or a warning sign of what's to come?

In their latest livestream Brian and Maksim looked past the price charts to uncover what on-chain and social metrics are telling us. They revealed some critical divergences between price and network activity, a surge in retail FOMO, and what the largest whale wallets are doing behind the scenes. Let's explore their key findings.

[00:15] Bitcoin Hits a New All-Time High, But Is It a Letdown?

The week was marked by major rallies across the board. Bitcoin set a new price record, and Ethereum came within inches of its own all-time high. This bullish price action allowed many altcoins like XRP and Cardano to post significant gains. But the initial excitement of the new peak was quickly followed by a retrace, leaving many traders wondering if the rally has lost its steam.

- Key Data: Bitcoin reached a new all-time high, while Ethereum came "within inches" of its own peak.

- Actionable Tip: When major assets hit all-time highs, observe the market's reaction in the following days. A swift rejection can be more telling than the peak itself.

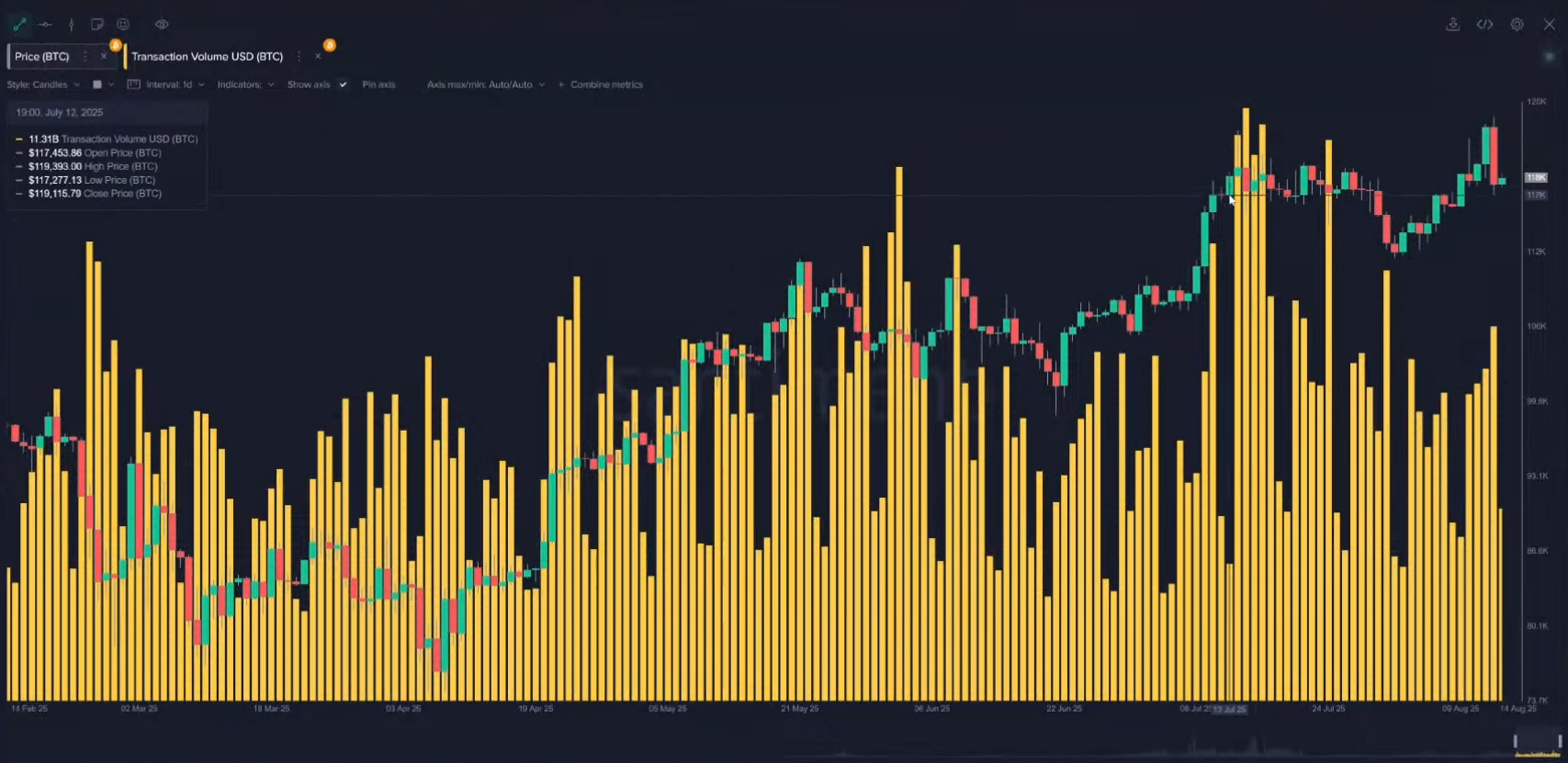

[03:01] Bitcoin's On-Chain Warning: A Bearish Divergence in Transaction Volume

A concerning signal has appeared in Bitcoin's on-chain activity. While the price was setting a new record on August 13th, the daily transaction volume was only $30.88 billion. This is significantly lower than the $48.87 billion peak seen a month prior when the price was lower. This is a classic bearish divergence, just one data-point to suggest the rally may be overheated.

- Key Data: Transaction volume on the day of the ATH was $30.88 billion, nearly $18 billion less than the peak volume a month prior.

- Actionable Tip: Look for divergences between price and on-chain utility metrics like transaction volume. A rising price on falling volume often signals a weak foundation for the rally.

[05:56] MVRV Analysis: Are Bitcoin Traders Dangerously in Profit?

The Market Value to Realized Value (MVRV) ratio shows the average profit or loss of traders. Currently, Bitcoin's 365-day MVRV sits at +21%, meaning the average trader who bought in the last year is well in profit. While not at extreme historical highs, this is considered a mild danger zone, as it increases the risk of profit-taking.

- Key Data: The 365-day MVRV for Bitcoin is at +21%, indicating the average holder who acquired BTC this year is significantly in profit.

- Actionable Tip: Use the MVRV ratio as a gauge for market sentiment. High positive values suggest increased risk of profit-taking, while deep negative values can signal capitulation and potential buying opportunities.

