This Week in Crypto, Full Written Summary: W1 September

Crypto's Fate Tied to Fed Rate Cut?

Executive Summary

- Fed Rate Cut is Priced In: The market assigns a 99.7% probability to a Fed rate cut this month. While this optimism supports prices, the real danger lies in the small chance the Fed doesn't deliver, which could trigger a sharp downturn.

- Bitcoin's Bullish Divergence: Bitcoin has recently fallen while the S&P 500 has climbed. This rare divergence from the stock market has historically been followed by a strong catch-up rally for BTC.

- Solana's On-Chain Warning: A significant red flag has appeared for Solana. Its price is rising while its network activity is declining, a divergence that suggests the price trend may be unsustainable without a fundamental catalyst.

- Whales and Crowd Sentiment Signal Turns: On-chain data proved highly effective, with whale activity pinpointing XRP's recent top and extreme crowd fear correctly signaling Cardano's price bottom.

Introduction

Welcome to our summary of the latest "This Week in Crypto" livestream. Santiment's founder Maksim and host Brian shared their data-driven perspectives on the market's recent rebound. Their analysis offers a clear view of the forces shaping crypto right now. In this edition, they explored the overwhelming market expectation for a Fed rate cut. They also uncovered a clear on-chain divergence for Solana and revealed what whale activity signals for major assets. Let's look at the key moments from their discussion.

[00:07] Market Overview: Bitcoin Rebounds to $113k & Ethereum Targets $4.5k

The crypto market saw a positive end to the week, with Bitcoin recovering to $113.2k and Ethereum nearing the key $4.5k level. [00:07, 00:31] Despite strong performance from some platform tokens, the broader market remained consolidated, a stability reflected in declining social media discussion as volatility has decreased. [01:09]

- Key Data: Social media discussion about Ethereum dropped by 31% compared to the previous week, signaling a sharp decline in crowd interest. [01:56]

- Actionable Tip: Pay attention to social volume metrics. A significant drop in crowd interest, like Ethereum's, can sometimes precede a price rally as it indicates waning retail speculation.

