Altcoin Flash Crashes Indicating Second Wave of Tariff Plot Twists?

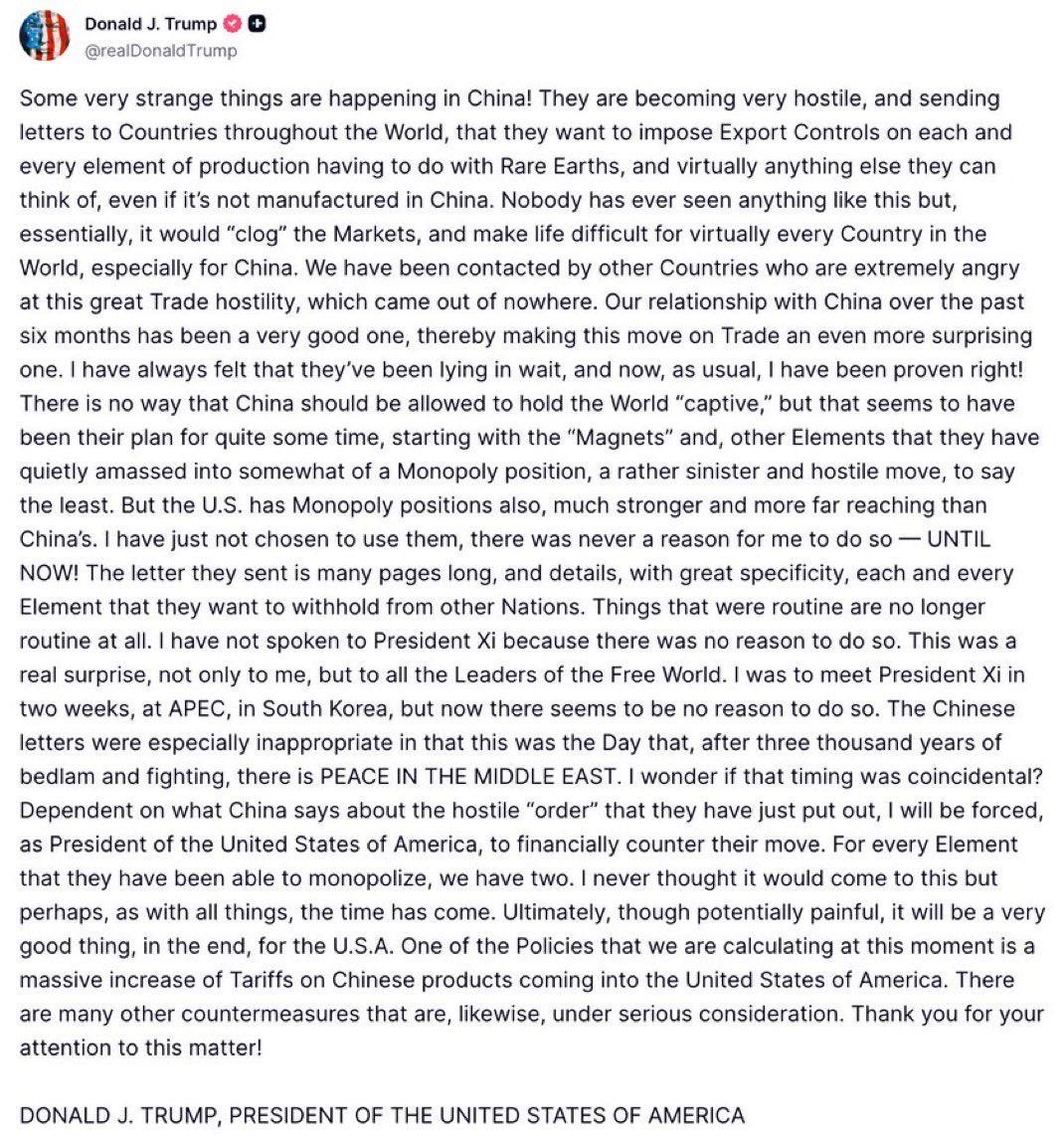

Who knew that the morning market (US time) shake-up Friday would be just the beginning? While stock markets were ranging, Trump used his Truth Social platform to deliver a sharp message about China and tariffs. His post accused Beijing of becoming “very hostile” and threatened a “massive increase” in import duties on Chinese goods in retaliation for China’s export controls on rare earth metals. The timing and tone of the message suggested an abrupt escalation in already tense trade relations. Many observers interpreted it as a rupture in what had been tentative progress in diplomacy between the two countries.