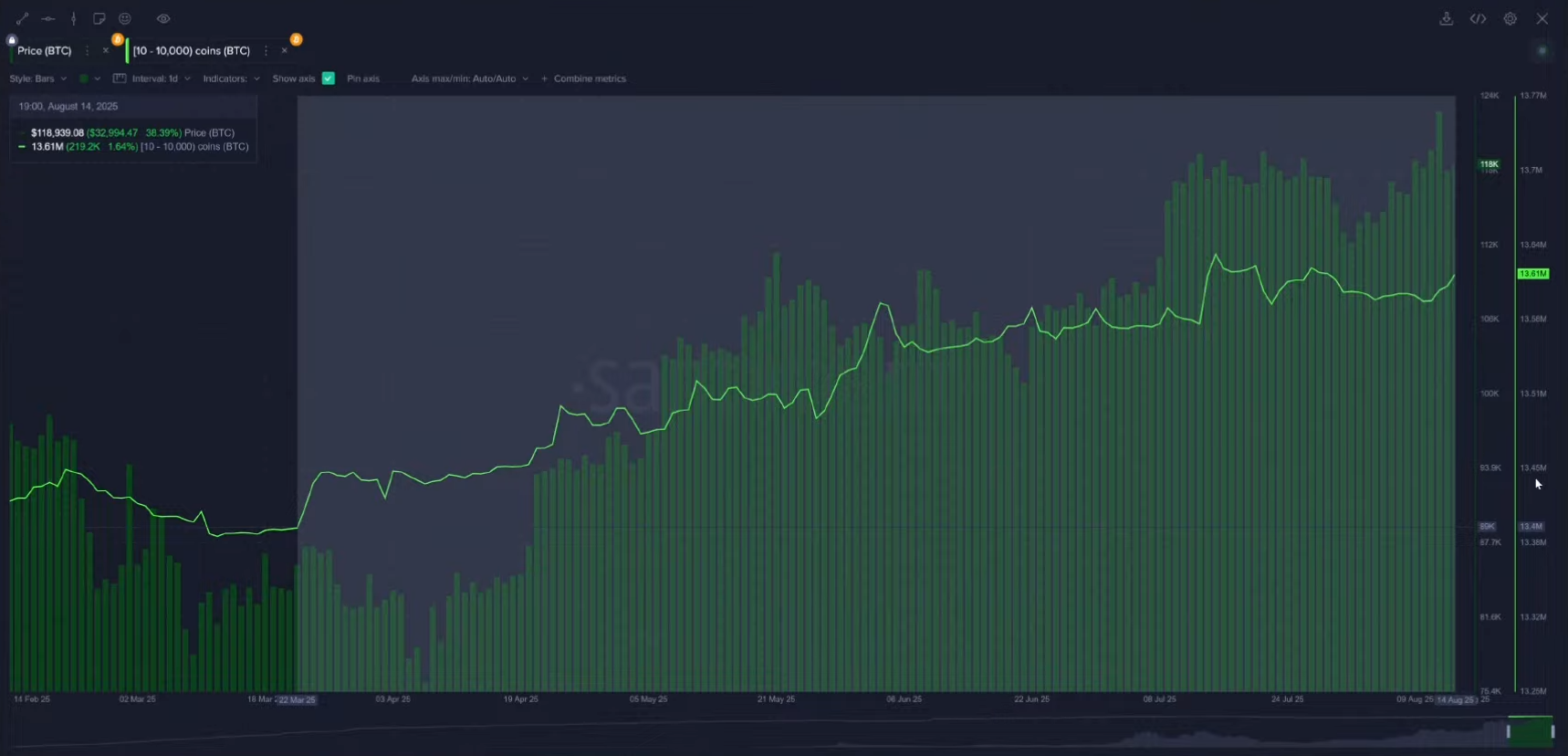

[10:13] What Are the Whales Doing? A Look at Key Stakeholder Accumulation

In a surprisingly bullish sign, Bitcoin's largest holders are not selling into this rally. Wallets holding between 10 and 10,000 BTC have continued to accumulate aggressively, even after the all-time high. In just the last 72 hours, this cohort added another 23,000 BTC to their holdings. This suggests they believe prices have further to climb.

- Key Data: Wallets holding 10 to 10,000 BTC added 23,000 BTC to their balance in the 72 hours following the all-time high.

- Actionable Tip: Track the behavior of large wallet cohorts. When they accumulate during price dips or after new highs, it can signal strong conviction in the market's future direction.

[15:24] Ethereum's MVRV Hits Extreme Levels: How Risky is ETH Right Now?

While Bitcoin's MVRV signals caution, Ethereum's MVRV is flashing major warning signs. Its 30-day MVRV is over +15.5%, a level that historically signals a high probability of a short-term top. Even more telling, its 365-day MVRV is at a staggering +57%, indicating massive unrealized profits and a high risk of a correction.

- Key Data: Ethereum's 30-day MVRV is above +15.5%, a historical danger zone, while its 365-day MVRV is at a massive +57%.

- Actionable Tip: Compare MVRV levels across different assets. An asset with significantly higher MVRV than the market leader may be more vulnerable to a sharp correction.

[20:49] Gauging Crowd Greed vs. Fear with a Unique Social Metric

Maksim and Brian analyzed social media conversations, comparing the frequency of bullish terms like "higher" to bearish terms like "lower." Just before Bitcoin's price peaked, there was a massive spike in bullish chatter, indicating extreme greed. Following the price drop, bearish mentions surged. This custom metric perfectly captured the crowd's emotional cycle.

- Key Data: A massive spike in the ratio of bullish-to-bearish social media terms occurred just before Bitcoin's price peaked.

- Actionable Tip: Monitor social sentiment trends. A surge in euphoric or greedy language across social platforms can often serve as a reliable contrarian indicator for a local top.