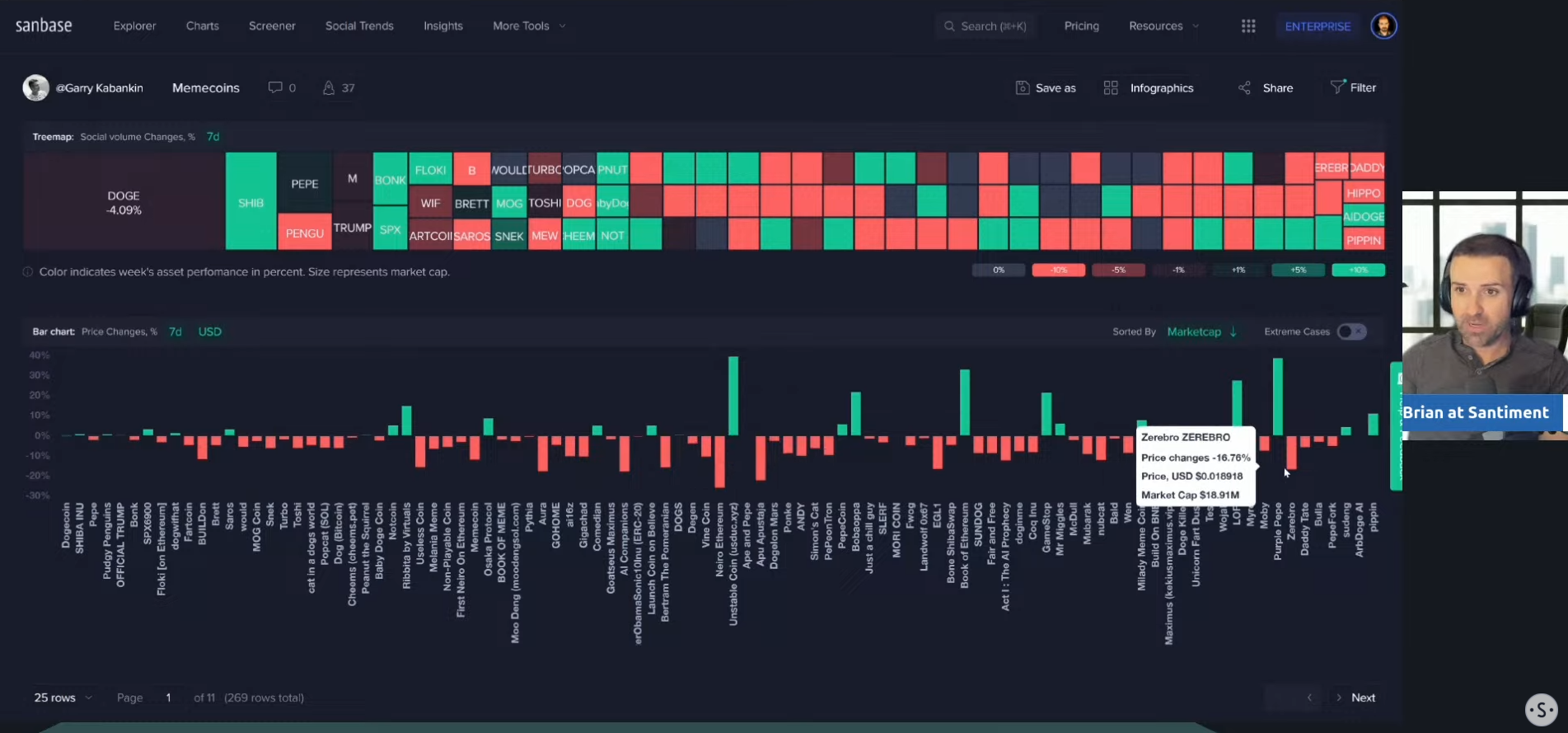

[02:55] Uncovering the Next Breakout Sector: Are Meme Coins Showing Strength?

Brian explored meme coins as a potential breakout sector, noting their inherent volatility. [03:22] While a few tokens like Unstable Coin (USDUC) posted impressive 40% gains, these were exceptions. [03:49] The vast majority of meme coins were down for the week, highlighting the sector's high-risk, high-reward nature. [04:10]

- Key Data: While a few meme coins like Unstable Coin (USDUC) rose nearly 40%, approximately 80% of assets in the sector were down for the week. [03:49, 04:10]

- Actionable Tip: When analyzing a sector like meme coins, look at the distribution of performance. A few big winners can mask widespread losses, so look beyond the headlines to understand the sector's true health.

[06:19] Economic Data's Impact: Speculation on an Imminent Fed Rate Cut Fuels the Market

Maksim explained that recent market activity is heavily driven by speculation around an imminent Fed rate cut. [06:56] He noted that weak economic data released on Friday has reinforced the belief that the Fed will have no choice but to cut rates, leading traders to front-run the potential decision. [06:19]

- Key Data: The economic data release on the first Friday of the month is consistently used by speculators as a primary trigger for market activity. [06:19]

- Actionable Tip: Keep an eye on the macroeconomic calendar, especially for U.S. jobs data and Fed announcements, as these events often create significant market volatility.

[08:48] A 99% Probability of a Rate Cut: What Happens if the Fed Doesn't Deliver?

The market's confidence in a rate cut is extremely high, with a 99.7% probability priced in for the upcoming Fed meeting. [09:14] Brian explained that because this is so widely expected, the real market risk is not the decision itself, but the small chance the Fed defies expectations and doesn't cut rates, which could be a "disaster" for markets. [09:14]

- Key Data: The market is pricing in a 99.7% probability of a Fed rate cut at the September 17th meeting. [09:14]

- Actionable Tip: Understand that widely expected news is often "priced in." The biggest market moves can occur when the unexpected happens, so consider the potential impact of the low-probability outcome.

[10:42] Bitcoin's Rare Divergence from the S&P 500: A Bullish Opportunity?

Brian highlighted a rare divergence between Bitcoin and the S&P 500. While the stock market has edged up, Bitcoin has fallen about 6% in the past two weeks. [10:16] Historically, when such a gap appears, Bitcoin eventually catches up to the stock market's performance, suggesting a potential bullish opportunity if the correlation holds. [11:38]

- Key Data: In the past two weeks, the S&P 500 is up 0.4%, Gold is up 5.5%, and Bitcoin is down 6%. [10:16]

- Actionable Tip: Use correlation charts between Bitcoin and traditional indices like the S&P 500 to spot divergences. Historically, these have sometimes indicated that one asset is due for a corrective move to catch up to the other.

[14:19] Is Crypto Now Just a Leveraged Tech Stock? Analyzing the Correlation

The hosts discussed how crypto increasingly functions like a leveraged tech stock. [14:19] With more institutional involvement through ETFs, Maksim noted that crypto's direction is now highly correlated with the stock market, just with amplified volatility. He explained that a 20% move in stocks could translate to a 50% move in crypto. [13:32]

- Key Data: Maksim's rule of thumb: if stocks move 20%, crypto can move up to 50% in the same direction. [13:32]

- Actionable Tip: When assessing crypto's potential movements, consider the broader stock market's direction. Due to increasing correlation, strength or weakness in equities can often signal the likely direction for crypto, albeit with greater volatility.

