Deep Dive: Has Bitcoin (and Crypto) Really 'Bottomed'?

Helpful Charts Used in This Analysis:

- Mentions of 'Bull Market' vs. 'Bear Market'

- Ratio of Bullish vs. Bearish Bitcoin Commentary

- Bitcoin Funding Rates Aggregated By Exchange

- 30-Day & 365-Day Bitcoin MVRV

- YouTube Education Video On Using MVRV

- Bitcoin Active Addresses & Network Growth

- YouTube Education Video On Using Network Growth

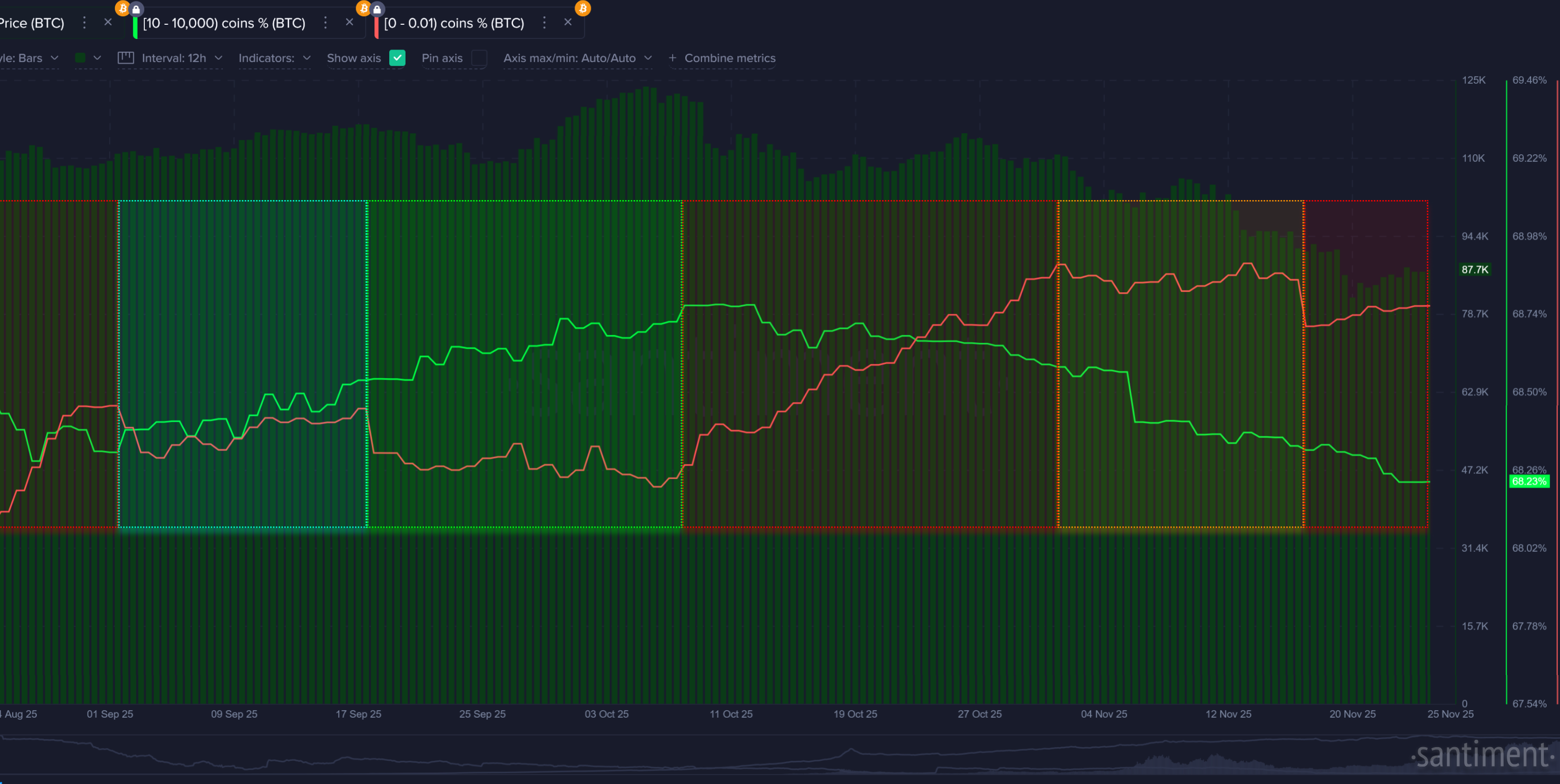

- Bitcoin Supply Held of 10-10K BTC Wallets & <0.01 BTC Wallets

- Main Bitcoin Metrics, Variety of Top Metrics

- All YouTube 'This Week in Crypto Livestreams

---

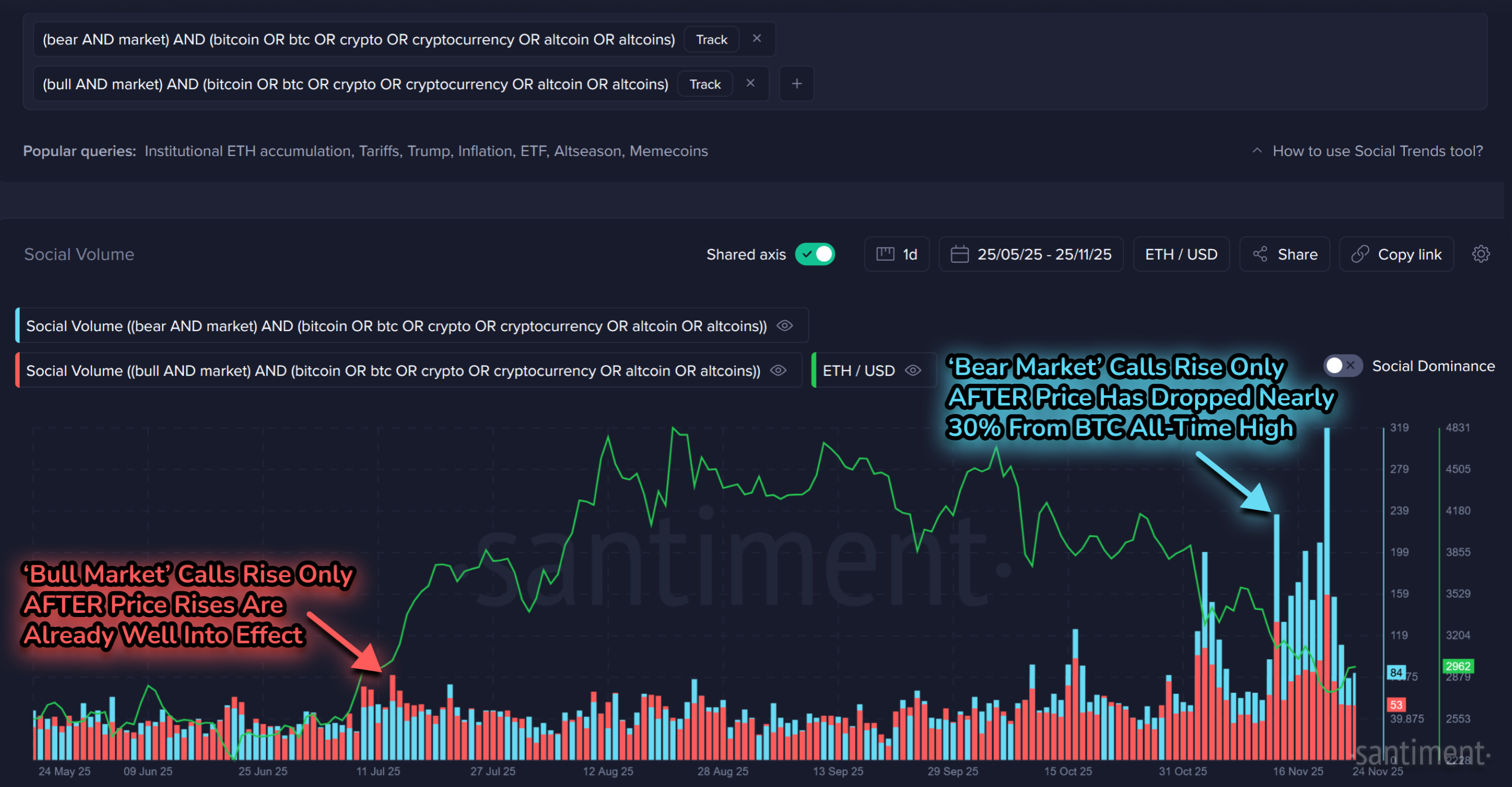

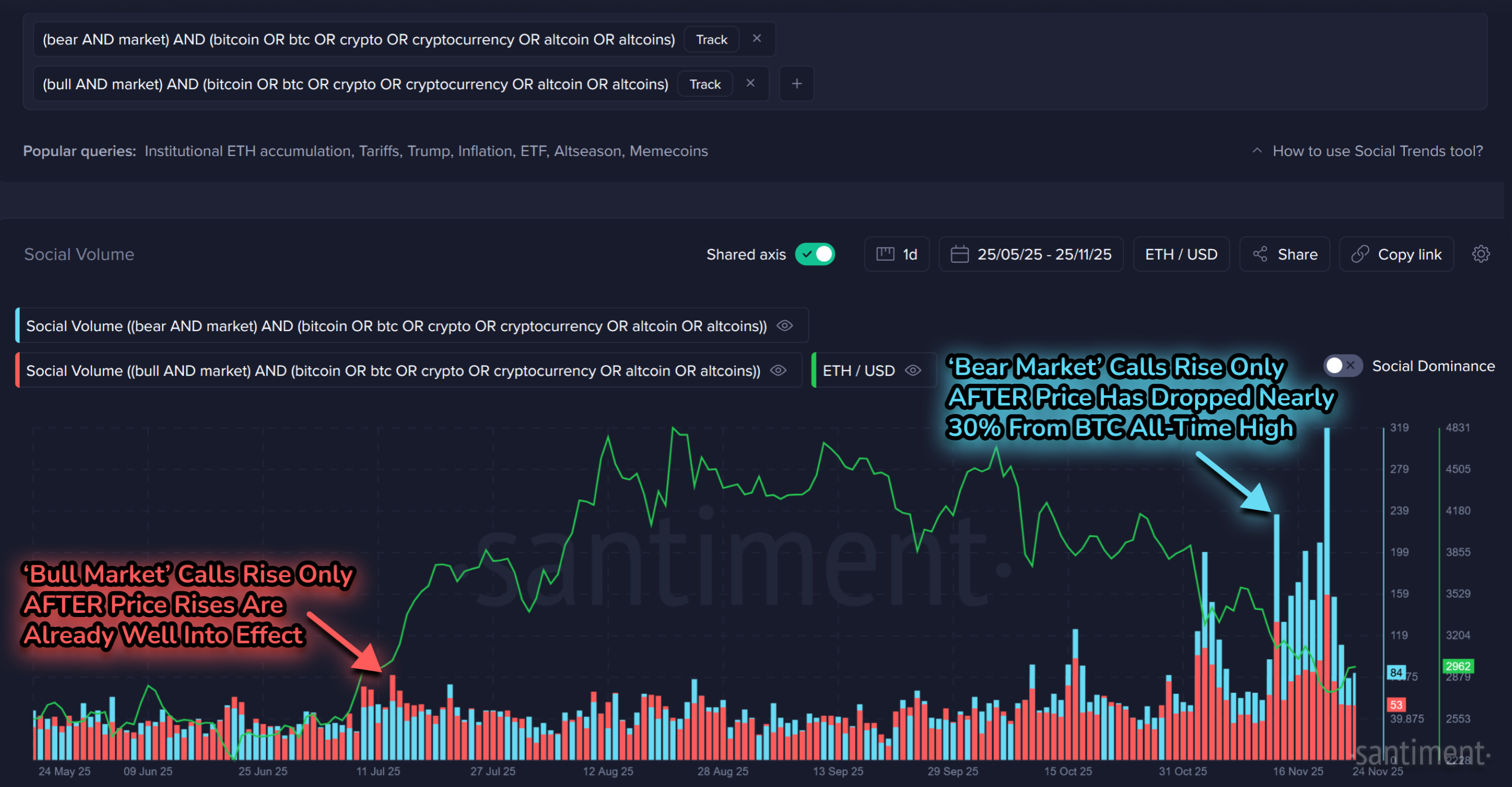

