Crypto's 2025 Year in Review: A Rocky, Geopolitical Rollercoaster

LINKS IN ARTICLE:

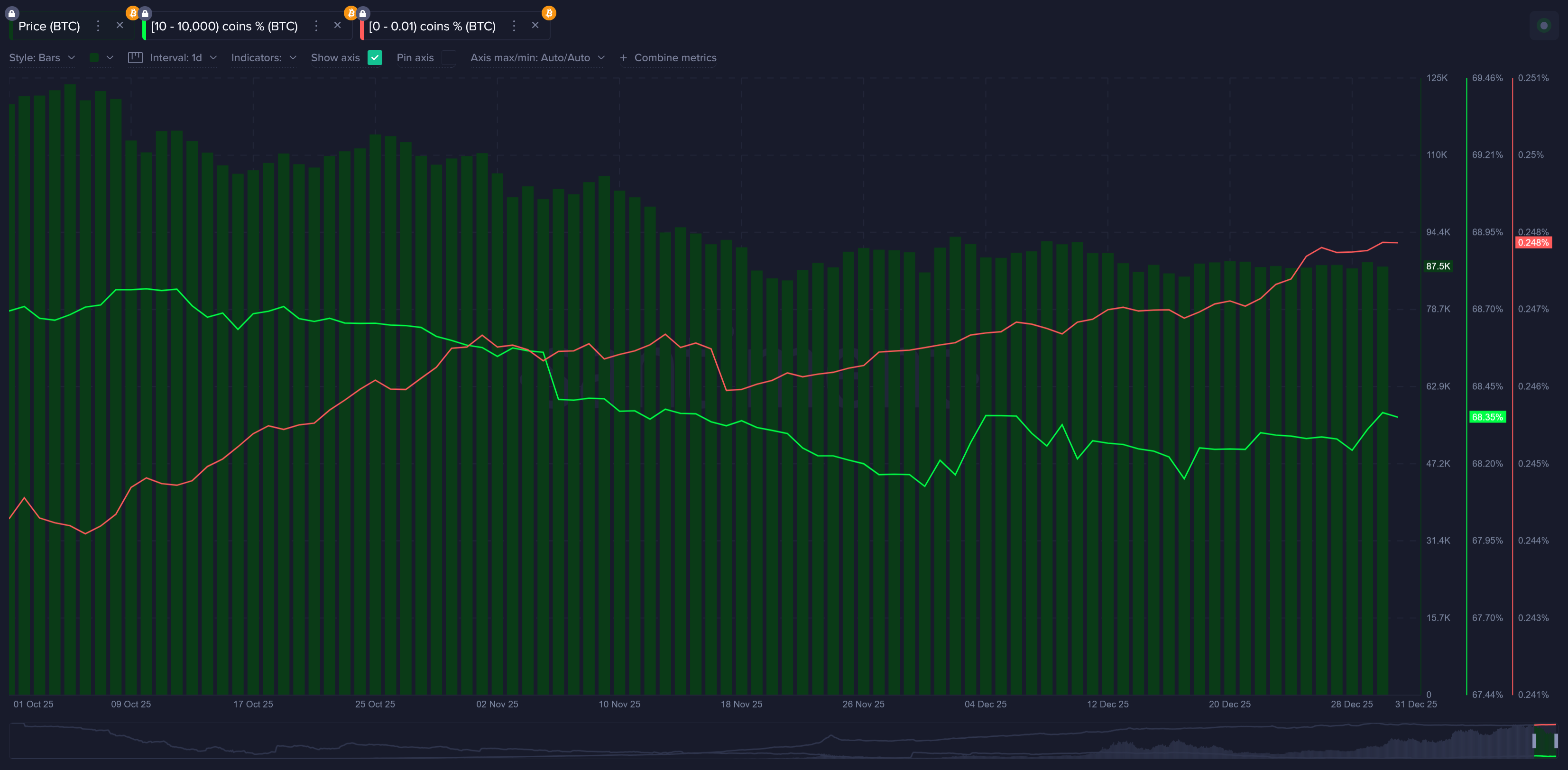

Whales vs. Retail Holdings For Crypto's Top Assets

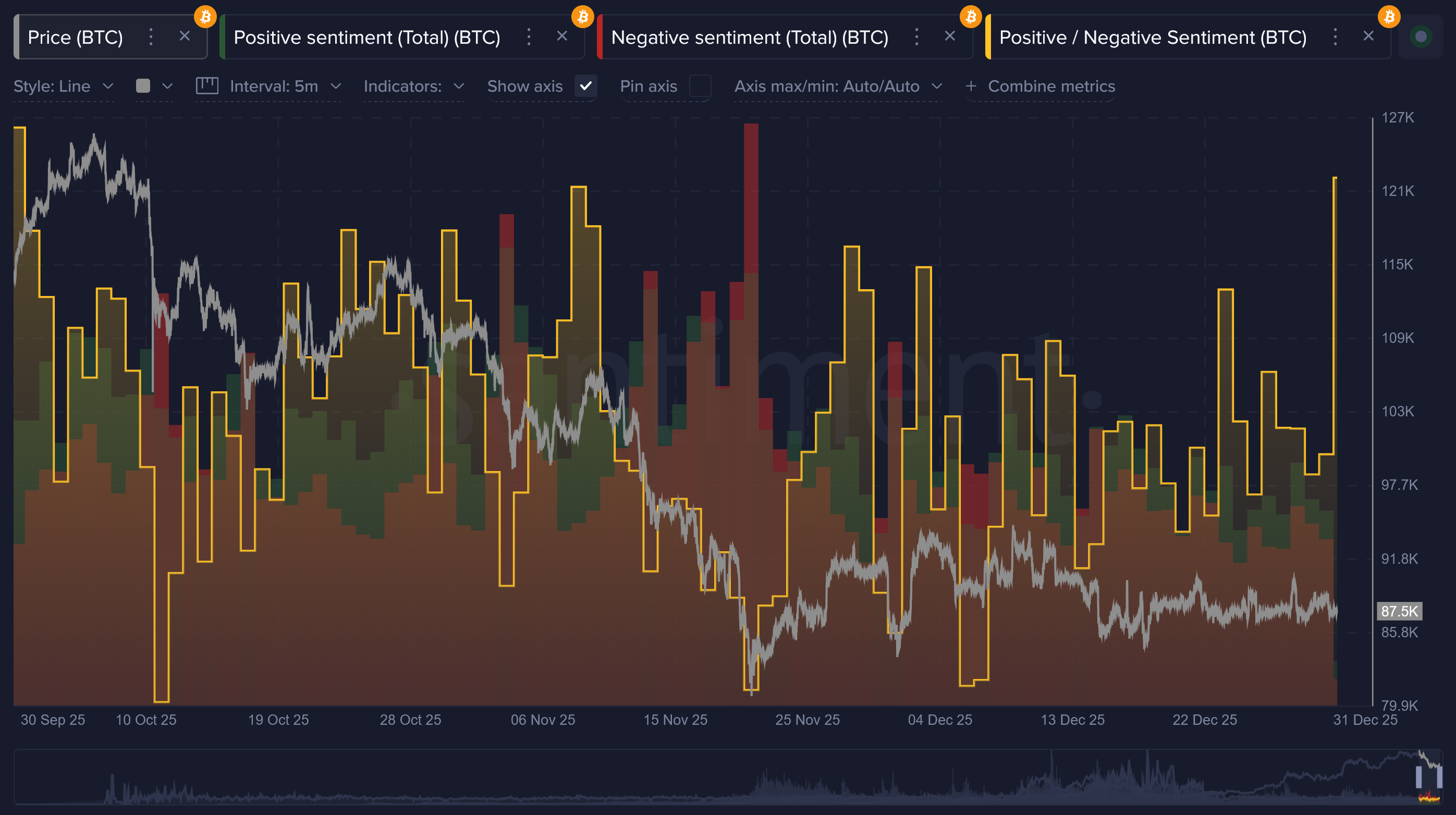

Ratio of Positive vs. Negative sentiment for Bitcoin

Social Volume Mentions of 'FOMC' or 'Powell'