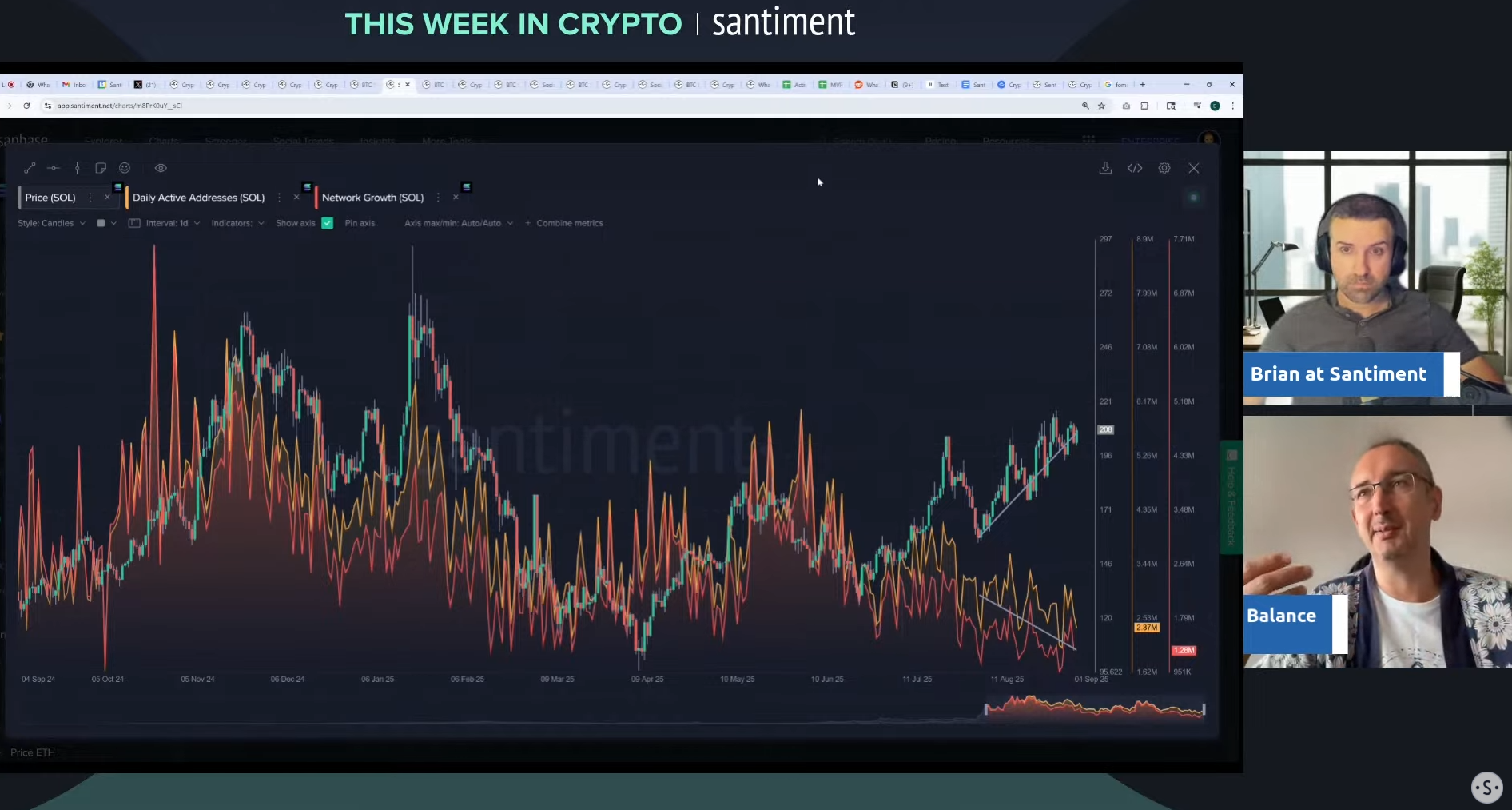

[16:37] On-Chain Alert: A "Heavy Divergence" Between Solana's Price and its Network Activity

Maksim pointed out a "heavy divergence" on Solana, a major on-chain warning sign. [16:45] For weeks, Solana's price has been trying to climb while its network activity has been declining. [17:52] This gap between price and fundamental usage is unsustainable and must be resolved, creating significant uncertainty for the asset. [18:11]

- Key Data: Solana's price has been rising while its network activity has been declining for weeks, creating a significant on-chain divergence. [17:52]

- Actionable Tip: Compare an asset's price chart with its on-chain activity metrics (like active addresses). A growing gap between price and fundamental usage can be a warning sign of an unsustainable trend.

