Ether’s Sentiment After its Revival From the Dead

After months of essentially being mocked for underperforming other cryptocurrencies, Ether’s market share has made an undeniable comeback that has silenced its long-term bears for the time being. In just the past month, ETH has surged over 63%, and it’s now up a massive 150% since bottoming out around $1,450 on Apr 8, 2025, a drop that coincided with global fears around tariffs. This rebound has silenced many doubters who thought Ethereum was stuck in the shadow of Bitcoin and newer blockchains.

Social media has reignited with conversation around ETH. Analysts are debating whether the rally still has legs, and traders are watching closely as Ethereum climbs back toward the $4,000 range. It wasn’t long ago that the crypto crowd was laughing about Ethereum’s “irrelevance.” But now, its tech upgrades, rising adoption, and price strength are reminding the market why Vitalik Buterin’s 10+ year old asset is still a dominant force in the space.

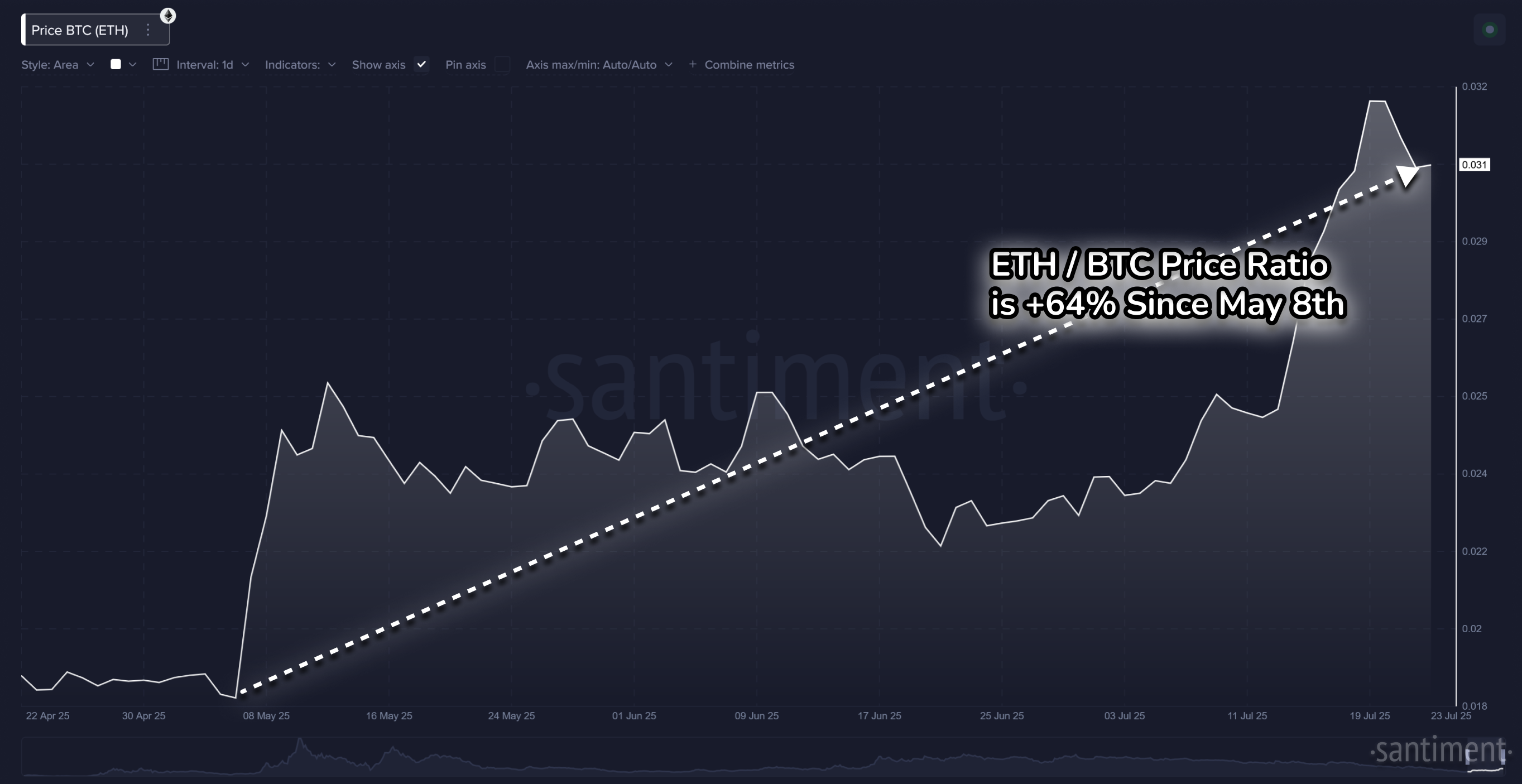

Ratio of Ethereum’s price vs. Bitcoin’s price, past 3 months. Source: Santiment

And as we see, Ethereum isn’t just being propped up by Bitcoin’s momentum, as it was for much of the past three years. Its market value ratio, directly vs. Bitcoin, has pumped +64% since May 8, 2025. Ironically, it was the overwhelming negativity back in early 2025 that may have helped fuel this recovery. When too many people bet against an asset, it often creates the perfect setup for a surprise bounce. Ethereum is once again showing that sentiment extremes tend to precede big moves. And this time, it has worked out in the bulls’ favor. But will it continue to do so?