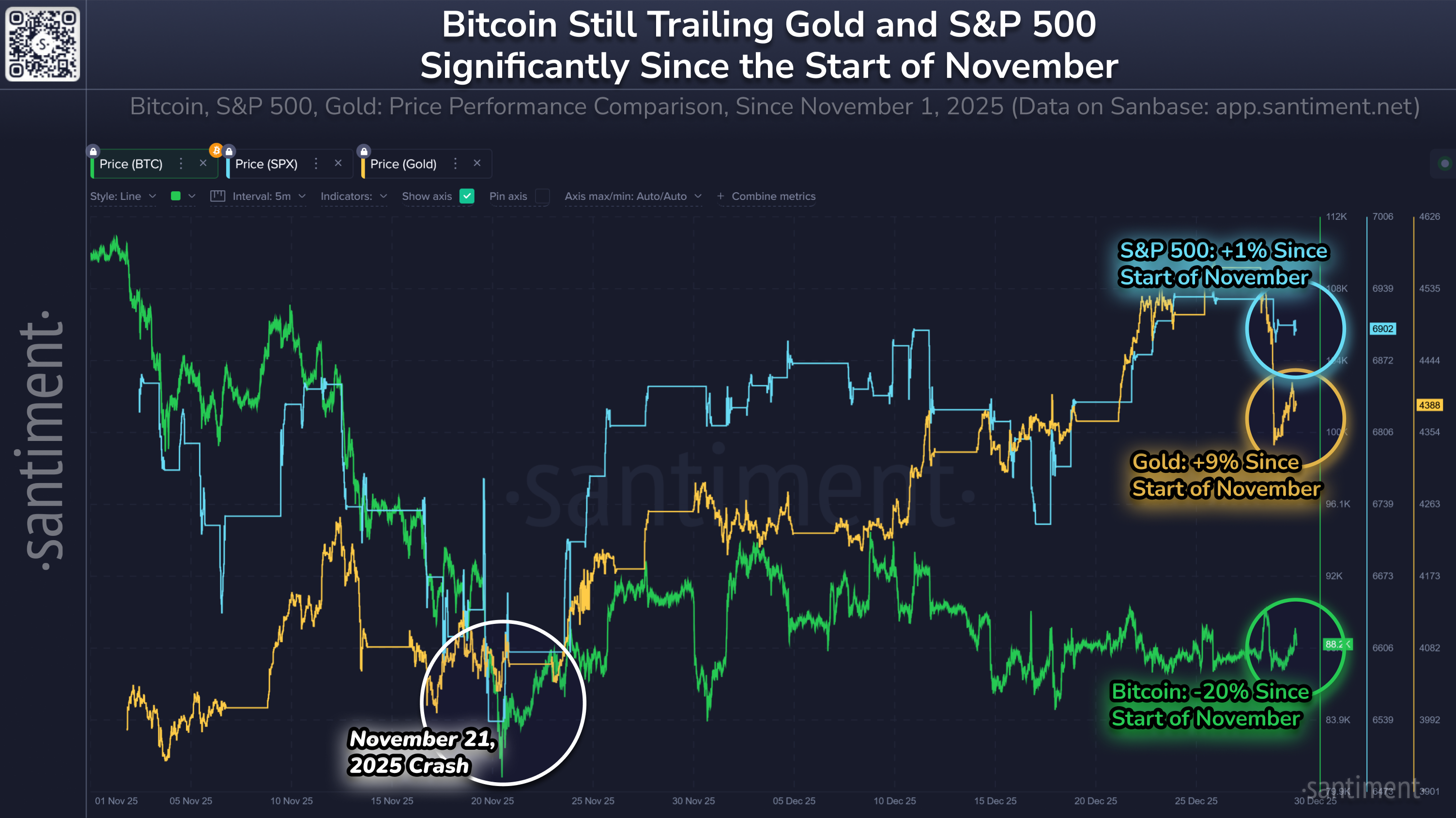

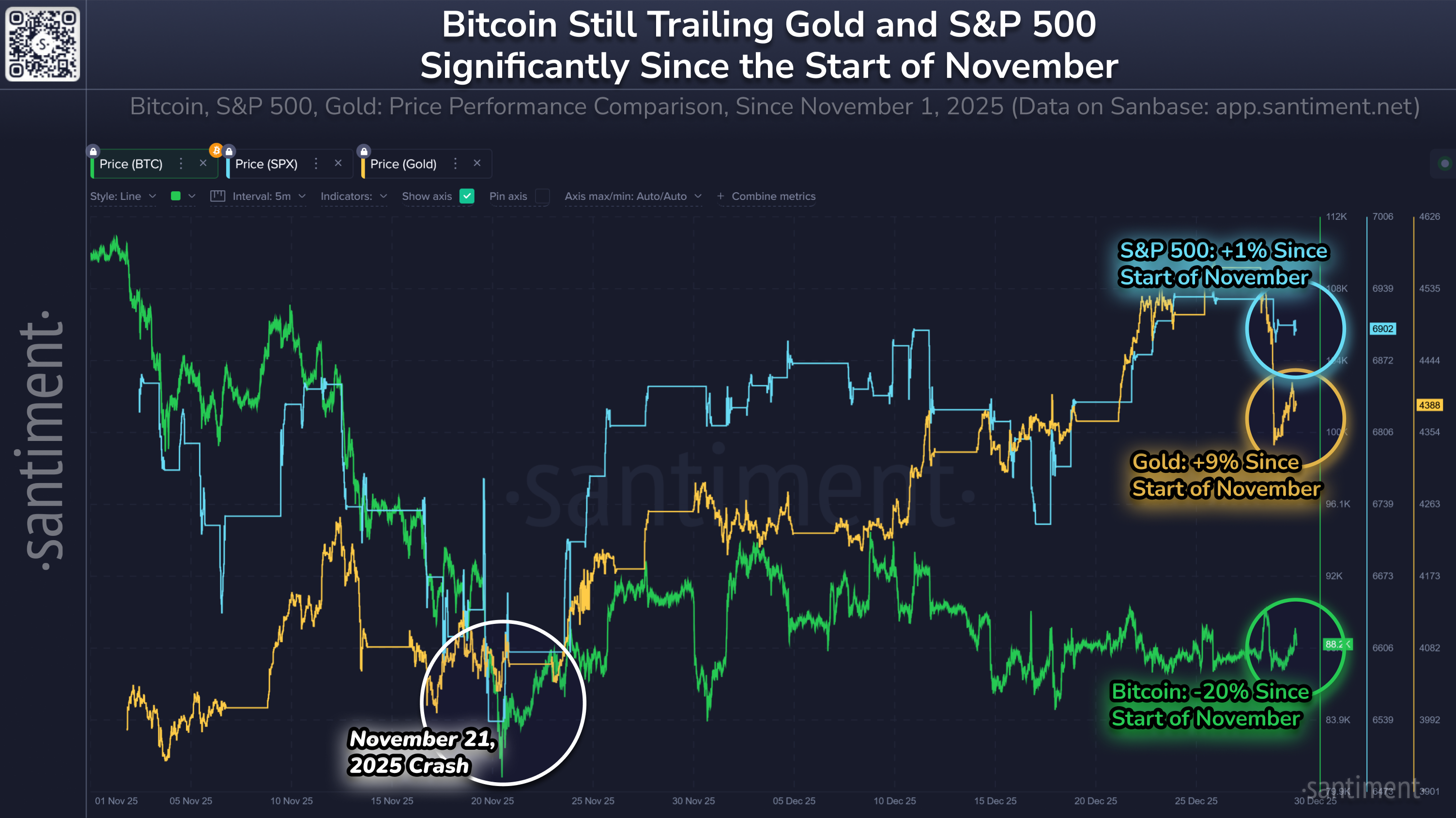

Price of Bitcoin vs. S&P 500 vs. Gold

Comparison of total non-empty wallets on the Bitcoin Ethereum, and XRP network

Social volume of 'tariff' or 'tariffs'

---

Well, what a year 2025 was for a group of crypto traders and investors who thought they'd already seen it all. Cryptocurrency markets were defined less by internal industry drama and more by outside pressure from the global economy and world events. In earlier years, crypto was often viewed as a potential safe haven from inflation, political conflict, and traditional financial instability.

By 2025, however, price action increasingly reflected institutional positioning and macro-driven risk appetite, with digital assets reacting more like established financial markets during moments of stress and relief. Bitcoin's price started the year reflecting the S&P 500 fairly closely, but ended the year trailing fairly significantly.

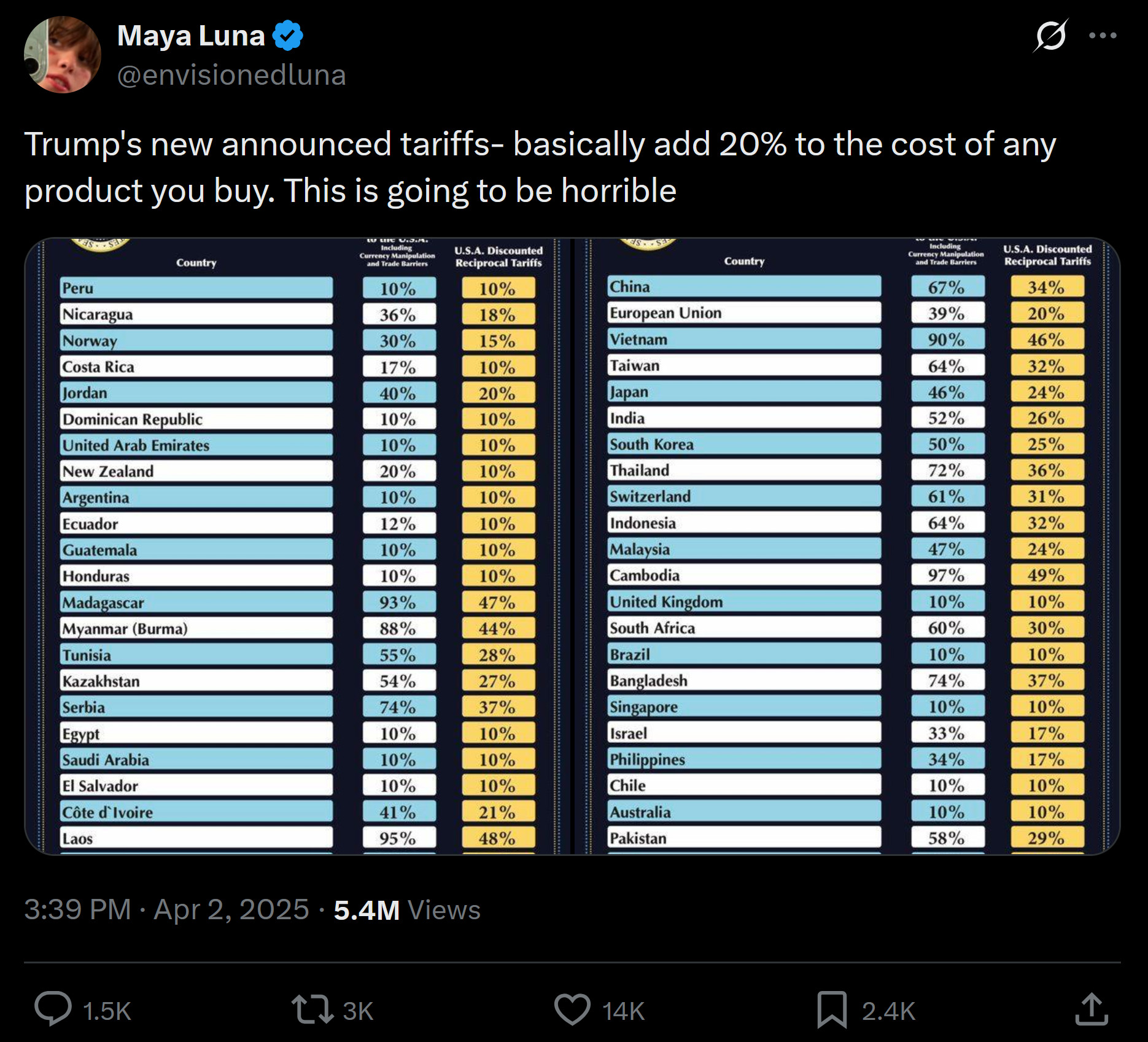

Markets spent much of the year reacting to Federal Reserve policy signals, surprise inflation data, and sudden geopolitical escalations tied to Israel, Palestine, and Iran. The most disruptive moment arguably arrived in early April, when President Trump announced sweeping new tariffs, triggering one of the sharpest risk-off reactions of the year across stocks, crypto, and commodities. Rather than trading on crypto-specific narratives alone, digital assets increasingly moved in step with broader macro fear and relief cycles.