[19:21] Bitcoin's Profit-Taking Indicator: What a Recent Spike Signals for the Bottom

Maksim highlighted that Bitcoin's Network Realized Profit/Loss metric is working well again, with a large spike correctly signaling the recent price bottom. [19:46] This indicates healthy profit-taking and capitulation, which prevents the kind of extreme euphoria that often marks a market top. [21:04]

- Key Data: A significant spike in Bitcoin's Network Realized Profit/Loss metric happened right at the recent price bottom, indicating capitulation. [19:46]

- Actionable Tip: Monitor realized profit/loss metrics. A spike during a price decline can indicate that fear is causing holders to sell, which can help form a local bottom. Conversely, a lack of profit-taking during a rally can signal extreme greed.

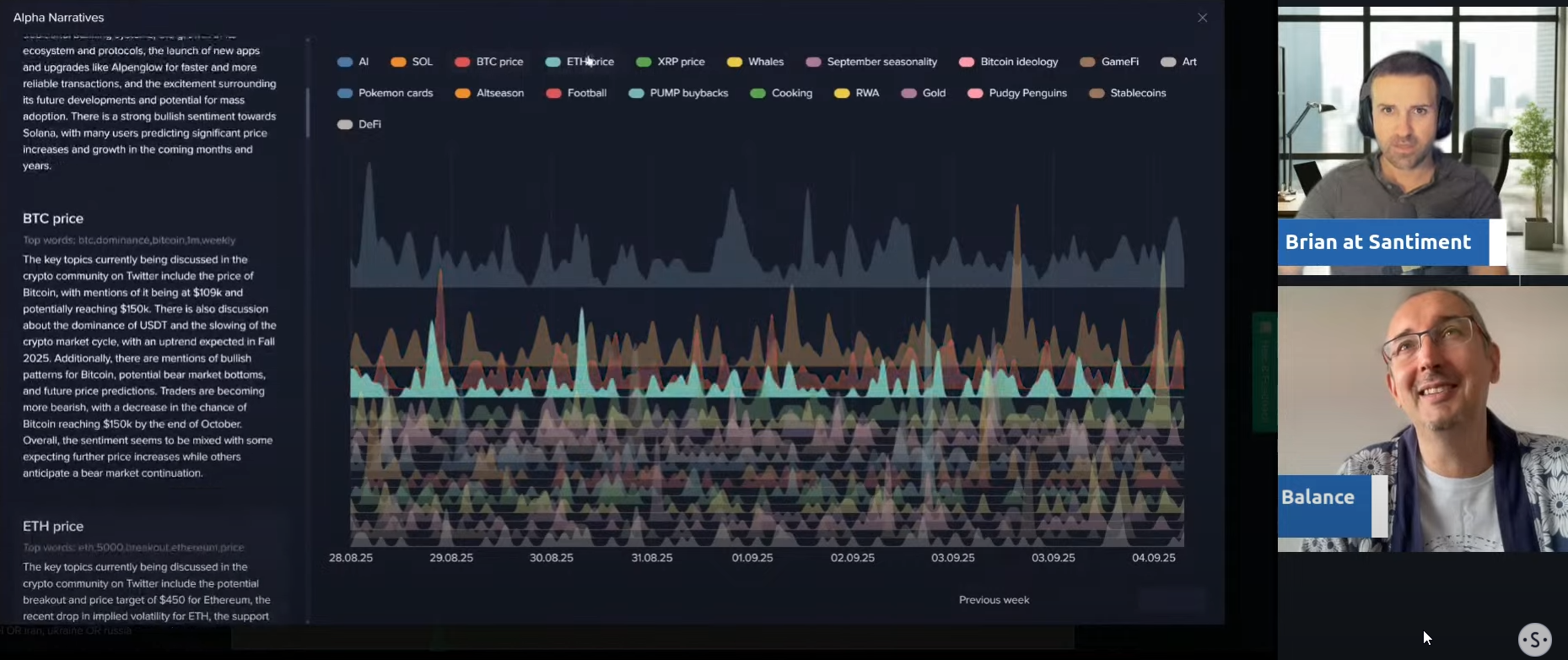

[27:53] Top Crypto Narratives: AI, Solana, and Price Debates Dominate Social Media

An analysis of emerging social narratives showed the crypto community is focused on large-cap assets. [28:20] With topics like AI, Solana, and the prices of BTC, ETH, and XRP dominating the conversation, it's clear traders are less interested in obscure altcoins and are instead debating which major asset will break out next. [29:07]

- Key Data: The top 6 emerging social topics are all related to large-cap assets or broad market themes (AI, Solana, BTC, ETH, XRP, Whales). [28:20]

- Actionable Tip: Use social trend tools to see which assets are capturing the market's attention. A heavy focus on large-caps can indicate a more cautious or "risk-off" sentiment among traders.