The terms "bull market", "bear market", "topped", or "bottomed" can truly mean whatever narrative a trader, investor, or community wants it to mean. What timeframe is someone referencing when proclaiming that crypto is now in a bear market, for example? Does this imply they believe crypto will continually go (mostly) down for the next month? Year? Decade? Some of these meanings have become so warped that it's no wonder they aren't taken nearly as seriously these days. Just take a look at how much confirmation bias comes into effect AFTER the uptrend or downtrend of prices are already well established:

Some have begun proclaiming that the bottom may have already come in, with explanations of why prices fell so low in the first place. Bitcoin's rally back to $88K after threatening to drop below $80K just last week is a mild relief for some that were fearful of even further blood, so content that covers whether the "bottom" has been established will always get some anxious traders excited again:

What's clear in Santiment's data is how far traders' optimism regarding Bitcoin (as an investment) can fall after monthly gains are no longer a guarantee. Check out the ratio of bullish vs. bearish comments across social media:

The uptick in declaration of crypto being in a bear market, and rise of bearish sentiment are both clearly great signs. Most major turnarounds occur when retail's hope is mainly lost. Markets have historically moved the opposite direction of the crowd's expectations, and we've seen it numerous times on both the greed and fear side of the coin... But is the crowd's hopes and dreams of getting their lambos really truly gone?