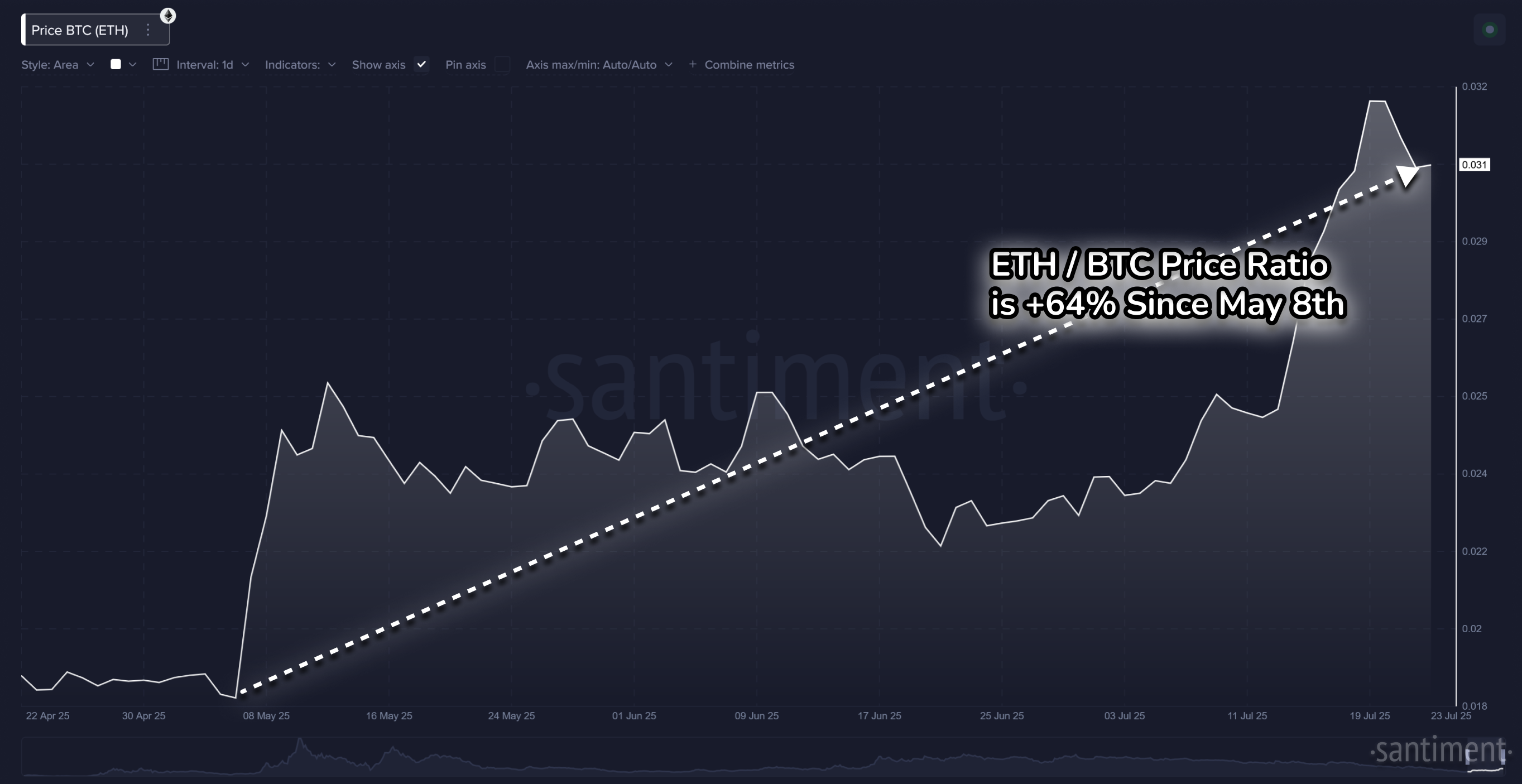

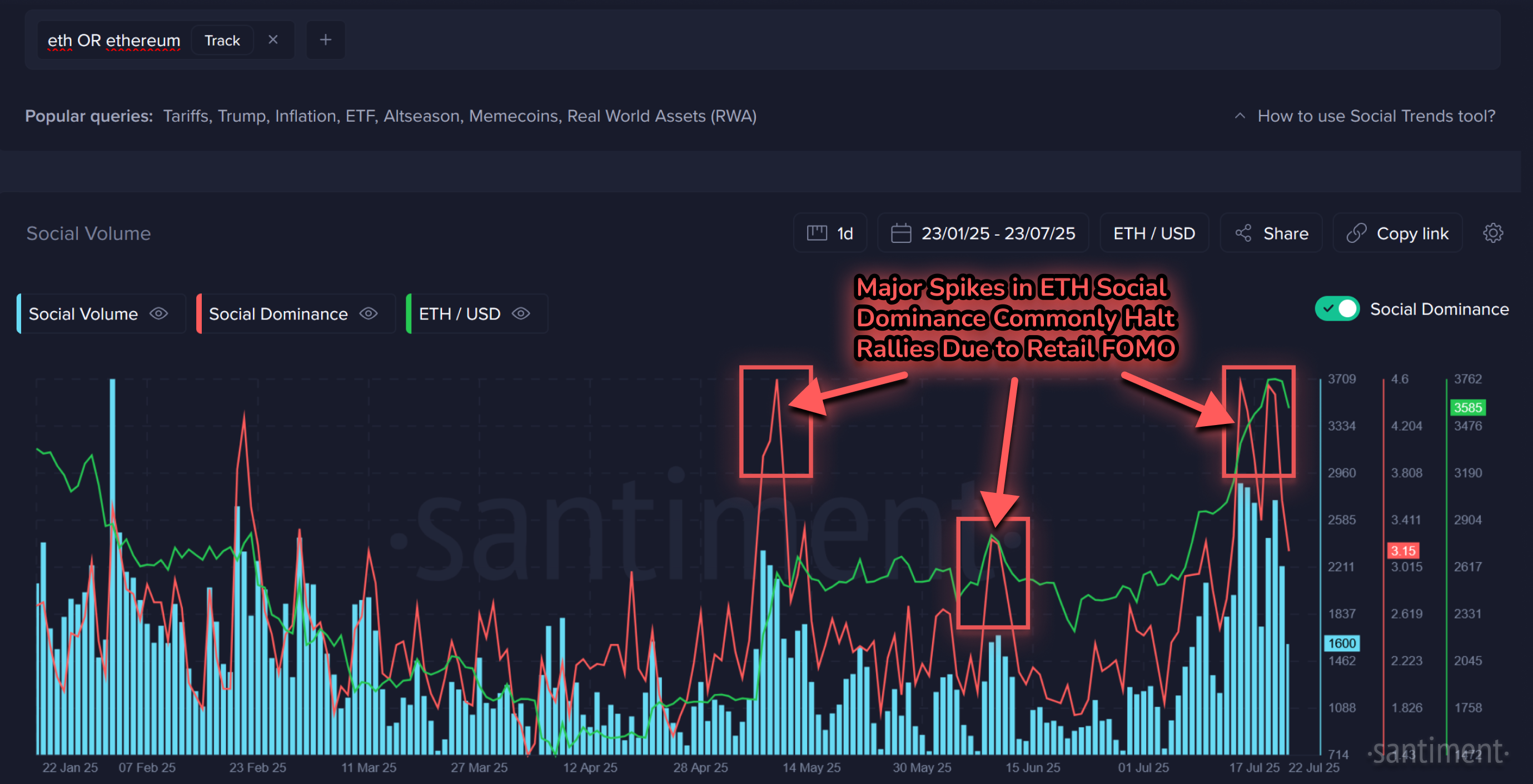

Volume Spikes: A Red Flag For Price Tops?

One of the more consistent signals in Ethereum’s history is that sudden spikes in trading volume tend to mark local price tops or at least temporary stalls in rallies. We saw this back in May and again in mid-July, where ETH volume surged alongside price before quickly cooling off. These moments often reflect a peak in retail excitement or “FOMO,” which can leave the market overextended and in need of a cooldown.

In both cases, ETH’s price leveled off or dipped shortly after these volume bursts. While rising volume can be a sign of growing interest, it often turns into a warning that too many traders are entering late and fueling unsustainable price action. We have already seen volume cool down since its peak a week ago, and as traders flock elsewhere, this will be an encouraging sign of a potential rebound.