Prior to the post, there had been signs of potential meetings between Trump and Xi Jinping. But the message seemed to foreclose further talks or delay them indefinitely. In some markets, this was seen as effectively cancelling or freezing any impending meeting between the two leaders. In that way, Trump’s public post acted as both signal and trigger: a signal that talks might be failing, and a trigger for markets to immediately reprice risk.

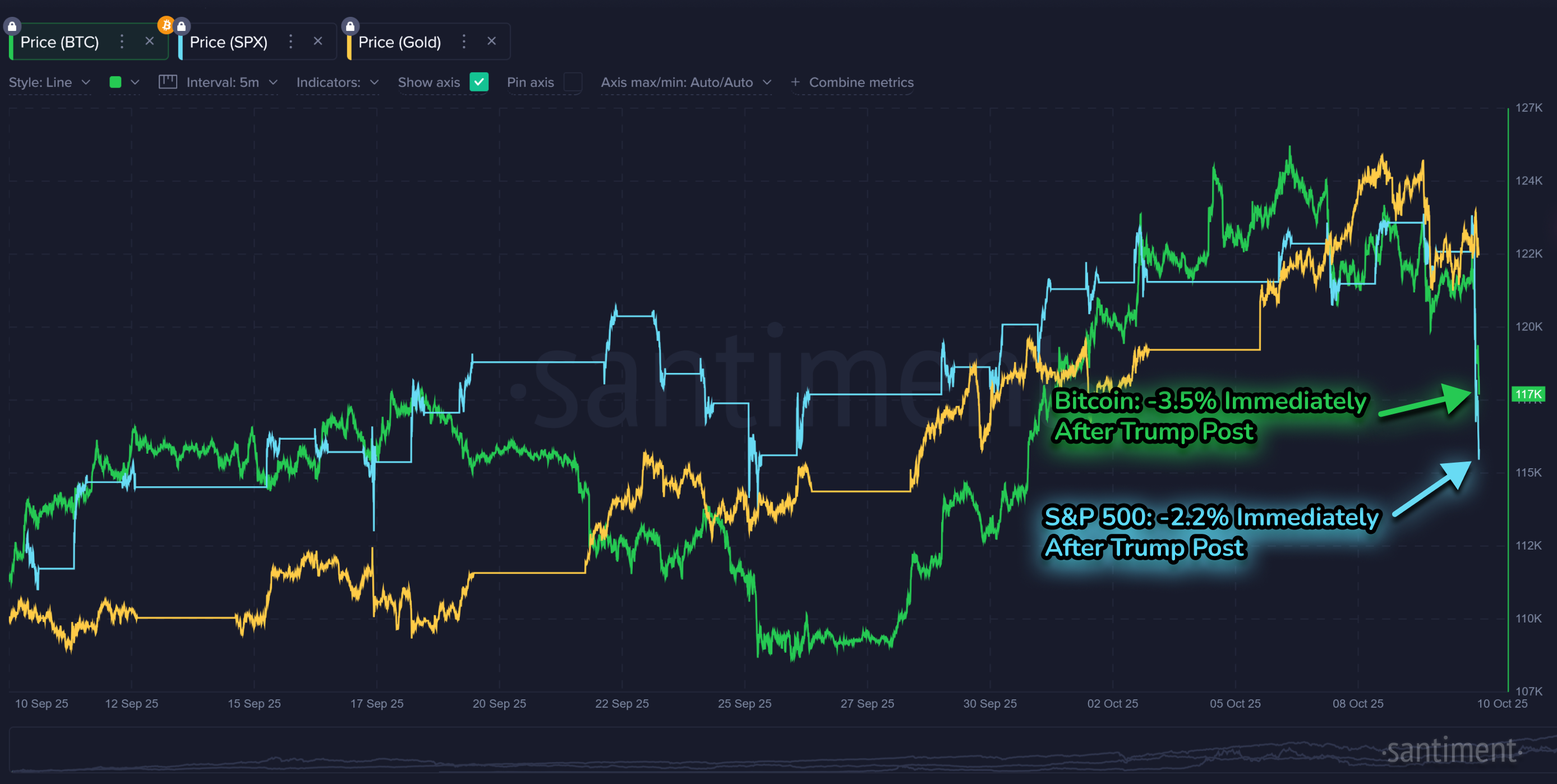

Regardless, the reaction was swift. Traditional markets braced for turbulence. U.S. stocks sold off hard as investors feared a new wave of trade friction. Reports indicate the S&P 500 fell by around 2 percent or more in early trading after the post. Safe-haven assets and interest rates moved in response: bond yields dropped, and gold surged past $4,000 an ounce as traders sought shelter. Crypto markets followed the same direction. Within minutes of the post, Bitcoin fell from around $122,000 to below $119,000, dropping roughly 3–4 percent in intraday movement.