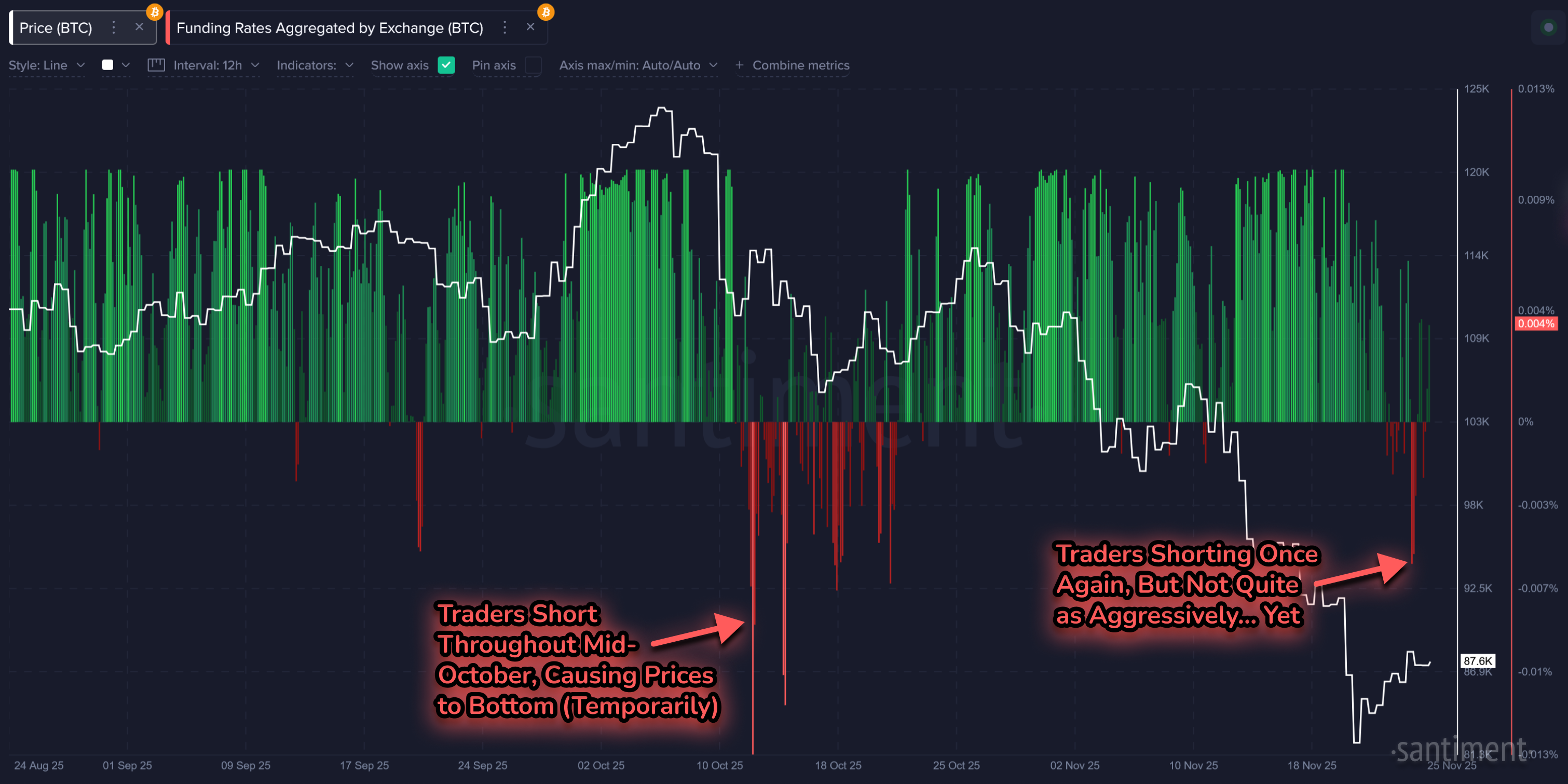

Another signal we can look at is the funding rates of Bitcoin, aggregated by exchange. When we see many shorts like this, indicating traders are betting that BTC will continue moving down, it often stops the downtrend in its tracks... and we see a bounce, causing those shorts to get liquidated. Many shorted about a week after the October 6th all-time high, and there was a temporary relief rally in late October as a result. Should shorts get as prevalent as they were six weeks ago, we could see history repeat itself. But we're not seeing quite the level of bets against the price of Bitcoin... just yet anyways.

We can also check out Bitcoin's short-term (30-day) and long-term (365-day) MVRV lines to get an idea of how much the losses have really piled up on the average Bitcoin traders and investors. MVRV shows the ratio between the current price and the average price of every token acquired. An increase in the ratio shows us how much unrealized profit the market is sitting on. As the ratio increases, more market participants become willing sellers. The value of MVRV gives an idea about the average profit of holders across different durations. You can also watch our recently made MVRV sketch here, where Brad and Esther break the metric down!