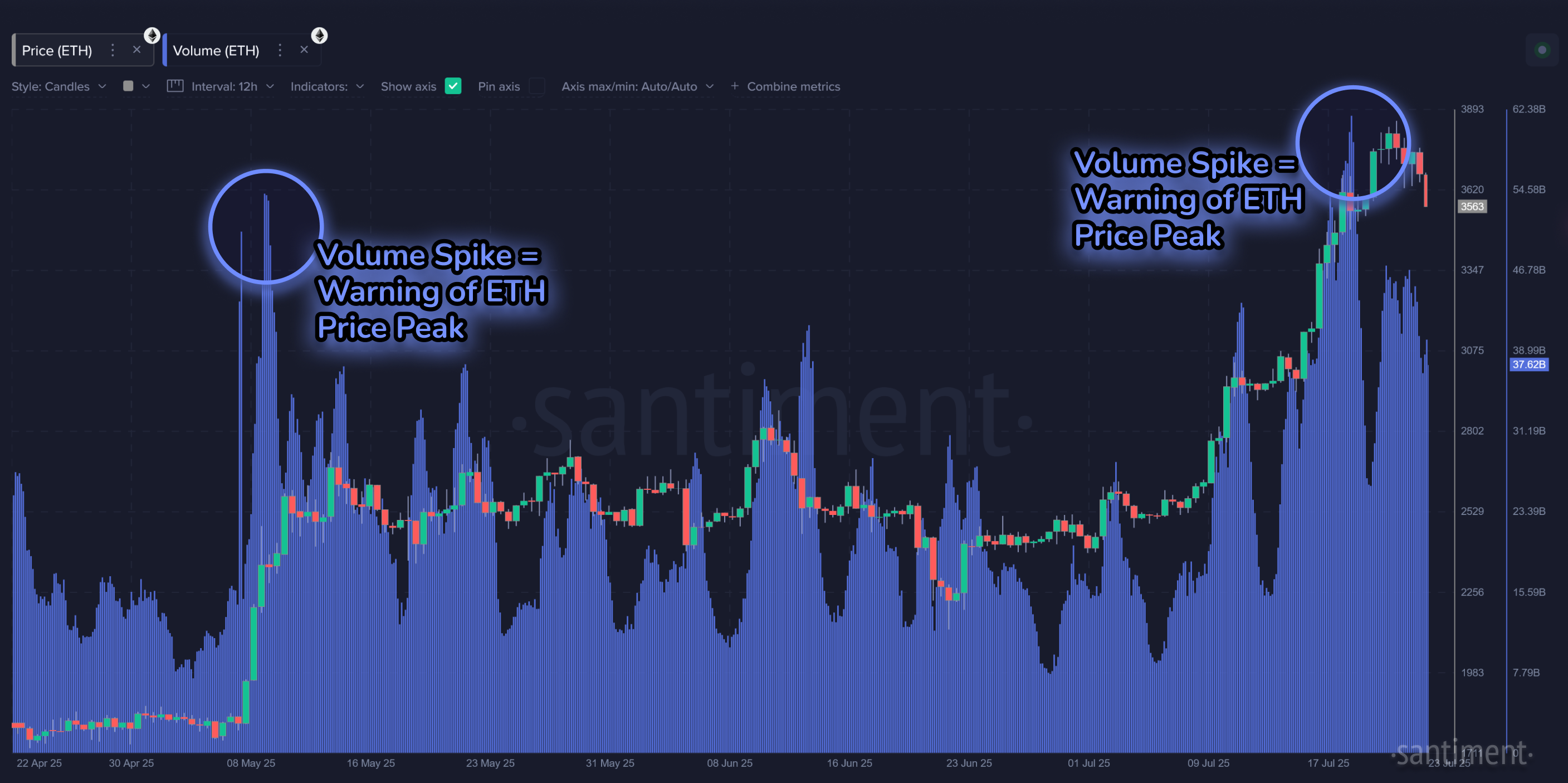

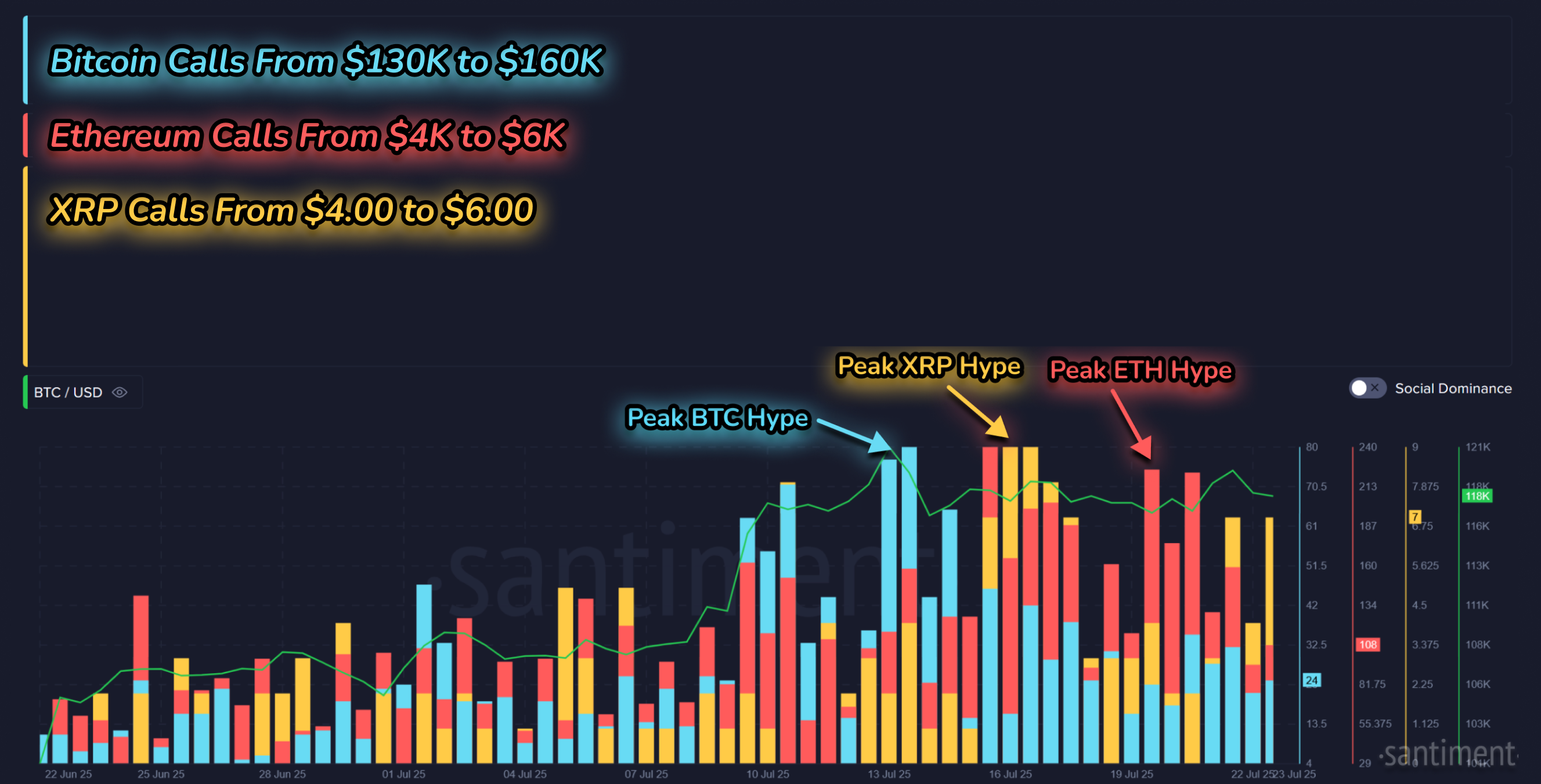

ETH, XRP, and BTC All saw Their Turn in the Hype Cycle

Over the past couple of weeks, Ethereum wasn’t alone in the spotlight. Social media chatter around price targets surged not just for ETH near the $4,000 mark, but also for XRP above $4.00 and Bitcoin above $130K. According to Santiment’s data, each of the three largest non-stablecoin assets had its moment of peak social hype over the past two weeks. Consider this chart a FOMO finder for each asset, as the bar sizes make up the amount of discussions that are still well above the coins’ current market values, indicating hopeful optimism from the crowd.

