Market daily digest - Nov 7 2025

What the data tells us

Two days ago we've experienced a big liquidation event when BTC price dipped below 100k USD for the first time in a while, and ETH almost got down to 3000 USD. In total, the amount of liquidations in DeFi protocols on ETH chain was close to 70M USD, which is a good number historically for a bottom to form (at least temporarily). Today price is testing those levels, which provides a nice opportunity if you have a bullish market outlook.

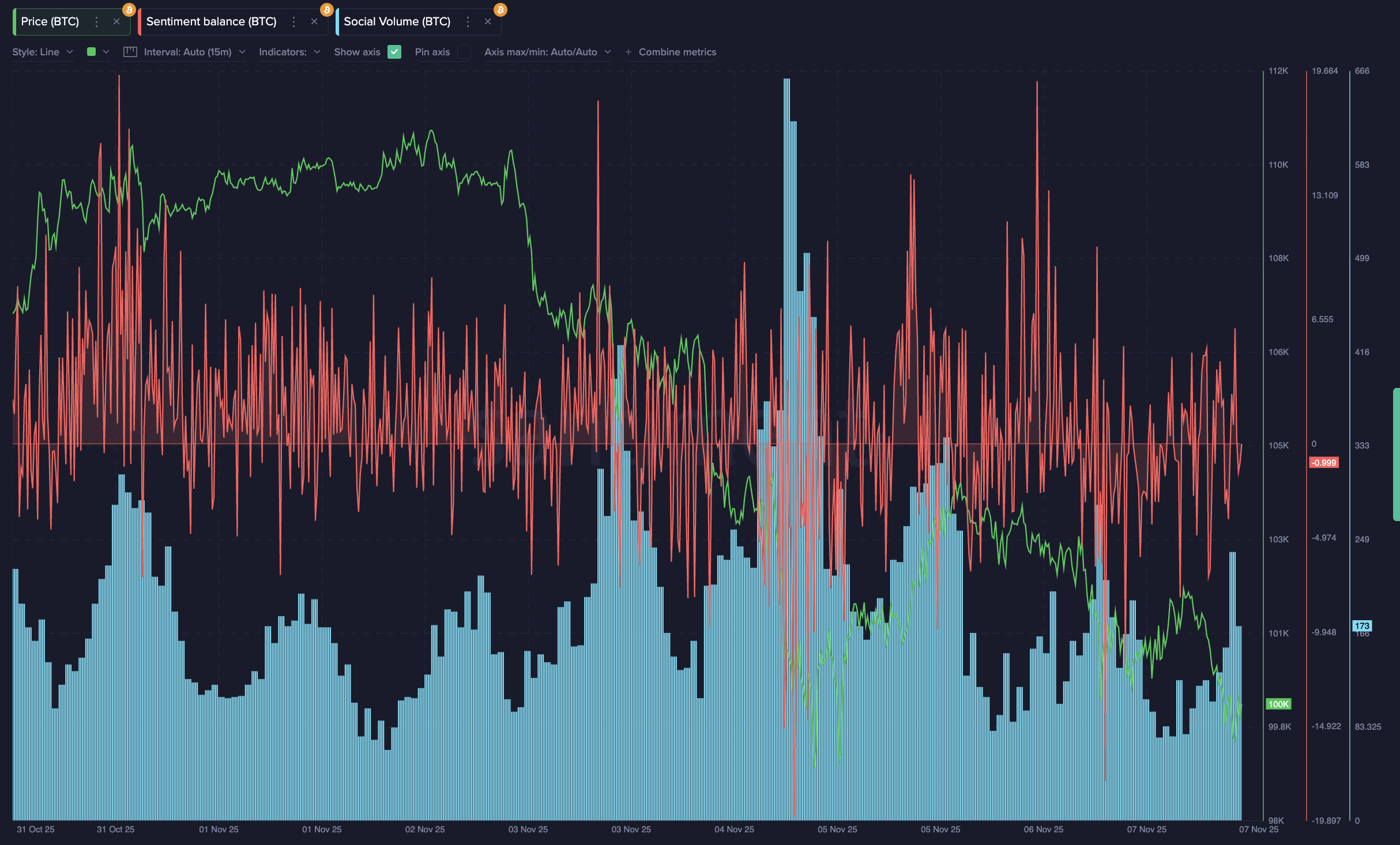

On top of that, at the time of the dump on Nov 5, we also observed a large spike in social volume combined with very low sentiment balance (which is the difference between positive and negative social sentiment, meaning negative sentiment prevails). This further supports the argument for a price to bottom at those levels.

Important observations

Right as I'm writing this article, Strategy announced pricing of their latest preferred stock IPO, Stream (STRE). It got upsized to 620M EUR from an initial 350M. This will put an additional dividend obligation of around 70M USD per year on the company, which is significant considering they already have to pay about 680M USD per year in interest and dividends and the company has negative cash flow from operations.

Another important thing to note is, many old-school crypto coins started pumping this week (link), which is usually also not a good sign if you hope to see a sustained market rally - those long-forgotten coins are often the last ones to pump.

Coins in the spotlight

RIght now it's definitely Zcash, as it has been for the last week or two.

With almost 2.5B USD daily trading volume and 350M USD open interest ZEC keeps going up parabolically, while deeply negative funding rate suggests a big skew towards short positions. Will those traders manage to catch the top and print money on the downside?

Conclusion

A lot hinges right not on Strategy's latest IPO. They should start bidding with the proceeds today when the US session opens and continue into the start of next week. If the history repeats, it should bring at least a couple days of uptrend. After that it makes sense for me to get out of the market and observe from the sidelines. The long-term situation with DATs doesn't look good at all, some of them are already unwinding and even MSTR is under a lot of stress. It seems unlikely that they will be able to survive a serious market drawdown, which means forced selling of large amounts of BTC.