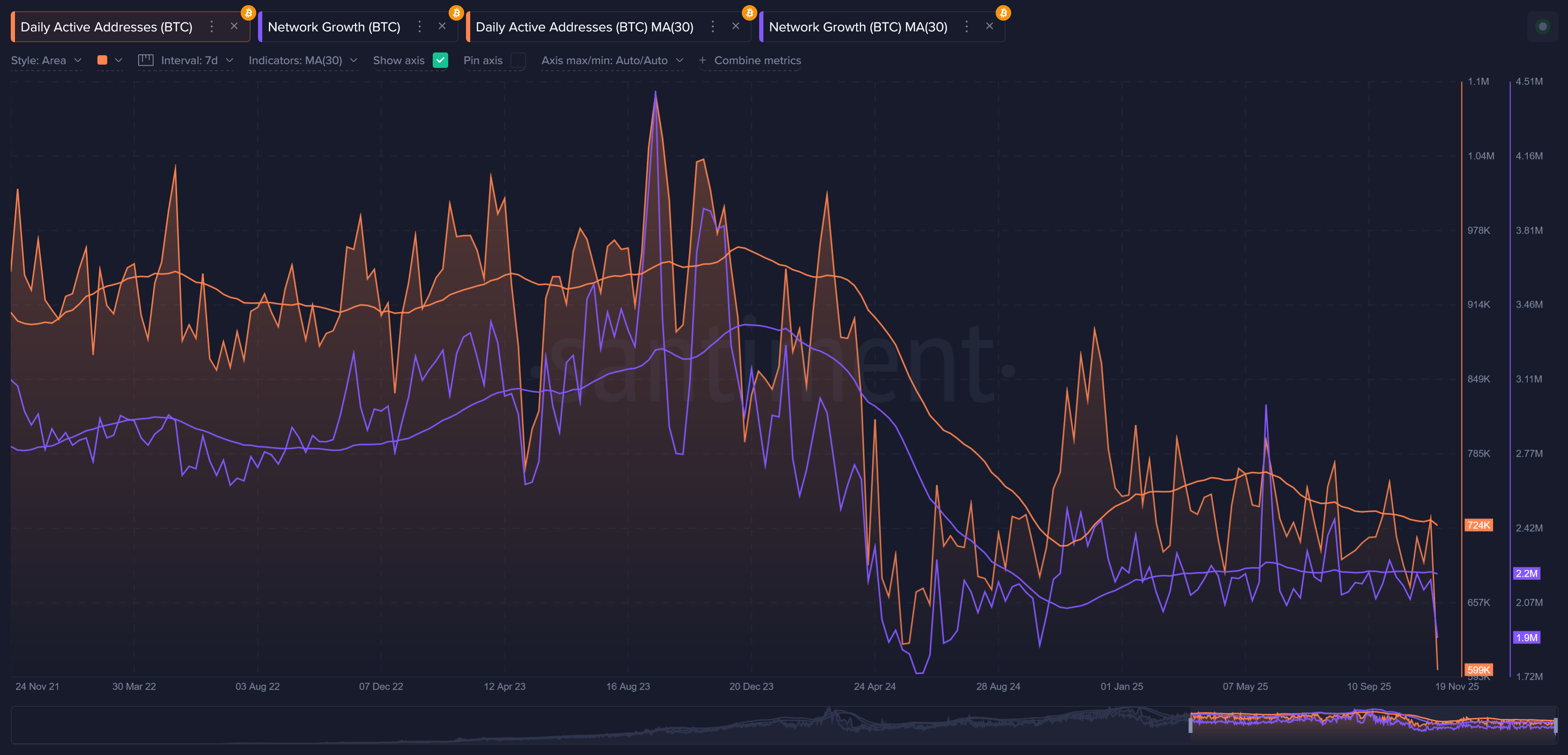

If we look at the overall utility of Bitcoin, however, things look a bit dicey. Looking at network growth on Bitcoin's network, the network peaked in mid-December, 2023 with over 3.37M new addresses created per week. Now? The network is getting a mere 2.21M. And as for interacting active addresses happening per week, we saw about the same timing of the network's peak with over 963.9K active addresses per week. Now, Bitcoin is producing just 729.2K. We have an educational video about how to effectively read Network Growth as well, here.

And there is one other major elephant in the room that should bring you a bit of hesitance that "the bottom is in"... As we can see on the whale vs. retail chart, wallets with 10-10K BTC continue to shrink their collective supply held while wallets with less than 0.1 BTC continue to grow theirs. This is the wrong combination to mark a bottom. Institutionals have driven up just about every bull rally since COVID-19, and the 10-10K BTC group (as we can see below) had a lot to do with the October 6th all-time high with their aggressive accumulation from early September to the first week of October.

By October 8th, these same Bitcoin whale and shark wallets that got crypto's top market cap to make history began to flat-line their holdings, and have been shrinking them for about six weeks straight now. Small wallets, mainly held by the vocal crowd you see across your social media timelines, are the ones scooping up dips in hopes that they "catch the falling knife". But until institutionals begin to pump up their own bags (and thus, everyone else's portfolios), our optimism on "the bottom being in" has to remain tempered.

Overall, data points to the most likely scenario being a short-term bounce. A rebound above $90K again soon wouldn't be a major surprise at all, considering MVRV's are still in the negative range and sentiment has shown a fair amount of retail panic (at least vocally on social media). But Bitcoin clawing its way all the way to six figures looks like a stretch when the overall retail bags are going more up than down, and whale bags are continuously appearing to be in "sell mode".

More likely, the long-term direction is still pointing to down based on, well... the two most important long-term indicators showing declining utility and declining whale and shark holdings. But crypto markets could be full of surprises, and the New Year is just over five weeks away. So stay tuned as we keep you posted the moment this trajectory changes, no matter what prices currently are when that happens.

Feel free to browse Bitcoin's major metrics here, and you can see the same ones that we most commonly cover in our insights, as well as on our This Week in Crypto livestreams!

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.