This shift throughout 2025 was reflected in price performance. Bitcoin's price finished 2025 down 6%, while Ethereum ended the year down 10%, despite multiple periods of strong rallies (and subsequent bull traps) from both of crypto's top assets along the way. Price action was often choppy, with fast draw-downs following policy headlines and equally fast rebounds when fears eased. Rate cuts later in the year offered temporary relief, but they also revealed how much good news had already been priced in. By year’s end, it was clear that 2025 was not a simple bull or bear market, but a year of constant recalibration. It was a lesson for many traders of why they can not get too comfortable, especially with crypto being significantly more "mainstream" than it was 5, or especially 10, years ago.

On-chain data told a much more constructive story beneath the surface. Bitcoin added roughly 3.42 million net new non empty wallets over the year, while Ethereum added about 34.85 million (10x more than BTC). This growth suggested steady accumulation and onboarding, especially from smaller holders, even as prices struggled to hold gains. Whale behavior leaned patient rather than aggressive, while retail participation continued to rise during periods of consolidation. The divergence between slowing price momentum and expanding network usage became one of the defining themes of the year.

Still, 2025 had clear setbacks alongside its progress. High profile exchange hacks and security breaches served as painful reminders that infrastructure risk remains a weakness during times of stress. At the same time, the year delivered an encouraging milestone: crypto adoption continued to expand even through macro shocks, tariff-driven volatility, and geopolitical fear. Network growth, improving liquidity, and sustained user activity showed that while prices ended the year lower, the foundations of the crypto ecosystem quietly grew stronger.

We've broken the somewhat disappointing year for crypto into four quarters, with mentions of a couple of the biggest news stories from each month. Enjoy our very recent visit down memory lane, as we go back and see what we observed and learned from in 2025.

-----

Quarter 1, 2025: January - March

Biggest News Stories

January 2025:

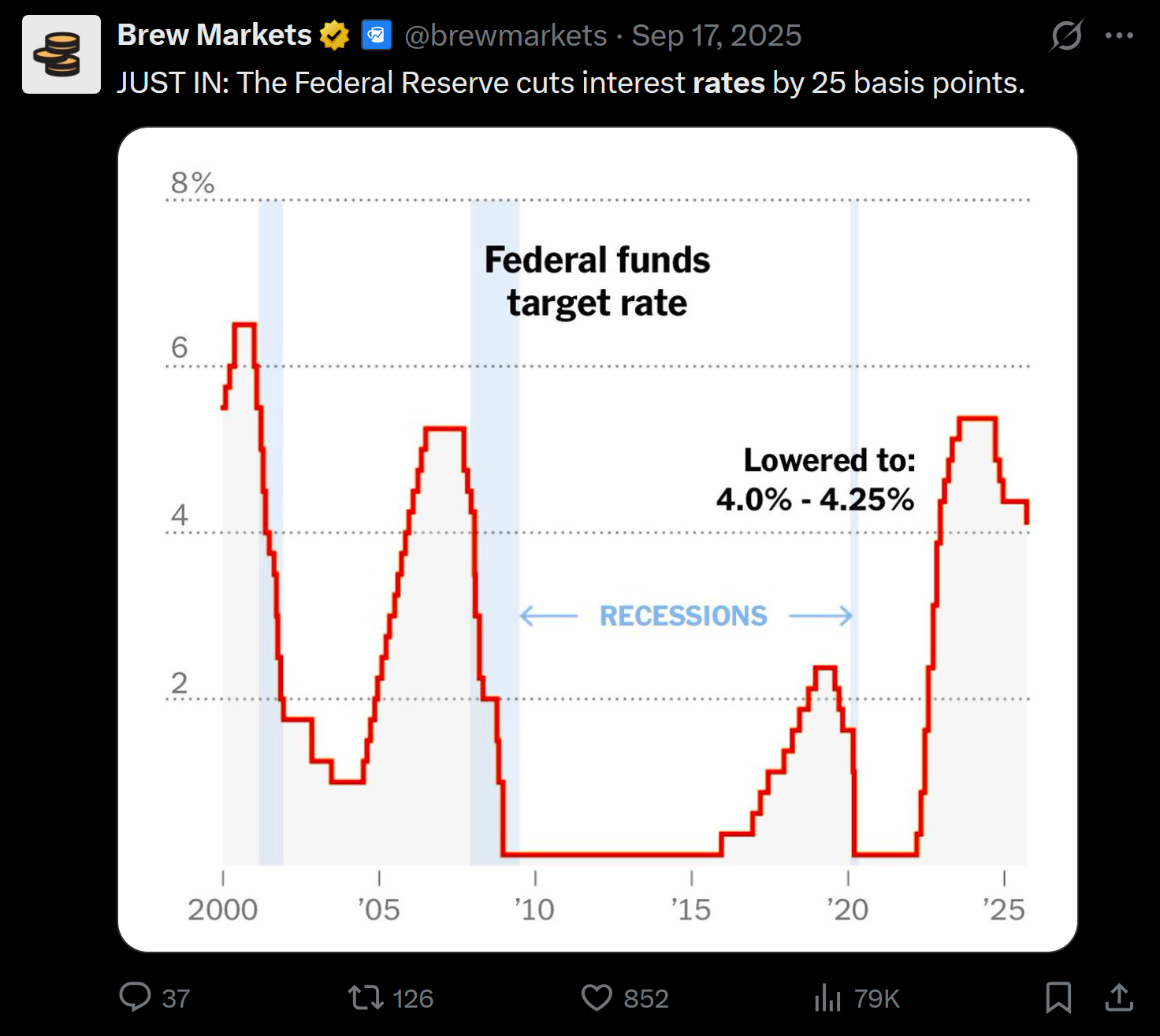

Fed holds rates steady and reinforces a “higher for longer” stance

January opened with the Federal Reserve leaving interest rates unchanged, but the market reaction was driven less by the pause and more by the message that cuts were not imminent. Crypto prices moved sharply in both directions as traders tried to interpret whether risk assets had moved too far ahead of policy reality. Bitcoin and major altcoins reacted much like equities, rallying briefly on relief before selling off as the longer-term implications sank in. The episode reinforced how tightly crypto had become linked to macro expectations rather than internal fundamentals alone.

Early-year optimism around U.S. crypto policy fuels volatility

Alongside rate uncertainty, markets entered the year speculating that U.S. policy could shift in a more favorable direction for digital assets. Even without concrete legislative changes, the idea that Washington might soften its stance was enough to swing sentiment. Traders alternated between optimism and caution, with price action reflecting hope more than confirmation. This disconnect between expectations and reality contributed to choppy conditions rather than sustained momentum.

February 2025:

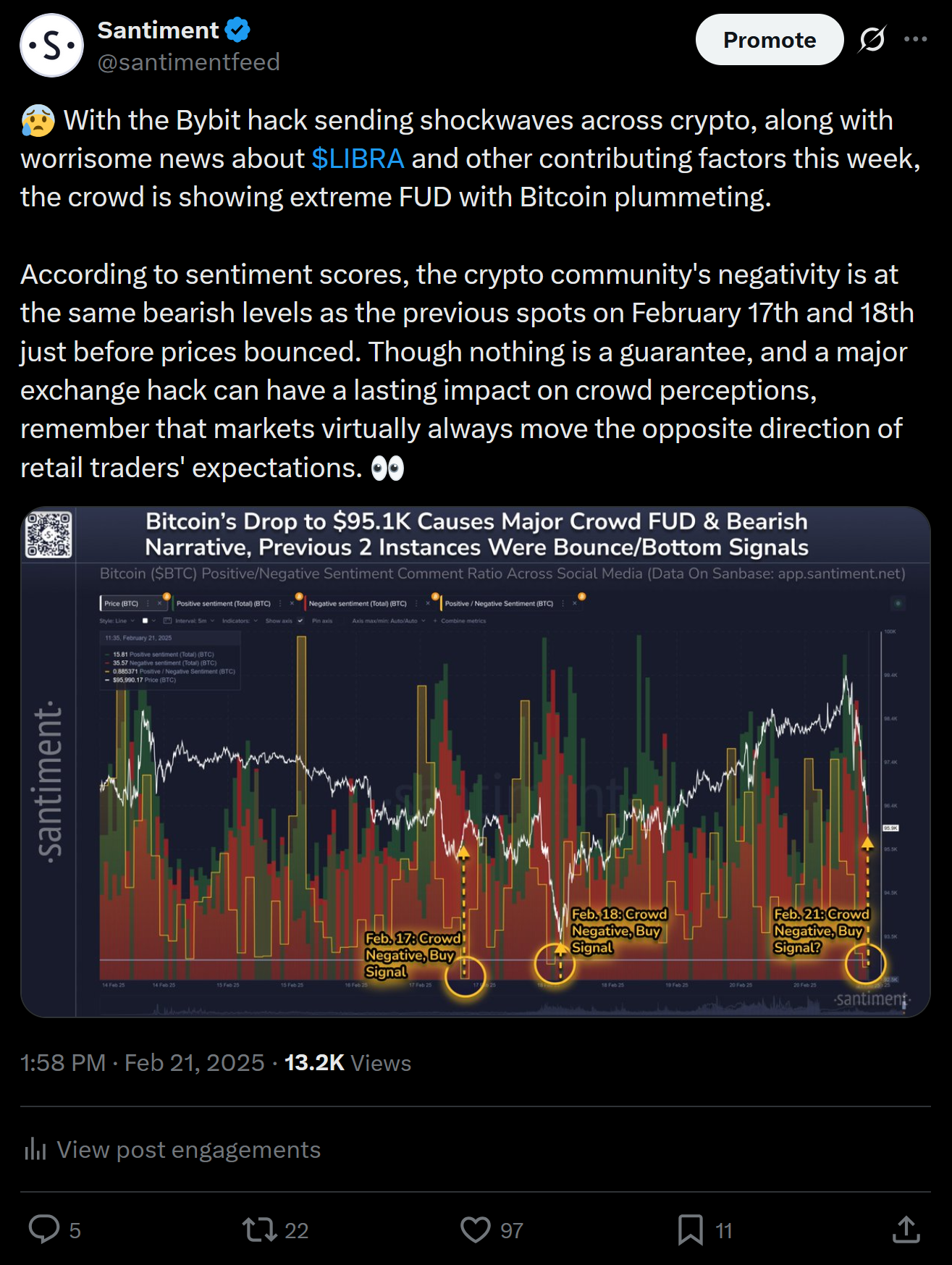

Bybit hack becomes the year’s most damaging security event

In mid-February, the Bybit exchange suffered a major security breach that resulted in the loss of over $1B in digital assets, quickly making it one of the largest crypto thefts of the year. The incident sent shock waves through the market, reviving concerns about centralized exchange risk just as confidence had begun to recover. Prices dipped as traders reassessed the safety of holding funds on exchanges, and on-chain data showed a short-term spike in withdrawals as users moved funds off of several centralized exchanges. The event served as a reminder that even during periods of improving adoption and favorable macro narratives, infrastructure weaknesses can still overwhelm market sentiment.