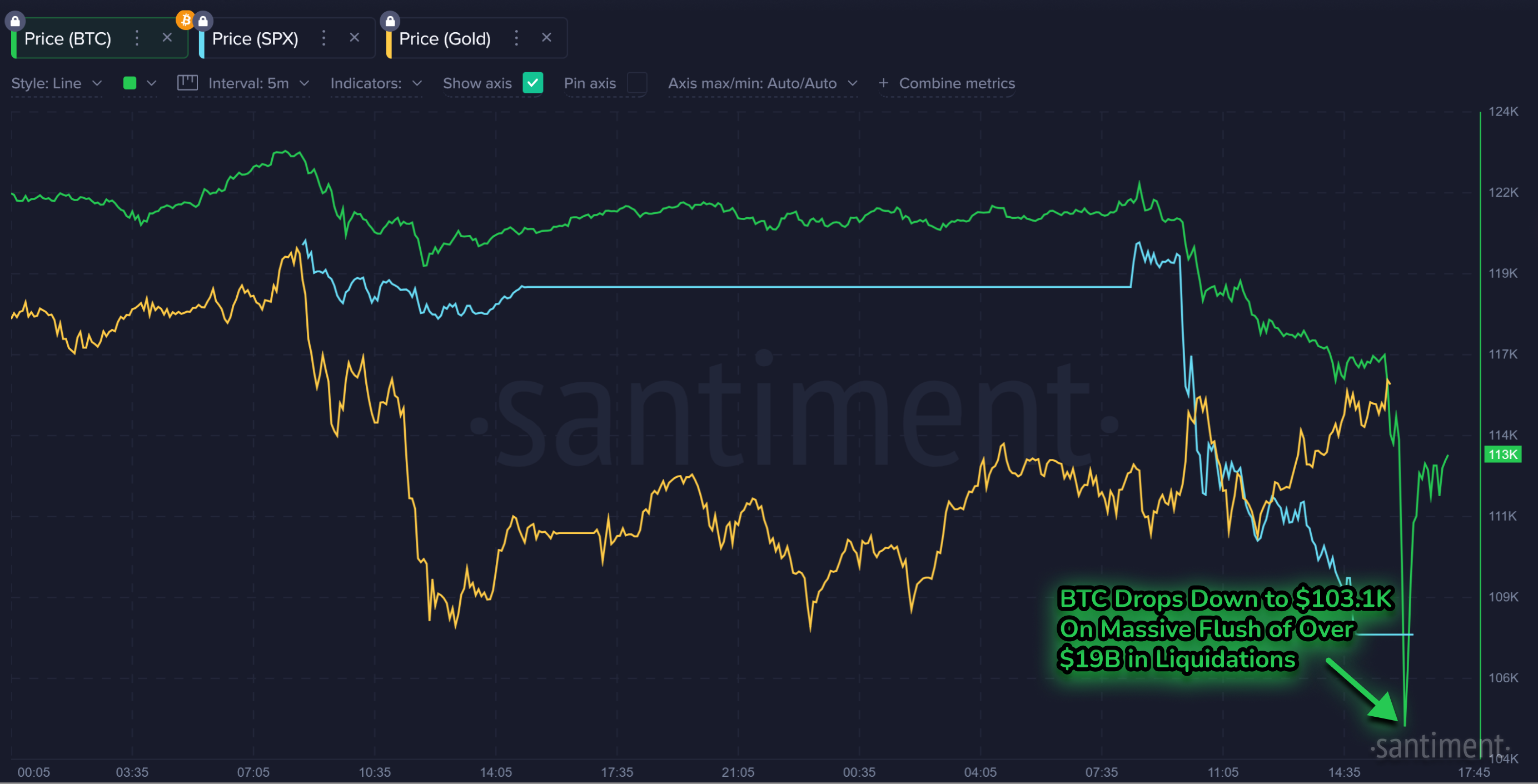

But if you're reading this now, you know that the retrace from the US President's Truth Social post was just the beginning. Approximately 6 hours after the initial downswing, we saw something more akin to a full-on market flash crash, with Bitcoin briefly falling all the way down to ~$103.1K before a sizable rebound back up to $113K.

Multiple news outlets are reporting more than $19 billion in leveraged crypto positions were liquidated, making this the largest ever single-day purge of leveraged bets in crypto history. Of that sum, the majority came from long positions across over 1.6M estimated unique traders. Reports indicate around $16.6B in long positions were forced closed, with only about $2.4B in short positions liquidated.

