Bybit x Santiment Biweekly Report: Platform Tokens Shine

Even though most blockchains are designed to be transparent, privacy remains one of crypto’s oldest and strongest ideals. Traditional cryptocurrencies like Bitcoin, Ether and over 99% of other tokens record each of their transactions in a public ledger that anyone can trace, meaning that anyone with the right tools can analyze your spending habits, income sources or wallet connections. Privacy tokens, on the other hand, protect sensitive information, such as the sender, receiver and amount of each transaction. Out of over 25,000 active crypto tokens tracked across exchanges and aggregators, fewer than 200 (≈0.8%) implement any form of privacy-by-design.

Often, the idea of these types of digital assets can cause some to associate these tokens with potential criminal activity. After all, why else would you need complete anonymity?. Nevertheless, for many users, the privacy sector doesn’t exist for the purpose of hiding from the law. Much of the pro-privacy coin community sees the sector’s existence as a way to truly restore the financial confidentiality that existed with cash. It certainly doesn’t hurt that prices have been soaring for the sector here in October.

Anonymity is a concept that’s aligned with the decentralized nature of cryptocurrency’s original objective. Just as people wouldn’t want their bank statements publicized, many crypto users don’t want their wallet activity exposed. Gray-area moral arguments aside, privacy tokens emerged back in early 2014 (with the release of Bytecoin and Monero) to give individuals the choice to transact freely without constant oversight. In doing so, the 11-year-old sector preserves a part of crypto’s original vision — financial freedom that isn’t conditional based on government or corporate approval.

How privacy tokens differ from the rest of crypto

Privacy tokens are unique because they go beyond decentralization, also hiding transaction details by default or on demand. Monero (XMR), Zcash (ZEC) and Dash (DASH) are three leading examples, each one taking a different approach to balancing transparency and anonymity. These long-standing tokens exist to ensure that user data can’t be linked back to an identifiable person or address. Here’s a breakdown of how each one works:

- Monero (XMR) uses ring signatures, stealth addresses and RingCT (Ring Confidential Transactions) to obscure the origin, destination and amount of every transaction. For instance, when someone sends XMR, their transaction is mixed with many other transactions, making it impossible to tell which one is real. This design makes Monero fully private by default, meaning every transaction on its network is shielded. Because no addresses or amounts are ever exposed, it’s nearly impossible for outside observers to blacklist coins or trace wallet histories. However, this same strength creates friction with regulators — as many exchanges have delisted XMR due to anti–money-laundering concerns, forcing users to rely on peer-to-peer markets or decentralized exchanges.

- Zcash (ZEC) takes a more flexible approach with zk-SNARKs (zero-knowledge proofs), allowing users to choose between public or shielded transactions. When users opt for shielded transactions, ZEC hides both the sender and receiver information, while still verifying that the transaction is valid. This lets users share “view keys” with auditors or tax authorities, making it a popular compromise between privacy and compliance. Yet, because many users still use transparent transactions, only a portion of Zcash’s total activity is truly private. Analysts note that if most users don’t opt in, the network’s privacy strength can be diluted.

- Dash (DASH) was one of the earliest Bitcoin forks to introduce privacy features. Its PrivateSend function mixes multiple transactions together, making it harder to track funds directly from sender to receiver. However, Dash’s privacy is optional and less sophisticated compared to Monero and Zcash. Today, Dash is often marketed more as a “fast payments” coin than a full privacy token, focusing on speed and global adoption rather than complete anonymity.

These three coins show how privacy in crypto exists on a spectrum. Monero sits at one extreme in that it’s considered fully private, but is constantly facing tighter regulations. Zcash balances privacy with optional transparency. Dash offers light obfuscation, mainly for more mainstream adoption and convenience.