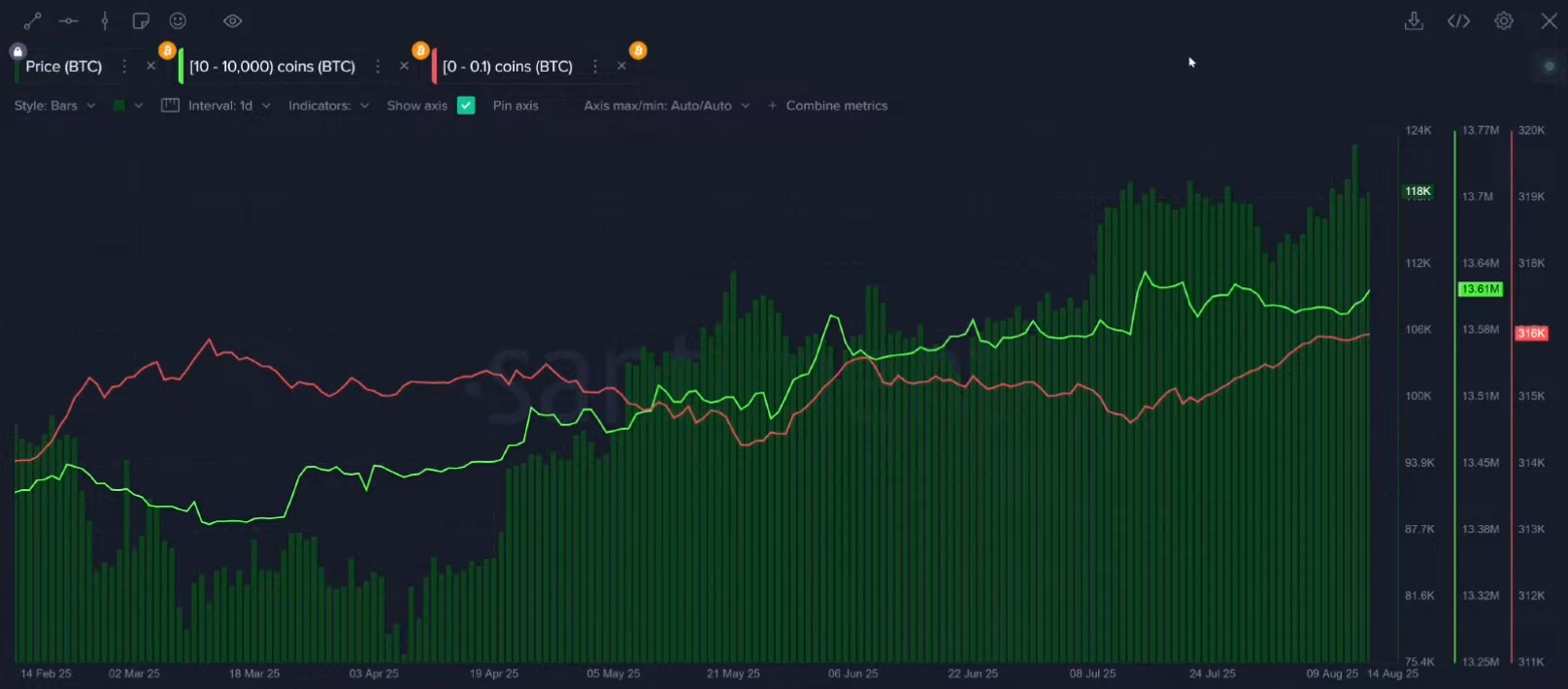

[28:46] Retail FOMO is Back: Small Wallets Are Surging - A Major Warning Sign?

One of the clearest signs of a potential top is the behavior of retail investors. The total number of non-empty Bitcoin wallets has surged from 55.96 million to 56.43 million in just nine days. This rapid increase in new participants is a strong indicator of FOMO (Fear Of Missing Out) and suggests the market is becoming overheated.

- Key Data: The number of non-empty Bitcoin wallets increased by 470,000 in just nine days.

- Actionable Tip: Pay attention to the growth rate of new and small wallets. A sudden, parabolic increase often indicates that less-experienced retail investors are rushing in, which can precede a market correction.

[31:52] Top Trending Stories Moving the Market: Tether, Trump, and Altcoin Season

Several key narratives are influencing market sentiment. The top trending story was Tether minting $1 billion in USDT, signaling a major liquidity boost. Other important topics include the U.S. Treasury confirming a strategic Bitcoin reserve and rising chatter about "altcoin season." The return of this narrative is often a sign of widespread greed.