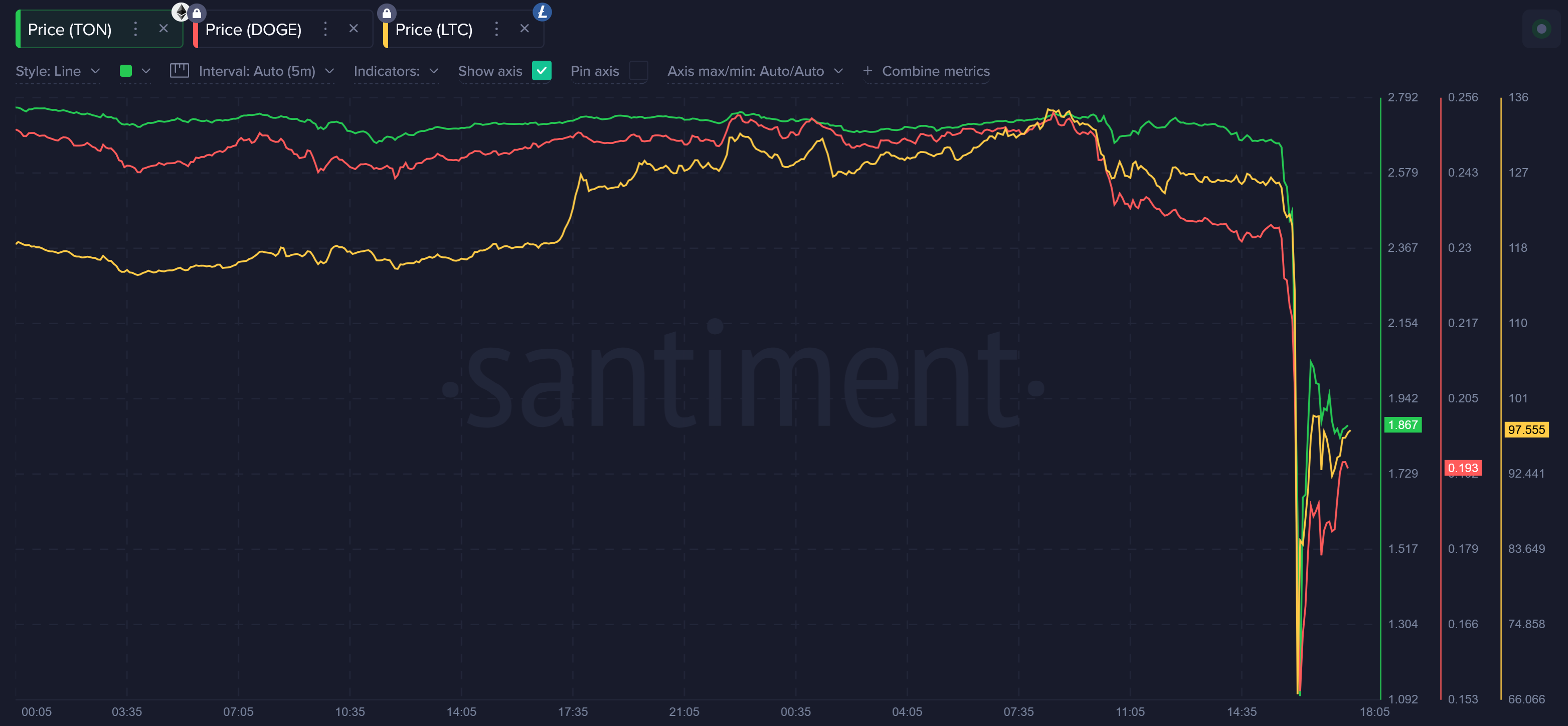

But even with Bitcoin dropping more than 12% (temporarily) in a matter of hours, crypto's top cap isn't what is drawing the most attention. Altcoins saw much more sizable flushes, as they typically are at much greater risk during times of crypto collapse.

Over the span of less than an hour, we saw market cap collapses from several top caps, temporarily reaching as low as:

- Litecoin $LTC -51%

- Toncoin $TON -41%

- Dogecoin $DOGE -39%

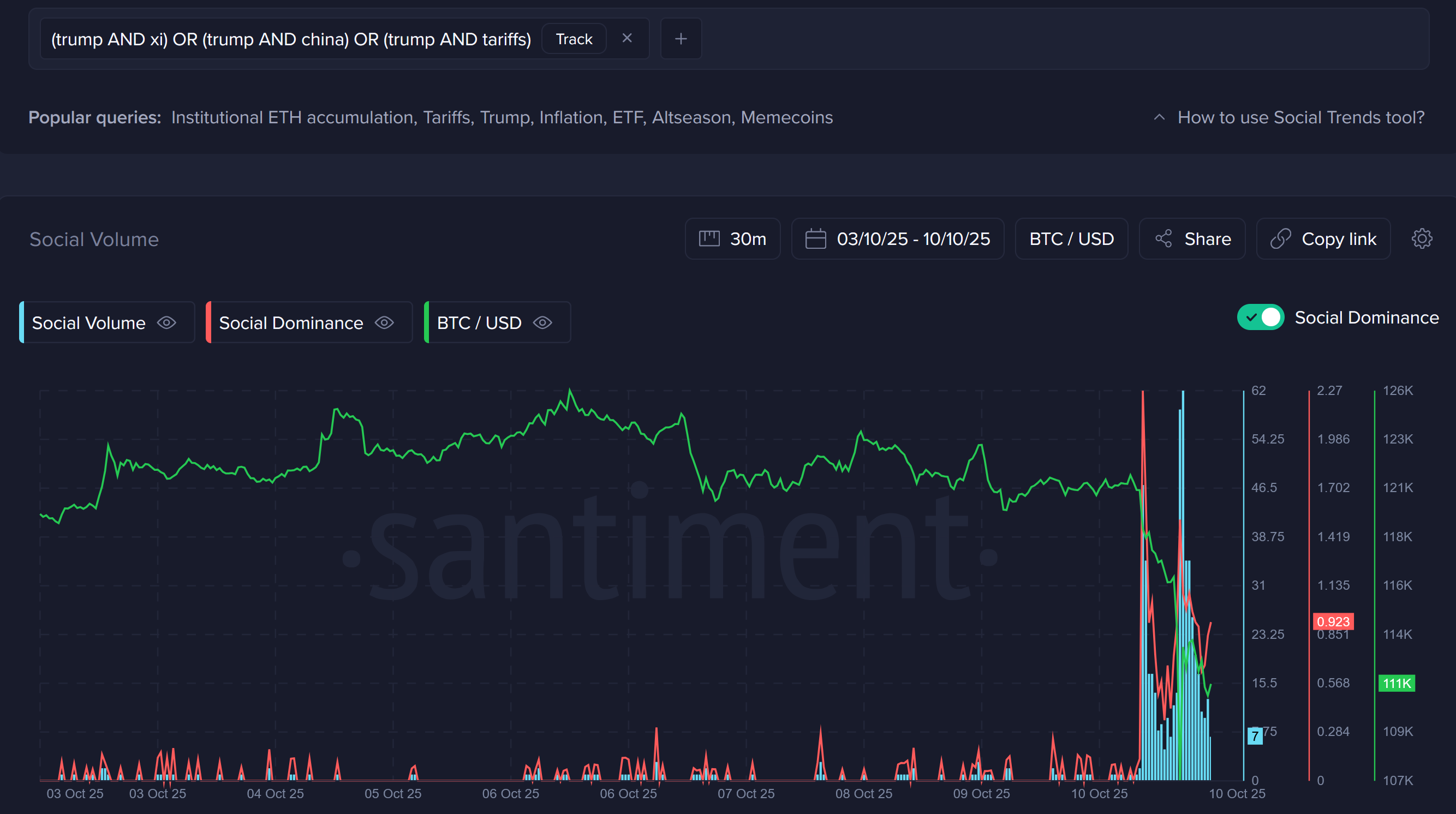

As for the geopolitical event that likely acted as a catalyst, the spike in discussions related to the new US-China tariff concerns as the main contributor is hard to ignore. Particularly after the crash, the crowd quickly jumped to collectively come to a consensus as to what the flush could be attributed to. This is typical "rationalization" behavior from retailers, who need to point to a singular event as the reason for a cataclysmic downturn in crypto.

And this doesn't just matter in hindsight. The above chart essentially confirms that the US-China talks will be central to their trading decisions for at least the short-term future. If Trump and Xi talks improve and show positive news, suddenly the retail sentiment toward crypto will improve. If their relationship gets even more sour, expect for the "Bitcoin sub-100K" prediction floodgates to begin opening up.