Rising hack totals deepen risk aversion

As February progressed, it became clear that the Bybit incident was not isolated. A growing tally of stolen funds across the year reinforced a defensive mindset among traders and investors. Each new exploit headline triggered short-term selloffs, even when the affected platforms were relatively small. The pattern showed how a few large security failures could shape sentiment for months, especially in an environment already sensitive to external shocks.

March 2025:

Economic uncertainty and macro anxiety keep markets unstable

March trading was dominated by unease around trade policy, inflation, and slowing growth expectations. Crypto moved largely in sync with stocks as investors reacted to shifting tariff rhetoric and mixed economic data. Rather than acting as an independent asset class, digital assets followed broader risk-on and risk-off flows. The result was a month defined by sharp moves and little follow-through in either direction.

Bybit fallout continues to influence trust and behavior

Even weeks after the hack, the Bybit incident continued to shape conversations around regulation, custody, and exchange exposure. Market participants became more cautious about where capital was held, and policymakers renewed discussions around oversight. This second-order impact extended beyond price, affecting how traders structured risk and how institutions evaluated counterparty relationships. The episode showed how a single failure can echo long after the initial shock fades.

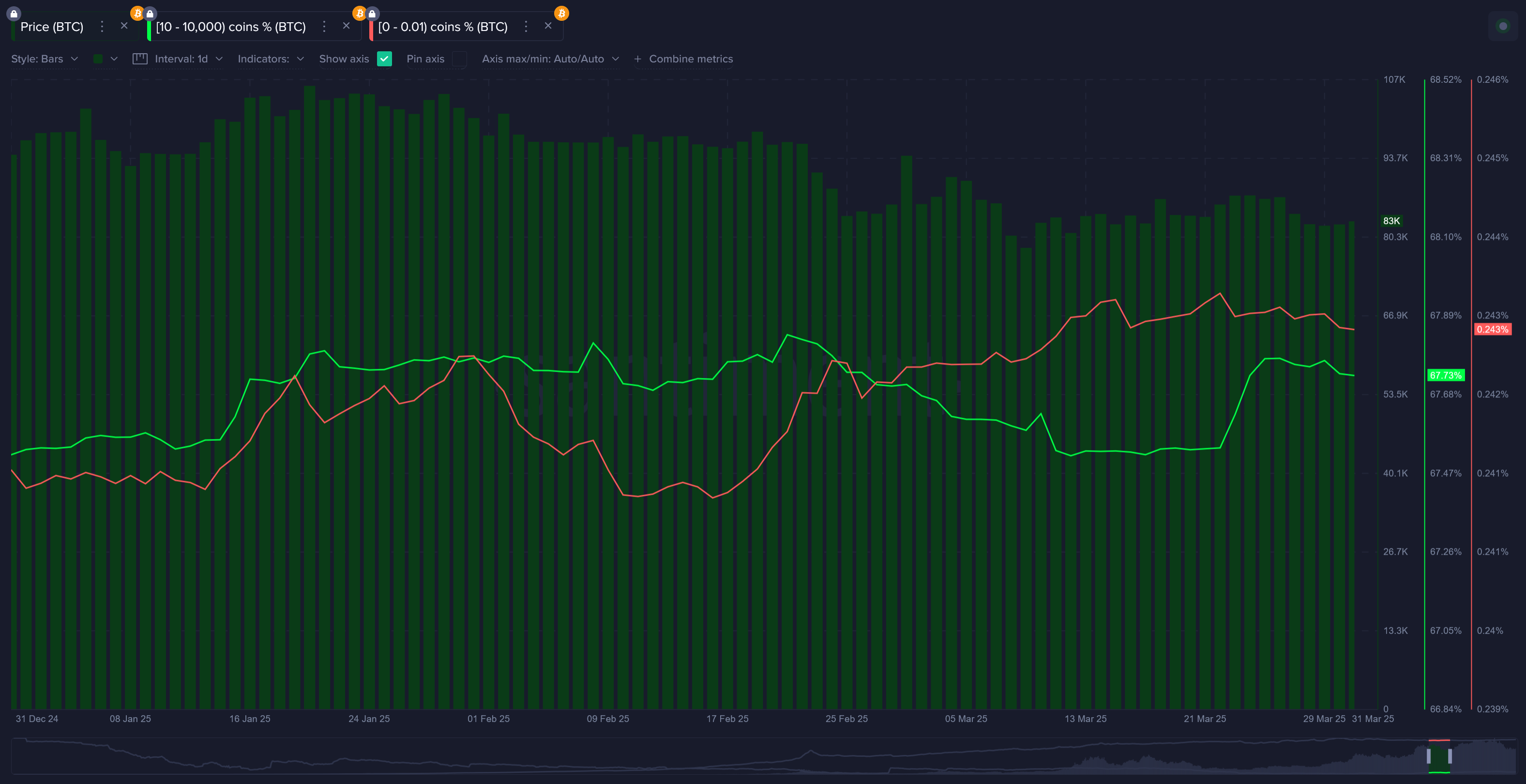

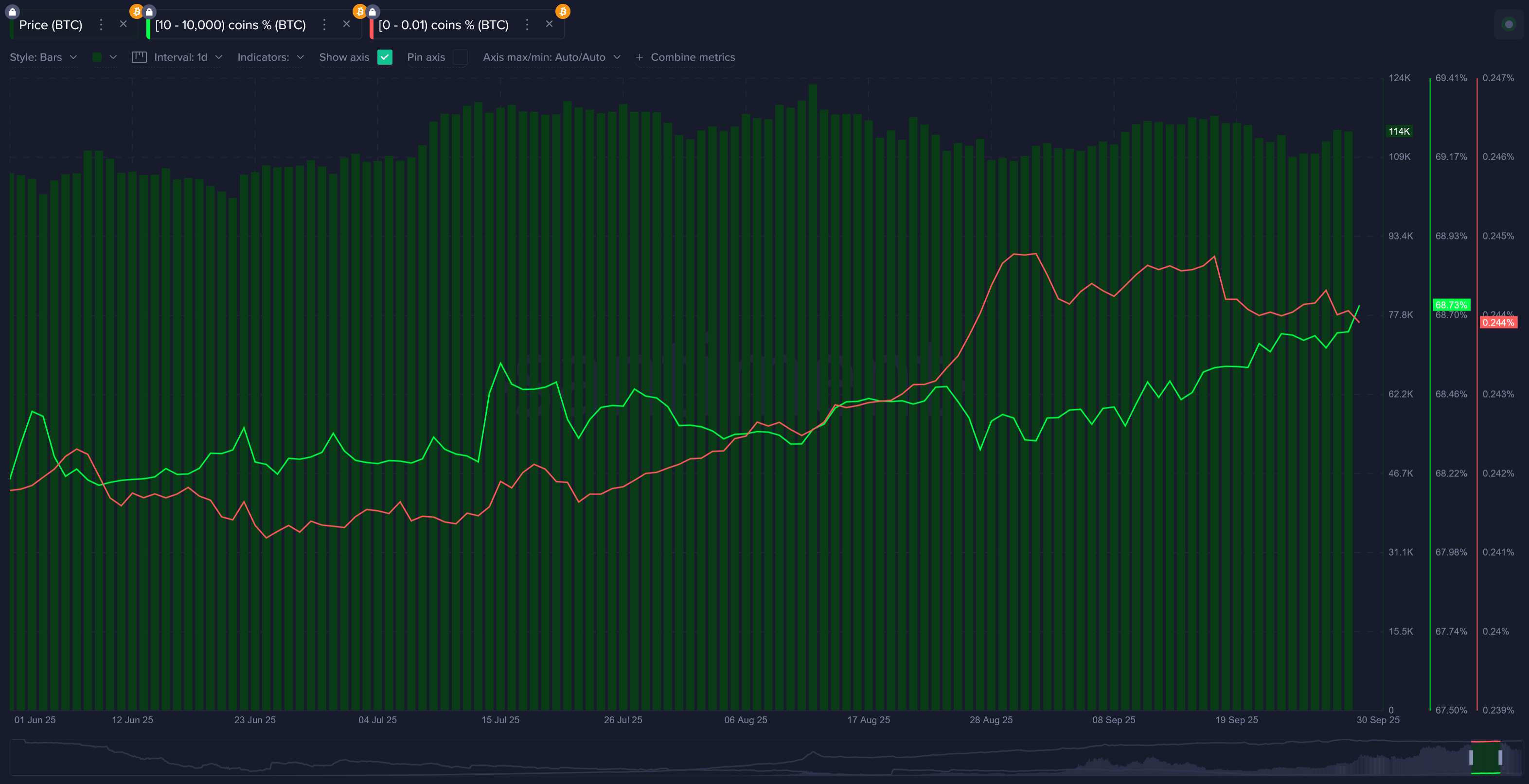

Whale vs. Retail Behavior

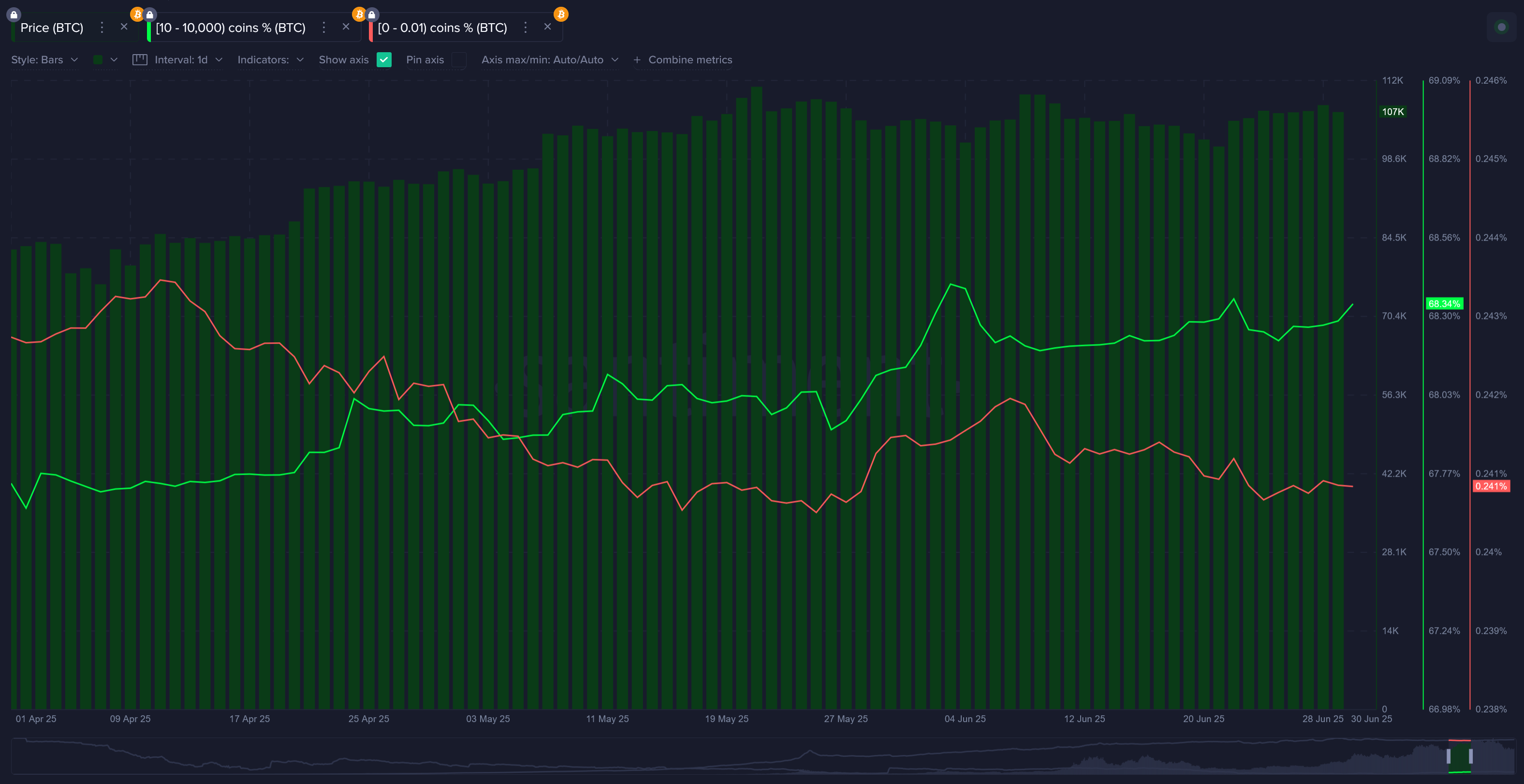

According to Santiment data, Q1's Bitcoin wallets with 10-10K (representing the most active whales & sharks) went through a period of ups and downs as prices declined throughout the quarter. Retail, on the other hand, was still showing plenty of confidence that Trump's new administration would spark some Bitcoin rallies. Ideally, prices will only pick up when high key stakeholders are the ones accumulating mainly, while retail is dumping out of fear. So these were not ideal conditions heading into Q2.