[30:55] Decoding XRP: How Whale Activity Has Signaled Major Tops and Bottoms

Brian showed how whale activity has been a powerful indicator for XRP. A huge spike in whale transactions(chart) correctly signaled the top after a 60% rally in July. [30:55] Similarly, another spike during a price drop marked an accumulation zone right before a rebound, showing how whale movements can signal key market turning points. [31:26]

- Key Data: A 60% XRP rally in July was immediately followed by a massive spike in whale transactions, which signaled the top. [30:13, 30:55]

- Actionable Tip: Track whale transaction counts for assets you follow. A sudden, large increase in whale activity after a strong price move (up or down) often precedes a trend reversal.

[33:10] Contrarian Signal: Cardano Sees a Price Rally After Extreme Crowd Fear

Brian highlighted a classic contrarian signal with Cardano. Just as social media sentiment for the asset hit an extreme low, indicating widespread fear, its price began to rally. [33:10, 33:45] This demonstrates the common pattern of the market moving against the expectations of the retail crowd.

- Key Data: Cardano's price rallied right after social sentiment for the asset hit its most negative point in recent memory. [33:10, 33:45]

- Actionable Tip: Pay attention to crowd sentiment data. Extreme levels of fear (very negative sentiment) can present contrarian opportunities, as the market often moves against the herd's expectations.

[37:09] Justin Sun Controversy: How a $3B Token Freeze Impacts Market Trust

The hosts discussed the week's controversy involving Justin Sun and a $3 billion asset freeze amid token dumping accusations. [37:09] Brian warned that such events, while often seen as drama, can erode trust in the broader crypto market and have long-term negative consequences for mass adoption, similar to the FTX collapse. [37:31]

- Key Data: Over $3 billion in assets related to Justin Sun were frozen following accusations of market manipulation. [37:09]

- Actionable Tip: Be aware that major negative events, like exchange collapses or large-scale scams, can impact overall market trust for weeks or months, even if they are isolated to one project.

[44:53] This Altcoin's Network is Red Hot: An On-Chain Look at Crypto.com's Frenzy

Brian identified Crypto.com (CRO) as an outlier with red-hot network activity that fueled a 137% price surge. [44:53, 45:20] However, on-chain metrics provided clear sell signals at the peak. The MVRV ratio was very high and whales were taking profits, correctly indicating the rally was overheated just before a 30% correction. [46:18]

- Key Data: After a 137% price surge, CRO's short-term MVRV ratio went well above 50%, a clear signal that the asset was extremely overvalued. [45:20, 46:18]

- Actionable Tip: Use the MVRV ratio to gauge if an asset is overvalued or undervalued. Extremely high MVRV values suggest holders are in significant profit and may be likely to sell, increasing the risk of a price correction.

[51:33] Final Price Outlook: Why Patience is Key as Markets Approach the Fed Decision

In their final outlook, the hosts advised caution. Brian noted that the market's muted reaction to rate cut news suggests limited upside. [52:44] Maksim is waiting for the Solana divergence to resolve and stressed the need for patience ahead of the Fed's decision, warning that the next two weeks could be volatile and "punish impatient participants." [54:04]

- Key Data: The Fed's interest rate decision is on September 17th, leaving two weeks for potential market-wide volatility. [53:39]

- Actionable Tip: In periods of high uncertainty leading up to major economic events, market conditions can be choppy and unpredictable. Maksim suggests that patience can be a valuable strategy during these times.

Conclusion

This week's discussion highlighted a market at a crossroads. It is buoyed by the prospect of a Fed rate cut but constrained by underlying on-chain warnings and a need for broader trust. The insights from Maksim and Brian show the value of a data-driven approach. By looking at metrics like network activity, whale transactions, and social sentiment, it is possible to gain a clearer understanding of market dynamics.

To form your own data-backed opinions, consider exploring the tools and charts discussed in the stream.