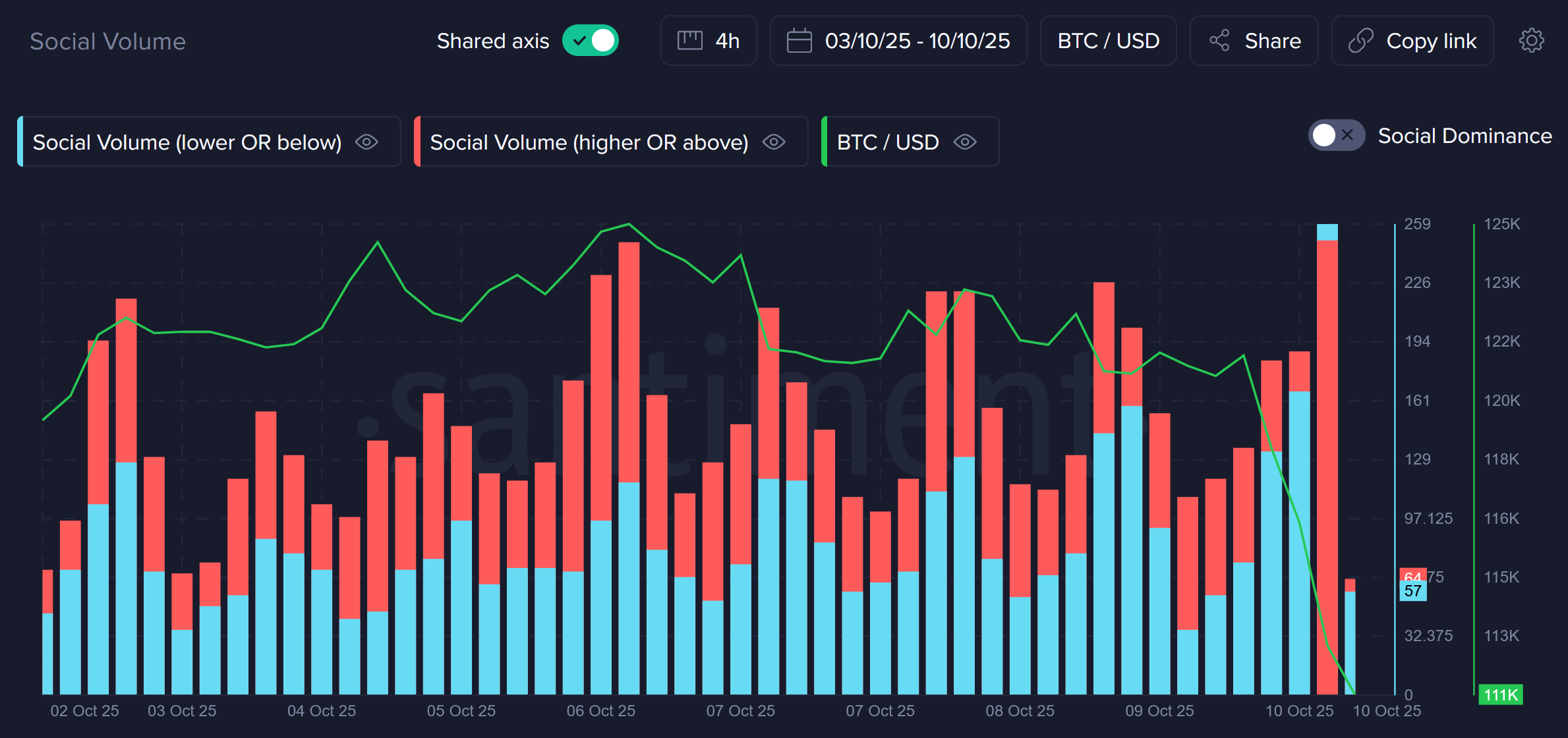

And what does a double digit percentage drop of Bitcoin do to the retail crowd? Well, for the first time in October, we've seen a 4-hour stretch where the words "lower" or "below" have gotten a higher frequency of mentions than "higher" or "above". This is a big deal, as it means the retail crowd has gotten spooked enough by this pullback to begin expecting markets to continue going down. All it took, apparently, was a reminder that crypto could actually fall off of a mild cliff for the first time in a long time.

For what it's worth, it appears that precious metals are getting a boost while all of this is going on. Similar to what we saw when Trump threatened tariffs just over six months ago, traders' fear of economic collapse has heightened. And when there are fears of currencies (dollar, Bitcoin, or otherwise) getting crushed, traders will often turn to something tangible, like gold or silver. Assuming no sudden developments are made to the US-China relationship by early Monday, we could see some heavy buy-ups of gold and silver from Wall Street to start the week.

Cryptocurrencies like Bitcoin are not immune to macro-political shocks. Though many view them as alternative or frontier assets, they are still highly sensitive to risk sentiment. Bitcoin, whether we like it or not, is behaving more like a risk asset than a safe haven during times of country tensions.

Looking ahead, one question is whether the breakdown in diplomacy will lead to a longer‐term freeze or deeper retaliation from China, and how that will ripple through technology, supply chains, and crypto mining or hardware supply. We still have likely Fed rate cuts to look ahead to at the end of October, so perhaps that will be the mark of relief that many will have to wait for.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.