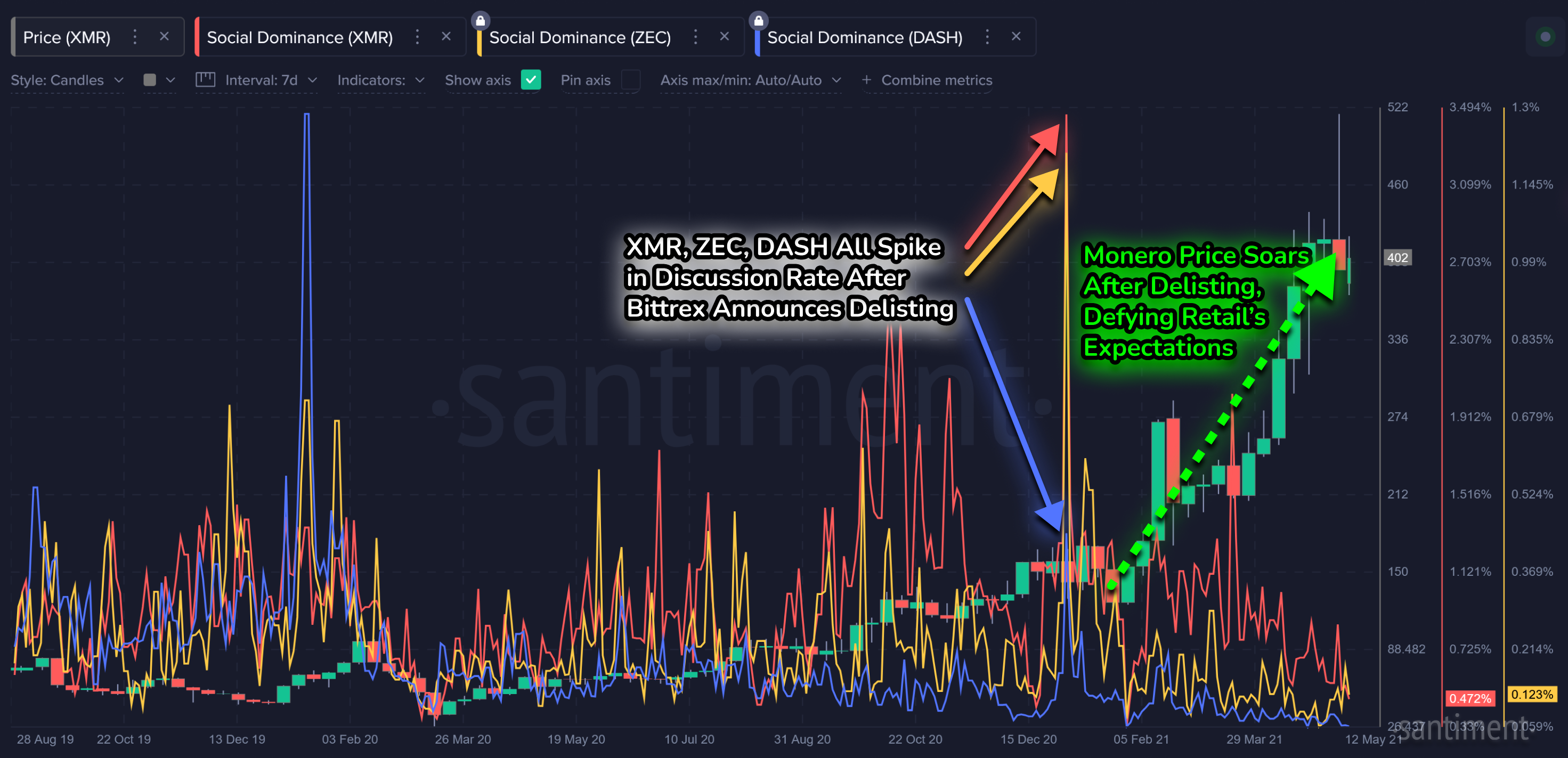

XMR, ZEC and DASH were all delisted on exchanges such as Bittrex (now permanently closed) back in late 2020, and we saw their metrics reflect this impact as coins were moved in mass exodus. Unsurprisingly, privacy coins can actually benefit from all of the retail panic that comes with this kind of news. Below is a chart reflecting the spike in discourse around these coins following the Bittrex delisting announcement, and the subsequent Monero price rally:

For users, the right choice depends upon priorities: do you want maximum anonymity, flexible compliance, or just more privacy than Bitcoin? Understanding these differences helps explain why privacy tokens are seen as a separate, often misunderstood, category of crypto.