Source: New Trending Stories feature

- Key Data: The narrative of "altcoin season" is trending, a social indicator that often appears when market-wide greed is high.

- Actionable Tip: Track dominant narratives. When conversations shift from Bitcoin to speculative altcoins, it's a sign that risk appetite is high and caution is warranted.

[38:04] The Big Question: Could Global Conflict Actually Be Bullish for Crypto?

The conversation turned to the broader macroeconomic picture. Maksim shared his view that economic conflict could ultimately test crypto's role as a safe-haven asset. If traditional markets falter while crypto remains resilient, the narrative of "digital gold" could strengthen, attracting capital from investors looking to preserve their wealth.

- Key Data: The discussion highlights the potential for crypto to act as a "digital gold" during times of macroeconomic instability.

- Actionable Tip: Consider how global economic events might influence crypto narratives. A strengthening safe-haven story could change how the market behaves relative to traditional assets.

[41:15] ETF Flows Flip: Is Ethereum Outpacing Bitcoin a Top Signal?

Recent data showed that inflows into Ethereum ETFs were outpacing those for Bitcoin ETFs. Maksim and Brian agreed this is a potential top signal. It suggests that capital is rotating out of Bitcoin and into a higher-risk asset like Ethereum, chasing performance. This shift is a classic sign that greed is becoming excessive.

- Key Data: A notable shift occurred where Ethereum ETF inflows began to surpass Bitcoin ETF inflows.

- Actionable Tip: Monitor capital flows between crypto ETFs. A significant rotation from Bitcoin to altcoin ETFs can signal that participants are chasing higher returns, a common feature of late-stage rallies.