As shown above, Ethereum's mentions of prices above $4K peaked around July 20th. Before that, XRP had its turn in the spotlight. And earlier still, Bitcoin stole the narrative. These waves of attention tend to come in cycles, with FOMO often peaking just before the market cools off—a pattern that long-time crypto watchers know well. Overall, it’s a good sign that $4K+ calls have essentially neutralized for the time being.

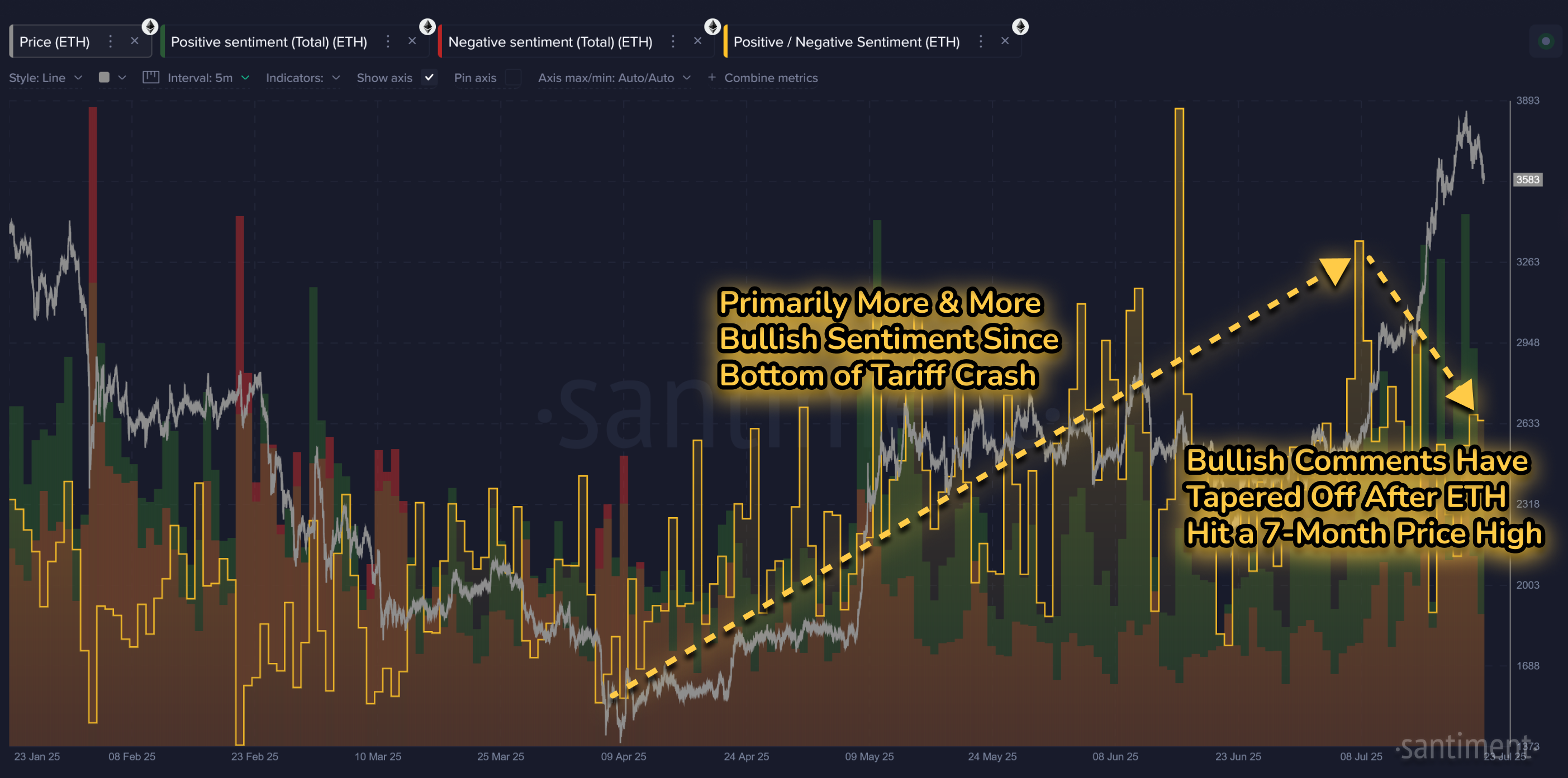

Sentiment Has Flipped Since the April Crash

When Ethereum bottomed out at $1,450 on Apr 8, 2025, sentiment was understandably grim. Bullish-to-bearish comment ratios across social platforms like X, Reddit, Telegram, and others hovered around 3:5—meaning for every 3 bullish takes, there were 5 bearish ones. That kind of fear and doubt often marks a great buying opportunity.