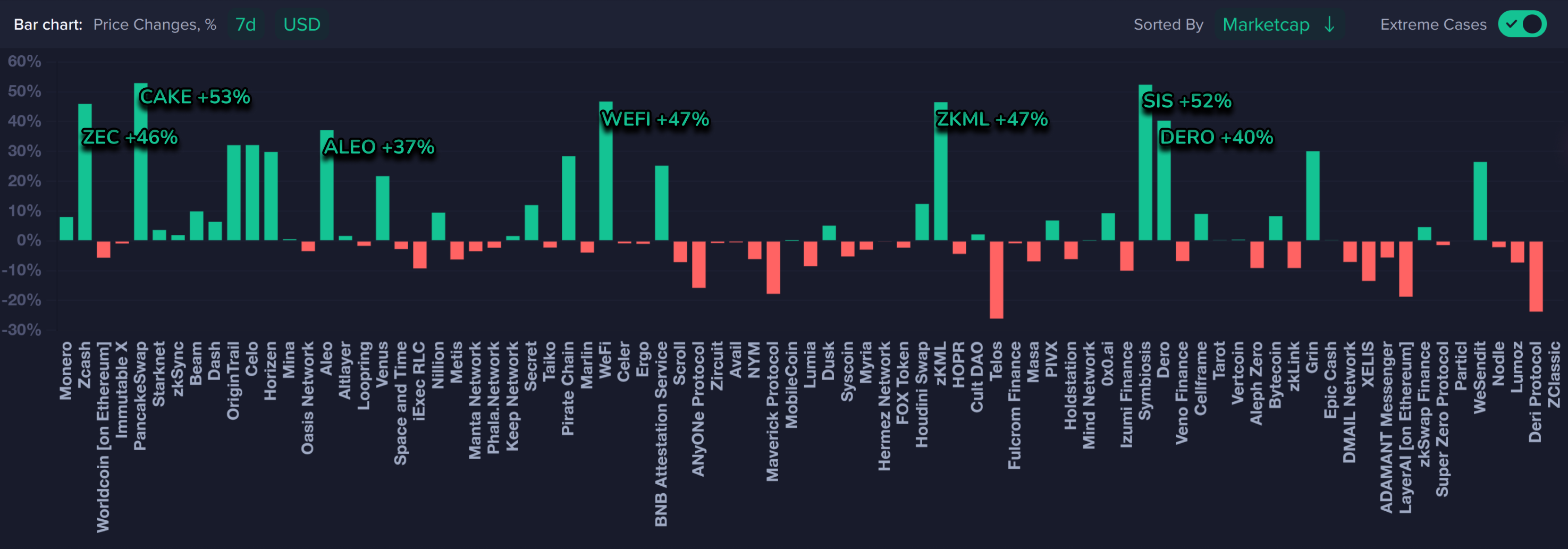

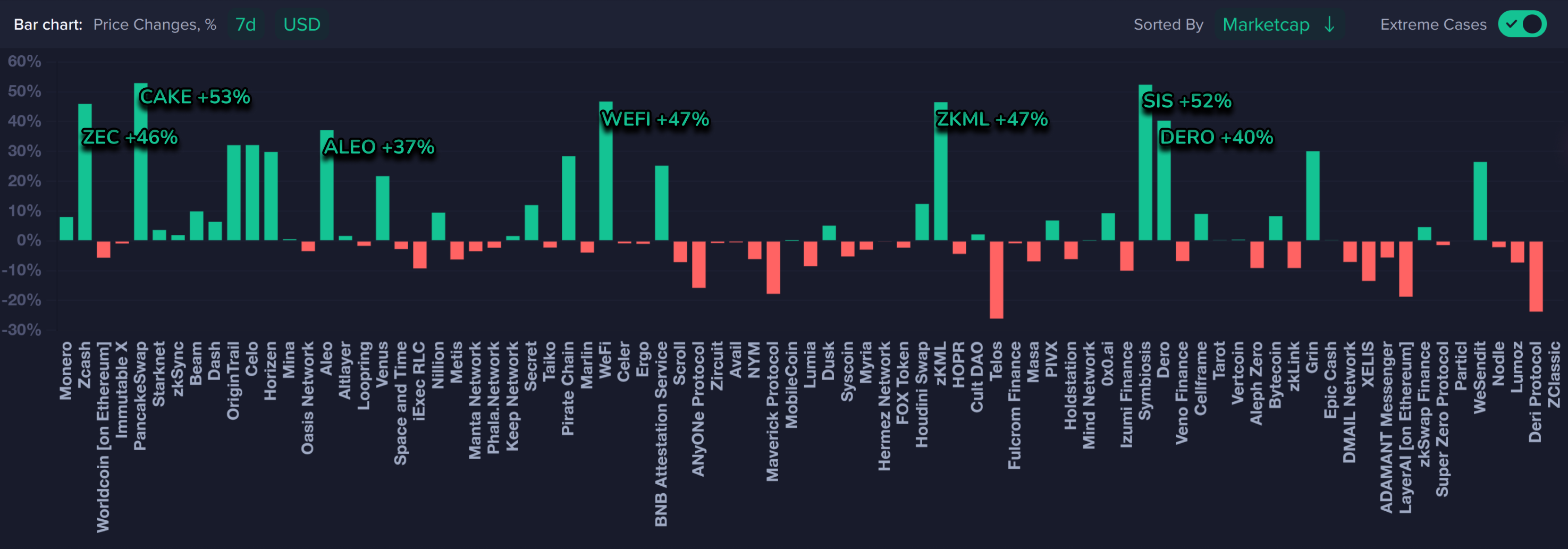

Why privacy coins are rising in popularity again

In 2025, privacy tokens have quietly made a comeback. Several privacy projects , like Monero, Zcash, Secret Network. and RAILGUN, have outperformed the majority of the altcoin pack this year. Their rebounds follow a long period in which privacy coins were overshadowed by trends such as AI tokens, meme coins and Layer 2 networks. So: Is it just regression to the mean, and privacy’s turn in the altcoin cycle? Well, this resurgence has also been fueled by heightened global surveillance debates and the rollout of central bank digital currencies (CBDCs), which have raised public concern over financial tracking. In response, many investors have turned to privacy coins as a hedge against a future in which every transaction could potentially be monitored.

One major reason for this resurgence is the increased global concern about surveillance. In many countries, governments are developing central bank digital currencies (CBDCs) that can track spending in real time. This raises fears of financial control or censorship. As a response, more users are turning to privacy-preserving cryptocurrencies to maintain autonomy over their money. Exchanges in regions like Asia and Latin America report steady growth in Monero and Zcash usage, suggesting users want alternatives to fully traceable systems. These tokens act as a hedge — not just against inflation, but against overreach.

Another key factor is that of technological innovation. Privacy tokens are no longer limited to simple “anonymous payments.” Projects like Secret Network and RAILGUN are introducing private smart contracts, enabling hidden DeFi activity and shielded token transfers on major networks such as Ethereum. This makes privacy compatible with modern crypto use cases, such as staking, lending and cross-chain trading. The result is a growing recognition that privacy isn’t a separate feature — it’s infrastructure that can integrate into the wider web3 ecosystem. As more tools make privacy easy and user-friendly, the stigma surrounding privacy coins is slowly fading.