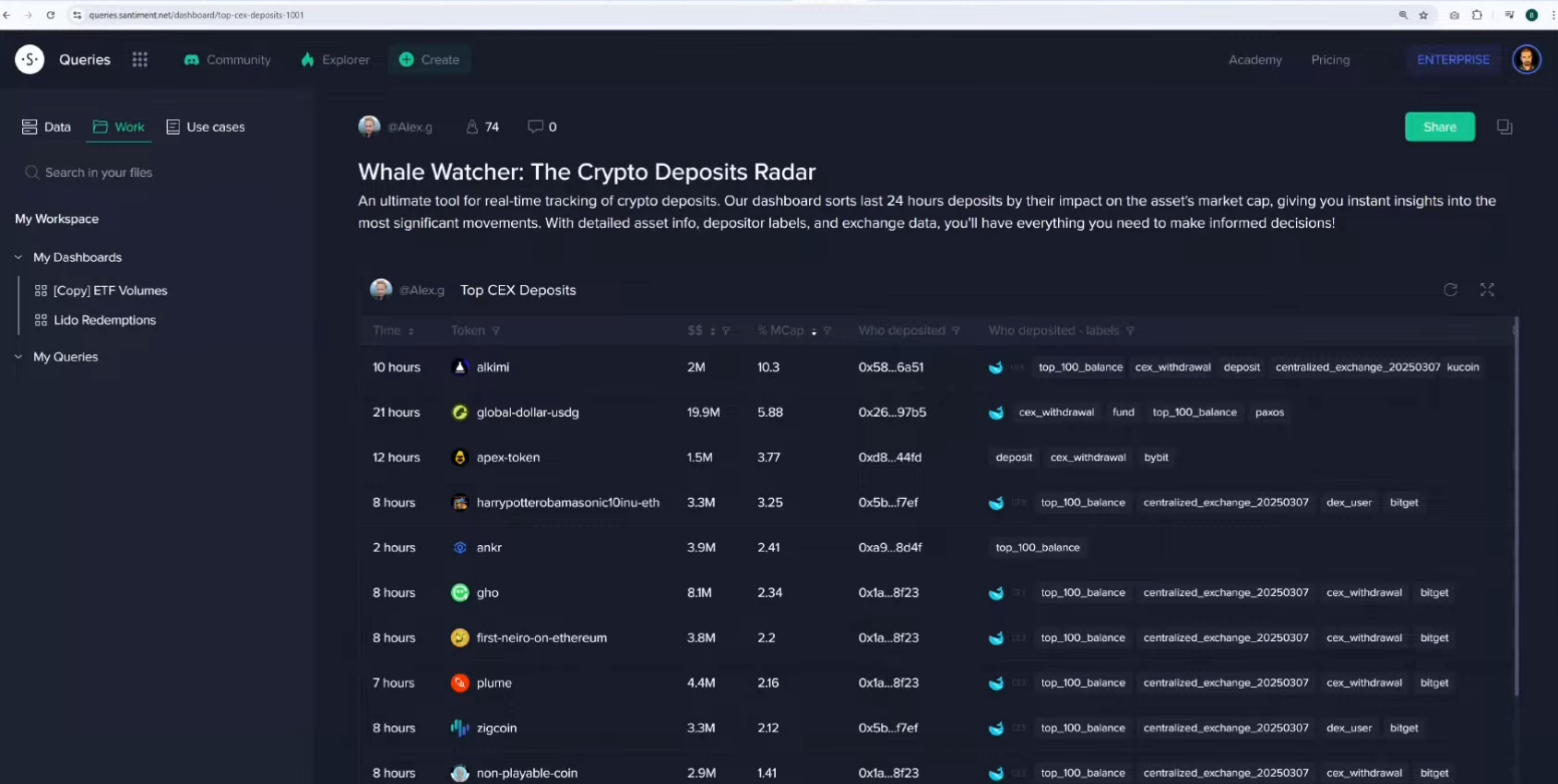

[44:04] Altcoin Deposit Radar: Which Coins Are Whales Moving to Exchanges to Sell?

A look at the crypto deposit radar by user Alex G revealed significant whale movements for several altcoins. This tool tracks large transactions moving to centralized exchanges, which is often a precursor to selling. One standout was Alchemy Pay (ACH), which saw a single transaction worth over 10% of its entire market cap move to an exchange.

- Key Data: A single transaction for Alchemy Pay (ACH) accounted for over 10% of its total market cap being moved to an exchange.

- Actionable Tip: Use exchange inflow tools to spot potential sell pressure. A large spike in deposits for a specific altcoin, especially from whale wallets, is a strong warning that a price drop could be imminent.

[51:00] A Key Ethereum Metric Flashes: Mean Dollar Invested Age Starts to Drop

A fascinating metric for Ethereum, the Mean Dollar Invested Age, has been dropping since July. This indicates that older, dormant ETH is finally being transacted. This "awakening" of old coins often precedes major price volatility and coincided with Ethereum's price rallying over 70% as long-term holders began taking profits.

- Key Data: The drop in Ethereum's Mean Dollar Invested Age began in July, preceding a price increase of over 70%.

- Actionable Tip: Watch for changes in "coin age" metrics. When the average age of coins on a network starts to decrease, it means long-term holders are moving their assets, often leading to increased volatility.

[57:06] Final Warning: The Crowd is Salivating, Here's Why You Should Be Cautious

The overarching theme from the data is one of caution. While whales remain bullish on Bitcoin, several other metrics point to excessive greed and retail-driven FOMO. The crowd is excited, positive sentiment is high, and traders are chasing altcoin pumps. This combination creates a high-risk environment.

- Key Data: The combination of retail FOMO, high positive sentiment, and a chase for altcoins creates a high-risk environment.

- Actionable Tip: Synthesize multiple indicators. Even if one metric (like whale buying) is bullish, weigh it against other bearish signals (like retail greed) to form a more balanced market perspective.

Conclusion

This week's market action provides a perfect example of why looking beyond price is essential. While the new all-time high for Bitcoin was exciting, on-chain and social data revealed a more complex picture filled with warning signs. Bearish divergences, extreme profitability in Ethereum, and surging retail FOMO all suggest the market needs to cool off.

By using a data-driven approach, traders can better understand market dynamics and avoid becoming exit liquidity. The insights from Brian and Maksim serve as a valuable reminder to remain objective, especially when emotions are running high.

To get more data-driven crypto analysis or learn to do it yourself, be sure to subscribe to our Youtube channel, read our insights, explore the academy, and use Sanbase!