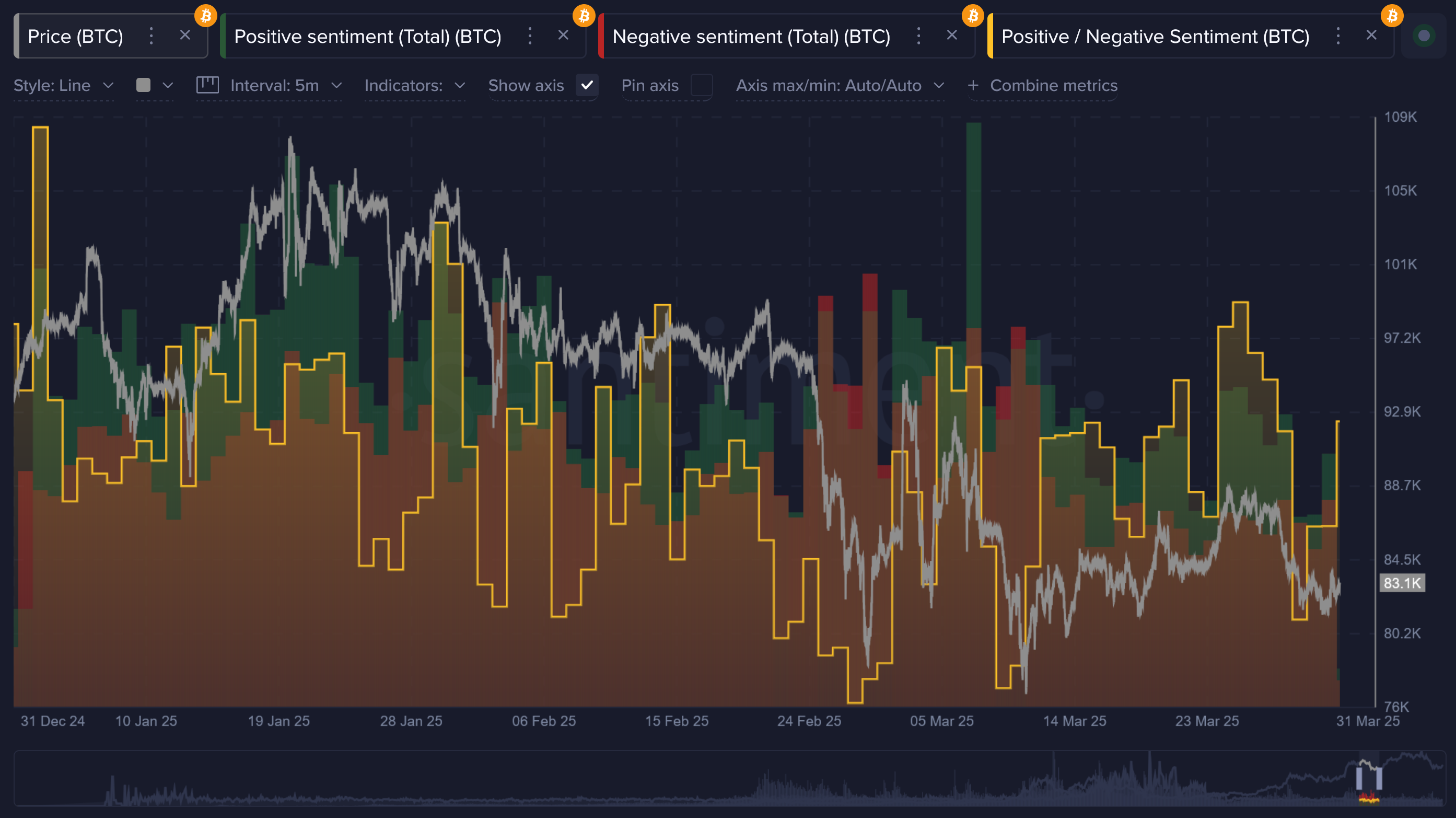

Crowd Sentiment

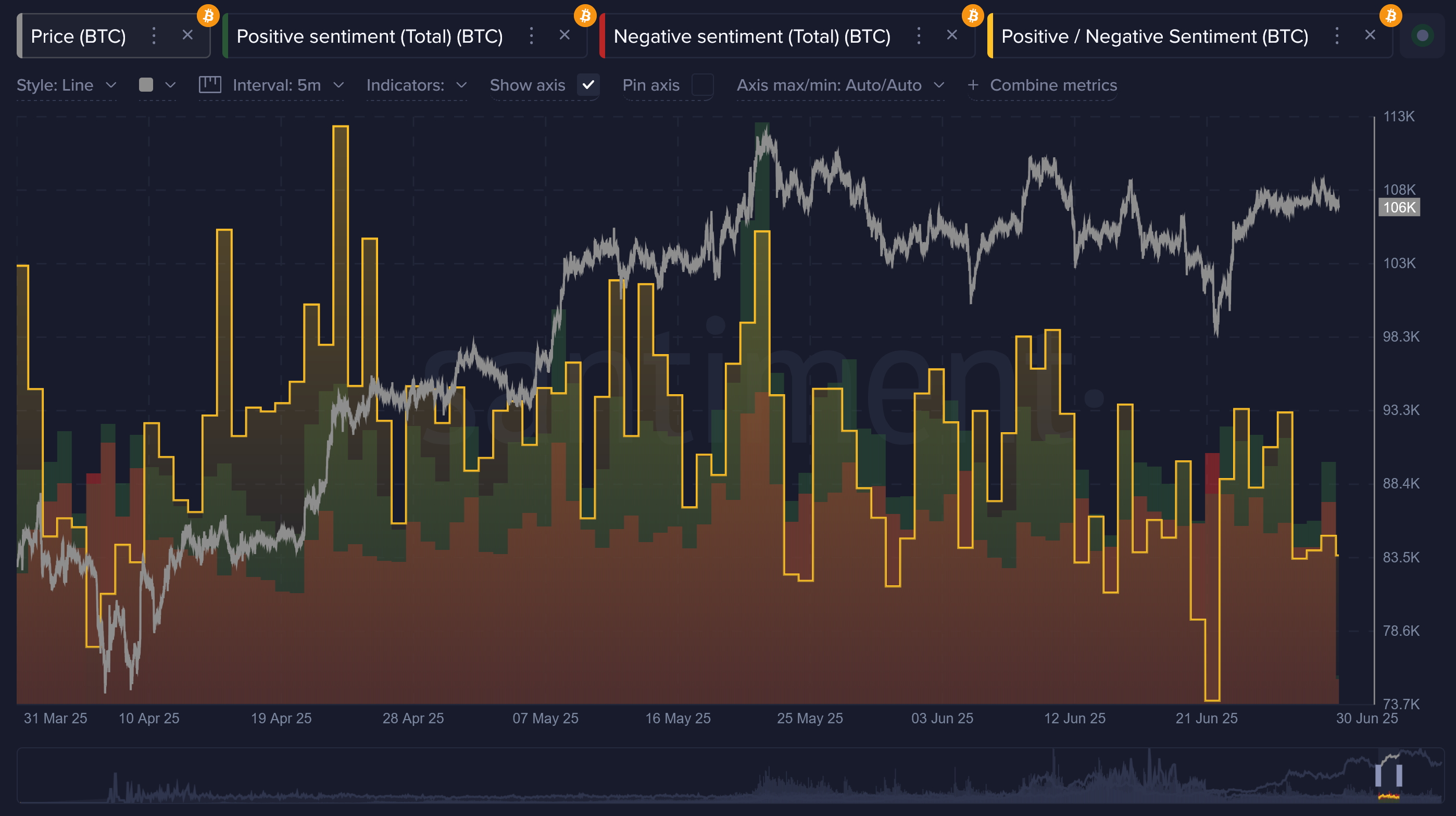

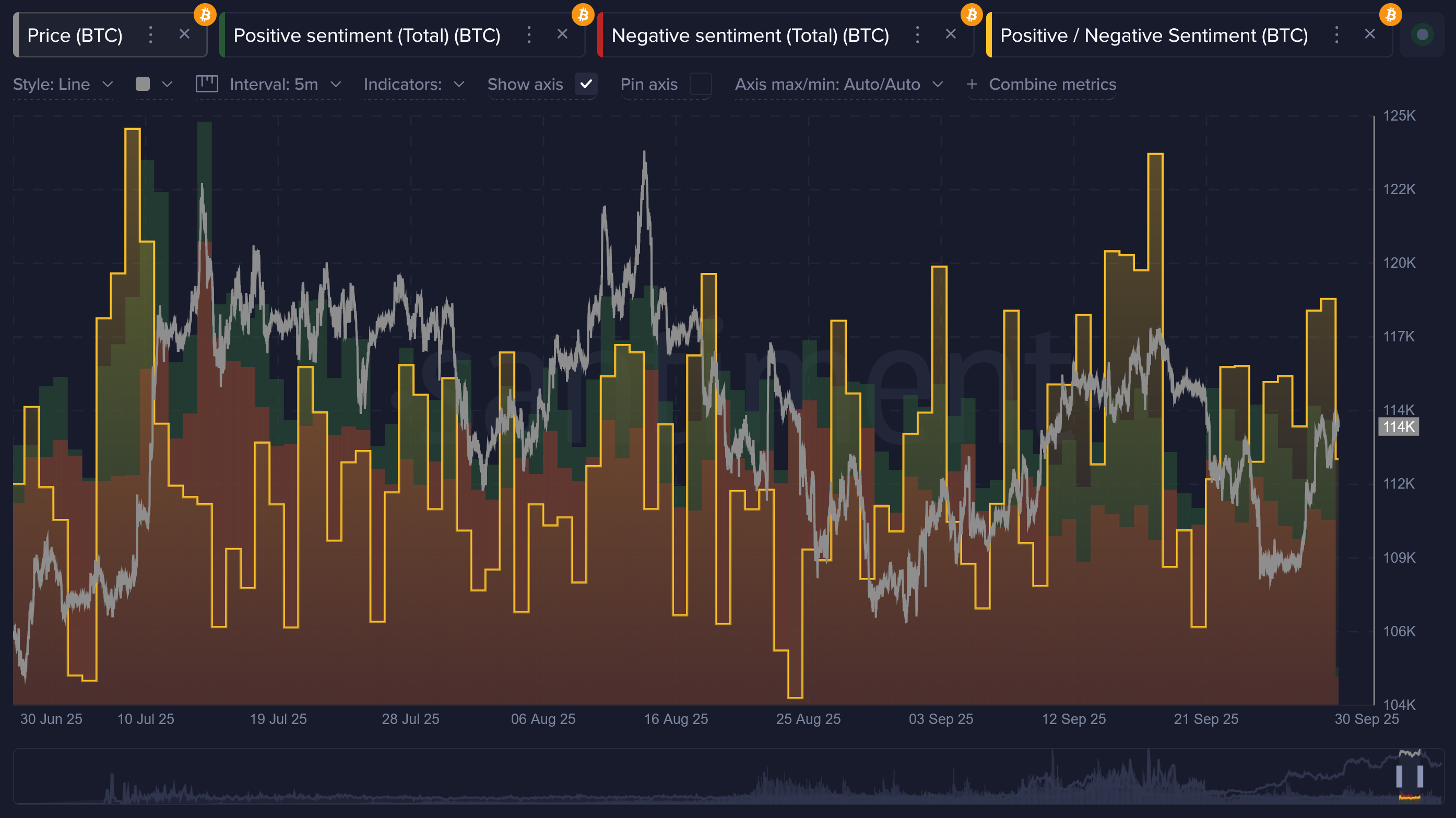

Optimism really rang in the new year at the start of 2025, as Trump was ready to be inaugurated in mid-January, promising a future of pro-crypto policy, the removal of Gary Gensler, and many other aspects to get excited over. But as crypto topped out and began correcting just days after the new president's inauguration, sentiment began to suffer.

There were two price bottoms in late February and mid March that were accompanied by particular bearish sentiment from retail. And as you'd expect, these were the exact times to buy.

Q1, 2025 ratio of positive vs. negative commentary across social media. Source: Santiment

Quarter 2, 2025: April - June

Biggest News Stories

April 2025:

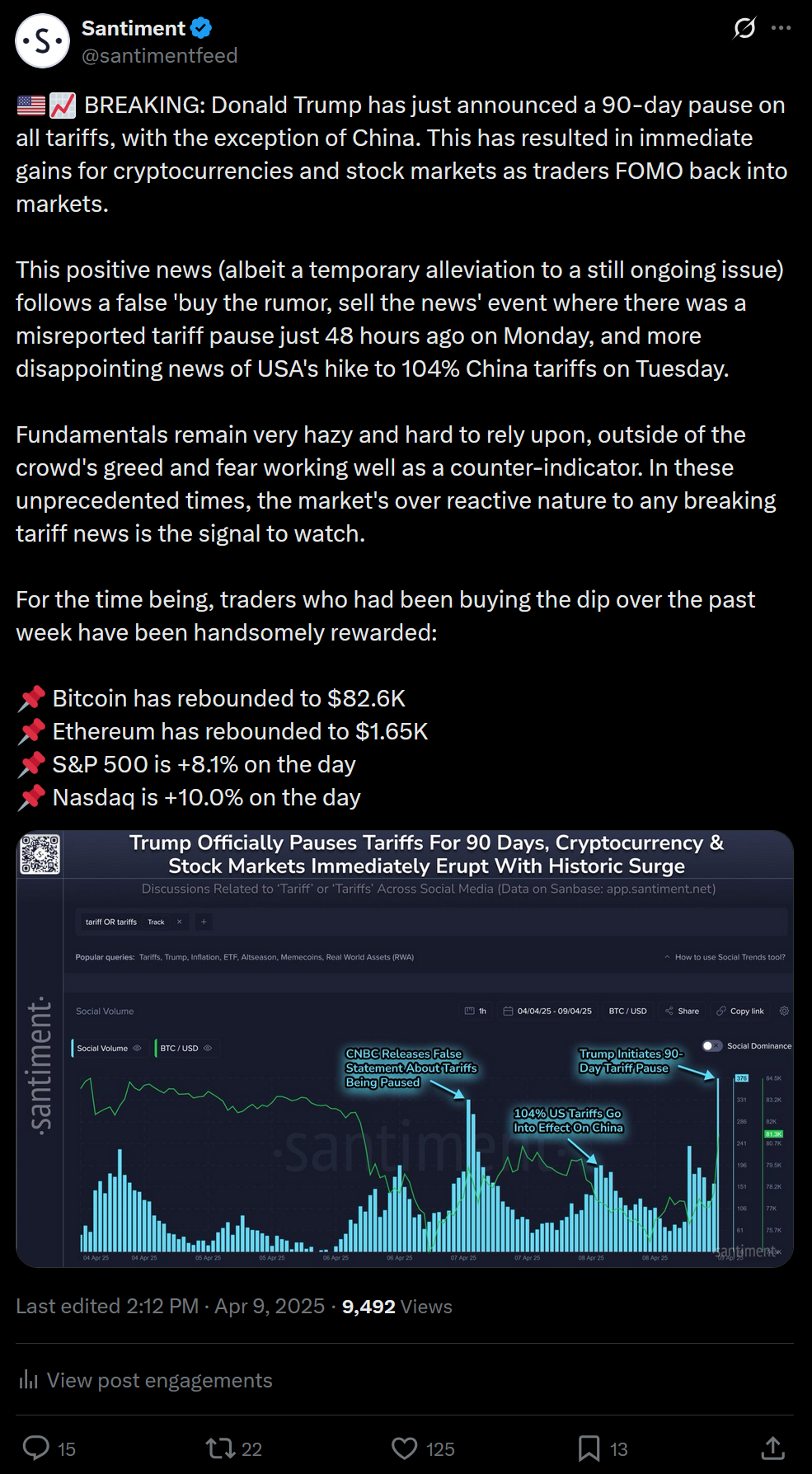

Trump’s tariff announcement triggers a broad risk-off selloff

Early April brought one of the most consequential moments of the year when President Trump announced sweeping new tariffs, often referred to as “Liberation Day.” Markets reacted immediately, with crypto selling off alongside equities as investors priced in slower global growth and higher uncertainty. Bitcoin experienced one of its sharpest declines of the year in the days following the announcement. The move confirmed that macro policy shocks could still overwhelm crypto-specific narratives.

Conflicting tariff signals keep volatility elevated

After the initial selloff, markets were repeatedly whipsawed by rumors of tariff pauses, revisions, or expansions. Each new headline triggered waves of liquidations as traders attempted to anticipate the next policy shift. Crypto markets, with their higher leverage and faster reaction times, amplified these moves. The constant push and pull kept volatility elevated well beyond the initial announcement.