Since then, sentiment has steadily grown more positive. By late July, the ratio has flipped to 2:1 in favor of the bulls. That’s a far cry from the panic in early spring. And while this shift shows confidence is returning, it also suggests some mild FOMO had been creeping in again. Fortunately, it’s not as extreme as mid-June, when optimism reached a frothy 3.5:1 bullish-to-bearish ratio. If bullish comments continue to fade like they have been, it creates a stronger and stronger argument that the rally can and will resume.

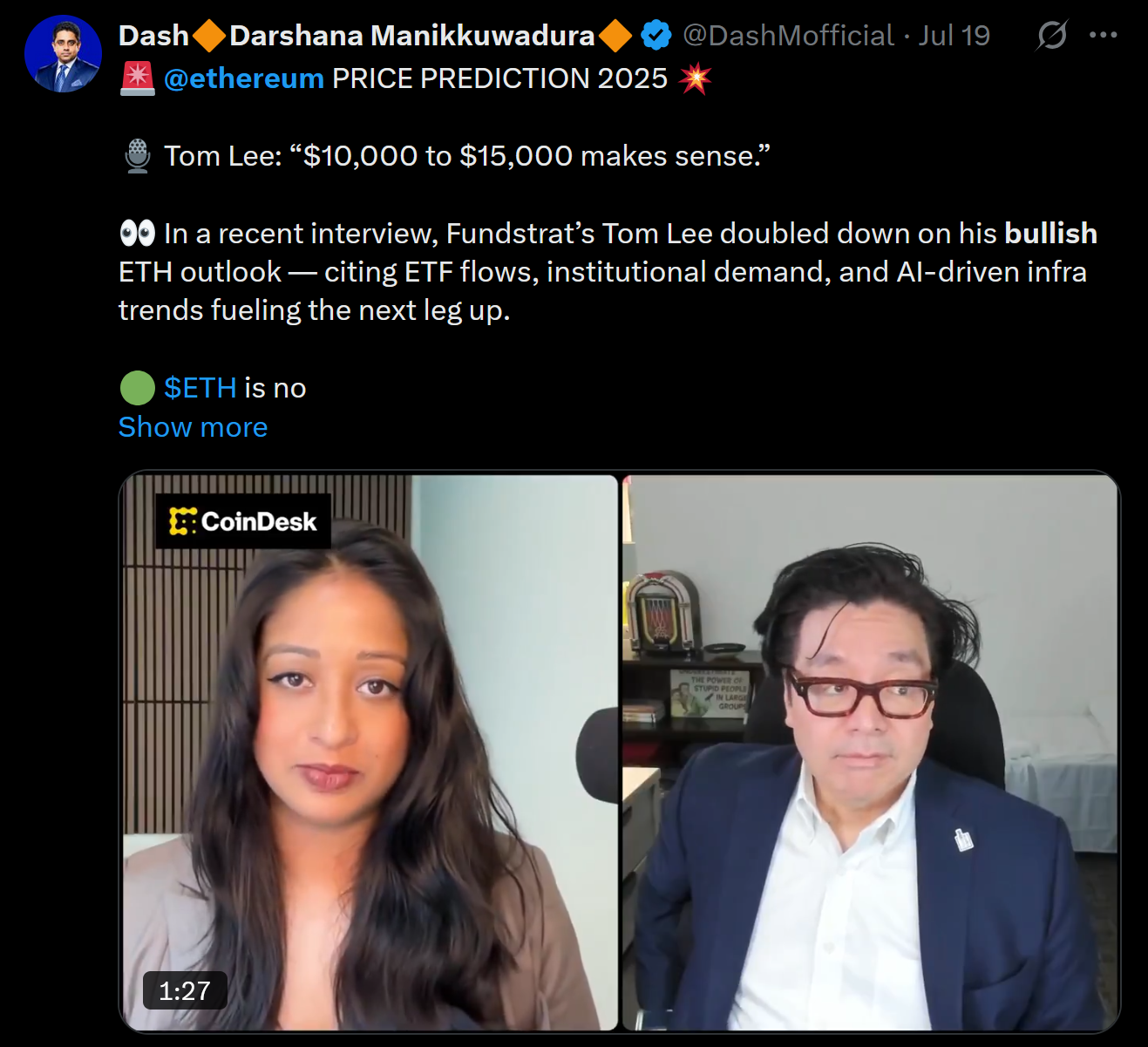

Bullish Narratives are Fueling Retail Confidence

Plenty of positive headlines have also helped support Ethereum’s rise. Fundstrat’s Tom Lee recently went on record stating that ETH reaching between $10,000 and $15,000 “makes sense,” thanks to ETF inflows, institutional demand, and AI infrastructure growth.

