Santiment Unveils Solana Data Coverage

8/25/2025

Santiment, the leading provider of on-chain, social, and behavioral analytics for crypto markets, is proud to announce the first part of a Solana-focused analytics suite release, offering investors, traders, and researchers unprecedented visibility into Solana network user behavior.

Solana has been experiencing a significant amount of mass adoption and retail activity, presenting a new and unique opportunity to find good trades for those equipped with the right data and tools.

"I am very excited to share that our data coverage allows anyone to see behavioral patterns, detect accumulation or distribution phases, and anticipate market inflection points for native Solana assets.”, said Maksim Balance, CEO of Santiment.

Metrics Available for Solana and Solana-based Assets Include:

On-Chain Metrics:

- Active Addresses (1h / 24h / Daily) – Spot bursts of activity that often precede price moves

- Network Growth – Detect inflows of new users to anticipate adoption-driven rallies

- Transaction Volume & Top Transactions Table – Track whale activity and identify potential market moves.

Social & Behavioral Analytics:

- All standard Santiment social metrics, including social volume, sentiment, and crowd greed & fear indicators, providing a 360° view of market participant psychology.

Metrics Planned for Future Release:

On-Chain Metrics:

- Total Amount of Holders – Track Solana’s growing user base in real time

- Supply Distribution by Number of Addresses – Identify retail vs. whale dominance

- Supply Distribution by Balance of Addresses – Gauge accumulation and distribution behavior

The launch of Solana-specific behavior analytics aligns with Santiment’s core mission, to empower crypto market participants with a competitive edge. We achieve this by offering tools to decode crowd behavior and capitalize on opportunities before they become obvious to the broader market.

The new Solana metrics are now available to all Santiment users through the Sanbase app, our API, and SanSheets; unlocking a new segment of behavior-driven alpha for one of the fastest-growing blockchain ecosystems.

—

Below are examples of how metrics can be applied to trade decisions with great success. We used BONK’s two recent price rallies and subsequent declines to demonstrate the power of good data. All pictured charts can be found here.

Meme coin prices are primarily driven by hype, momentum, and narrative. Using a combination of battletested social metrics and newly added on-chain metrics we can identify when the market is reaching a potential reversal point.

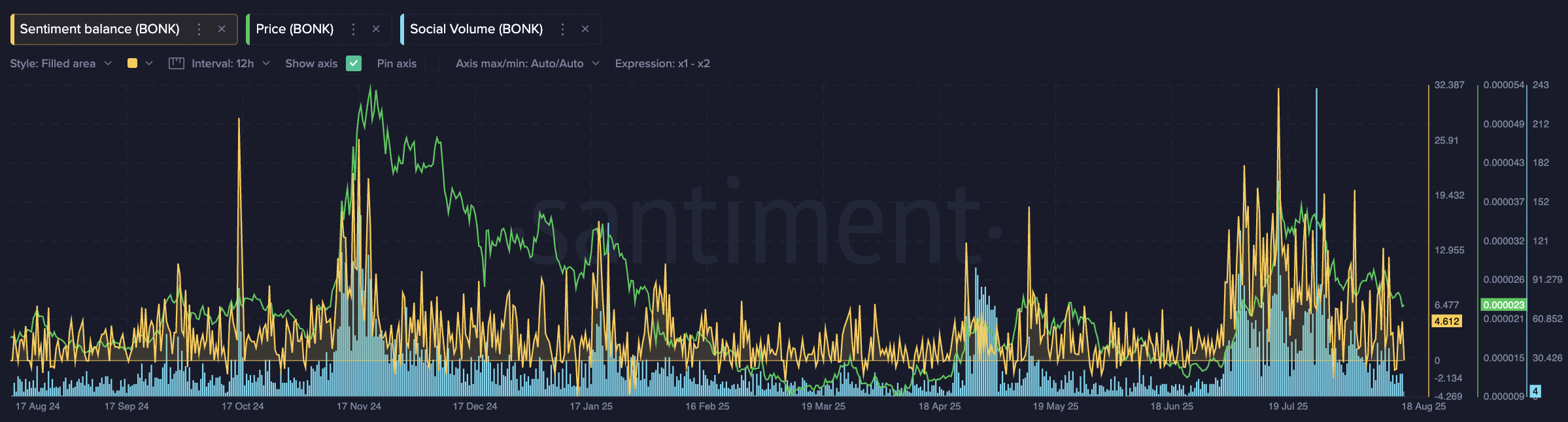

Using Social Volume and Sentiment Balance To Determine Crowd Euphoria

Significant increase of Social volume, combined with the extremely positive Sentiment balance provides a signal that the crowd may be over-hyped about a coin. This provides one point of logic for a potential decision to take profits.