May 2025:

Bitcoin increasingly trades like a macro-sensitive asset

In the aftermath of the tariff shock, Bitcoin’s price behavior closely mirrored other risk assets. Coverage increasingly framed bitcoin not as a standalone hedge, but as part of the broader macro trade influenced by growth expectations and policy uncertainty. Rallies were tied to easing fears, while pullbacks followed renewed concern. This reinforced the idea that institutional positioning was now a dominant force in crypto markets.

State-level bitcoin reserve discussions boost sentiment

Amid macro turbulence, headlines around U.S. states exploring bitcoin reserve strategies provided a rare positive narrative. While largely symbolic, these discussions helped counterbalance negative macro pressure and offered a glimpse of longer-term adoption trends. Markets responded more to the signal than the scale, viewing it as evidence that public-sector experimentation with bitcoin was continuing despite volatility.

June 2025:

Middle East escalation drives a global flight to safety

In June, markets were rattled by a sharp escalation in tensions between Israel and Iran, including direct military actions and heightened warnings of broader regional involvement. Fears that the conflict could disrupt energy markets and draw in global powers quickly spread across financial markets. Risk assets sold off as investors moved capital toward perceived safe havens such as government bonds and the U.S. dollar, and crypto followed that same pattern. Bitcoin dropped alongside equities during the most intense news cycles, showing little insulation from geopolitical fear. Rather than acting as a hedge, crypto traded as a high beta asset, with price movements closely tied to headlines that raised the risk of a wider, global conflict rather than a contained regional one.