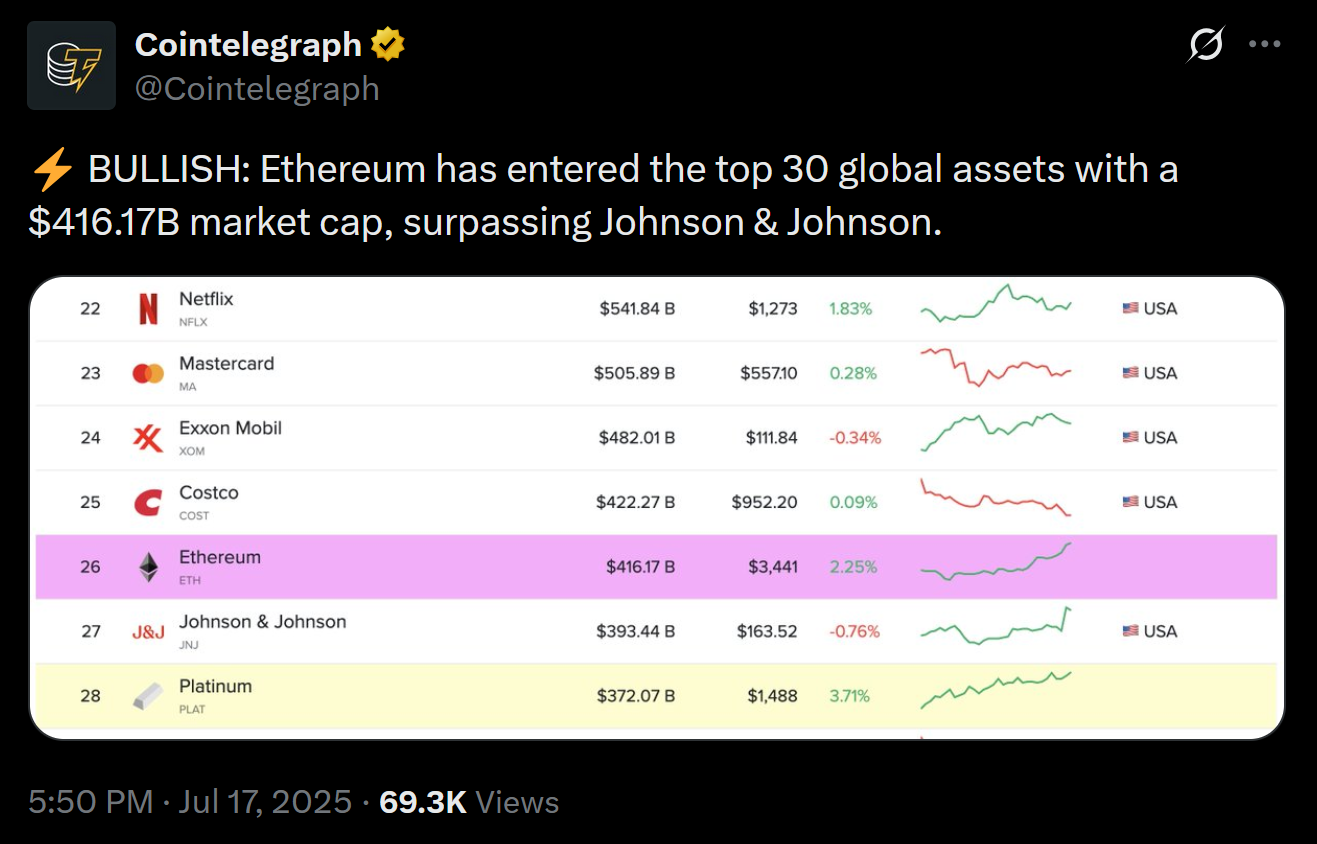

Meanwhile, Cointelegraph reports that Ethereum has climbed to the 26th spot on the global asset leaderboard, with a market cap of over $416 billion—surpassing Johnson & Johnson. News like this from outlets like Cointelegraph gives traders confidence that Ethereum is not only back in the race but climbing the ranks fast.

But Some Say the Top May Already Be In

Despite the excitement, not everyone believes Ethereum's rally is sustainable. Technical analysts have pointed out that ETH has fallen below a key trendline on the charts. If this support level doesn’t recover, it may signal a short-term retrace is needed before any shot at breaking above $4,000.

@0xCrypton on X warned that Ethereum looks “bearish after a long time," suggesting that overleveraged retail traders may soon face a flush if the price drops further. While the long-term trend is still intact, these warning signs are causing some traders to take profits or tighten their stop losses.