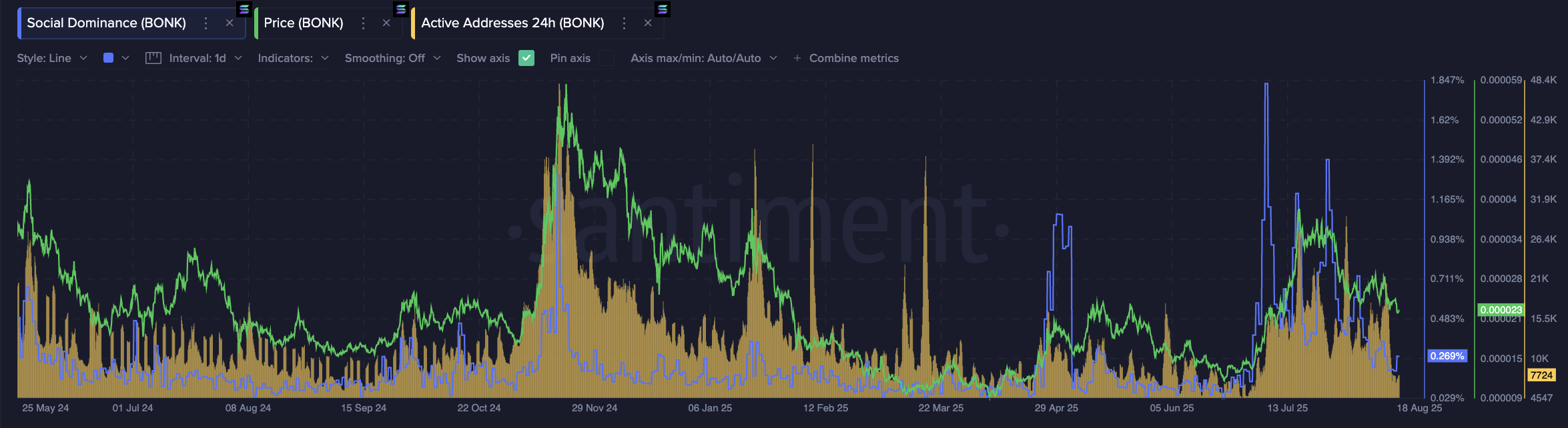

Using Social Dominance With Active Addresses To Separate Sustainable Trends From Speculative Noise

Retail hype without usage or adoption is a classic signal of a potential top: people talk more, but the network activity doesn't grow. In this example, Social Dominance(blue line) spiked repeatedly (signaling hype), but Active Addresses(yellow bars) failed to follow through, while price only briefly rallied before stalling and reversing in multiple instances.

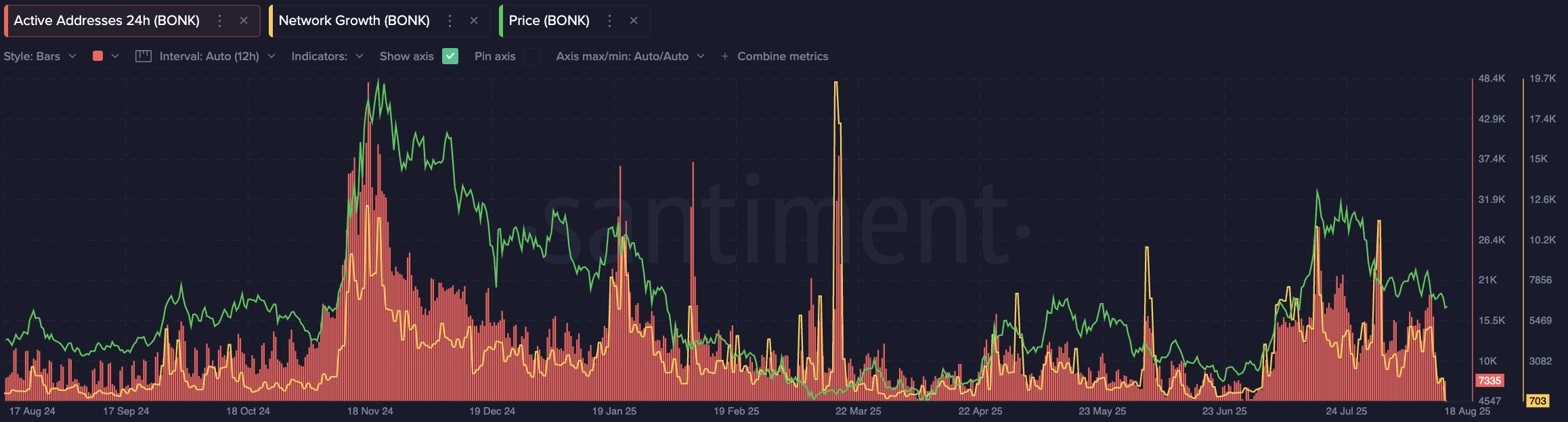

Spotting Network Growth and Active Address Divergences

On-chain activity correlated well to a token’s price dynamics, and understanding how will help you achieve results in the market. Network Activity will spike as the crowd's interest in a token increases, and later when you notice the price still clinging to the highs while activity declines, this is typically a good spot to reduce exposure.

About Santiment

Santiment is a comprehensive market intelligence platform for cryptocurrencies, focusing on clean and reliable data feeds, low-latency signals and custom market analysis.

Leveraging on-chain, social, development and other data sources, Santiment has developed dozens of specialized tools, indicators and strategies that help users identify, contextualize and react to market events and anomalies. To Learn more visit Santiment.net