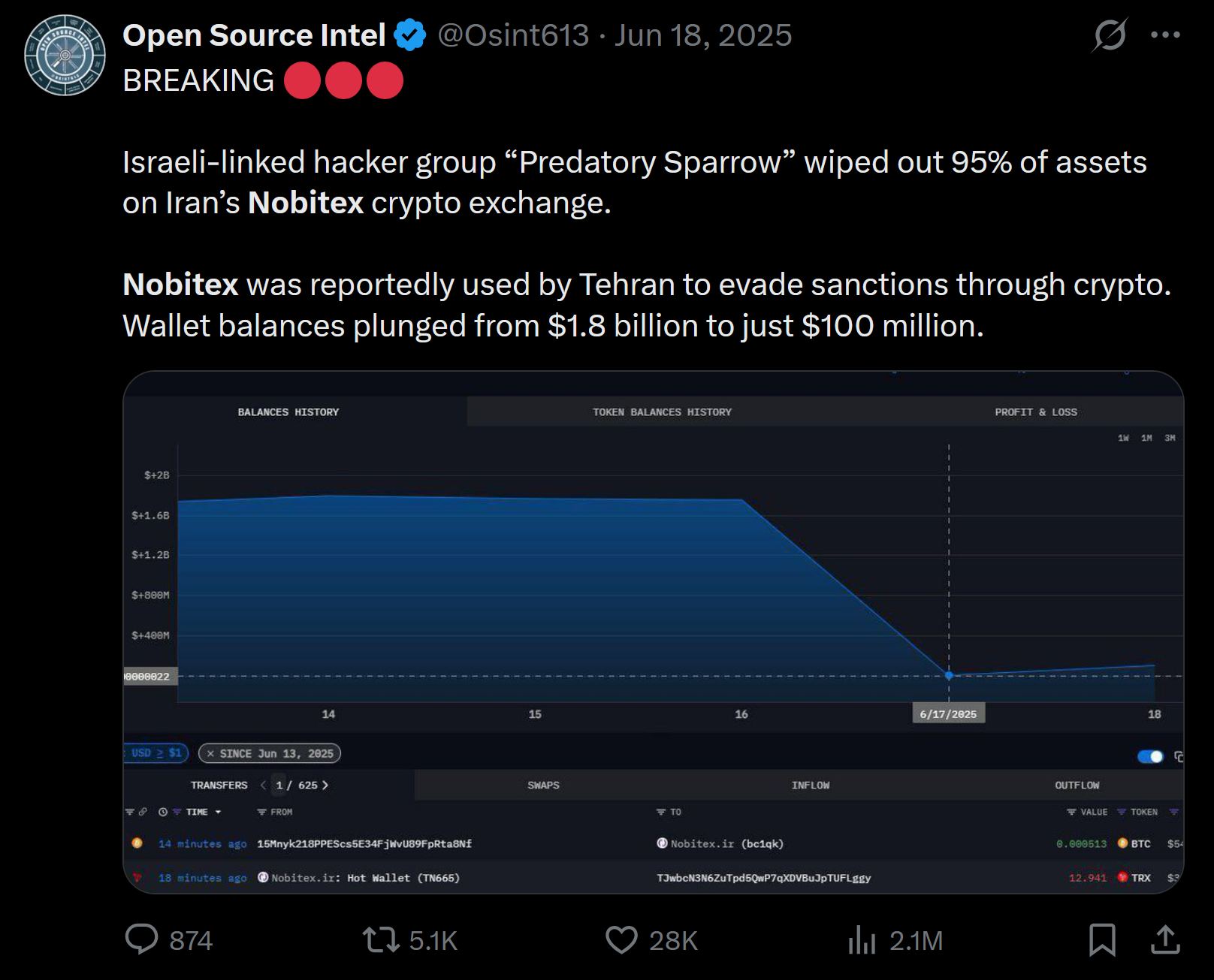

Nobitex hack blends geopolitics with crypto security fears

Around the same time, a major breach at Iran-based exchange Nobitex introduced a new and unsettling dimension to crypto security risk. Blockchain tracking showed that wallet balances tied to Nobitex collapsed from roughly $1.8 billion to near $100 million in a very short window, indicating that the vast majority of assets had been wiped out rather than gradually drained. The attack was quickly linked by open-source intelligence accounts to a hacker group known as “Predatory Sparrow,” which has been widely associated with Israeli cyber operations.

Reports suggested the exchange had played a role in helping Iran move funds around sanctions, giving the incident clear geopolitical overtones rather than the typical profit-driven motives seen in most exchange hacks. This made the Nobitex event especially impactful for markets, as it demonstrated how crypto infrastructure could become a direct target in state-level or proxy conflicts. Instead of being treated as an isolated security failure, the hack reinforced fears that exchanges operating in politically sensitive regions face risks that extend beyond code vulnerabilities, further complicating how investors assess counterparty and regional exposure.

Whale vs. Retail Behavior

Following the major tariff drama right at the beginning of April, 2025, the ideal conditions began to form. Key stakeholders with 10-10K BTC began to go on a massive surge of accumulating throughout Q2, and it really never showed any threats of slowing down. Meanwhile, retail distrust grew over how this new monetary policy may impact their portfolios. So even with price rises, small traders had a tough time justifying to themselves that they could fully FOMO in and support any rallies. These are conditions when prices typically rise, and April through June was certainly no exception to this rule.

Long-term holders continued to strengthen their positions. Dormant coins stayed mostly inactive, suggesting limited panic selling. Exchange balances declined slowly, pointing to users choosing self-custody over short-term speculation.

Crowd Sentiment

Outside of the major panic as a result of Trump's April 2, 2025 tariff announcements, as well as the air strikes between Israel and Iran in late June, sentiment stayed in a slight state of disbelief even as markets significantly rallied and Bitcoin made it back above $110K for a brief moment in late May. This was a good sign of things to come (the eventual October all-time high), considering prices were heating up significantly in Q2, but FOMO from retail wasn't following.

Quarter 3, 2025: July - September

Biggest News Stories

July 2025:

ETF mechanics and regulation keep institutions focused on structure

July coverage focused heavily on the expanding role of spot crypto exchange-traded funds, particularly around how fund structure, custody arrangements, and creation and redemption mechanisms could influence market liquidity. Regulators weighed in on operational details such as settlement timing and how underlying assets were sourced, which mattered greatly for large investors managing inflows and outflows at scale. While these developments did not trigger immediate price surges, they shaped expectations around how easily institutional capital could enter and exit crypto markets without distorting prices.

Large institutional bitcoin purchases support confidence

Throughout July, several high-profile corporate and institutional bitcoin purchases helped anchor sentiment during an otherwise uneven market. Firms such as MicroStrategy, Marathon Digital, and Tesla either added to existing holdings or reaffirmed long-term treasury strategies centered on bitcoin exposure, while large asset managers continued accumulating through regulated vehicles tied to spot ETFs. These purchases were closely watched because they represented deliberate, balance-sheet level decisions rather than short-term trades. Although the buying did not ignite a sharp rally, it provided a consistent source of demand during pullbacks and reinforced the view that institutional participation in bitcoin had matured into a long-term allocation strategy rather than a speculative trend.

August 2025:

Cooling inflation data revives rate cut expectations

August brought softer inflation readings that reignited hopes for easier monetary policy. Crypto markets responded positively as traders priced in a higher probability of future rate cuts. Bitcoin and altcoins benefited from the shift, reflecting their growing sensitivity to traditional economic indicators rather than crypto-specific developments.

Macro data continues to dominate sentiment swings

Despite periods of optimism, sentiment remained fragile. Traders closely monitored every data release and policy comment, with prices reacting quickly to even small changes in outlook. The month highlighted how fast crypto sentiment could reverse when macro expectations shifted, reinforcing a cautious trading environment.

September 2025:

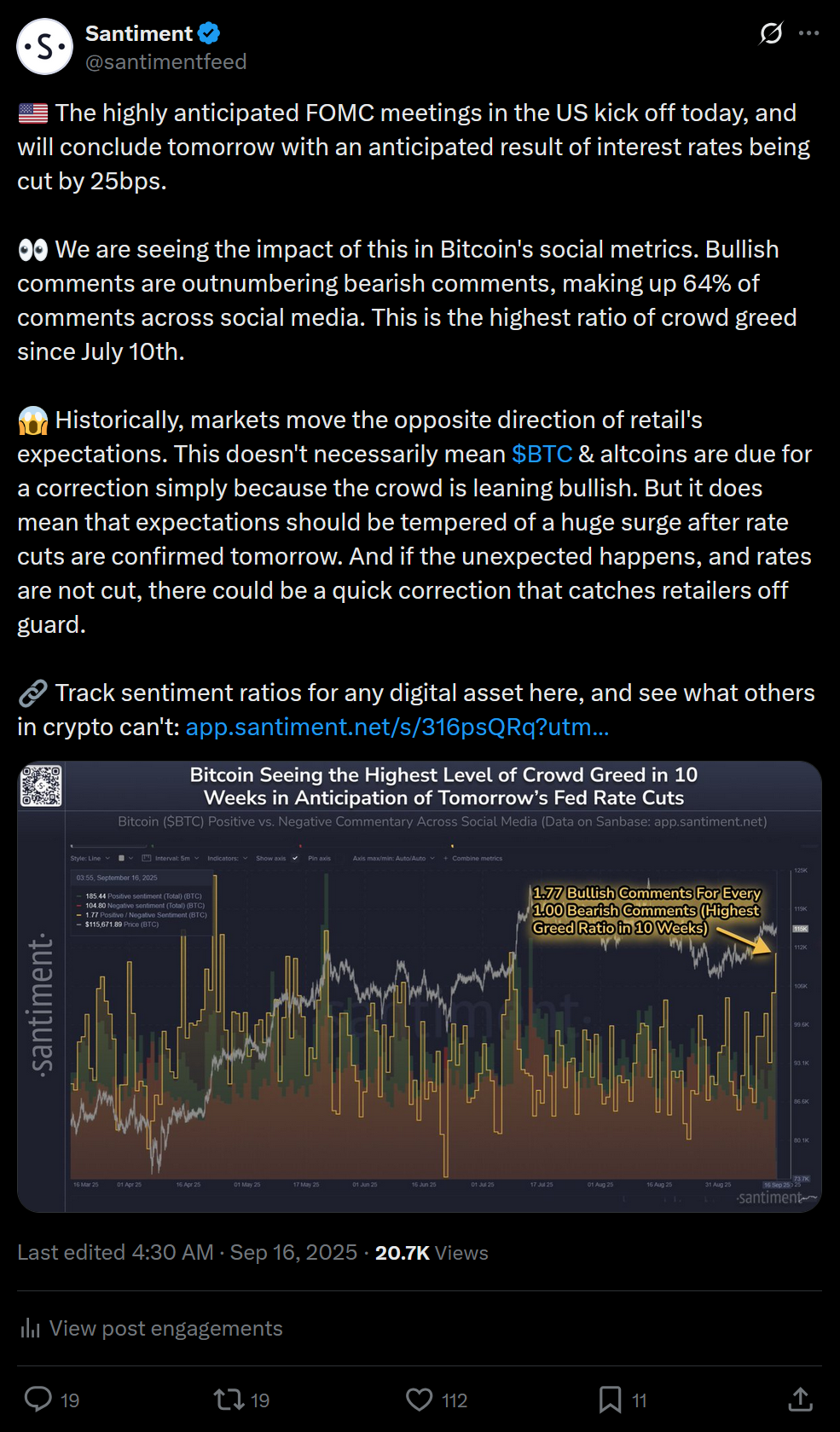

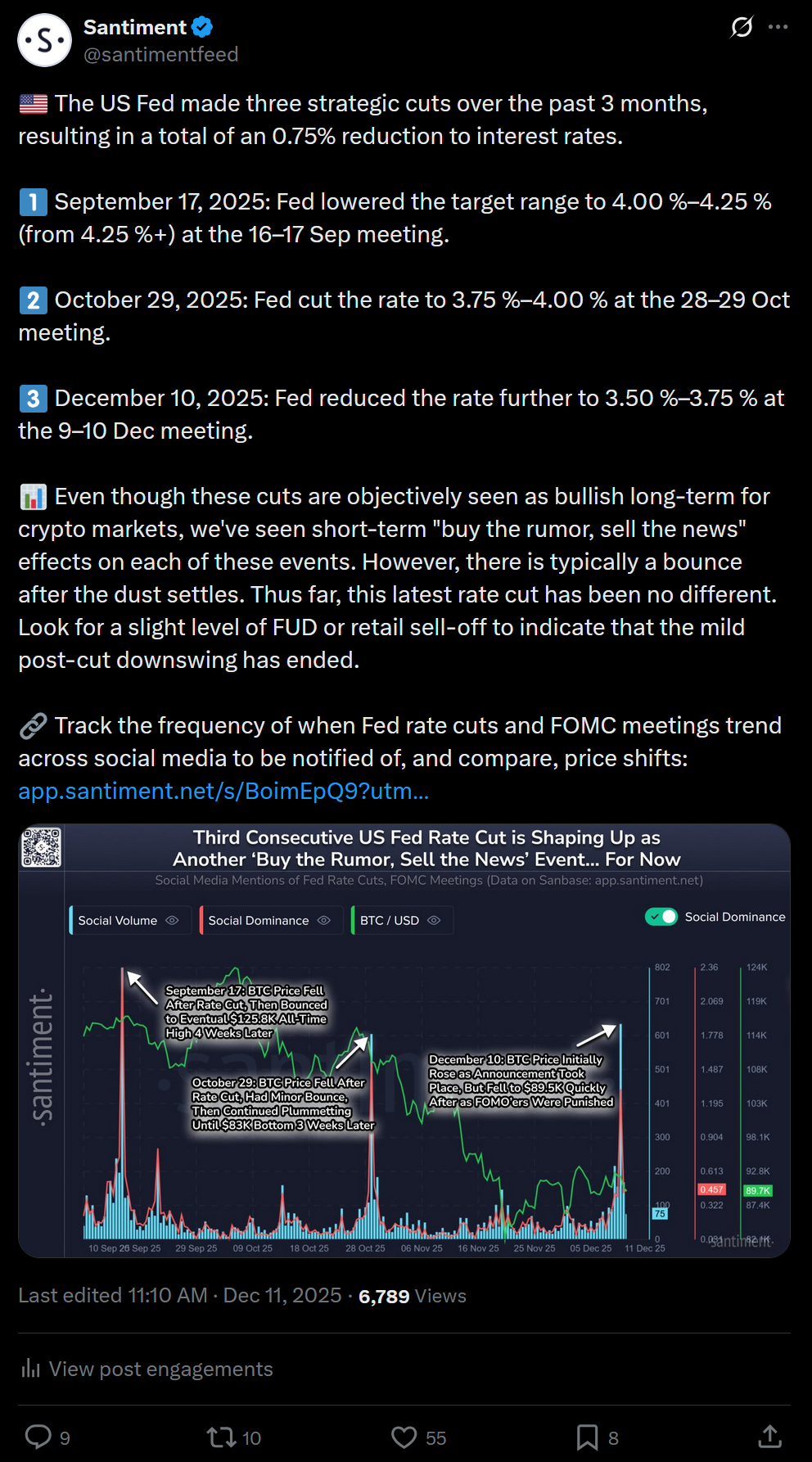

Fed delivers a long-anticipated rate cut with mixed results

When the Federal Reserve finally cut rates in September, the crypto market response was more subdued than many expected. Prices moved initially but struggled to hold gains, suggesting that much of the optimism had already been priced in. Attention quickly shifted from the cut itself to the Fed’s guidance on what might come next.

Easing cycle narrative shapes positioning into Q4

Even with a muted immediate reaction, the first rate cut of the year set a new framework for the months ahead. Traders began positioning around the idea that monetary policy was turning supportive again, even if slowly. This narrative became a key driver of expectations heading into the final quarter.

Whale vs. Retail Behavior

Wallets with 10-10K BTC wallets started quite slow, mostly moving their collective bags just slightly up through June and July. Meanwhile, retail began to accumulate extremely aggressively between mid-July and late August. Not coincidentally, this was where we saw Bitcoin and crypto prices begin to top out. But just as August was coming to an end, there was a sudden switch that led to retail dumping and whales & sharks accumulating. This pattern seemingly picked up more and more steam all the way until the end of September. Not coincidentally, the first week of October (in the next section) would make these aggressive whales & sharks very wealthy.

Crowd Sentiment

Social sentiment during the third quarter actually began to heat up as summer turned to fall. By late July, the narrative surrounding the looming threat of tariffs were mostly being put behind by retail. Many, during these months, wrote them off as simply a one-time threat that would not haunt the markets again. Those who had failed to buy the early April dip "wouldn't be fooled again", and were rapidly becoming more and more confident during this time.

Quarter 4, 2025: October - December

Biggest News Stories

October 2025:

Bitcoin reaches a new all-time high on strong ETF inflows

Early October marked a major milestone as bitcoin surged above $126,000, driven largely by heavy inflows into spot ETFs. Institutional demand played a central role, with large capital movements pushing prices to record levels. The move reinforced the importance of regulated investment vehicles in shaping market structure.

Renewed tariff threats trigger sharp liquidation event

That optimism was short-lived. Around October 10, renewed tariff threats involving China sparked a violent selloff across crypto markets. Leverage was flushed out rapidly, leading to one of the largest liquidation waves of the year. The speed of the reversal highlighted how fragile sentiment remained in the face of policy uncertainty.

November 2025:

Post-liquidation environment forces traders to reduce leverage

Following the October crash, markets entered November in a more cautious state. Traders adjusted position sizes and risk models, aware that sudden policy headlines could still trigger sharp moves. Volatility remained elevated, but leverage levels dropped as participants became more defensive.

Tariffs remain a persistent macro overhang

As the year neared its end, trade policy continued to loom over crypto markets. Even without new announcements, the possibility of further escalation was enough to influence positioning. Tariffs had become one of the most reliable drivers of sudden market reactions in 2025.

December 2025:

One final Fed rate cut brings brief relief, then hesitation

In December, the Federal Reserve cut rates again, prompting an initial bounce in crypto prices. That rally quickly faded as traders focused on the pace and limits of future easing rather than the cut itself. The reaction underscored how forward guidance mattered more than headline decisions by year’s end.

Year-end security reviews reinforce caution into 2026

As 2025 closed, attention turned to the year’s heavy losses from hacks and exploits. Reviews showed that a handful of major incidents accounted for a large share of stolen funds. This sobering assessment tempered optimism and reinforced the importance of security as the market looked ahead to 2026.

Whale vs. Retail Behavior

As alluded to in the whale vs. retail recap in Q3, the major accumulation throughout the five weeks leading up to Q4 helped trigger Bitcoin's monumental run to its first (all-time high) $126K market value. And just as celebrations were getting under way, we began to see whales & sharks suddenly take tons of profit and dump. All this while retail went on an aggressive accumulation spree of their own as Bitcoin's price began to freefall. This switch marked the end of the "good times" for BTC and crypto in 2025.

Crowd Sentiment

Though October started off well with an incredible and historic Bitcoin surge to $126K, things quickly soured after Trump's announcement of 100% tariffs on China (which were rescinded just two days later). Regardless, this is where crypto began to really take a beating. Bitcoin's price plummeted -30.4% from its October 6, 2025 to the end of the year. This did not stop retail from confidently trying to buy dips, assuming any fall was reminiscent of the bear traps that occurred during the first tariff scares back in early April. But it really wasn't until massive FUD began to show up in mid-November and early December when Bitcoin was able to at least cease the bleeding.

Looking back, 2025 stands out as a year that challenged how crypto markets behave. Prices were driven much more by interest rates, tariffs, and global conflicts than by crypto-specific news. Bitcoin and Ethereum both ended the year lower, yet activity on their networks continued to grow. Wallet creation increased, long-term holders stayed patient, and whale behavior often told a clearer story than social sentiment. The year showed that crypto has become more connected to traditional markets, reacting quickly to the same fears and relief that move stocks and other risk assets.

Heading into 2026, the big question is whether this pattern of retail defiantly buying dips continues or begins to shift. If there is too much more retracing, expect that small traders finally get impatient to sell their bags at a loss, which is what crypto needs in order to rebound. Investors should pay close attention to how future rate cuts actually impact markets, not just how they are announced. It will also be important to watch whether institutions keep buying through ETFs and corporate treasuries, or if that demand slows during the next bout of uncertainty.

Security risks and geopolitical tensions also will remain key factors, as future hacks or global conflicts could once again test confidence across the crypto ecosystem. Crypto being sensitive and heavily involved to geopolitical and other real-world events is likely the new normal, but this doesn't mean they can't benefit markets the same way they can take away.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.