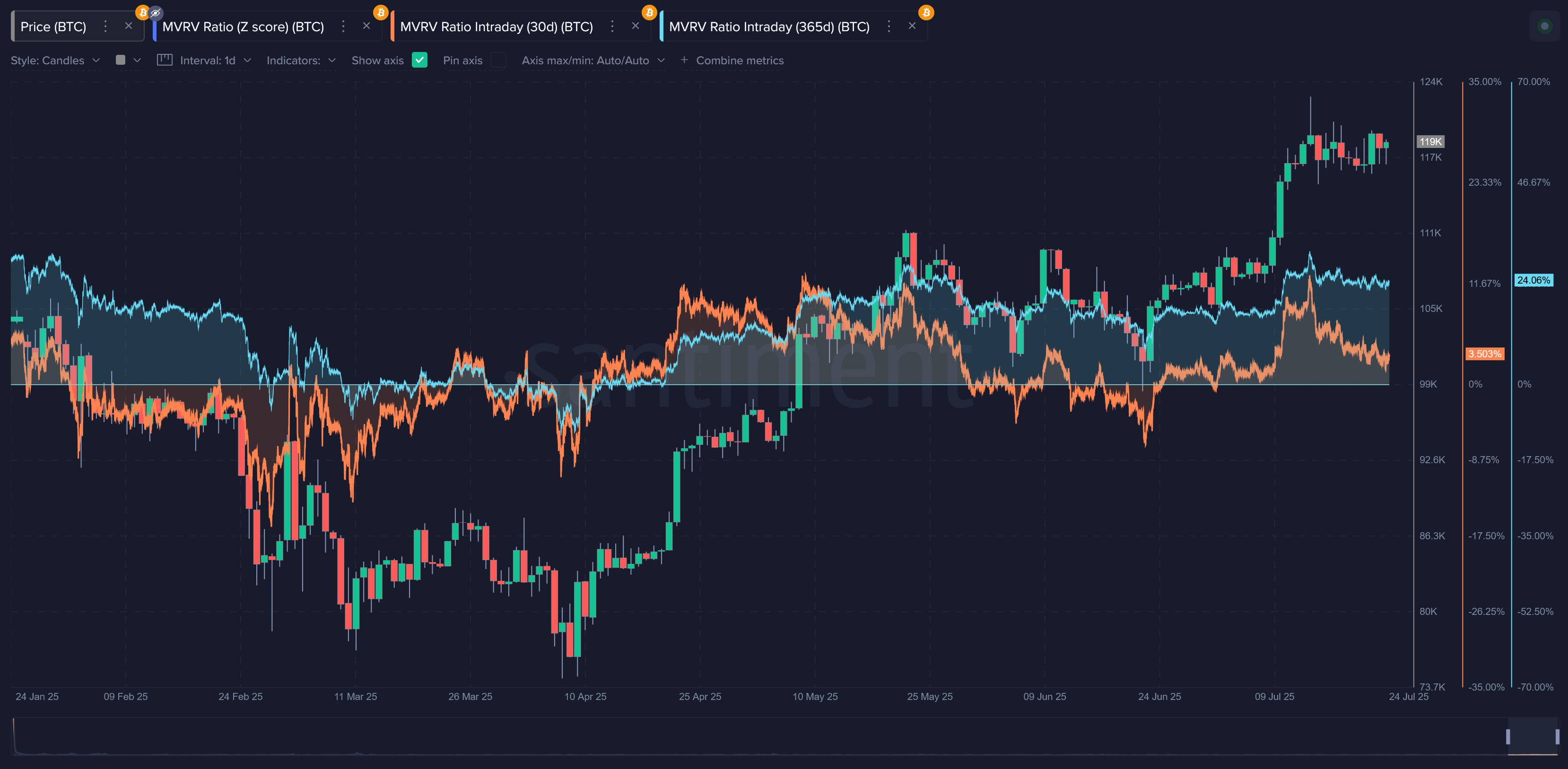

Although Santiment deals less with support & resistance lines, the fundamentals toward Ethereum do show signs of traders being very highly in profit for the time being, according to Mean Value to Realized Value (MVRV).

Wallets active in the past year are up an average of +24.1% on their investment, while wallets active in the past month are +3.5%. Historically, all assets will average around 0% for all MVRV timeframes. So while both short and long term timeframes show profits, there is increased risk to buying or adding on to your positions while so many traders are already well above the average profit of 0%.

Ethereum’s Social Dominance May Be a Warning Sign

Santiment’s data also shows Ethereum's share of overall crypto-related discussions—what’s known as “social dominance”—has recently spiked. While it’s a sign of growing interest, these social dominance spikes often happen right as price momentum is peaking.

When everyone is suddenly talking about the same coin, it typically means the crowd is late. Historically, ETH rallies that coincide with major jumps in social chatter tend to cool off shortly afterward. It's a reminder that too much attention in a short period can be a double-edged sword. This is one of the more bearish indicators, as discussion rates toward ETH are still much higher than normal as the crowd continues to hope for further price gains.

Final Thoughts: Better to Be a Bull or Bear From Here?

There’s a strong bullish case for Ethereum. Its recent momentum has been fueled by a blend of rising institutional interest, powerful network upgrades, and expanding real-world use. Developments like the proto-danksharding upgrade and increased block gas limits are improving scalability and lowering fees. Ethereum is also benefitting from its leading role in DeFi ,staking, and tokenization. With staking and token burns reducing supply, many believe ETH’s path toward $6,000 or even $6,500 by early 2026 is very realistic.

However, the bearish side of the argument can’t be ignored. Layer 2 activity is perceived as weakening to some, and Ethereum’s scaling ecosystem may be leaning too heavily on centralized platforms like Base. Some see Ethereum’s future more as a settlement layer for centralized chains rather than a decentralized backbone. If institutions begin rotating away from ETH or market structure shifts unexpectedly, its growth path could be interrupted. For now, Ethereum is at a crossroads—and traders will be watching closely to see whether it can break above $4,000 or needs to cool off first.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

This full article is also available on Bybit's website!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.