The permanent role of privacy in crypto

Privacy tokens have faced years of scrutiny, and yet they continue to thrive because they fill a void no other cryptocurrency category can. Decentralized networks may secure your funds from centralized control, but only privacy networks protect your identity and data from exposure. In a world in which every transaction on public blockchains is traceable, privacy coins restore a level of discretion that used to exist with physical cash. This matters not only for individuals, but also for charitable donations, businesses managing sensitive contracts and payrolls that shouldn’t be publicly visible.

Looking ahead, privacy technology will likely evolve toward a balance between user protection and regulatory compliance. Developers are already experimenting with ways to let auditors verify activity without exposing private details, potentially easing the ongoing debates between transparency and privacy. Meanwhile, users are learning that protecting their financial footprint may not be as shady as once imagined. It’s arguably just smart cybersecurity: just as we lock our phones and encrypt our messages, keeping transactions private is becoming part of responsible digital behavior.

Privacy coins may never dominate headlines as Bitcoin or Ethereum do, but they serve as a vital foundation for financial freedom. Their steady presence reminds the world that cryptocurrency is far more than just investment vehicles, large caps and meme coins: it was built to empower people to control their money and their data, regardless of how economies progress. As awareness of digital surveillance grows, that purpose ensures privacy tokens will always have a meaningful place in crypto’s future.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

This full article is also available on Bybit's website!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.